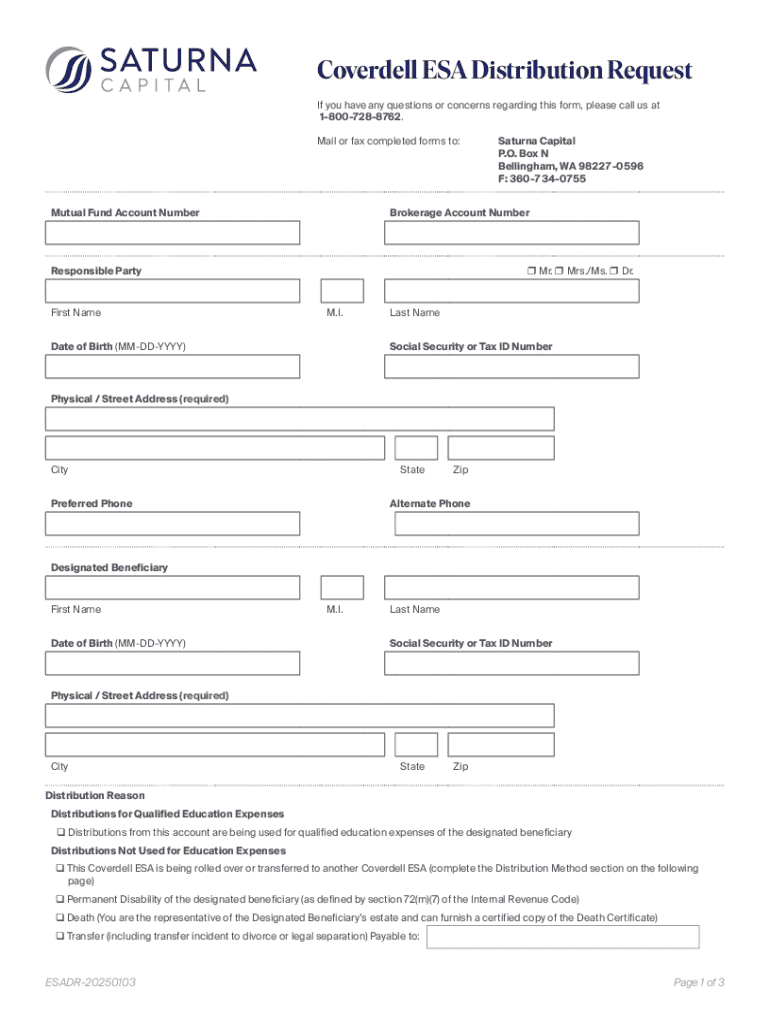

Get the free Coverdell Esa Distribution Request

Get, Create, Make and Sign coverdell esa distribution request

How to edit coverdell esa distribution request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell esa distribution request

How to fill out coverdell esa distribution request

Who needs coverdell esa distribution request?

