Get the free Salary Advance Form

Get, Create, Make and Sign salary advance form

Editing salary advance form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out salary advance form

How to fill out salary advance form

Who needs salary advance form?

Salary Advance Form: A Comprehensive How-To Guide

Understanding the salary advance form

A salary advance form is a document that employees fill out to request access to part of their earned but unpaid wages before the regular payday. The primary purpose of this form is to provide a temporary solution for employees facing unexpected financial challenges, offering them immediate liquidity without the need for high-interest loans. Both employees and employers can benefit from this arrangement; employees gain financial flexibility, while employers foster goodwill and enhance employee satisfaction by addressing urgent cash flow needs.

Increasing financial literacy around salary advances can empower employees to make informed decisions about their finances. Understanding when and how to use this form not only helps in managing immediate crises but also promotes a culture of responsible personal finance within the workplace.

Why you might need a salary advance

There are several common scenarios where requesting a salary advance becomes necessary. For instance, emergency expenses such as medical bills or unexpected car repairs can arise suddenly, leaving employees in a precarious financial position. Unplanned bills may also jeopardize their financial stability, prompting them to seek a salary advance for temporary relief.

Opting for a salary advance can offer distinct advantages over traditional loans or credit options. Unlike personal loans, salary advances usually have fewer qualifications, lower or absent interest rates, and do not require credit checks. This can make them more accessible, particularly for those who may struggle to secure other forms of financial assistance.

