Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Fill Out Form 8-K: A Comprehensive Guide

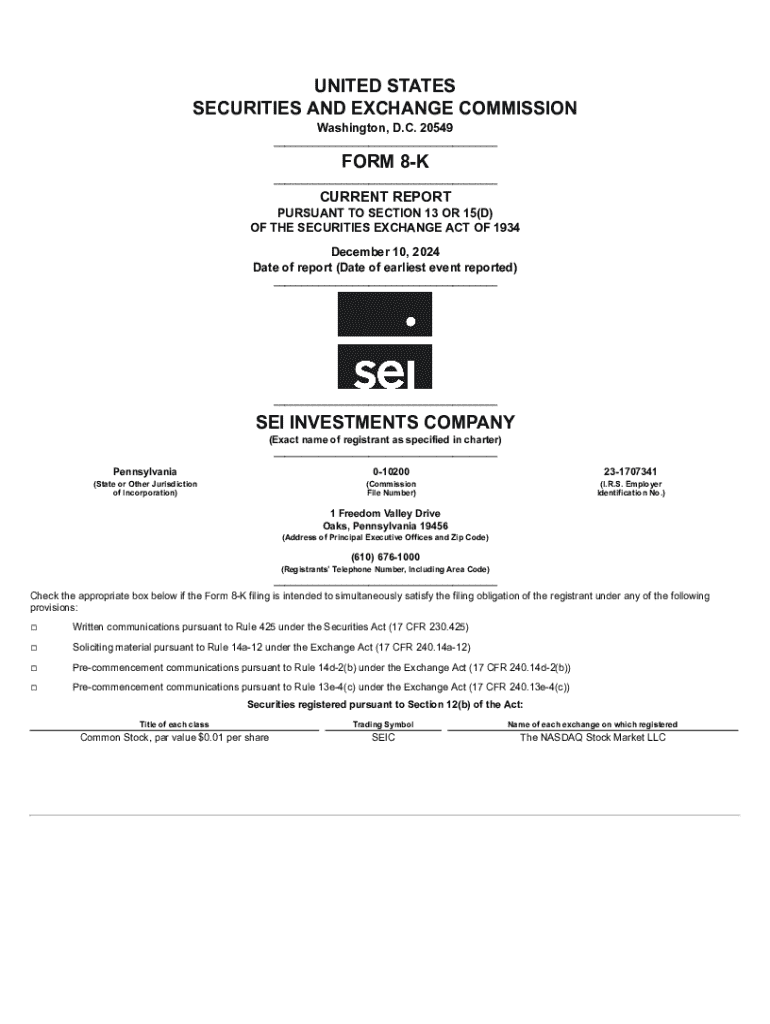

Understanding Form 8-K

Form 8-K is a crucial document that public companies in the United States are required to file with the Securities and Exchange Commission (SEC) to disclose significant events that may be of interest to shareholders. This form serves as a communication tool between the company and its investors, providing transparency regarding major occurrences that affect the company's operations, financial health, or leadership.

The importance of Form 8-K in corporate governance cannot be overstated. It helps maintain a level playing field for all investors by ensuring that material information is disseminated in a timely manner, allowing stakeholders to make informed decisions.

Key information disclosed in Form 8-K

Form 8-K covers a variety of critical disclosures. Required disclosures and events triggering this filing include significant corporate events such as mergers or acquisitions, changes in executive leadership, delisting from a stock exchange, or calls of convertible securities. For example, if a firm announces a merger that alters its landscape dramatically, this must be reported via Form 8-K to inform investors of potentially significant changes impacting their investments.

When is Form 8-K required?

Federal regulations dictate specific instances when a company must file Form 8-K. Common scenarios necessitating this form include major corporate changes such as mergers and acquisitions, entering or terminating material agreements, and changes in the company’s financial condition. It’s essential for companies to recognize the events that trigger Form 8-K filings to comply with the SEC's requirements.

Typically, the deadline for submitting Form 8-K is four business days after the occurrence of the event. For timely reporting, companies need efficient processes in place to ensure that significant events do not go unreported or delayed, jeopardizing their regulatory compliance.

Navigating the 8-K filing process

Preparing to file Form 8-K requires careful consideration and organization. Companies should gather necessary information well in advance of the filing deadline. This involves compiling relevant documentation related to the triggering event, fact-checking, and assessing corporate timelines to ensure all information is accurate and concise.

