Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive How-to Guide

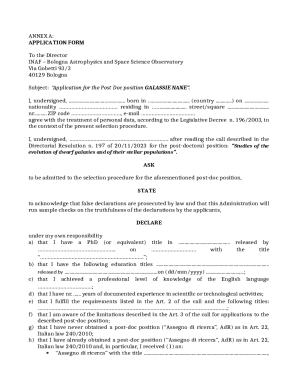

Understanding Form 8-K

Form 8-K serves as a crucial reporting tool for publicly-traded companies to communicate important events and milestones to the SEC and its investors. This form is designed for comprehensive disclosure, allowing companies to inform stakeholders about significant changes that might affect their business operations or stock prices. As such, it aligns with the overarching objective of the Securities and Exchange Commission (SEC) to ensure transparency in the securities markets.

The primary purpose of Form 8-K is to provide timely updates regarding various corporate events that could influence shareholder decision-making. This forms a part of a broader regimen of SEC reporting requirements, which also includes forms like Form 10-K and Form 10-Q. While those forms are focused on annual and quarterly reporting, Form 8-K ensures that investors can stay up-to-date with recent developments, keeping the market informed and equitable.

When is Form 8-K Required?

Filing a Form 8-K is generally triggered by significant corporate events that may affect the company’s stakeholders or market standing. These include major events like mergers or acquisitions, bankruptcy proceedings, or the appointment of key executives. The requirement for disclosure ensures that investors are promptly informed about events that could influence the company's performance or the stock's value.

Companies are obliged to file their 8-K forms within four business days of a triggering event. This tight deadline emphasizes the importance of timely communication and accountability in corporate governance. Failing to file on time may result in penalties, regulatory scrutiny, or even difficulty in attracting investors.

Key components of Form 8-K

Form 8-K encompasses several mandatory sections that companies must complete when filing. These sections include not only basic company details but also specific information relevant to the events being disclosed. Each company must adhere to the SEC's guidelines by ensuring their report is comprehensive and transparent, covering all required disclosures.

Key sections in Form 8-K include detailed components that guide companies on what to submit. The use of item numbers helps categorize disclosures; for instance, Item 1.01 pertains to the entry into a material definitive agreement, while Item 5.02 covers executive officer resignations or appointments. Understanding these sections can facilitate more effective reporting and ensure compliance.

How to read an 8-K form

Navigating through a Form 8-K requires a critical eye, as the layout is pivotal in understanding the information presented. Typically, an 8-K consists of several identified sections, including the event date and an item number that categorizes the type of disclosure. Reading these sections in order aids in grasping the full context and implications of the event.

When interpreting the information in a Form 8-K, focus on key sections such as the event summary, additional disclosures, and any legal notes. Additionally, the implications of the reported event should also be assessed, as they can affect market performance and investor sentiment. By efficiently dissecting an 8-K, stakeholders can extract essential facts and take informed actions in response to the information provided.

Benefits of filing Form 8-K

Timely filing of Form 8-K is instrumental in reinforcing shareholder confidence. By ensuring that important updates are communicated in a prompt manner, companies build trust with their investors. An effective disclosure strategy highlights the company’s commitment to transparency, potentially leading to improved investor relations and market reputation.

Moreover, proper compliance with Form 8-K filing can help organizations avoid legal repercussions that may arise from failing to disclose relevant information. Companies that neglect timely filings may face penalties from the SEC, increasing regulatory scrutiny and adversely affecting their market perception. Consistently adhering to filing obligations is crucial for maintaining a positive image and securing investor trust.

Interactive tools for managing Form 8-K

The evolution of technology has introduced digital solutions that streamline the process of creating and filing Form 8-K. Cloud-based platforms, such as pdfFiller, offer users the ability to collaborate seamlessly on documentation, enhancing efficiency for teams managing disclosures. These platforms often include templates specifically for 8-K forms, combined with electronic signature capabilities, thereby simplifying the process of document management.

Best practices for assembling an 8-K filing can significantly improve workflow and compliance. This includes maintaining accurate records of all corporate events that may necessitate an 8-K filing, documenting due diligence processes, and setting reminders for filing deadlines. Leveraging digital tools can assist in streamlining these practices, ensuring that companies are always prepared for the timely submission of necessary forms.

Frequently asked questions about Form 8-K

Understanding Form 8-K can be complex, leading to several common inquiries. A frequent question is how Form 8-K differs from other reporting forms like Form 10-Q or Form 10-K. While those forms focus on quarter and annual performance respectively, Form 8-K is used specifically for disclosing significant events as they occur, representing a real-time communication tool for companies.

Another common concern involves amending previously filed Forms 8-K. Companies may need to correct or provide additional information after filing, which is permitted through an amendment. It's essential to clearly mark the document as an amendment to signal to the SEC and investors that further clarification is being provided.

Resources for further learning

To master the intricacies of Form 8-K, numerous resources are available, including comprehensive guides and tutorials. Many organizations and professionals in the finance and legal sectors offer insights into SEC requirements, which could prove invaluable for someone preparing to file a Form 8-K. Exploring these resources not only deepens understanding, but also equips individuals and teams with practical knowledge for compliance.

Additionally, webinars and workshops are excellent avenues for staying up-to-date on best practices related to Form 8-K and SEC regulations. Engaging in such educational activity fosters a culture of continuous improvement, ensuring that companies remain vigilant and informed in their disclosure obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8-k without leaving Google Drive?

How do I execute form 8-k online?

How do I edit form 8-k straight from my smartphone?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.