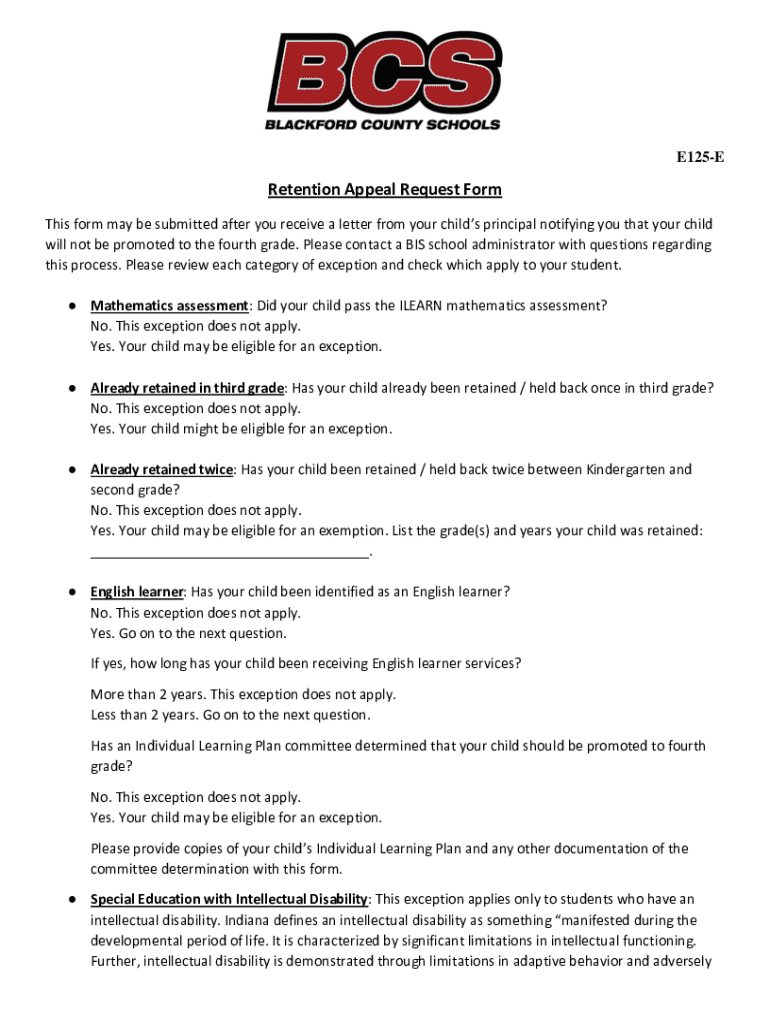

Get the free E125-e

Get, Create, Make and Sign e125-e

How to edit e125-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e125-e

How to fill out e125-e

Who needs e125-e?

e125-e Form: A Comprehensive How-to Guide

Understanding the e125-e Form

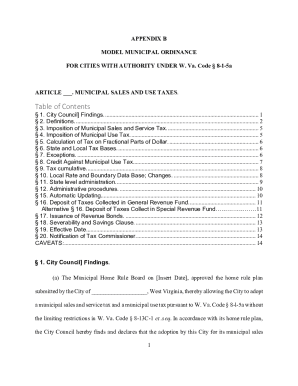

The e125-e form plays a crucial role for individuals and businesses, particularly within specific regions like Pike County, Indiana, where compliance and precise documentation are vital. This form primarily serves as a means of communication with regulatory bodies, ensuring that important data is conveyed accurately and in a timely manner.

Commonly used in various administrative processes, the e125-e form is essential for applications, reports, and compliance documentation. Whether for educational institutions in Pike County, especially schools managing data against state regulations, or businesses notifying changes in operational status, the form fulfills specific requirements to prevent delays and complications.

Preparing to fill out the e125-e form

Before starting the e125-e form, it’s essential to assess your eligibility. Not everyone is required to fill this form out. Individuals, small business owners, or institutions like schools in Pike County that engage in specific activities must evaluate whether they fall under the guidelines that necessitate this form's completion.

Confirming prerequisites for submission is equally important. There may be specific criteria such as state residency, type of business structure, or institutional status that affects whether you need to complete the e125-e form. Understanding these factors can save you time and ensure that your submission is valid.

Gathering necessary documents is the next step. It is advisable to compile all relevant information beforehand. Typical documents may include tax identification numbers, business registration papers, or educational accreditations, depending on your specific circumstances. Ensuring these are organized will streamline the process significantly.

Step-by-step guide to completing the e125-e form

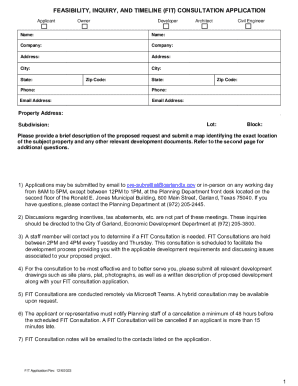

Accessing the e125-e form can be done easily through online platforms like pdfFiller. Users can find the form by searching through the extensive library provided, or directly visiting a specific page where the e125-e form is hosted. After locating it, opening the form in pdfFiller allows for a seamless experience with easy-to-use features.

