Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

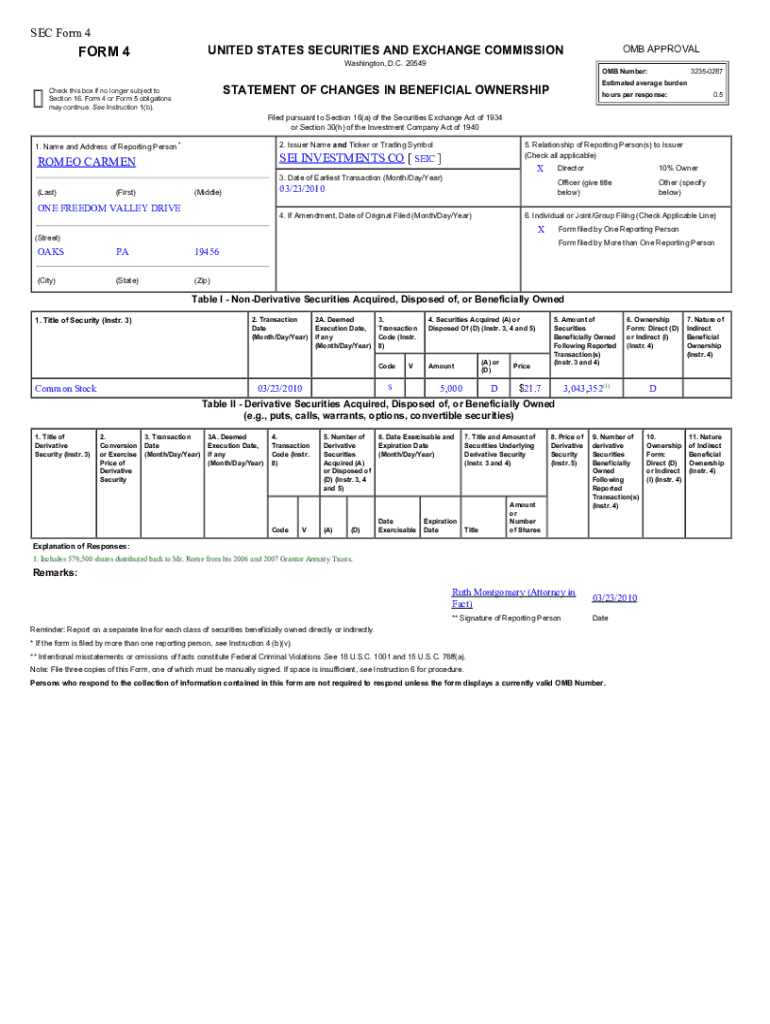

Understanding SEC Form 4

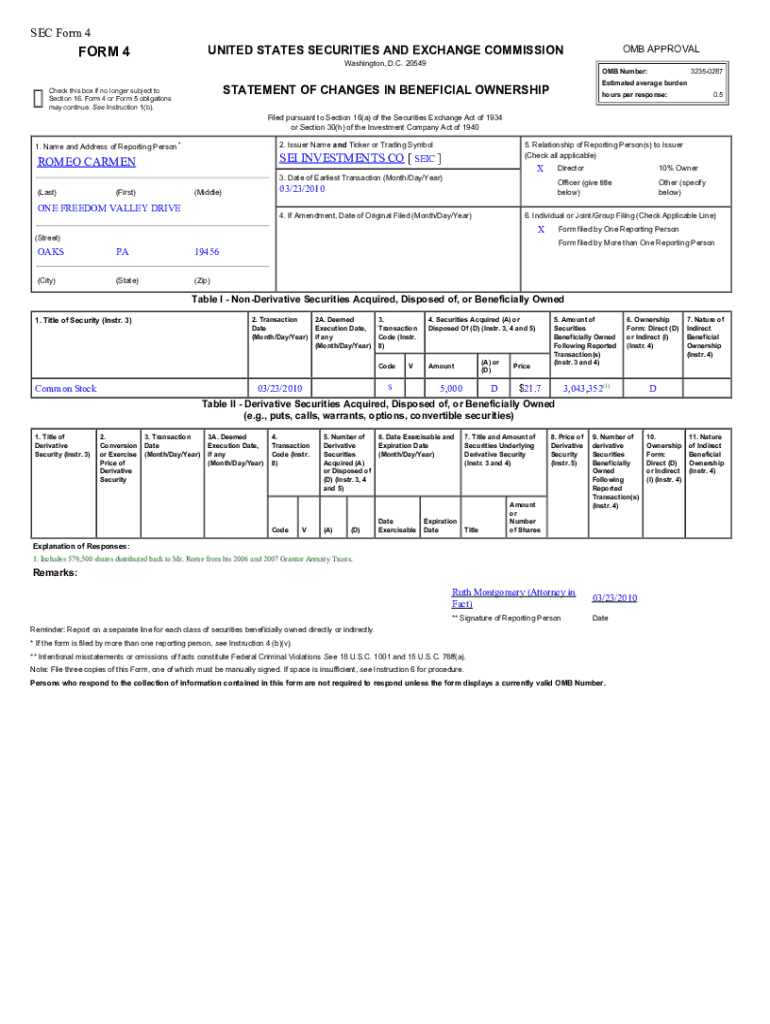

SEC Form 4 is a crucial submission required by the U.S. Securities and Exchange Commission (SEC) that discloses changes in the holdings of company insiders, including officers and directors. Designed to promote transparency and investor confidence, this form helps keep track of insider trading activities, allowing shareholders to monitor significant changes in ownership which could indicate shifts in company strategy or performance.

The filing requirements for SEC Form 4 mandate that it must be submitted within two business days of any transaction involving the securities of the reporting company. This includes not only sales and purchases of stocks but also other transactions such as stock options, gifting of shares, or the use of shares as collateral.

Importance of SEC Form 4 in financial reporting

The significance of SEC Form 4 in maintaining a transparent marketplace cannot be overstated. By requiring insiders to report their trades publicly, the SEC aims to mitigate insider trading risks, ensuring that all investors have equal access to material information that could influence their investment decisions. Such transparency is critical for maintaining trust in the financial markets.

When investors notice patterns of insider trading through SEC Form 4 filings, they often scrutinize these patterns for potential insights into the company’s future performance. For example, if several executives are purchasing a significant number of shares, investors may interpret this as a bullish signal, whereas increased selling could raise red flags. Thus, SEC Form 4 plays a key role in shaping investor sentiment and market dynamics.

Who is required to file SEC Form 4?

Eligible filers of SEC Form 4 primarily include company officers, directors, and beneficial owners who hold more than 10% of a class of equity securities. The regulation covers various roles within a company, emphasizing the need for accountability among those whose positions grant them insight into the firm’s financial health and operational shifts.

Notably, certain individuals are exempt from filing SEC Form 4, such as those involved in particular transactions that fall under established exceptions. Additionally, the SEC regulates the filing frequency, mandating that insiders must report their transactions within two business days, ensuring prompt public disclosure and compliance.

Detailed steps for completing SEC Form 4

Completing SEC Form 4 involves several precise steps, which ensure accurate reporting and compliance with regulations. Below are detailed steps to guide you through the process:

Common mistakes to avoid when filing SEC Form 4

When filing SEC Form 4, it’s critical to avoid common pitfalls that could lead to inaccuracies or violations. Frequent errors include:

