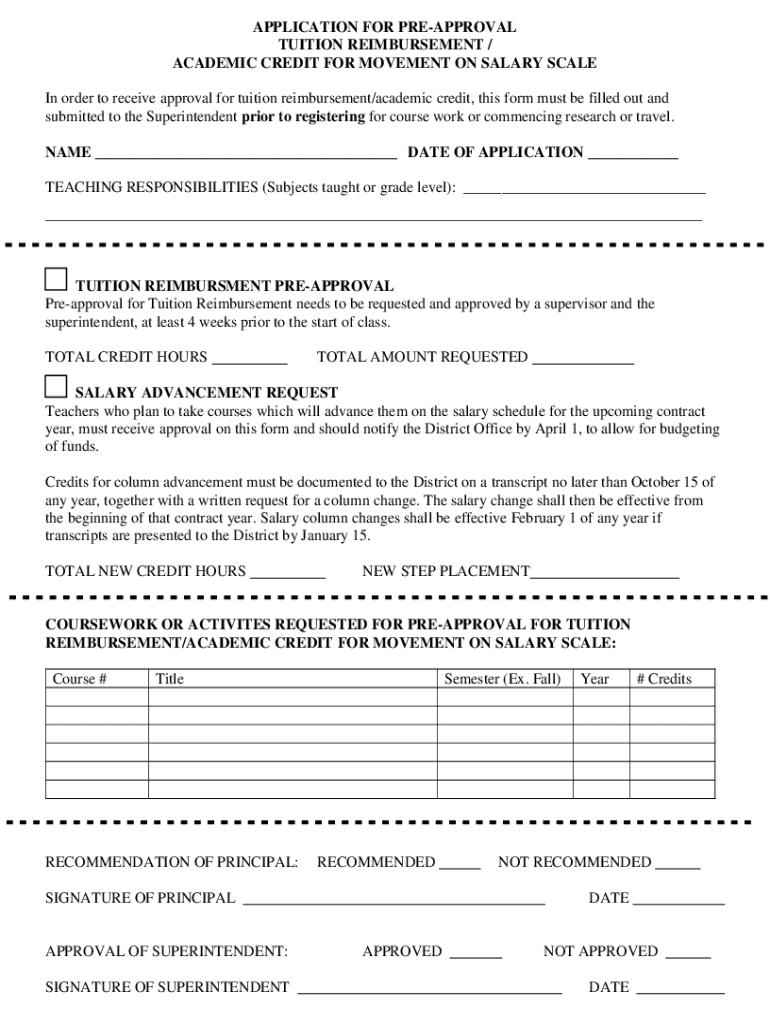

Get the free Application for Pre-approval

Get, Create, Make and Sign application for pre-approval

Editing application for pre-approval online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for pre-approval

How to fill out application for pre-approval

Who needs application for pre-approval?

Application for pre-approval form: A comprehensive guide to your home-buying journey

Understanding pre-approval: The first step to home ownership

A pre-approval letter is a document from a lender that states how much money you can borrow for a mortgage. This letter is essential because it serves as a preliminary commitment from the lender, giving you a reliable understanding of your budget when looking for a new home.

The significance of this letter cannot be understated; it not only empowers you as a buyer by streamlining the financing process but also enhances your position when negotiating with sellers. Having a pre-approval letter shows that you are a serious buyer, which can be advantageous in competitive housing markets.

Key preparations before starting your application

Before diving into the application for pre-approval form, it's vital to assess your financial situation. Understanding your finances will give you a clearer picture of what you can afford and help streamline the application process. Start by checking your credit score, as this three-digit number can influence the rates you'll receive from lenders.

Next, calculate your debt-to-income (DTI) ratio, which takes into account your monthly debts in relation to your income. Lenders typically prefer a DTI under 36%, so this assessment will be crucial. If your DTI is higher, consider paying down debt before applying.

