Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Comprehensive Guide to Sec Form 4: Understanding, Filing, and Compliance

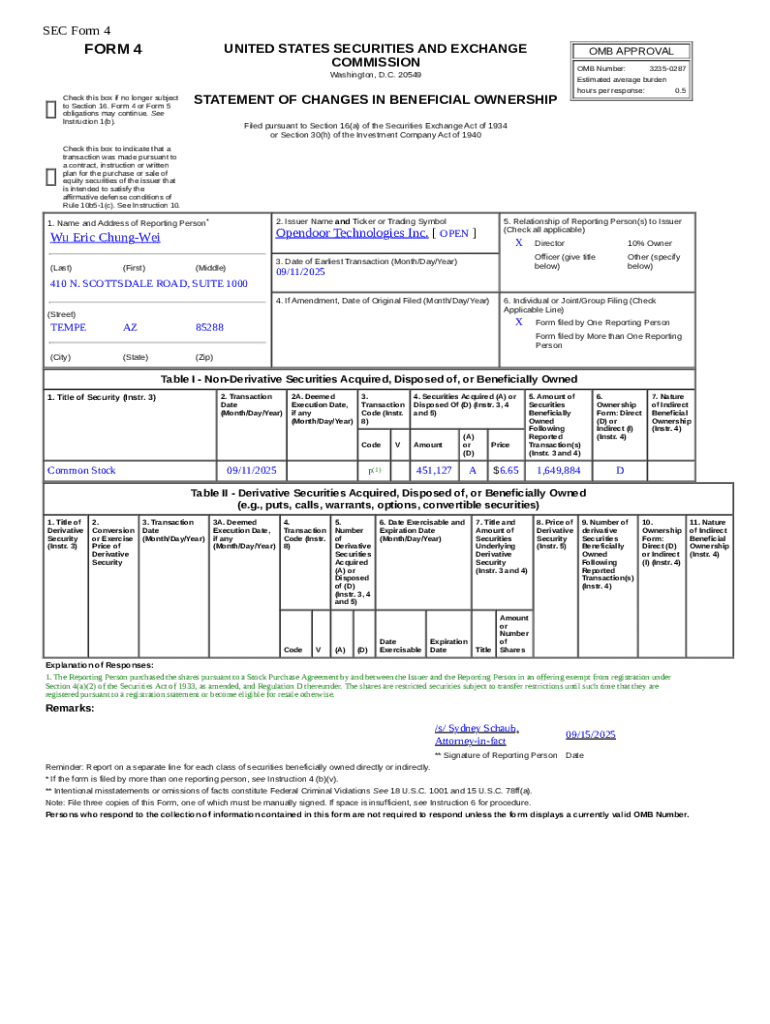

Understanding Sec Form 4

Sec Form 4 is a critical document required by the U.S. Securities and Exchange Commission (SEC) for certain individuals in the financial markets, particularly insiders of publicly traded companies. Its primary purpose is to provide insight into insider trading activities by presenting detailed information about an insider's purchases or sales of the company's securities. This level of transparency is vital for maintaining market integrity, as it allows other investors to make informed decisions based on the ownership trends of people who are privy to nonpublic information.

Individuals required to file Sec Form 4 include company executives, directors, and anyone with a significant stake in the company—often referred to as insiders. Compliance with this filing requirement ensures that the trading activities of these individuals are open and transparent, thereby helping to prevent potential market abuses.

When is Sec Form 4 Required?

Sec Form 4 must be filed promptly following any change in ownership of a company's securities. Generally, this includes transactions caused by buying or selling stocks and derivative securities. The SEC mandates a specific timeline for these submissions, usually within two business days of the transaction. This ensures that any changes in the shareholders' stakes are reported swiftly to maintain market transparency.

Common scenarios necessitating a filing of Sec Form 4 include insider purchases or sales of company stock, which can greatly impact the market perception surrounding that company. It’s also required when insiders report stock options or other types of security transactions. Being aware of specific deadlines and crucial dates is essential for avoiding potential compliance issues.