When filling out the e125-e form, each section demands careful attention. Start by inputting your personal or business details accurately. Ensure compliance with the format specified on the form. Following this, move to sections demanding specific information based on your prior assessments—such as eligibility and document requirements.

Editing and reviewing your form is vital. Utilize pdfFiller's editing tools to make adjustments as needed. Double-check entries against your original documents to avoid common mistakes, such as typos or incorrect data inputs. This additional review phase can prevent potential submission issues later.

Signing the e125-e form

Understanding the signature requirements for the e125-e form is crucial. Generally, the person completing the form must sign it, but in the case of institutional submissions, a designated representative may be required to provide their signature. This additional layer ensures accountability and proper authorization.

Using pdfFiller for electronic signatures simplifies the process immensely. To eSign, navigate to the signature field, select the eSigning option, and follow the prompts to create or upload your signature. This alternative is particularly beneficial for users in Pike County, allowing for quick turnaround without needing to print and scan documents.

Submitting your e125-e form

When it comes to submitting your e125-e form, you have several options. The online submission process is often the most efficient. After completing and signing the form, follow the submission instructions provided by pdfFiller, which may include direct uploading through their system to the relevant authority.

Alternatively, for those preferring traditional methods or in cases where online submission is not possible, mailing or in-person submission may be required. For this, ensure all materials are enclosed and sent to the correct address, possibly including any necessary cover letters or additional documentation.

Tracking the status of your submitted e125-e form is crucial. Most administrative bodies offer a method for you to check the status through their websites. If issues arise, having a record of your submission date and method can facilitate smoother communications.

Managing and storing your e125-e form

Saving your completed e125-e form is the next step in maintaining an organized documentation system. Utilize best practices for file naming, such as including your name, date, and purpose of the document, making files easily identifiable in the future. pdfFiller offers convenient cloud storage options, allowing you to keep these important documents securely accessible.

To effectively organize your forms for future reference, consider creating categories or folders based on types of documents or purposes. Using tags can make retrieval easier, especially for schools and businesses requiring frequent access to forms such as the e125-e in Pike County.

Troubleshooting common issues

Even with thorough preparation, issues can arise when filling out the e125-e form. Common problems include incomplete fields, illegible handwriting, or incorrect document formats. Always ensure to follow the guidelines provided with the form closely. Utilizing pdfFiller's features allows for digital corrections before submission, which is a significant advantage.

In the event of submission problems, first check that all necessary fields are filled. If your form has been rejected, consult the feedback provided by the receiving authority. If additional questions remain, don't hesitate to contact support for assistance in resolving issues effectively.

Frequently asked questions about the e125-e form

Many individuals have queries regarding the e125-e form, especially concerning processing timeframes. Generally, processing times can vary based on the submitting organization, and it's advisable to allow several weeks for processing to account for any delays.

In cases where amendments are needed after submission, most authorities have protocols in place. Knowing how to navigate these processes can save time and enable users to keep their records up to date without re-filing entire applications.

While resources may vary from state to state, numerous official websites provide guidance on the requirements for the e125-e form. pdfFiller also offers streamlined support through their platform, ensuring that users can easily proceed with their form completion tasks.

User testimonials & success stories

Real-life experiences highlight the practicality and efficiency that the e125-e form process can bring when utilizing pdfFiller. Many users from Pike County, Indiana, have reported streamlined operations and significant time savings in dealing with regulatory forms, praising the combination of accessible tools and clear guidance.

Feedback from satisfied users often points out how the collaborative features of pdfFiller enhanced teamwork, enabling multiple individuals to contribute to a single submission without complication. These testimonials underline how effective document management solutions can lead to successful project outcomes.

Enhancing your document management skills

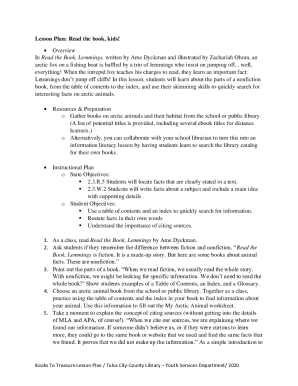

For those looking to enhance their document management skills, utilizing additional features of pdfFiller can be incredibly beneficial. The platform provides collaborative tools that allow teams to work simultaneously on forms, improving overall efficiency, especially in larger institutions such as schools.

Automation also plays a significant role in streamlining document workflows. By implementing best practices for document management, such as maintaining organized files and utilizing digital tools effectively, users can save time and reduce the likelihood of errors in future submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit e125-e from Google Drive?

How can I send e125-e to be eSigned by others?

Where do I find e125-e?

What is e125-e?

Who is required to file e125-e?

How to fill out e125-e?

What is the purpose of e125-e?

What information must be reported on e125-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.