Upon gathering the necessary details, the actual process of filling out Form 8-K can seem daunting. However, following a structured approach makes it manageable. Below is a step-by-step guide on how to fill out this essential form effectively.

For submission, follow the guidelines laid out by the SEC's EDGAR system, ensuring that all necessary filing fees and requirements are adhered to. Knowing the administrative aspects of submission can prevent unnecessary delays.

Benefits of using pdfFiller for Form 8-K

Incorporating pdfFiller into your Form 8-K filing process can significantly enhance efficiency. pdfFiller provides seamless PDF editing capabilities and comprehensive document management features that make it easier for users to complete, sign, and collaborate on Form 8-K filings. Users can edit the form directly, ensuring clarity and precision.

With eSigning features, obtaining signatures for quick approvals becomes straightforward, enabling teams to expedite the filing process. Moreover, the platform’s collaboration tools foster teamwork and transparency among team members by allowing real-time edits and discussions on the document.

How to read an 8-K form effectively

Understanding the components of Form 8-K is essential for interpreting the information it contains. The structure of an 8-K typically includes several key sections, such as the purpose of the filing, the timestamp of the event, and detailed descriptions of the events or changes being reported.

When reading an 8-K, it’s crucial to focus on the most pertinent sections that relate to your interests, such as the financial outlook, impact on shareholders, and examples of past performance. Understanding the terminology can be challenging, but resources are available for those who seek deeper insights into specific filings.

Common FAQs about Form 8-K

Form 8-K filing can raise many questions among corporate teams and stakeholders. For instance, many companies wonder what consequences they might face if they fail to file this form on time. The repercussions can include regulatory penalties and declining investor trust, making timely filings critical.

Another common question revolves around amendments: yes, a Form 8-K can be amended after submission, but it must follow specific protocols to ensure compliance. Understanding how frequently companies should file is also relevant, as it depends on the company’s activities and events. Lastly, finding past Form 8-K filings can easily be done through the SEC's EDGAR database.

Interactive tools for managing Form 8-K filings

Utilizing the right interactive tools can greatly simplify the process of managing Form 8-K filings. Features offered by pdfFiller allow organizations to track changes and updates on filed documents efficiently. This real-time monitoring capabilities provide a framework for ensuring compliance while improving overall organizational efficiency.

Collaboration features also empower teams to work together on filings, promoting a unified approach to compliance and regulatory reporting. These tools contribute to transparency and accountability within organizations, making them invaluable assets in managing SEC filings successfully.

Real-world examples of Form 8-K usage

Analyzing practical examples of Form 8-K filings can provide valuable insights into how companies navigate significant events. Notably, companies like Amazon and Microsoft have filed Form 8-Ks to announce strategic mergers, leadership changes, or financial restatements. Each filing illustrates not only regulatory compliance but also the companies’ commitment to keeping their stakeholders informed.

Consider a merger: when a company announces its acquisition of another, the Form 8-K will detail the transaction’s financial implications, projected outcomes, and timelines. Analysts often look closely at these filings to gauge market reactions and how such events might influence stock prices.

Understanding Form 8-K in different sectors

Form 8-K filings can vary across different sectors, each presenting unique considerations. For instance, technology companies might frequently report on product launches and patent acquisitions, while firms in finance often disclose changes in management and regulatory compliance issues. Tailoring one’s approach to filing based on industry requirements is crucial for ensuring the form’s effectiveness.

Knowing-sector specific trends can also guide companies on how best to communicate news. For instance, a biotech firm might file due to clinical trial results, while retail companies could signal shifts based on consumer spending patterns. Understanding the nuances of your industry ensures that filings are timely and relevant.

Latest trends and updates related to Form 8-K

The landscape for Form 8-K is never static; it continually evolves in response to regulatory changes and market phenomena. Recently, the SEC has introduced new guidelines aimed at making disclosures more streamlined and relevant. This trend toward clear, concise reporting means companies need to stay abreast of these developments to ensure compliance and improve stakeholder communication.

Additionally, the incorporation of technology in filing processes is gaining traction. Firms are leveraging software platforms such as pdfFiller to enhance their efficiency during the filing process. Looking ahead, predictions suggest that future requirements may call for more comprehensive disclosures, reflecting ongoing changes in corporate governance and investor expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k for eSignature?

Can I create an eSignature for the form 8-k in Gmail?

How do I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.