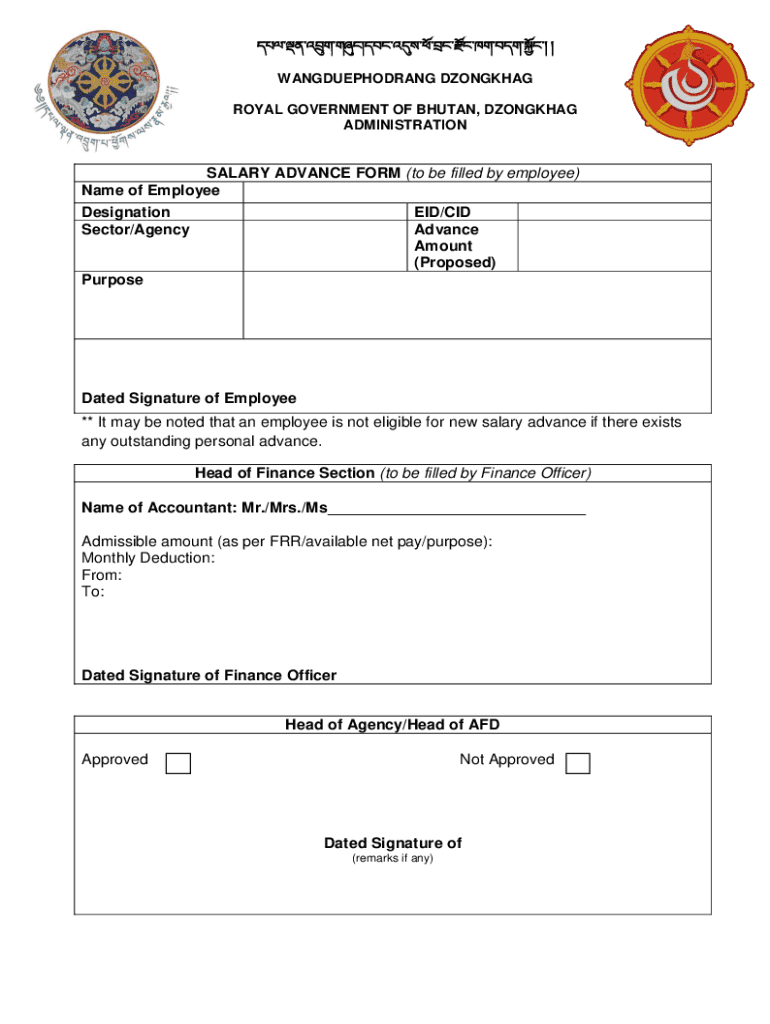

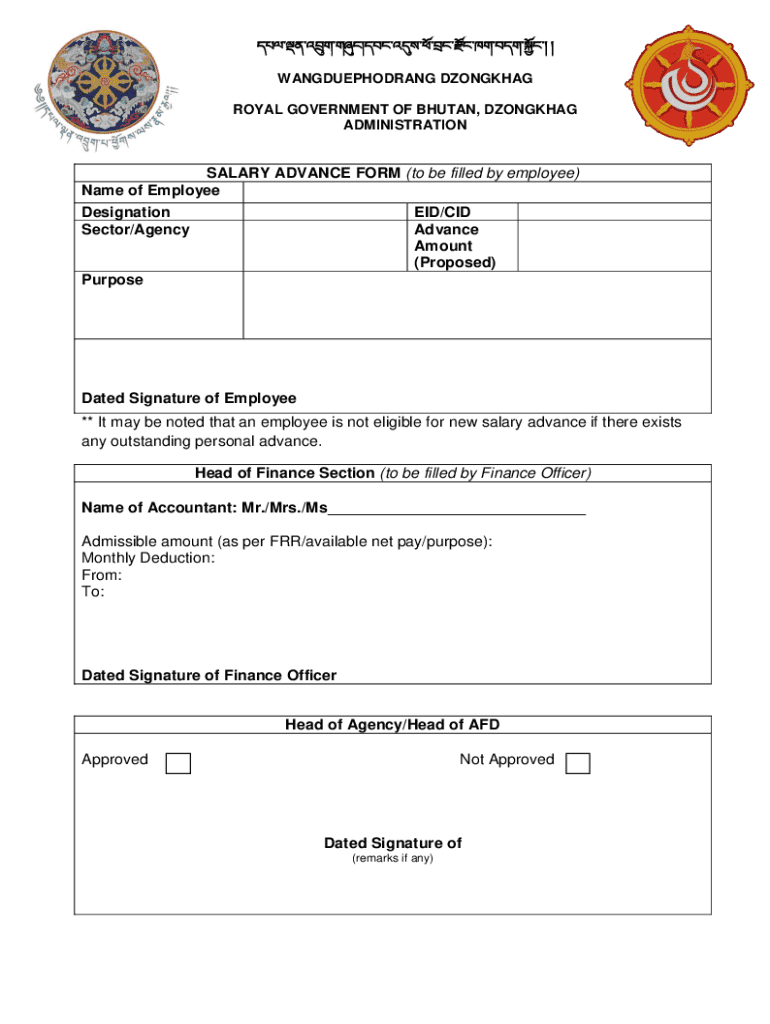

The components of a salary advance form

Understanding the components of a salary advance form is crucial for successfully navigating the application process. Key fields typically included in the form are the employee's name, position, and department, which help HR identify the applicant's status within the company. Additionally, the form will require the amount requested along with a justification for the advance, helping justify the need for the funds.

Furthermore, it's essential to outline clear repayment terms and conditions, often indicating how the advance will be repaid via payroll deductions. Supplemental documents may be required as well, such as proof of identification or, optionally, documentation supporting the need for the advance.

Step-by-step guide: filling out the salary advance form

Filling out the salary advance form can seem daunting, but it's a straightforward process. First, gather all necessary information by reviewing your company's policies regarding salary advances. It's essential to check eligibility and understand any limits on advance amounts, as each organization may have different guidelines.

Next, complete the form by filling in each section carefully. Start with personal information, then specify the requested amount and provide a concise justification for the advance. Pay close attention to repayment conditions to ensure compliance with organizational policies. To avoid common pitfalls, double-check the form for any errors or incomplete sections.

After filling out the form, submit it through the appropriate channels within your company, whether digitally or as a printed document. Understanding the approval workflow is crucial; identify who will review your request and what the expected turnaround time is. Finally, follow up on your submission by inquiring about the status of your request. Keep in mind that if your request is denied, reviewing the justification with HR will be essential for future applications.

Managing your salary advance

Once a salary advance is approved, managing the repayment plan is key to ensuring that it doesn’t disrupt your budget or financial planning. Different repayment structures are available, including lump-sum payments or scheduled payroll deductions. It’s vital to choose a plan that aligns with your financial capabilities, making it easier to manage alongside regular living expenses.

Tracking your balance is also important. Maintain awareness of how much is being deducted from your paychecks and communicate with HR if any issues arise. A proactive approach to financial planning post-advance will help you avoid needing future advances. Create a budget that incorporates your usual expenses and a buffer for unforeseen circumstances, allowing for greater resilience against financial pressures.

FAQs about salary advance forms

Understanding the nuances surrounding salary advances can clarify many common concerns. For instance, if you exceed your repayment timeline, it may lead to deductions from subsequent paychecks or negatively impact your standing with HR. Additionally, it’s essential to consider that salary advances are typically not taxable; they are simply an early disbursement of your earned wage. Employees often wonder if they can request multiple salary advances within a year, which largely depends on the guidelines set by their employer.

It's also vital for employees to know their rights when requesting a salary advance, including their entitlement to transparency regarding the approval process and repayment terms. Understanding these factors empowers employees to make informed decisions about their financial needs without undue stress.

Best practices for employers

Employers should strive to create a fair salary advance policy that balances employee needs with financial prudence. Guidelines for approval should be clear and transparent, ensuring consistency across the board. It’s equally important to educate HR teams on effectively handling salary advance requests, as they play a critical role in this process.

Additionally, fostering open communication with employees regarding the salary advance process will enhance understanding and acceptance of the policy. Employers might consider providing informational sessions or resources to ensure employees are aware of the forms and procedures involved, ultimately leading to smoother operations.

Utilizing interactive tools for managing salary advances

pdfFiller offers innovative solutions for managing salary advance forms that simplify the entire process. Employees can easily edit salary advance forms to suit their needs, and the eSignature feature allows for quick approvals, reducing turnaround time for both HR and employees.

Collaboration tools become particularly useful when multiple team members are submitting salary advance requests. pdfFiller enables seamless communication and real-time updates, ensuring clarity and efficiency throughout the organization when managing salary advances.

Conclusion: streamlining salary advance processes

The salary advance form plays a vital role in alleviating financial stress for employees, providing a mechanism for quick access to needed funds. Encouraging open communication between employees and management can help ensure that the process is transparent and efficient. By leveraging tools like pdfFiller, organizations can streamline the document management aspect, making it easier for both employees and HR teams to navigate the salary advance process effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find salary advance form?

How do I execute salary advance form online?

Can I create an eSignature for the salary advance form in Gmail?

What is salary advance form?

Who is required to file salary advance form?

How to fill out salary advance form?

What is the purpose of salary advance form?

What information must be reported on salary advance form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.