The consequences of such errors can be severe, including potential penalties from the SEC, legal implications, and damage to credibility among stakeholders. Timely and accurate reporting is essential for accountability and upholding trust in financial operations.

Tools and resources for managing SEC Form 4 filings

Managing SEC Form 4 filings effectively is essential for compliance and organizational efficiency. Solutions like pdfFiller offer a range of interactive tools that can simplify this process, including:

Additionally, pdfFiller's collaborative features allow teams to share and review documents seamlessly, ensuring multiple filings are organized and managed efficiently. This capability is particularly crucial for larger organizations where various insiders may be filing simultaneously.

Best practices for keeping track of SEC Form 4 filings

Staying organized with SEC Form 4 filings is vital for compliance and risk management. Here are best practices to adopt:

Additionally, tracking changes in ownership through SEC Form 4 filings can provide insights into insider trades. Staying informed about these movements not only aids individual transactions but can also help in analyzing overall market trends, thereby enhancing strategic decision-making.

Real-world examples and case studies

High-profile SEC Form 4 filings often make headlines and can offer invaluable lessons for understanding market sentiment. Analyzing these cases provides insights into the broader implications of insider trading. For instance, notable filings from executives of major corporations often coincide with dip or surge in stock prices, influencing investment decisions.

Observing how specific insider moves can correlate with market performance is crucial. For example, when executives of tech giants report significant purchases of stock during downturns, it can serve as a bullish signal for investors, reinforcing confidence in the company’s future trajectory.

Frequently asked questions about SEC Form 4

SEC Form 4 can lead to many questions, especially for those new to filing. Common queries include how to handle complex transactions or what the implications are for late filings. Navigating these complexities often requires clarity on specific rules and timelines.

For example, complex transactions that involve multiple stages or conditions require detailed disclosures to avoid confusion. Additionally, late filings can attract penalties from the SEC, making punctuality a critical aspect of the filing process. Seeking guidance from legal or compliance professionals is often beneficial for navigating these complexities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

Can I create an electronic signature for signing my sec form 4 in Gmail?

How can I edit sec form 4 on a smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.