Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A How-To Guide

Understanding Form 10-Q

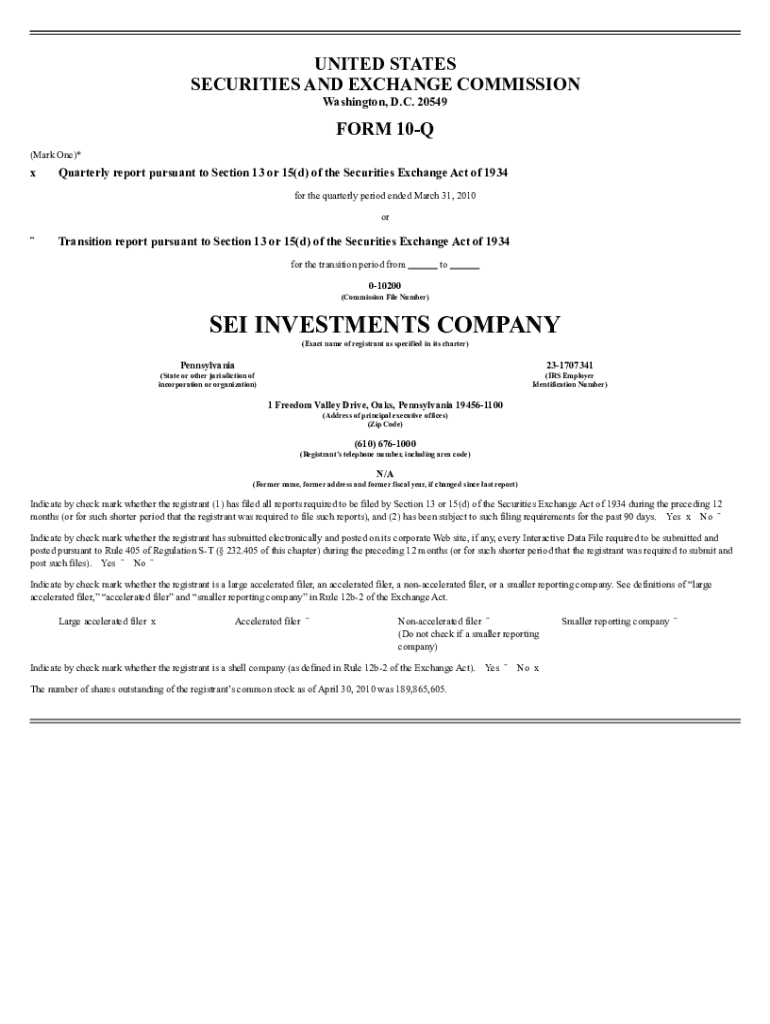

Form 10-Q serves as a crucial instrument in corporate financial reporting, providing an overview of a company's financial performance on a quarterly basis. This report is mandated by the U.S. Securities and Exchange Commission (SEC) and must be filed by publicly traded companies. The fundamental purpose of Form 10-Q is to keep investors informed about a company’s financial position and operational progress throughout the fiscal year.

Beyond basic numbers and statistics, Form 10-Q offers valuable insights into company management’s perspective through the Management's Discussion and Analysis (MD&A) section. This component enhances investor understanding by clarifying the financial results presented alongside future business prospects. Overall, Form 10-Q plays a vital role in promoting transparency and compliance, ensuring that stakeholders have access to timely and relevant information.

Who must file Form 10-Q?

Filing Form 10-Q is a requirement for all publicly traded companies in the United States. This includes both domestic companies and foreign companies listed on U.S. exchanges as American Depositary Receipts (ADRs). The eligibility criteria extend to those who meet the definitions of large accelerated filers, accelerated filers, and non-accelerated filers, which are contingent on market capitalization and filing history.

By assessing the entity’s public float and the timing of previous filings, companies can determine their filing status under the SEC regulations. It’s imperative for firms that fall under these categories to remain compliant to avoid legal penalties and maintain investor trust.

Contents of Form 10-Q

Form 10-Q comprises several key sections designed to provide comprehensive updates about a company's financial condition. Firstly, it contains an overview of quarterly financial data, which presents the company’s income statement, balance sheet, and cash flow statement. Such detailed financial information is essential for investors who want to understand the operational effectiveness of a business in real time.