Steps to Fill Out Sec Form 4

Filling out Sec Form 4 requires careful attention to detail to ensure accuracy and compliance. Start by gathering the necessary information such as your personal details, transaction specifics, and the information regarding the company’s securities. Understanding your responsibilities as an insider is crucial, as failing to disclose pertinent information can lead to legal ramifications.

The following step-by-step instructions can guide you through the form completion:

Editing and managing your Sec Form 4

Using tools like pdfFiller can significantly simplify the editing and management of your Sec Form 4. You can upload your form into pdfFiller’s platform for easy adjustments, ensuring all information is correct before submission. The platform provides various editing tools useful for correcting inaccuracies, adding necessary fields, or updating transaction details.

In collaborative environments, pdfFiller also allows teams to share the document, collect feedback, and track changes before finalizing the filing, fostering a collaborative atmosphere in compliance management.

eSigning your Sec Form 4

In today's digital age, digital signatures have become integral to filing legally binding documents. They provide the necessary legal backing for your filings while maintaining the ease of submission. eSigning your Sec Form 4 through pdfFiller ensures that your document meets all compliance requirements and provides an efficient way to finalize the filing process without the need for printouts or in-person visits.

To eSign your Sec Form 4 within pdfFiller, follow these straightforward steps:

Filing your Sec Form 4

Filing your Sec Form 4 electronically has become the standard procedure, primarily through the SEC's EDGAR system. This process allows for immediate public access to filed documents and ensures that your submission is timestamped accurately. Understanding the electronic filing process is fundamental to ensuring compliance, particularly as failure to file accurately and on time can lead to significant penalties.

Common mistakes to avoid include submitting the form with inaccurate transaction details, missing the filing deadline, or not including the required signature. It's imperative to dedicate time to review your form before submission to sidestep any potential issues.

Staying compliant post-filing

Post-filing obligations for insiders do not stop with the submission of Sec Form 4. Individuals must remain vigilant regarding ongoing insider reporting obligations, which include monitoring their transactions and staying aware of changes within the company that might necessitate additional disclosures.

Setting reminders for future filings and tracking changes in ownership on a regular basis can help ensure compliance and prevent oversight. Utilizing tools and resources provided by platforms such as pdfFiller can facilitate this process.

Frequently asked questions (FAQs)

Understanding the nuances of Sec Form 4 can lead to a variety of questions, especially for first-time filers. Common inquiries often pertain to filing rules, the specifics of what transactions need reporting, and best practices for ensuring accuracy in submissions. Getting clarity on these topics is essential to maintain compliance and avoid potential pitfalls.

For example, questions may arise about the distinction between Form 4 and other SEC forms or whether certain transactions are exempt from reporting. Engaging with experts or using comprehensive guides can help demystify these queries and enhance the filing experience.

Importance of Sec Form 4 in insider trading compliance

Accurate reporting via Sec Form 4 is pivotal for maintaining market transparency and integrity. The implications of timely and correct disclosures influence not only the credibility of the insiders but also the broader market sentiment surrounding a company. Investors often analyze these filings to gauge the confidence and motives of insiders, which can impact trading strategies.

Failing to comply with the reporting requirements of Sec Form 4 can have serious consequences, including legal ramifications for insiders, such as fines and other penalties, which can tarnish a company’s reputation and harm investor trust. Therefore, understanding and adhering to the filing obligations associated with Sec Form 4 is essential for any executive or insider within the financial markets.

Additional tools and features

pdfFiller offers a range of interactive tools that enhance the Sec Form 4 filing process. These include customizable templates and compliance checklists, which provide tracking features essential for effective document management. The cloud-based solution guarantees accessibility from anywhere, allowing users to manage their filings efficiently and securely.

With the convenience of having everything accessible from one platform, pdfFiller empowers users to streamline their filing efforts and ensure adherence to compliance standards. These capabilities make it an invaluable resource for anyone tasked with managing Sec Form 4 filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How do I make edits in sec form 4 without leaving Chrome?

Can I sign the sec form 4 electronically in Chrome?

What is SEC Form 4?

Who is required to file SEC Form 4?

How to fill out SEC Form 4?

What is the purpose of SEC Form 4?

What information must be reported on SEC Form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.