Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Comprehensive Guide to Form 10-Q: Completion and Management

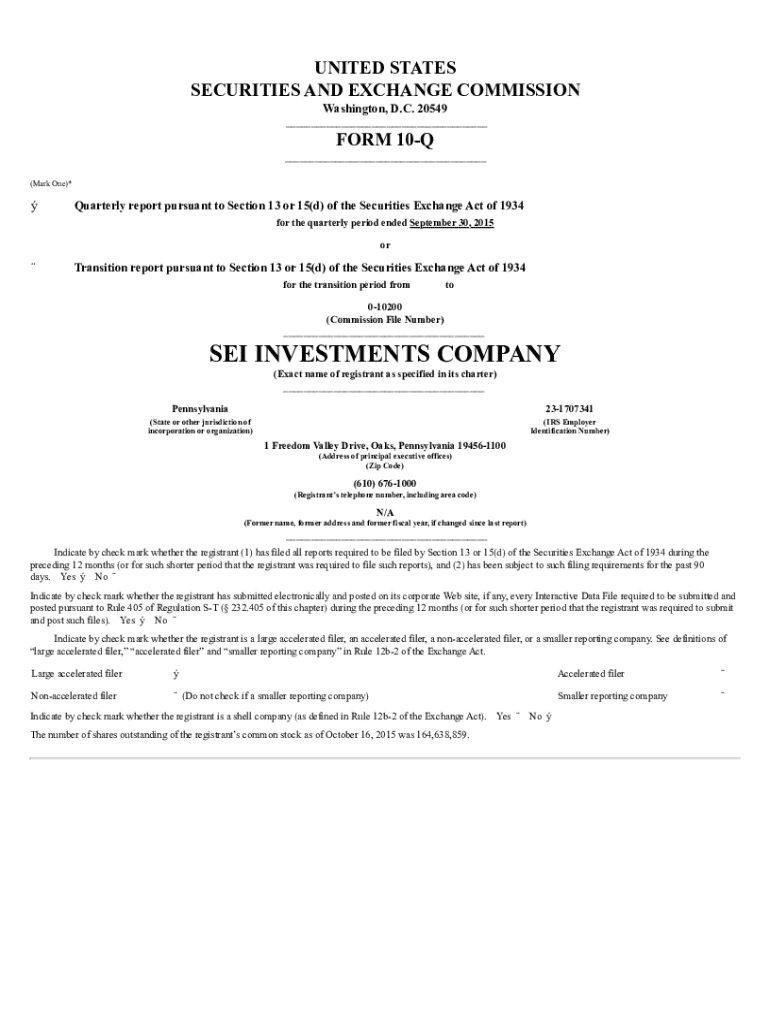

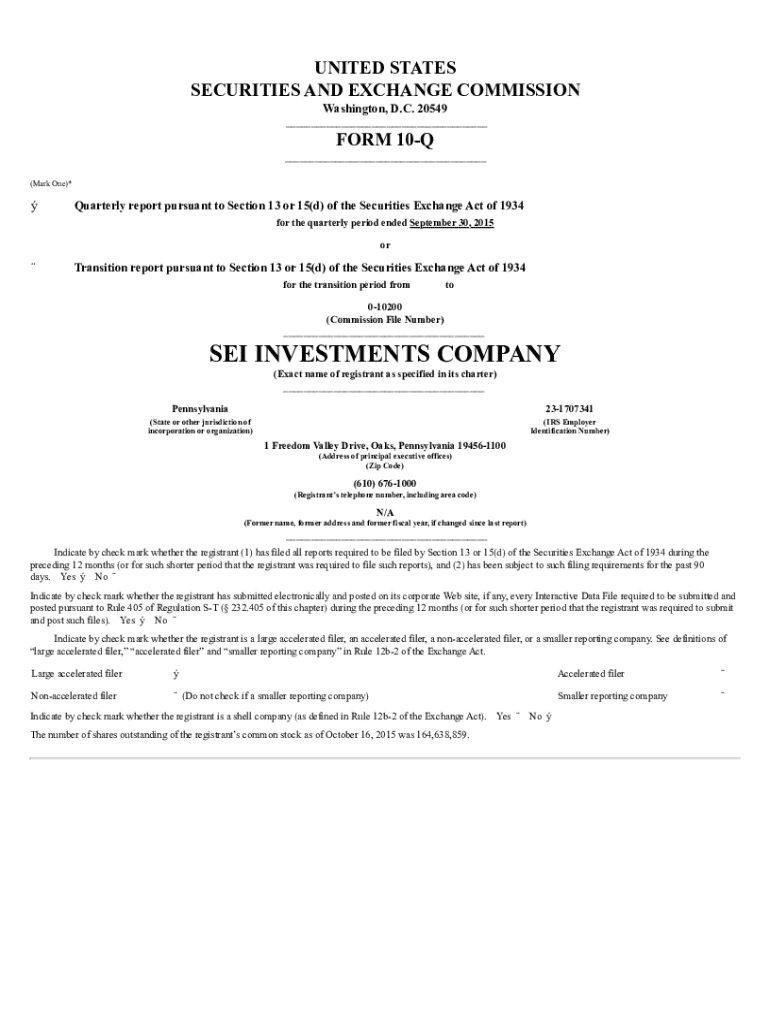

Understanding Form 10-Q

Form 10-Q is a quarterly financial report mandated by the U.S. Securities and Exchange Commission (SEC). It provides a comprehensive overview of a public company's financial performance within a fiscal quarter and is a crucial tool for maintaining corporate transparency. The 10-Q plays an essential role in investor relations by offering timely updates that aid investors in making informed decisions. Unlike the annual Form 10-K, which presents a complete picture of the company's performance over the entire year, the Form 10-Q focuses on the most recent quarter, allowing stakeholders to assess trends and short-term performance.

