Get the Free Loan Agreement TemplateEasy & Simple

Get, Create, Make and Sign loan agreement templateeasy amp

Editing loan agreement templateeasy amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan agreement templateeasy amp

How to fill out loan agreement templateeasy amp

Who needs loan agreement templateeasy amp?

Loan Agreement Template - Easy & Form

Understanding loan agreements

A loan agreement is a legally binding document that outlines the terms and conditions of a loan provided by a lender to a borrower. The agreement details the obligations and rights of both parties involved. Key components typically included in a loan agreement are the loan amount, purpose of the loan, interest rate, repayment terms, default conditions, and any collateral requirements. It ensures that both the lender and borrower have a shared understanding of the arrangement.

Having a loan agreement is essential because it provides legal protections for both the borrower and lender. A well-drafted loan agreement minimizes the potential for disputes and misunderstandings. It clarifies expectations regarding repayment schedules, interest rates, and potential fees associated with the loan, creating a transparent framework. Failing to formalize a loan with a proper agreement can lead to confusion and strained relationships.

Types of loan agreements

Loan agreements can take many forms, depending on the purpose and financial context. Personal loan agreements are typically used for personal expenses, such as home improvements or vehicle purchases. They allow individuals to secure funds from friends, family, or banks, providing financial flexibility and manageable repayment options.

In contrast, business loan agreements are tailored for funding business ventures, such as expanding operations or purchasing equipment. These agreements often involve more stringent evaluation processes, as lenders assess the viability of the business along with repayment capabilities. Furthermore, loans can be categorized as secured or unsecured. Secured loans require collateral, providing the lender with a sense of security, while unsecured loans do not, typically resulting in higher interest rates.

Specialty loan agreements include student loans for educational purposes and mortgages for home purchases, each featuring unique terms and conditions. Understanding the specific features of these agreements is crucial for borrowers to ensure they select loans that align with their financial situations.

When to use a loan agreement

Loan agreements are essential in various situations, particularly when significant amounts of money are involved. Using a loan agreement for family loans can help avoid misunderstandings among relatives. For instance, lending a significant sum for a wedding or educational purposes without a written agreement may lead to uncomfortable situations regarding repayment expectations.

In business ventures, having a loan agreement is equally critical, as it outlines the terms under which funds are borrowed and can prevent future disputes over repayment. Moreover, not having a documented agreement can expose lenders and borrowers to poten পর, বের্ট, য, the most considerable financial risks, making a clear contract indispensable.

How to write a loan agreement

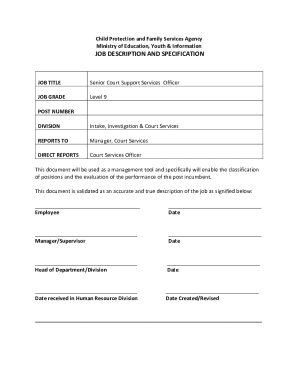

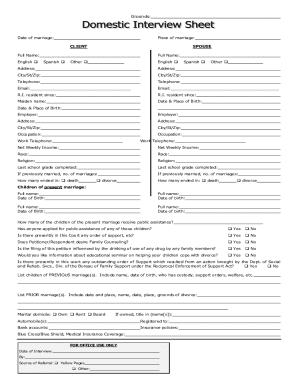

Writing a loan agreement can be straightforward when following specific guidelines. Start by gathering all necessary information about the parties involved: names, addresses, and contact details of both the borrower and the lender. Next, determine the loan amount, interest rate, and repayment terms, including the payment schedule and final due date.

Choose a suitable template from pdfFiller to help ensure compliance with legal standards and make the process manageable. Fill out the key sections using the interactive form. It's advisable to review the terms collaboratively with the involved parties for transparency and understanding before finalizing the agreement.

Loan agreement sample

For ease of use, a downloadable loan agreement template is available on pdfFiller. This customizable template allows users to tailor the document to their specific needs quickly. Each section of the template is built to guide you through the completion process, ensuring clarity and comprehension.

Additionally, we provide annotations explaining each section of the template. This breakdown helps you understand the purposes of various fields, such as the loan amount and repayment terms, making the process less intimidating for first-timers.

Editing and customizing your loan agreement

Utilizing pdfFiller for editing your loan agreement is a straightforward process. The platform offers various features that allow users to personalize the agreement seamlessly. You can easily modify sections, add additional clauses, or adjust specific terms to better fit your circumstances. Investing in a thorough review process through editing helps ensure that both parties enter into the agreement with full awareness and understanding.

It's also essential to maintain legal compliance while drafting your loan agreement. Be vigilant with common pitfalls to avoid, such as ambiguous language or omitting key terms like interest rates, repayment schedules, and default clauses. A clearly defined agreement minimizes potential legal challenges, ensuring both parties are adequately protected.

Signing and managing your loan agreement

Signing a loan agreement electronically is easy with pdfFiller’s eSigning features. The step-by-step instructions guide users to ensure that both parties sign the document in a secured manner. This modern solution caters to a fast-paced world, allowing quick transactions without compromising the formality required in a loan agreement.

In addition, managing your loan agreement on a cloud-based platform significantly enhances organization. You can keep all relevant documents related to the loan together, making it easy to access when needed. This centralized management simplifies tracking payment schedules and communication, helping both borrower and lender stay informed.

Mortgage vs. personal loan agreements

A clear understanding of key differences between mortgage and personal loan agreements is vital for borrowers to make informed decisions. Mortgages are often long-term agreements specifically designed for purchasing real estate, featuring lower interest rates due to the asset being used as collateral. In contrast, personal loans are typically short-term solutions for personal expenses that may carry higher interest rates due to the lack of collateral.

When choosing the right agreement, consider your financial needs and the implications of interest rates, fees, and repayment terms. Evaluating the total cost over time versus the urgency of the funds needed will guide you toward the most beneficial loan agreement for your situation.

Payment plans and flexibility

Establishing a payment plan within your loan agreement is a vital aspect that allows you to customize repayment schedules to your financial circumstances. Options may include fixed monthly payments, escalating payments, or even flexible plans based on cash flow variances, enabling both borrower and lender to find a mutual understanding that suits their needs.

Moreover, circumstances may change, and amending loan agreement terms may become necessary. It’s critical to outline the proper procedures for modifying the agreement within the contract, ensuring both parties can navigate changes productively while minimizing conflicts.

Appendices

Understanding some common terms in loan agreements is helpful for both parties involved. Familiarize yourself with essential definitions such as 'collateral,' 'default,' 'interest rate,' and 'repayment schedule.'

Additionally, being aware of legal considerations when drafting a loan agreement is crucial. Factors such as state regulations, notary requirements, and witness signatures may vary by locality, ensuring that you create a legally binding document.

Lastly, frequently asked questions related to loan agreements provide insight into common concerns, such as what happens in case of default or how to handle changes to loan terms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get loan agreement templateeasy amp?

How do I make edits in loan agreement templateeasy amp without leaving Chrome?

How do I complete loan agreement templateeasy amp on an iOS device?

What is loan agreement templateeasy amp?

Who is required to file loan agreement templateeasy amp?

How to fill out loan agreement templateeasy amp?

What is the purpose of loan agreement templateeasy amp?

What information must be reported on loan agreement templateeasy amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.