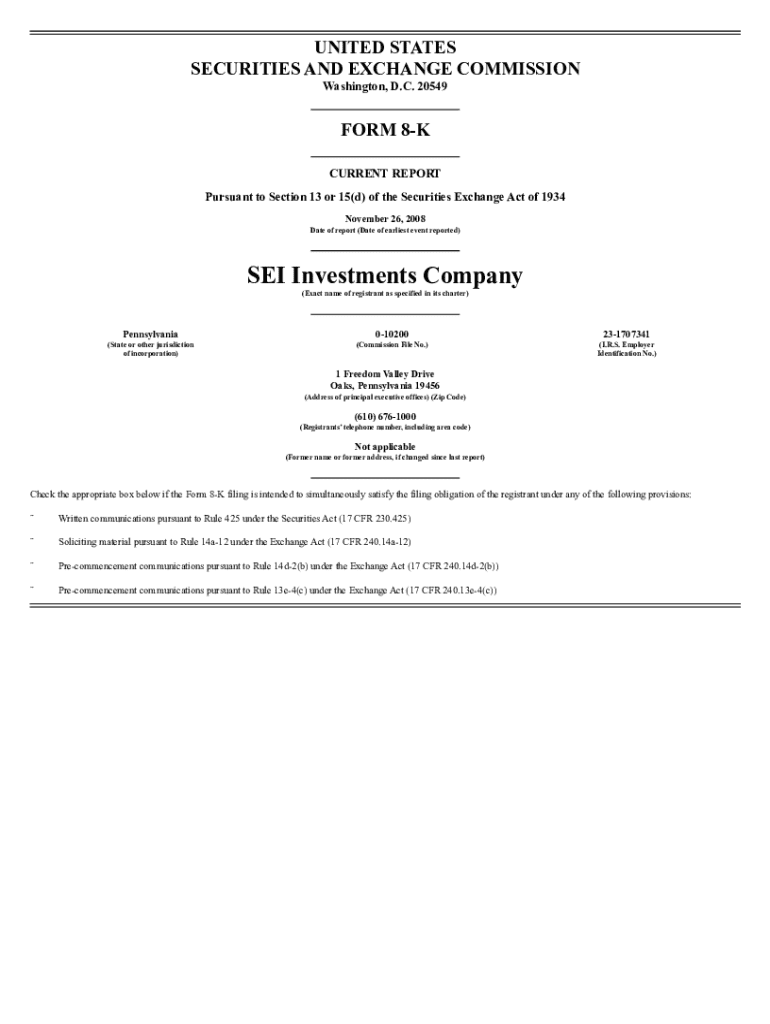

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding the 8-K Form: A Comprehensive Guide

Understanding the 8-K form

The 8-K form is a crucial document for public companies in the United States, serving as a means for timely disclosure of material events. This form is imperative for maintaining transparency with investors and upholding regulatory compliance. It allows companies to report significant corporate events that may influence the financial condition or operations of the company, thereby protecting investor interests.

Since the Securities Exchange Act of 1934, public companies have been obligated to file this form, which ensures that all investors have access to important information at the same time. Such compliance is essential not only for legal reasons but also for fostering trust in the corporate sector.

Historical context and purpose of the 8-K form

The 8-K form has evolved significantly since its inception. Initially, its main purpose was to provide immediate information related to company mergers, acquisitions, or changes in leadership. Over the years, the scope has expanded, now including a wide range of events that could affect a company's financial position, such as bankruptcies, stock buybacks, and significant agreements.

Key events triggering an 8-K filing include changes in a company's executive leadership, substantial asset purchases or sales, entry into significant contracts, or any other events that the Securities and Exchange Commission (SEC) deems material. This evolution showcases the SEC's commitment to enhancing market transparency and protecting investors from information asymmetry.

Key components of the 8-K form

The 8-K form consists of several critical sections, which vary depending on the nature of the event being reported. Items range from 1 to 9 and include topics like material agreements, termination of a material agreement, bankruptcy or receivership, and changes in the company’s certifying accountants.

The specifics of different disclosures can have substantial implications. For instance, if a company enters into a significant merger and fails to report it correctly, it can lead to investor discontent and legal repercussions. Hence, understanding how to effectively use these sections is vital.

When is the 8-K form required?

Certain mandatory events require an 8-K filing. These typically include significant corporate changes such as mergers and acquisitions, changes in executive leadership, restatement of financial statements, or bankruptcy filings. Public companies must remain vigilant to ensure they report these events within the designated timelines.

Filing deadlines are particularly strict, with the SEC requiring most events to be reported on Form 8-K within four business days of the occurrence. Exceptions exist, but they are relatively limited. Therefore, a clear understanding of these timelines is indispensable for compliance.

How to properly fill out the 8-K form

Completing the 8-K form involves several detailed steps. First, gather all necessary information like financial statements, relevant press releases, and any other documents that substantiate your disclosure. Clear and concise documentation is paramount.

Next, you'll need to select the appropriate items on the form that reflect the events prompting the filing. The specific formatting requirements must be carefully followed to facilitate review by the SEC. Best practices include clear definitions and relevant context for corporate events reported.

Utilizing tools like pdfFiller can streamline this process with interactive templates designed specifically for the 8-K form, allowing companies to fill out the document efficiently.

Tips for editing and reviewing the 8-K form

Emphasizing accuracy and compliance in the 8-K form is crucial. Common pitfalls include overlooking required items and providing vague details. Engaging both legal and finance teams for reviewing the document is a must, as they can help catch inaccuracies and ensure compliance.

Editing is another vital step; tools like pdfFiller offer a range of capabilities to enhance clarity and precision. Collaboration features allow team members to review and input changes seamlessly, guaranteeing that every statement in the final submission reflects the company's position accurately.

Benefits of using the 8-K form

Filing an 8-K form provides numerous benefits, most notably in establishing transparency and building trust with investors. Timely reporting of significant corporate events reassures stakeholders that they are kept informed of the company’s status.

Moreover, the submission of the 8-K form fosters enhanced corporate governance. It ensures that management is held accountable for their actions, and also provides a mechanism for the SEC to monitor compliance. These disclosures carry weight, as they can influence market reactions and regulatory scrutiny.

Resources for understanding and accessing the 8-K form

To navigate the complexities surrounding the 8-K form, various resources are available. Frequently asked questions often arise regarding specific filing requirements and the various items covered by the form. Addressing these queries can dispel many misconceptions about the form's purpose and its usability.

For practical documentation needs, platforms like pdfFiller offer tools to create, edit, and file 8-K forms efficiently. The user-friendly approach ensures that businesses can maintain compliance while managing other documentation seamlessly.

Case studies: Real-world examples of 8-K filings

Analyzing significant 8-K filings helps in understanding the implications and outcomes of disclosures. High-profile cases, such as major acquisitions or executive changes, provide insights into how timely and accurate reporting can affect investor confidence and market trends.

Lessons from these notable filings highlight the importance of not only regulatory compliance but also the potential market movements that can occur in response to the disclosed events. Such analyses guide companies in improving their reporting practices.

Future outlook: The evolution of 8-K filings

As corporate reporting continues to evolve, the 8-K form is likely to adapt as well. The rise of technology in financial reporting has led to developments in artificial intelligence and data analysis, enhancing transparency and compliance efforts within companies.

Looking ahead, potential legislative changes could further influence the structure and requirements of the 8-K form, leading companies to integrate more robust disclosure practices. Staying informed about such updates will be crucial for companies aiming for regulatory compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8-k without leaving Google Drive?

Where do I find form 8-k?

How do I fill out the form 8-k form on my smartphone?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.