While both forms serve to keep investors informed, the 10-Q may contain less detailed information than the 10-K, especially in the discussion of risks and financial condition. The distinction lies in the frequency and depth of disclosures, with the 10-Q acting as a periodic update and the 10-K serving as a more exhaustive resource.

Components of Form 10-Q

The structure of the Form 10-Q is designed to present key financial information clearly and succinctly. It typically includes the following sections:

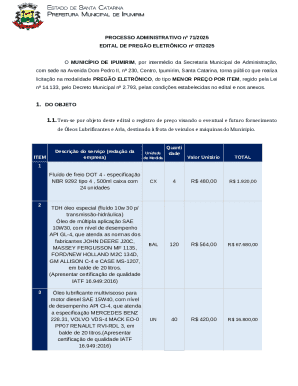

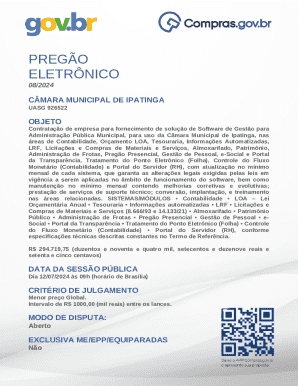

Specific items required in the Form 10-Q include financial metrics such as revenues, net income, earnings per share, and segment reporting. The SEC mandates that all public companies disclose significant events affecting their operations and financial standing during the quarter, thus ensuring investors remain informed and equipped to make sound decisions.

How to locate Form 10-Q filings

Locating Form 10-Q filings is essential for investors, analysts, and company stakeholders. The SEC's EDGAR database is the primary source for accessing these documents. To effectively navigate this resource, follow these steps:

Reviewing multiple quarters is crucial for analyzing performance trends, especially in industries where seasonality can have significant effects on financial results. Observing changes from quarter to quarter can provide deeper insights into the company's operational health and strategic choices.

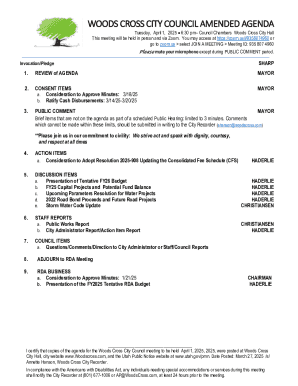

Filing deadlines for Form 10-Q

Understanding the timelines for filing Form 10-Q is key to compliance and maintaining market trust. The SEC has established standard deadlines based on a company's classification, which includes:

Timeliness in filing is paramount as delays can lead to repercussions, including penalties from the SEC and a decline in investor trust. Furthermore, missing deadlines can negatively impact the company's market perception, leading to a decrease in stock prices and shareholder confidence.

Managing the Form 10-Q filing process

Effective management of the Form 10-Q filing process is critical to ensuring accuracy and compliance. Preparation steps should include best practices for data collection and team collaboration. Recommended tools can aid in streamlining processes and enhancing efficiency.

The review phase is equally important. Thorough checks and edits should be conducted to ensure accuracy and compliance with SEC regulations. Utilizing tools like pdfFiller allows for collaborative reviews and eSigning capabilities, streamlining the final approval process.

Common challenges and solutions

Filing Form 10-Q comes with its share of challenges. Managing data accuracy and completeness is a significant concern that companies face. Ensuring compliance with SEC regulations can also be intricate, particularly when multiple departments are involved.

To overcome these challenges, leveraging dynamic tools like pdfFiller can facilitate smoother processes. Furthermore, effective team collaboration and communication strategies can lay the groundwork for a successful filing experience.

Interactive tools for Form 10-Q management

Incorporating technology into the Form 10-Q management process can dramatically enhance efficiency. pdfFiller offers a range of features that allow for creating, editing, and managing Forms 10-Q seamlessly.

Using these interactive tools ensures that revisions are tracked, and document versions are managed effectively, promoting transparency and reliability within the filing process.

Key takeaways for successful Form 10-Q filing

To successfully navigate the complexities of Form 10-Q filings, it is crucial to adhere to a structured approach that encompasses all phases from preparation to submission. Key points to consider include:

A comprehensive checklist is beneficial to ensure that necessary items are not overlooked before submission. Key components of this checklist should include verifying financial figures, ensuring all required disclosures are included, and confirming the compliance with SEC regulations before finalization.

Empowering teams with pdfFiller

Adopting cloud-based solutions like pdfFiller can offer significant advantages for teams involved in preparing Form 10-Q filings. The platform provides convenience, accessibility, and error reduction, key factors in today’s fast-paced financial environment.

Moreover, pdfFiller enhances team collaboration by allowing multiple users to work on documents simultaneously. This level of interactivity not only increases efficiency but also promotes a culture of teamwork and accountability, vital for navigating complex filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-q from Google Drive?

How do I execute form 10-q online?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.