Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

Understanding SEC Form 4

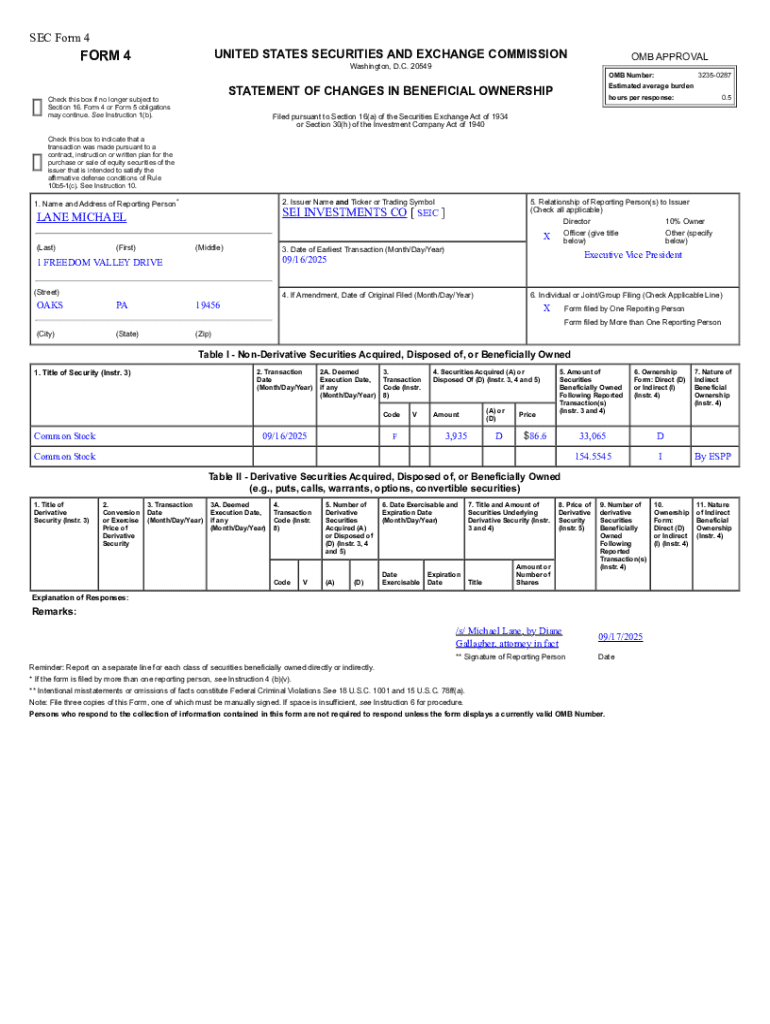

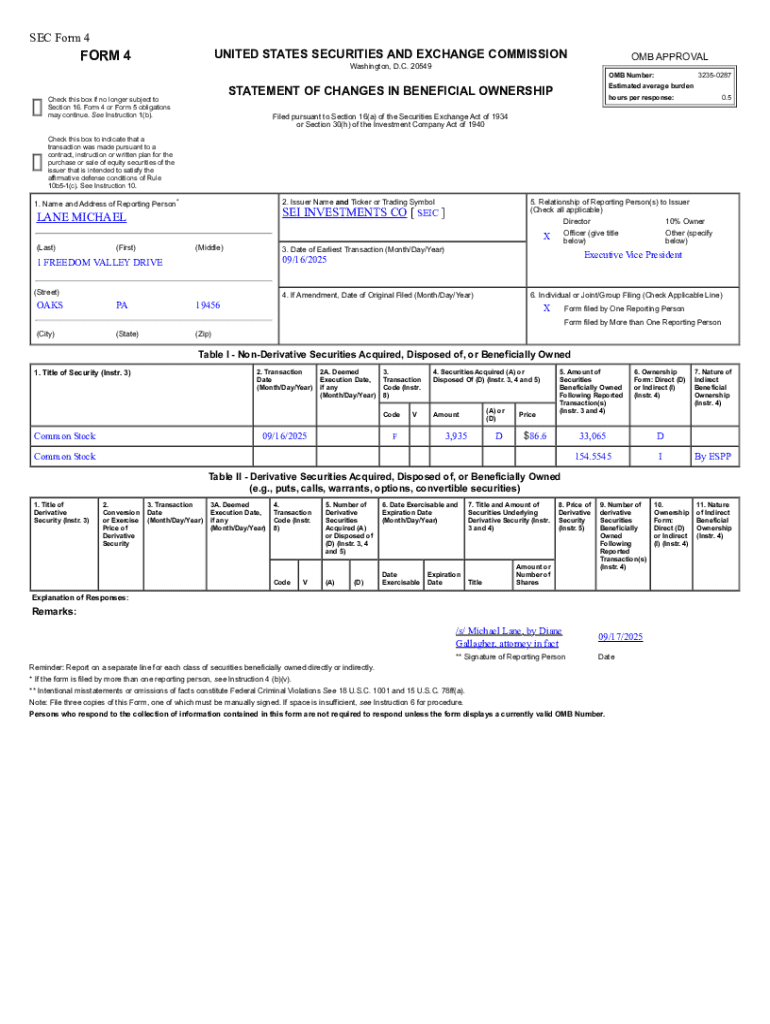

SEC Form 4 is a crucial document required by the Securities and Exchange Commission (SEC) that mandates insiders to report their equity securities transactions. Specifically designed for the reporting of insider trading activities, it helps maintain transparency in financial markets. According to Section 16(a) of the Securities Exchange Act, corporate executives, directors, and certain shareholders must file this form whenever they buy or sell shares in the companies they are associated with.

The essence of filing SEC Form 4 lies in its role in protecting investors and ensuring regulatory compliance. By disclosing insider transactions, this form allows investors to monitor the trading activities of key insiders, offering insights into market sentiments and potential stock performance.

Key elements of SEC Form 4

SEC Form 4 encompasses several key elements that must be accurately reported. The first crucial aspect includes the identification of the insiders involved, precisely indicating their roles within the company, whether they are executives, directors, or large shareholders. These individuals are categorized as insiders due to their access to sensitive, non-public information about the company.

Furthermore, the form requires information regarding the transaction dates, detailing when the buying or selling occurred. The nature of transactions must also be clearly explained; insiders can either acquire shares or dispose of them. Understanding terms such as 'disposition' (selling shares) and 'acquisition' (buying shares) is vital, along with different ownership types, which can range from direct ownership to indirect ownership through family members or trusts.

The filing process

Filing SEC Form 4 might seem daunting, but following a systematic process can alleviate potential challenges. Here’s a step-by-step guide to simplify the task:

Common mistakes when filing SEC Form 4

Despite the straightforward nature of SEC Form 4, many filers encounter pitfalls that can lead to complications. Some of the most frequent errors include:

To minimize these mistakes, utilizing interactive tools like pdfFiller can be beneficial for verifying information before submission. These tools help streamline the filing process, ensuring all data is accurate and complete.

Importance of timely filing of SEC Form 4

Timely filing of SEC Form 4 is imperative not only to adhere to legal obligations but also to maintain investor trust. Late filings can lead to serious legal implications including fines and penalties. Furthermore, delays can damage the reputation of the company and its insiders, ultimately affecting shareholder sentiments and market performance.