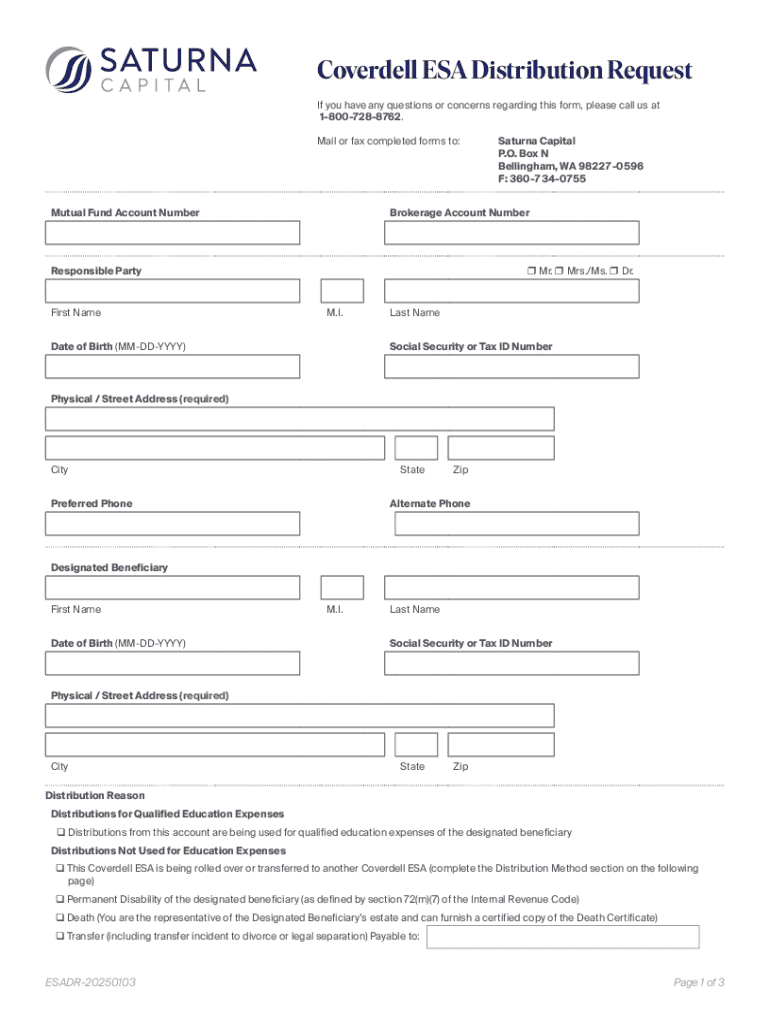

Understanding the Coverdell ESA Distribution Request Form

What is a Coverdell Education Savings Account (ESA)?

A Coverdell Education Savings Account (ESA) is a tax-advantaged savings account designed to help families save for education-related expenses. While primarily intended for elementary and secondary education, Coverdell ESAs can also be utilized for post-secondary education costs. The account allows for tax-free growth and tax-free withdrawals when the funds are used for qualified educational expenses. This makes Coverdell ESAs an attractive option for parents aiming to alleviate the financial burden of educational costs.

The key benefits of utilizing a Coverdell ESA include flexibility in the use of funds, the ability to make contributions until the beneficiary reaches the age of 18, and the absence of taxes on earnings or withdrawals as long as the money is used appropriately. These accounts enable families to invest in a wide range of educational expenses, including tuition, books, and other related costs, ensuring that children have access to the learning resources necessary for success.

Who qualifies for Coverdell ESA?

Eligibility for contributing to a Coverdell ESA hinges on the contributor’s income and the age of the beneficiary. Contributions can be made by any individual, including relatives, as long as their modified adjusted gross income (MAGI) is below established limits. As of the current tax year, individuals with a MAGI below $95,000 or couples filing jointly below $190,000 are eligible to contribute the maximum amount of $2,000 per beneficiary annually.

The beneficiary must be under the age of 18 at the time of contribution unless they are a special needs beneficiary. It’s crucial to keep track of contribution deadlines, which typically coincide with the tax-filing deadline each year. Not adhering to these eligibility criteria can lead to unwanted taxes and penalties, making comprehension of the qualification rules paramount for anyone considering a Coverdell ESA.

Importance of the distribution request form

The Coverdell ESA distribution request form is a critical document as it authorizes the release of funds from the account, ensuring that distributions are conducted in compliance with tax regulations and account terms. The legal implications of this request are significant; improper distributions can incur taxes and penalties, compromising the financial benefits the ESA provides. By completing this form accurately, account holders protect their educational savings.

Distributions are typically requested for qualified expenses such as tuition, educational materials, and other approved costs. Retirement planning should also consider whether distributions suit long-term financial strategies and whether they align with the beneficiary’s educational timeline.

Step-by-step guide to completing the Coverdell ESA distribution request form

Completing the Coverdell ESA distribution request form requires careful attention to detail and accurate information. Begin by gathering your necessary information, including details about your ESA account, personal identification information such as Social Security numbers, and documentation that substantiates your intended expenses.

Next, filling out the distribution request form involves specifying the desired method of payment and listing the qualified expenses. Be sure to avoid common errors such as leaving sections blank or providing inaccurate beneficiary details. Proper completion ensures a smooth distribution process.

Types of distributions available

When it comes to withdrawing funds from a Coverdell ESA, you have several options. The two most common methods are lump-sum distributions, where the entire requested amount is withdrawn at once, and periodic distributions, where funds are taken out over a specified timeline. Each option carries different implications, particularly in relation to cash flow and tax consequences.

Choosing between these distribution types often depends on your immediate educational expenses and cash flow needs. For instance, if a child is entering college and has a large tuition obligation, a lump sum might be appropriate, whereas ongoing education expenses could be better managed with periodic withdrawals. Assessing your needs and considering your financial strategy is essential.

