Mary Kay Worksheet free printable template

Show details

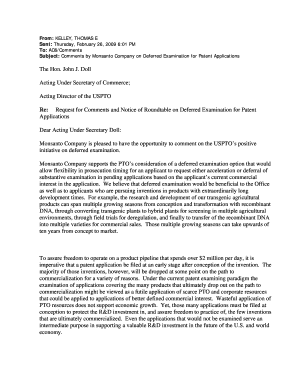

SPECIALIZING IN SMALL BUSINESSES TAXES Name Year If this is your first year - Give Start Date MARY KAY WORKSHEET THIS IS AN INFORMATION WORKSHEET FOR OUR CLIENTS CALL IF YOU HAVE QUESTIONS. Total Sales Including Tax Commissions Prizes Beginning Inventory At Your Cost Section 1 Purchases Your Cost - From Packing Slips Personal Use Product Your Cost - Unseen - Physically Can Not See Closing Inventory At Your Cost Advertising PCP PINK etc. Insurance on Mary Kay Product Interest on Loan or Credit...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mary kay tax worksheet form

Edit your mary kay tax worksheet 2024 pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mary kay form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mary kay form online online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mary kay tax form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mary kay form template

How to fill out Mary Kay Worksheet

01

Step 1: Download the Mary Kay Worksheet from the official website or obtain a physical copy.

02

Step 2: Gather any necessary information such as financial details and customer data.

03

Step 3: Start by filling out your personal information at the top of the worksheet.

04

Step 4: Move on to the section for sales goals and targets, ensuring to set realistic objectives.

05

Step 5: Fill in the customer details, including names and contact information.

06

Step 6: Record your product inventory and pricing information accurately.

07

Step 7: Document any expenses associated with sales activities.

08

Step 8: Review the completed worksheet for accuracy before submitting.

Who needs Mary Kay Worksheet?

01

Mary Kay beauty consultants looking to manage their business effectively.

02

Individuals aiming to track sales performance and set future goals.

03

New consultants seeking guidance and organization in their business.

04

Anyone interested in improving their understanding of the Mary Kay sales process.

Fill

mary kay income tax preparation sheet

: Try Risk Free

People Also Ask about accounting unlimited mary kay worksheet

What is Mary Kay income Advisory Statement?

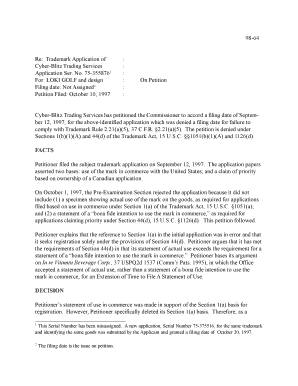

Income Advisory Statement are mailed annually to all Independent Sales Directors and Independent Beauty Consultants who received prizes or awards totaling $200 or more or earned use of a career car. Income Advisory Statements are also available on Mary Kay JnTouch®.

How is Mary Kay sales tax calculated?

As a wholesale provider, Mary Kay charges you sales tax on the full retail price of the item you purchase, even though you purchase at wholesale cost (50%). You then charge your customers sales tax to recoup this, thereby Mary Kay basically pre-charges you sales tax.

Is selling Mary Kay considered self-employment?

Because Mary Kay consultants are independent distributors, they are subject to self-employment tax. Federal self-employment taxes must be paid on a quarterly basis. In addition, a Mary Kay consultant should check with her state and local tax authorities to determine the process for submitting taxes to them.

What can I write off for my Mary Kay business?

Operating Expenses Each tax year the allowance per mile changes so check with the IRS website or a tax professional before figuring the mileage cost. Operating expenses like a business telephone line, parking costs, inventory insurance and inventory shelving are allowable deductions.

Do I have to report Mary Kay on my taxes?

Do you have to file taxes with Mary Kay? Yes, you must file this income. Mary Kay will send you a Form 1099-MISC, which they also file with the IRS, so the IRS knows. Because you earned money, the IRS will not regard this as a hobby.

What income do I not have to report on taxes?

The minimum income amount depends on your filing status and age. In 2022, for example, the minimum for single filing status if under age 65 is $12,950. If your income is below that threshold, you generally do not need to file a federal tax return.

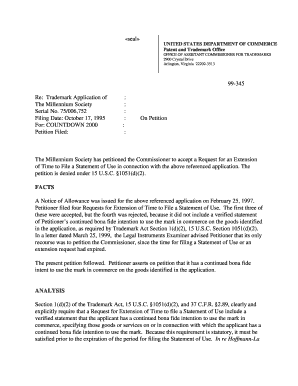

Do I have to claim my direct sales income?

A direct seller must include all income received on the tax return regardless of whether or not he or she received an information return, usually a Form 1099-MISC reporting that income.

Do I have to report my side hustle on taxes?

Income from freelancing, running your own small business, or working at a second job brings in extra income without requiring you to quit your day job. But, like your main source of income, a second job or multiple side gigs have to be reported on Form 1040 at tax time.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the mary kay worksheet printable in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your mary kay form.

How do I edit kay form online straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing kay form printable.

How do I fill out mary kay worksheet on an Android device?

Use the pdfFiller mobile app and complete your kay form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Mary Kay Worksheet?

The Mary Kay Worksheet is a document designed for Mary Kay consultants to track sales, expenses, and inventory as part of their business operations.

Who is required to file Mary Kay Worksheet?

Mary Kay consultants who participate in the business model are required to file the Mary Kay Worksheet to report their earnings and business-related expenses.

How to fill out Mary Kay Worksheet?

To fill out the Mary Kay Worksheet, consultants should gather their sales and expense records, categorize them appropriately, and enter all relevant information into the provided fields of the worksheet.

What is the purpose of Mary Kay Worksheet?

The purpose of the Mary Kay Worksheet is to help consultants keep track of their business finances, which aids in reporting income for tax purposes and managing overall business operations.

What information must be reported on Mary Kay Worksheet?

Consultants must report information such as total sales, cost of goods sold, expenses related to the business, and any other income or deductions pertinent to their Mary Kay business.

Fill out your mary kay tax worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Worksheet Mary Kay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.