Investors heavily rely on SEC Form 4 disclosures to gauge insider confidence in the company. A lack of timely reporting can lead to skepticism and potential selling pressure on the stock. Historical examples illustrate that firms who fail to file timely filings often experience significant drops in stock prices as investor confidence wanes.

Navigating financial disclosures with pdfFiller

pdfFiller offers a suite of tools designed to enhance the experience of managing SEC Form 4 filings. Users can conveniently edit and complete forms digitally, ensuring smooth compliance with SEC requirements. The platform allows for eSigning and collaboration, making it easier for teams to manage financial disclosures from any location.

By integrating various financial reporting tools, pdfFiller significantly improves the filing experience, allowing users to access and manage documents seamlessly from anywhere. These features empower individuals and teams to stay organized and compliant with regulations effortlessly.

Analyzing trends in SEC Form 4 filings

The data captured in SEC Form 4 filings provides invaluable insights into market movements. Analyzing trends in insider buying versus selling activities can indicate broader market sentiments. For instance, a surge in insider buying could suggest confidence in the company's future prospects, while increased selling may raise red flags for investors.

Case studies reveal that significant SEC Form 4 filings have been associated with stock price fluctuations. Investors can utilize pdfFiller for efficient research, allowing them to manage and interpret insider activity data accurately. Understanding these trends can enable better investment strategies and informed decision-making.

Support and resources for SEC Form 4 filers

To address common concerns regarding SEC Form 4 filings, it's essential for filers to have access to reliable information. Frequently asked questions often revolve around scenarios such as what to do if a filing deadline is missed or how to correct a submitted Form 4. Addressing these queries helps users navigate the filing landscape more effectively.

Moreover, pdfFiller offers extensive support through its live chat and customer service options. Tutorials and webinars are also available to assist filers in managing their documents effectively. This support reinforces users' confidence in navigating the complexities of SEC regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

How do I execute sec form 4 online?

How can I fill out sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.