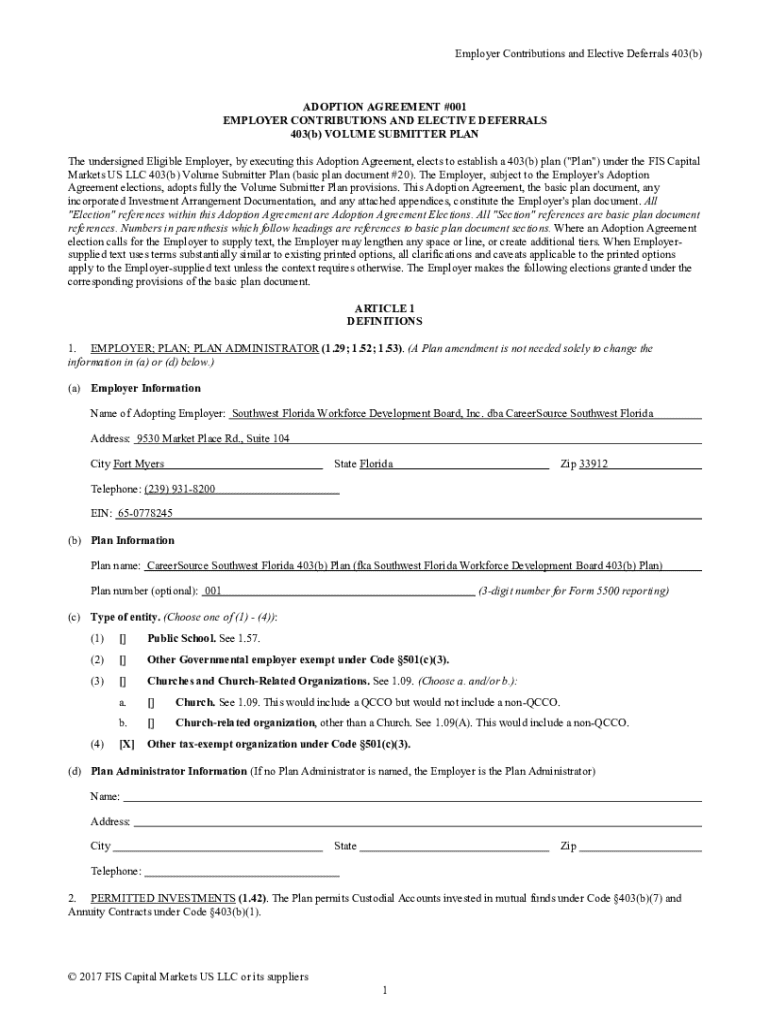

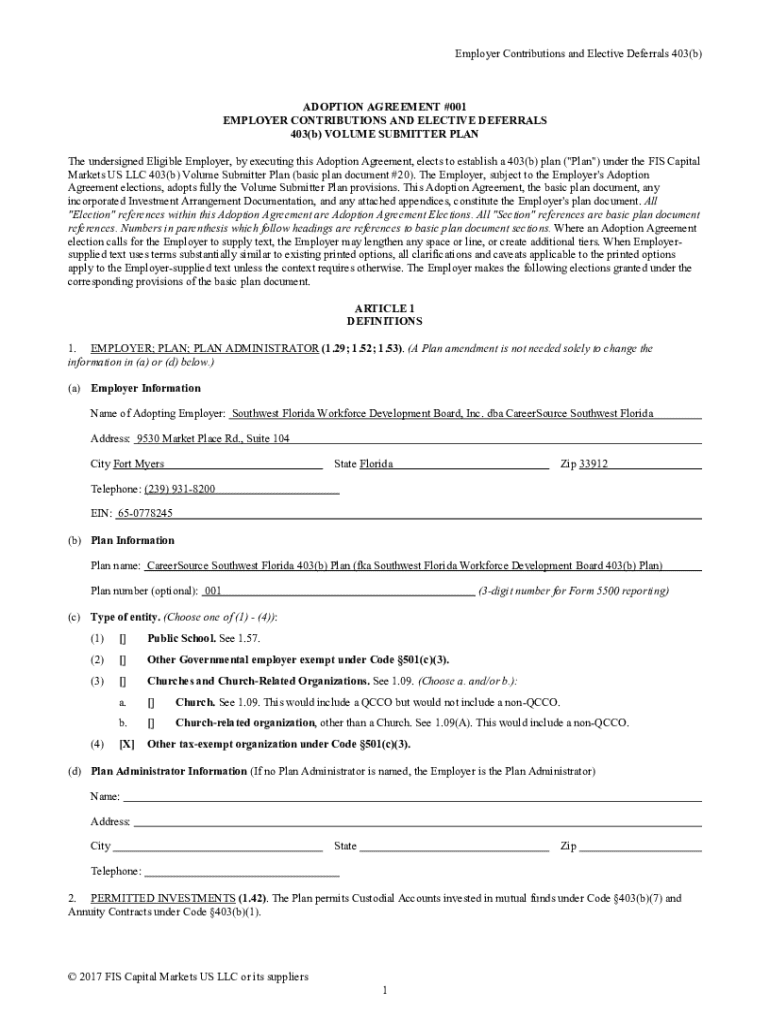

Get the free Employer Contributions and Elective Deferrals 403(b)