Another critical section is the Management’s Discussion and Analysis (MD&A), where management elaborates on the numbers and discusses significant trends, risks, and uncertainties faced by the company. This section provides qualitative context to the quantitative data, allowing a deeper understanding of performance drivers. In addition to these, Form 10-Q includes updates on legal proceedings, market risks, and internal control procedures, collectively enhancing transparency.

Filing a Form 10-Q

Filing a Form 10-Q may seem daunting, but it can be streamlined with proper preparation. To start, companies must collect all necessary financial data and ensure that it is accurate and up-to-date. This includes compiling quarterly figures from the company's accounting system and preparing detailed financial statements consistent with generally accepted accounting principles (GAAP).

Next, drafting the Management's Discussion and Analysis (MD&A) section is crucial. This narrative should explain the financials in detail, emphasizing significant changes compared to previous periods and discussing uncertainties that could affect future performance. Companies should be careful to avoid common pitfalls, such as including outdated information or omitting necessary disclosures that impact stakeholder understanding.

How to find and access Form 10-Q filings

Locating Form 10-Q filings is straightforward thanks to the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database. This online repository provides direct access to all required filings from publicly traded companies. Users can search by company name, ticker symbol, or the type of form they wish to review. An efficient user experience is crucial, as investors often rely on this information for timely decision-making.

Additionally, many companies make their Form 10-Q filings accessible on their investor relations pages, often providing direct links to the most recent documents along with previous quarters for comparative analysis. Tools like pdfFiller also offer interactive resources, allowing users to search for, retrieve, and manage these essential documents easily and efficiently.

Filing deadlines for Form 10-Q

Timelines for filing Form 10-Q vary based on the company’s classification. Large accelerated filers must submit their reports within 40 days after the end of the fiscal quarter, while accelerated filers have 40 days, and non-accelerated filers are given 45 days. Understanding these deadlines is crucial for compliance, as missed filings jeopardize the company's standing with the SEC and can adversely affect investor confidence.

Late filings can result in legal consequences, including penalties from the SEC, as well as potential reputational damage that may deter investors. In extreme cases, these ramifications can lead to delisting from public exchanges. Consequently, maintaining a strict schedule for Form 10-Q submissions is imperative for companies wanting to uphold their regulatory responsibilities.

Navigating potential issues with Form 10-Q

Failure to meet filing deadlines can create significant challenges for companies. If a Form 10-Q is filed late, companies should reach out to the SEC to explain the circumstances and take necessary remedial actions. It’s important to note that continuous late filings can lead to increased scrutiny and difficulties in securing future financing or maintaining share prices.

Moreover, if inaccuracies are discovered in filed forms, issuing an amended Form 10-Q is essential. This act of transparency not only helps maintain investor trust but also demonstrates the company’s commitment to regulatory compliance. The process involves correcting the initial data and re-filing the document promptly, highlighting the importance of diligence in financial reporting.

Beyond filing: Utilizing your Form 10-Q

The actionable insights gleaned from Form 10-Q can provide considerable value to internal teams and stakeholders. By analyzing financial performance trends over time, management can make informed decisions about strategic initiatives, resource allocation, and operational improvements. Furthermore, companies often leverage the insights from Form 10-Q during earnings calls and investor presentations, using the information to articulate their business narrative effectively.

Tools like pdfFiller enhance this process by allowing collaborative edits and secure sharing options with stakeholders. Teams can work together in real-time, ensuring that all key members are aligned with the financial updates and strategic discussions. By adopting a comprehensive document management platform, companies not only streamline their filing processes but also enhance communication and collaboration.

Best practices for efficient form management

Effective document management is essential for maintaining organized and accessible records of Form 10-Q filings. One strategy is to implement consistent organizational techniques, such as creating a dedicated folder system for each quarter's filing and archiving older forms in a systematic manner. This approach ensures quick retrieval and avoids confusion when analyzing historical data.

Furthermore, regular review processes are critical for maintaining compliance and readiness for audits. Establishing a routine to revisit submitted forms ensures that any discrepancies or inaccuracies can be identified and rectified promptly. Incorporating robust auditing tools within platforms like pdfFiller can simplify this monitoring process, providing reminders and alerts for upcoming deadlines and potential compliance issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

How do I make edits in form 10-q without leaving Chrome?

How do I edit form 10-q straight from my smartphone?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.