Utilizing pdfFiller’s tools for optimal document management

To simplify the completion and management of the Coverdell ESA distribution request form, pdfFiller offers an advanced suite of tools designed to enhance user experience. With pdfFiller, users can easily fill out forms, add signatures, and collaborate with others. The platform provides a seamless interface, allowing users to access their documents from any location and device, thus championing efficient document organization.

Interactive tools include templates for various forms, which can be easily edited to suit individual needs. These features empower users to take control of their document management, reducing the hassle of paperwork related to educational savings accounts.

Tracking your distribution request

Monitoring the status of your Coverdell ESA distribution requests is vital for ensuring a smooth experience. Establish best practices for tracking your requests, including keeping records of submission dates and any confirmation received. Regular follow-ups with the financial institutions involved can help clarify any status updates and address potential issues swiftly.

Moreover, using pdfFiller’s management tools can further enhance your ability to track and monitor forms. Users can receive alerts and notifications about document statuses directly within the platform, providing a clear overview of pending requests.

The importance of eSignatures in the distribution request process

In the era of digital documents, eSignatures have revolutionized the way individuals finalize legal forms, including the Coverdell ESA distribution request form. The convenience and security associated with eSigning streamline the submission process and minimize delays often associated with physical signatures, allowing users to manage their documents efficiently.

Using eSignatures through pdfFiller guarantees the integrity of the document while providing a legal validity that is widely accepted. This can accelerate the approval of distribution requests while ensuring that all legal requirements are met with ease.

How to eSign your Coverdell ESA distribution request form using pdfFiller

To eSign your Coverdell ESA distribution request form on pdfFiller, navigate to the document you need to sign. The platform guides users through the eSigning process by offering intuitive steps: first, choose your signature style or create one directly on the platform. Click on the designated signing area, and your signature will be placed effortlessly into the document.

Once signed, you can then download the finalized document or send it directly to the relevant financial institutions. Security features, including encryption and secure cloud storage, ensure that your documents and signatures are protected at all times.

Troubleshooting common issues with distribution requests

The process of submitting a Coverdell ESA distribution request can occasionally come with hurdles. Common challenges include delayed processing times due to errors on the form or the submission of incomplete applications. Additionally, having forgotten credentials or misunderstandings regarding distribution eligibility can hinder the approval process.

Fortunately, addressing these issues is often straightforward. If you face processing delays, reach out to your financial institution for updates and clarification. Familiarizing yourself with the submission requirements and guidelines can prevent misunderstandings, ensuring smoother navigation through the request process.

Understanding tax implications

Understanding the tax implications surrounding distributions from a Coverdell ESA is critical to avoid unwanted penalties and to maximize its financial benefits. Distributions used for qualified expenses remain tax-free, while non-qualified distributions may subject the account holder to income taxes and a 10% penalty on the gains. This underscores the importance of accurately documenting and filing all expenses associated with the withdrawals.

To maintain compliance, individuals should keep meticulous records of all distributions made, including invoices and receipts for educational expenses. This documentation serves as protection against any audits or inquiries from the IRS. Adhering to these practices can help users fully leverage the financial advantages of their Coverdell ESAs.

Keeping records of distributions

Documentation is vital for managing a Coverdell ESA effectively. Keeping detailed records of distributions provides clarity and aids in tax reporting. It's essential to retain copies of all distribution requests submitted, along with any correspondence with financial institutions involving those requests. You should also track the amounts withdrawn and their corresponding purpose, resulting in a clearer picture of your educational spending.

Establishing a dedicated file or folder for these records enables easier access when preparing annual taxes or for potential AUDIT inquiries. Maintaining accurate documentation can contribute to better financial management practices across all education-related expenses.

Additional templates and forms available on pdfFiller

pdfFiller offers a variety of additional templates and forms that can enhance your educational funding experience. These resources include tax forms specifically related to educational expenses, expense reimbursement forms, and other document templates that streamline the financial management process. Utilizing these additional resources increases efficiency and helps simplify the overall process of education-related financial management.

Accessing these templates on pdfFiller allows users to focus on educational goals rather than getting bogged down in paperwork. The platform's comprehensive toolkit supports users in managing both expenditures and documentation, empowering them to navigate their financial responsibilities smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the coverdell esa distribution request electronically in Chrome?

How can I fill out coverdell esa distribution request on an iOS device?

Can I edit coverdell esa distribution request on an Android device?

What is coverdell esa distribution request?

Who is required to file coverdell esa distribution request?

How to fill out coverdell esa distribution request?

What is the purpose of coverdell esa distribution request?

What information must be reported on coverdell esa distribution request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.