Get, Create, Make and Sign employer contributions and elective

Editing employer contributions and elective online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employer contributions and elective

How to fill out employer contributions and elective

Who needs employer contributions and elective?

Employer contributions and elective form: A comprehensive how-to guide

Understanding employer contributions

Employer contributions are the amounts that employers add to employee retirement plans, enhancing the overall value and benefits of these plans. These contributions not only help employees save more for retirement but also encourage workforce loyalty.

There are primarily two types of employer contributions: matching contributions and non-elective contributions. Matching contributions occur when an employer matches the employee's contributions, often up to a specified limit. Non-elective contributions, on the other hand, do not depend on whether employees contribute to the plan; the employer simply contributes a set percentage of the employee’s salary.

Understanding these contributions is essential, as they significantly impact retirement savings and can motivate higher employee retention and satisfaction.

Exploring elective forms

Elective forms play a critical role in employee retirement choices. These forms allow employees to specify how much they wish to contribute to their retirement plans, typically through payroll deductions. The purpose of the elective form is to facilitate contributions that best align with employees' financial goals and retirement preparedness.

Elective contributions differ from employer contributions because they are employee-driven. While employer contributions aim to incentivize participation and savings, elective contributions reflect each employee’s personal financial decision-making.

Mastering both employer contributions and elective forms empowers employees to optimize their retirement strategies effectively.

Key requirements for completing the elective form

When filling out an elective form, it's crucial to comply with specific requirements. Eligibility criteria generally encompass the employees who can partake in the plan, typically contingent upon their employment status, age, and length of service.

For example, some plans may require employees to be at least 21 years old and have completed a year of service to participate. Additionally, employees need to be aware of federal contribution limits, which dictate how much they can elect to put into these retirement plans each year. Meeting deadlines for contributions is equally important to ensure no penalties or missed opportunities.

Understanding these key requirements sets the stage for successful contributions to retirement plans via elective forms.

Step-by-step guide to completing the elective form

Completing the elective form effectively necessitates careful attention to detail and a step-by-step approach. First, you will want to gather all necessary personal and employer information, including your name, address, social security number, and specific details about your employer and the retirement plan.

Next, employees need to decide whether to select a traditional contribution or a Roth option. A traditional contribution is made before taxes, while Roth contributions are made post-tax but allow for tax-free withdrawals in retirement.

Following this decision, accurately determine the contribution amount, which may either be a percentage of your salary or a fixed dollar amount. Remember to consider how these contributions will impact your gross income and potential taxation. After confirming these amounts, review the form for accuracy before submitting it through the appropriate channel, whether online or by mail.

Properly completing the elective form facilitates smoother processing and maximizes benefits for your retirement plan.

Best practices for managing contributions

To ensure that contributions are effectively managed, regular reviews are paramount. Periodically assessing both employer and elective contributions enables employees to adjust their savings strategies in line with changing financial goals and life circumstances.

For instance, if income levels rise or financial responsibilities shift, adjusting contribution rates can lead to better long-term saving outcomes. Keeping thorough records of contributions also supports effective tax filing. Documentation is invaluable if discrepancies arise and can justify contribution levels during audits.

By adhering to these best practices, employees can maximize their retirement savings while ensuring compliance with contribution guidelines.

Common mistakes to avoid

One prevalent mistake employees make is incorrectly calculating their contribution limits. This can lead to overcontributions, resulting in tax penalties. Moreover, failing to update contributions after significant life events, such as marriage or the birth of a child, can derail a well-planned financial strategy.

Another common error is not fully understanding employer matching policies. Employees should clarify these details to make informed decisions about their contributions and ensure they benefit from their employer's offerings.

By sidestepping these pitfalls, employees can create a more stable and effective retirement savings plan.

Employer considerations in contribution management

Employers have significant responsibilities when it comes to managing contributions. Clear communication of contribution strategies is essential to help employees make informed decisions regarding their retirement plans. Employers should provide thorough resources and guidance to enable employees to understand their options fully.

Moreover, compliance with regulatory requirements is non-negotiable. Employers must stay updated on changing laws and regulations that may impact contribution limits and options. Additionally, gathering employee feedback allows organizations to adapt contribution plans, catering to the highly diverse needs of their workforce.