The pre-approval application process

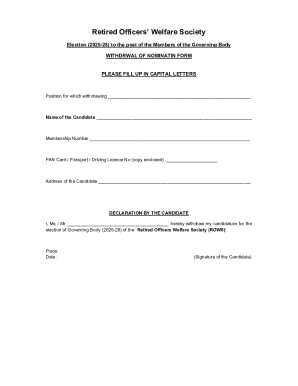

To initiate the pre-approval process, fill out the application for pre-approval form accurately and thoroughly. This will typically involve multiple sections, starting with your personal information such as your name, address, and social security number.

Your employment history also plays a key role, so be prepared to present your work background concerning the last two years. Financial details are crucial as well; lenders will ask extensive questions about your income, debts, and assets to evaluate your financial stability.

Commonly asked questions about pre-approval

During the pre-approval process, applicants often have numerous questions. Understanding what to expect can ease your mind. Generally, expect the lender to review your financials and guide you through the steps involved. It's important to understand the language used by different lenders; terms like 'prequalification' and 'preapproval' are often used interchangeably but hold different weight in the home-buying process.

Most lenders will need about one to three days for the review process, but this can vary depending on how busy they are and how promptly you provide the necessary documents. Knowing this timeframe allows you to plan your home search accordingly.

What comes after you get your pre-approval letter?

Receiving your pre-approval letter is merely the beginning of your journey toward purchasing a home. Understanding the details within this letter is essential. It typically outlines the loan amount you qualify for, interest rate details, and the length of time the pre-approval is valid.

To keep your pre-approval valid, avoid making large purchases, changing jobs, or taking on new debts. These actions can impact your financial standing and cause complications when closing your loan.

Potential pitfalls and how to navigate them

Navigating the application for pre-approval form can present challenges, particularly if applicants fail to provide accurate information or neglect to disclose debts. These oversights can lead to denial of pre-approval or issues during underwriting, both of which can hinder your home-buying aspirations.

To strengthen your application, consider improving your credit score before applying. Simple actions like paying down your credit card balances or disputing inaccuracies on your credit report can enhance your score and make you a more attractive borrower.

Collaborating with your lender

Establishing a good rapport with your lender during the pre-approval stage can make all the difference. Prepare targeted questions to clarify any uncertainties regarding your finances, potential loan amounts, and what stipulations might impact your pre-approval.

Understanding fees attached to your mortgage is critical as well. Familiarize yourself with terms like origination fees, which are charged for processing the loan, and closing costs, which are fees associated with finalizing the purchase. Knowledge is power when it comes to avoiding unexpected charges.

Finalizing your home purchase: Pre-approval to closing

Once your pre-approval letter is in hand, the next step is to use it wisely when making an offer on a home. Sellers are more likely to consider offers from pre-approved buyers, knowing these buyers have a committed lender backing them.

Ensure that you maintain financial stability during the home-buying process; refraining from opening new credit lines or making big-ticket purchases can prevent potential issues when it comes time to close.

Maximizing pdfFiller for your pre-approval application

pdfFiller streamlines your experience with the application for pre-approval forms, allowing you to edit PDFs easily, sign them digitally, and manage your documentation from anywhere. The platform’s user-friendly interface not only helps with completing forms but also ensures they stay organized.

Using pdfFiller’s interactive features, you can upload essential documents seamlessly and share them securely with your lender. This workflow not only saves you time but also ensures that every document is up to date and easily accessible when you need it.

Optional considerations: Refinancing post-purchase

After securing your home, you may find opportunities to refinance in the future. Refinancing can offer several advantages, such as a lower interest rate or reduced monthly payments, which can be worth considering after a period of homeownership.

Understanding the refinancing application process is similar to that of pre-approval but can circle back to assess your updated finances. Keeping abreast of market trends in interest rates can inform your decision on whether refinancing is a beneficial move for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete application for pre-approval online?

How do I edit application for pre-approval straight from my smartphone?

How do I edit application for pre-approval on an iOS device?

What is application for pre-approval?

Who is required to file application for pre-approval?

How to fill out application for pre-approval?

What is the purpose of application for pre-approval?

What information must be reported on application for pre-approval?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.