Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide

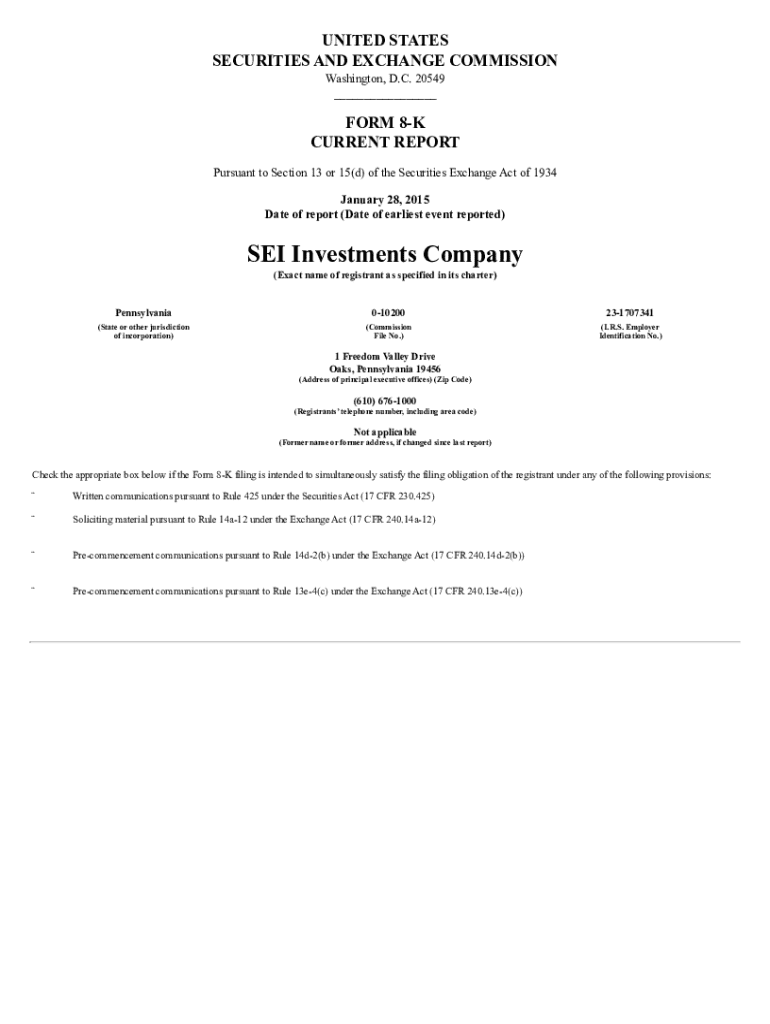

What is Form 8-K?

Form 8-K is a critical document that publicly traded companies must file with the Securities and Exchange Commission (SEC) to disclose significant events that may impact the company's financial condition or operations. This form serves as a tool for corporate transparency, allowing investors and stakeholders to stay informed about important developments.

Its importance in corporate transparency cannot be overstated; it provides timely information that might affect investment decisions, thereby enhancing market integrity and investor confidence.

Key components of an 8-K

An 8-K form typically includes several key components, such as:

When is Form 8-K required?

Understanding when Form 8-K must be filed is essential for compliance. Events triggering the need for an 8-K filing include:

Legal requirements dictate the necessary timeliness and deadlines, generally mandating submissions within four business days of the event's occurrence.

Benefits of filing Form 8-K

Filing Form 8-K provides several advantages for companies and investors alike. Firstly, it enhances investor trust by promoting transparency with stakeholders. Regular updates build a trusting relationship and inform stakeholders about their potential risks and opportunities.

Secondly, it offers legal safeguards and compliance. By adhering to SEC regulations through diligent disclosure practices, companies avoid penalties and maintain their reputations. This legally mandated transparency fosters a culture of accountability.

Lastly, having detailed 8-K filings empowers informed decision-making. Investors can analyze disclosed information to make better investment choices, responding proactively to market developments.

How to read an 8-K form

Understanding how to read an 8-K form effectively is crucial for investors. The legal jargon can sometimes be overwhelming, but focusing on clear sections will simplify the process. Start by looking at the date of the filing to understand its timeliness.

Next, identify key information typically found in the following sections:

Case studies exemplifying effective 8-K filings can elucidate the impact of these disclosures. Companies witnessing spikes or drops in stock prices following specific events often show how vital these filings can be.

Steps to file a Form 8-K

Filing Form 8-K requires careful preparation. Start by gathering necessary data and incident details relevant to the event that triggered the filing. Creating a checklist of required information like key details, dates of occurrence, and the nature of the event can enhance accuracy.

Once prepared, follow a step-by-step process to submit an 8-K through the SEC's EDGAR system. This includes:

Important considerations include verifying the accuracy of details and ensuring compliance with SEC rules to avoid challenges during the process.

Common mistakes when filing Form 8-K

One of the most frequent pitfalls is inaccurate disclosures. Examples include failing to properly document significant events or omitting critical details. To prevent such mistakes, a thorough internal review process can be beneficial.

Additionally, overcoming technical challenges during the filing process is crucial. Be prepared to address common errors that could arise while navigating the EDGAR system, such as connectivity issues or errors in formatting. Familiarizing yourself with the system ahead of time can mitigate these risks.

Tracking and managing 8-K filings

Staying updated on Form 8-K filings is essential for both individual and institutional investors. Several tools and methods can help monitor corporate disclosures effectively. Online databases and financial news platforms often provide alerts for new filings, allowing investors to remain informed.

Additionally, interpreting the impacts of these filings on stock performance is crucial. Investors should analyze how the market reacts following significant disclosures, as 8-K filings often lead to immediate changes in stock prices due to the market's perception of the information provided.

Frequently asked questions about Form 8-K

Some complex scenarios arise regarding the necessity of filing Form 8-K. For instance, companies might wonder whether all board member changes require filing or only those related to significant executive positions. Addressing such unique filing requirements with clarity is essential for compliance.

To further assist, there are numerous resources available online, including templates and guides for specific filing requirements through platforms like pdfFiller. These tools offer practical solutions for streamlining the filing process.

Using pdfFiller for streamlined form management

pdfFiller simplifies the filing process, making it more efficient for companies to manage forms like Form 8-K. By offering features designed for seamless form completion and submission, users can easily fill out critical documents directly on a cloud-based platform.

The collaborative tools provided by pdfFiller enhance teamwork by allowing shared access and document editing, ensuring that all stakeholders can contribute to the completion of forms effectively.

Moreover, pdfFiller prioritizes document security and compliance, implementing built-in measures to protect sensitive information throughout the filing process, assuring users that they can rely on their services as they navigate regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8-k directly from Gmail?

How do I execute form 8-k online?

How do I edit form 8-k online?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.