By addressing these employer considerations, organizations can create effective and attractive retirement plans.

The role of pdfFiller in streamlining elective form processing

pdfFiller offers invaluable features for the efficient management of elective forms. With user-friendly interfaces, individuals can easily edit and sign forms, alleviating stress associated with cumbersome paperwork. The collaborative tools provided by pdfFiller facilitate seamless interaction, especially in team environments.

Employers and employees can utilize pdfFiller for submitting and tracking contributions effectively. The platform offers real-time tracking of form submissions, ensuring that users can verify the status of their documents with ease. Furthermore, storing and organizing submitted forms within pdfFiller's secure cloud environment ensures that all essential documents are accessible, compliant, and easy to retrieve.

By integrating pdfFiller into contributions management, both employees and employers can optimize their processes, leading to better outcomes.

Case studies: Successful implementation of elective contribution plans

To illustrate the impact of effective employer contributions, consider the example of Company A. By implementing a robust matching contribution policy, the company saw increased participation in their retirement plans, leading to enhanced employee morale and retention.

Similarly, Company B identified that tailored elective contributions significantly boosted employee satisfaction. Providing various contribution options allowed employees to adjust their savings according to personal financial circumstances, fostering a more engaged workforce.

These case studies emphasize the tangible benefits realized through thoughtful contribution strategies.

Frequently asked questions about employer contributions and elective forms

Questions often arise surrounding employer contributions and elective forms. One common query is whether employers can change their contribution policies—the answer is yes, but any changes must be communicated transparently to employees to maintain trust.

Another concern is what happens to contributions if an employee leaves the company. Typically, employees may roll over their contributions into a new plan or withdraw funds, according to the plan’s specific rules. The IRS oversees employer contributions, ensuring compliance with federal guidelines to protect employee rights.

Staying informed about these facets helps both employees and employers navigate the complexities of retirement planning.

Related topics to explore

In addition to understanding employer contributions and elective forms, exploring retirement plan compliance and best practices can deepen financial literacy. Understanding 401(k) plan alternatives can also be invaluable, as employees look for versatile savings options to match their circumstances.

The future of retirement contributions is an evolving field, impacted by changing work environments that adapt to employee needs and economic conditions. Staying ahead of these changes enhances both employer offerings and employee participation rates.

By broadening knowledge on these related topics, individuals can cultivate a more holistic understanding of retirement planning.

Services offered by pdfFiller relevant to employer contributions

pdfFiller provides a suite of services catered specifically to managing employer contributions and elective forms. With comprehensive document templates, users can access legally compliant forms tailored to their requirements. Additionally, secure cloud-based storage ensures that all sensitive documents remain protected yet easily retrievable.

Collaboration features facilitate team efforts, making it simpler to handle all aspects of contribution management efficiently. By leveraging pdfFiller’s capabilities, organizations can streamline their documentation processes around contributions and enhance overall efficiency.

Utilizing pdfFiller for these services can empower both employees and employers to navigate the complexities of retirement contributions with confidence.

Industries rich in employer contribution programs

Various industries stand out when it comes to robust employer contribution programs. The technology sector, for instance, typically offers extensive retirement plans to attract and retain top talent in a competitive market. Similarly, healthcare industries prioritize employee benefits, recognizing that a well-supported workforce enhances patient care.

Retail and hospitality sectors are increasingly adopting competitive contribution strategies to incentivize employee longevity in high-turnover environments. Understanding industry-specific trends in employer contributions can help employees make informed decisions about their career paths.

Recognizing these trends allows both employers and employees to stay competitive and forward-thinking in their approaches to retirement contributions.

Explore posts by category

For readers interested in deeper explorations, we offer related posts sorted by categories such as retirement solutions, document management, and compliance regulations. Each category is designed to provide insightful content, further enhancing your understanding of employer contributions and elective forms.

These categories foster a comprehensive understanding of the retirement planning landscape, empowering informed decision-making.

Search by topic

Those seeking to narrow their focus can search for related laws and regulations concerning retirement savings or discover best practices in employee benefits management. Innovative tools for document processing can also enhance efficiency within organizations, particularly during complex contribution planning.

Engaging with targeted topics can further refine knowledge and skills necessary for effective retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my employer contributions and elective directly from Gmail?

How can I send employer contributions and elective to be eSigned by others?

Can I create an electronic signature for signing my employer contributions and elective in Gmail?

What is employer contributions and elective?

Who is required to file employer contributions and elective?

How to fill out employer contributions and elective?

What is the purpose of employer contributions and elective?

What information must be reported on employer contributions and elective?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.