Get the free I watched 2010: The Year We Make Contact last night and ...

Get, Create, Make and Sign i watched 2010 form

How to edit i watched 2010 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i watched 2010 form

How to fill out i watched 2010 form

Who needs i watched 2010 form?

watched 2010 form - How-to Guide

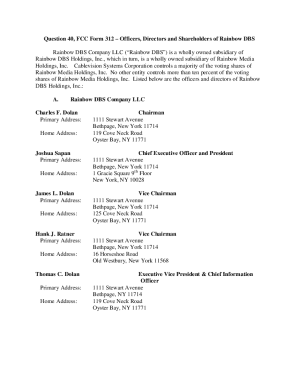

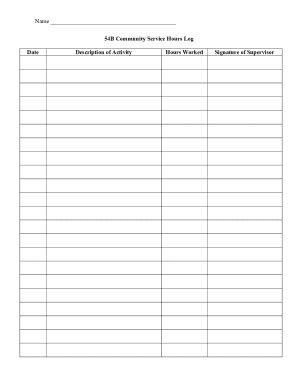

Overview of the 2010 Form

The 2010 Form is a crucial document used for various administrative and legal purposes, particularly in real estate and tax-related matters. It serves as a foundational template for information that allows homeowners and property taxpayers to apply for benefits such as the homestead deduction. Understanding the importance of the 2010 Form is essential for maximizing tax protections available to homeowners under the existing legislation.

With the potential for significant financial implications, this form becomes particularly important for Hoosiers looking to safeguard their property tax bill. By claiming homestead deductions, eligible homeowners can reduce their taxable value, thus decreasing the amount owed in property taxes, which ultimately fosters economic stability.

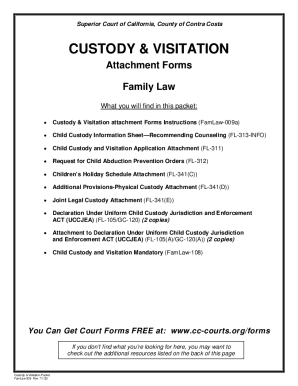

Accessing the 2010 Form

Accessing the 2010 Form is straightforward, with multiple sources available online. The official government websites publish the most current and accurate versions of the document. Users can easily download the form from these platforms, ensuring they are working with the latest updates and stipulations regarding property tax eligibility.

Alternatively, pdfFiller offers an efficient way to access and manage the 2010 Form. The platform allows users to fill out, edit, and save the form digitally, which can significantly streamline submission and record-keeping processes. This cloud-based service affords users flexibility, as they can access their forms from anywhere, facilitating collaboration with team members or family.

Detailed instructions for filling out the 2010 Form

Filling out the 2010 Form requires careful attention to detail. The form is divided into several sections, including taxpayer information, property details, and eligibility for deductions. It is crucial to complete each section accurately to avoid potential issues with the property tax office.

As you proceed with the completion of the form, here are some tips to assist with accuracy: double-check information regarding property ownership, ensure proper residency details, and confirm eligibility for homestead deductions. Small mistakes can result in delays or even denials of benefits, so it's wise to take your time during this process.

Editing and customizing the 2010 Form

One significant advantage of using pdfFiller is its ability to edit and customize PDF forms easily. The platform features tools that allow users to add notes or comments directly onto the 2010 Form, making it easier to clarify details or provide additional context where needed. This customization ensures that all required information is comprehensively conveyed.

For professional-looking documents, it's essential to follow best practices for formatting. This includes maintaining consistent fonts and sizes, using bullet points for clarity, and organizing information logically. pdfFiller also provides various templates to help users streamline their form customization, making it suitable for different purposes and audiences.

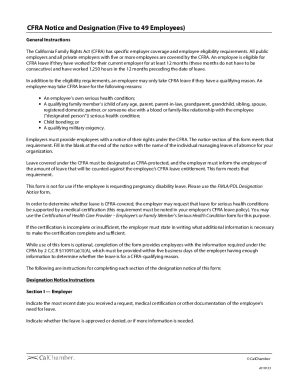

Signing the 2010 Form

Signing the 2010 Form typically involves either physical signatures or electronic signatures, especially when using online platforms like pdfFiller. The eSign capabilities of the platform simplify the signing process, allowing users to add their electronic signature quickly and legally. This method is recognized for its validity and acceptance in various legal contexts, making it a preferred option for many.

In instances where collaboration is necessary, pdfFiller also enables users to share forms with others for signatures. The platform tracks changes and approvals, ensuring all parties are updated on the status of the document. This is particularly helpful in team environments where multiple signatures are required for completion.

Managing your 2010 Form

Once the 2010 Form has been completed and signed, it's essential to manage it properly. pdfFiller offers cloud storage options that not only secure documents but also provide easy access for future reference. This means users can retrieve their forms from any device, eliminating the hassle of physical paper storage.

Alongside storage, pdfFiller’s version control features enable users to keep track of changes made to the 2010 Form. This is particularly useful if there are updates or corrections afterward, as users can restore previous versions when necessary, ensuring a reliable record of all changes.

Troubleshooting common issues

Even with thorough preparation, users might encounter issues when dealing with the 2010 Form. Addressing common questions and concerns can help streamline the process. For instance, questions about incomplete sections or eligibility requirements often arise and can be resolved by consulting the guidelines or reaching out to customer support.

Additionally, pdfFiller offers robust customer support resources, including tutorials and forums where users can engage with communities for insights. If specific issues occur, such as difficulties in downloading or signing forms, the available help resources can provide valuable assistance.

Advanced features and secondary uses

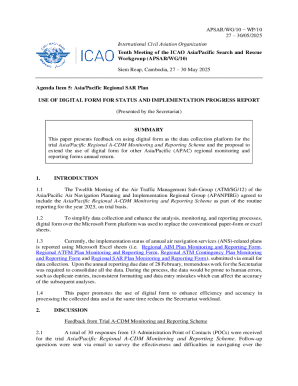

Beyond individual use, the 2010 Form can be integrated into broader workflow management processes. This integration allows users to set reminders for submissions and deadlines, enhancing efficiency. For instance, taxpayers can receive notifications regarding crucial dates, ensuring they never miss important filings that could affect their property tax bill.

Furthermore, pdfFiller is replete with additional features that extend beyond simple forms. Users can explore advanced document management tools, all designed to enhance productivity, whether through collaborative features or automation of routine tasks. Leveraging these tools effectively can significantly simplify the management of numerous documents.

Conclusion & next steps

Effectively managing the 2010 Form is not just an administrative task; it’s a step towards safeguarding property rights and financial responsibility. Understanding the various functionalities that pdfFiller offers enhances your ability to complete this form accurately and efficiently. By following best practices and utilizing pdfFiller, users can ensure they maximize their benefits while minimizing headaches.

Encouraging ongoing learning and adaptation in using applications like pdfFiller can lead to enhanced document management skills, making it easier to tackle additional forms and administrative tasks in the future. With a comprehensive understanding of the 2010 Form and the tools available, users can confidently navigate property tax processes and related documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete i watched 2010 form online?

Can I sign the i watched 2010 form electronically in Chrome?

How can I fill out i watched 2010 form on an iOS device?

What is i watched 2010 form?

Who is required to file i watched 2010 form?

How to fill out i watched 2010 form?

What is the purpose of i watched 2010 form?

What information must be reported on i watched 2010 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.