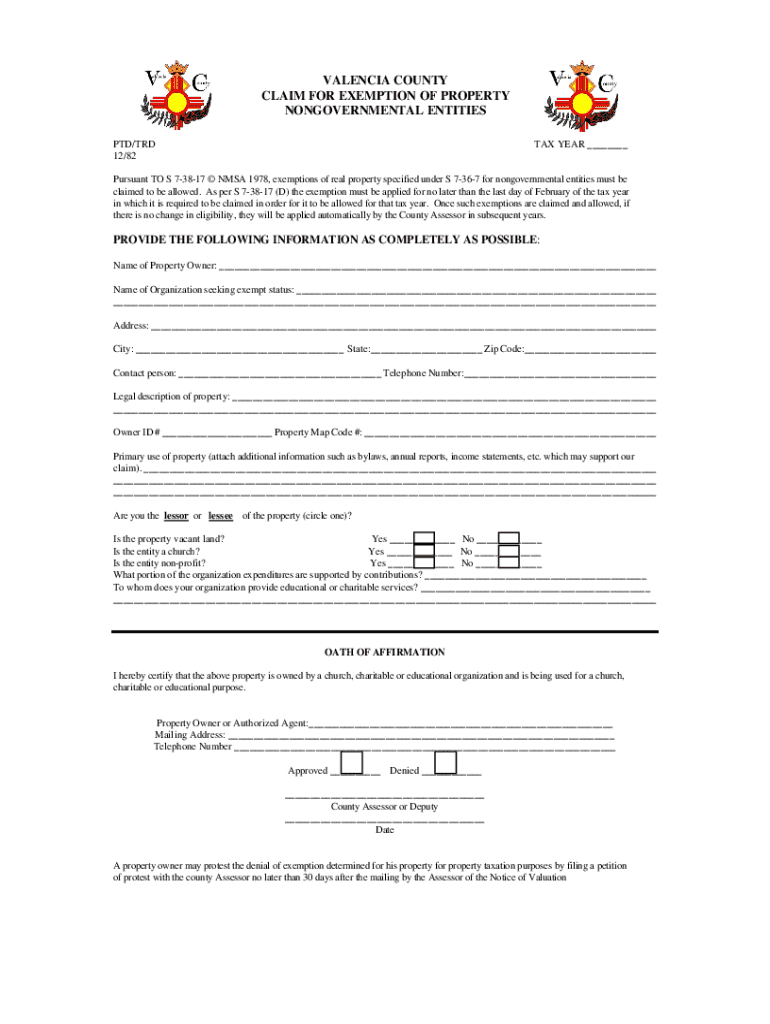

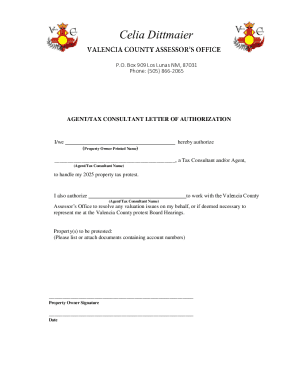

Get the free Claim for Exemption of Property

Get, Create, Make and Sign claim for exemption of

How to edit claim for exemption of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim for exemption of

How to fill out claim for exemption of

Who needs claim for exemption of?

Claim for Exemption of Form: A Comprehensive Guide

Understanding tax exemption claims

A claim for exemption of form refers to the process by which individuals or organizations may seek to reduce or eliminate their tax liabilities based on specific criteria established by the IRS or local tax codes. Primarily, these exemptions help taxpayers lower their taxable income and, in turn, the amount of taxes they owe. Understanding this claim is critical for effective financial planning and can significantly impact one’s overall tax burden.

For taxpayers, claiming an exemption can provide immediate financial relief by reducing withholding amounts from their paychecks, thereby increasing take-home income. This can translate into increased savings or spending power throughout the year, adding to the importance of knowing eligibility and procedures.

Who qualifies for exemption?

Qualification for a tax exemption typically hinges on various factors, including income levels, family situations, and other specified criteria. For instance, individuals may claim exemptions based on income thresholds set by the IRS, which can vary year by year. It’s essential to consult updated guidelines to understand exactly who qualifies for exemptions after accounting for personal circumstances.

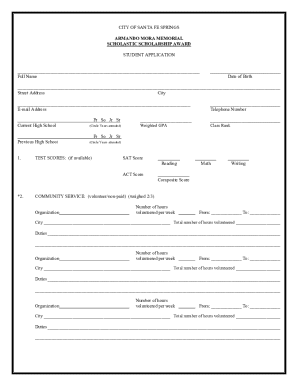

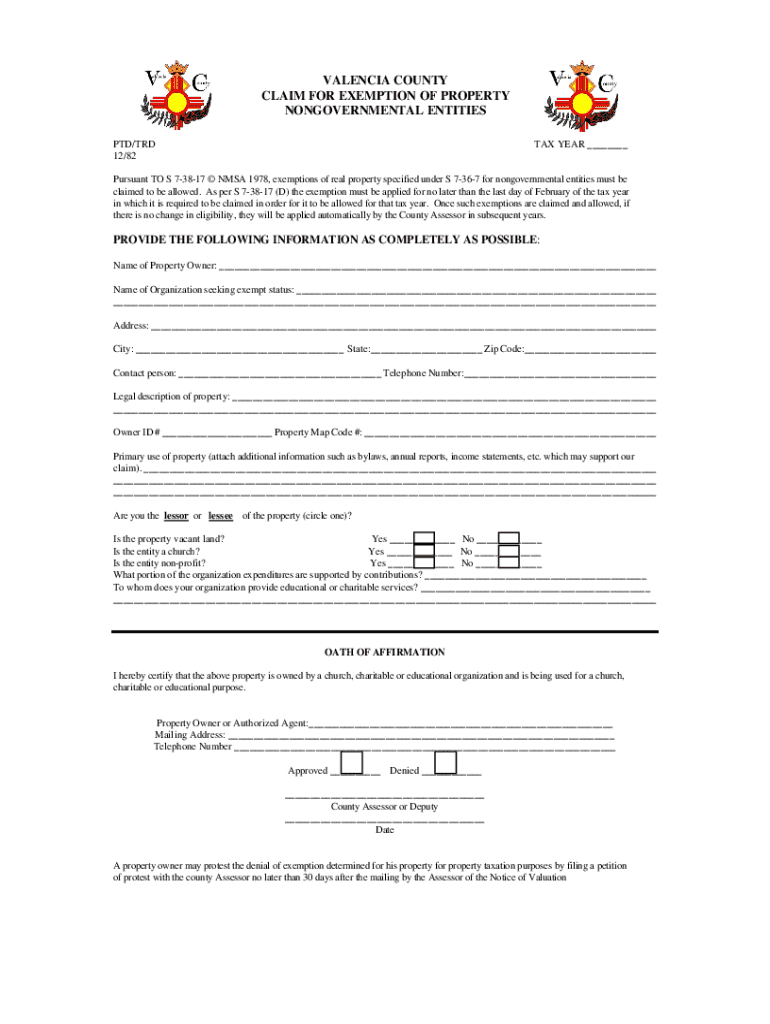

Key components of the exemption form

The exemption form is structured to gather specific information relevant to the exemption claim. Understanding the critical sections of this form is vital for effective submission. Usually, it is divided into several sections, such as personal identification, financial details, and the actual claim for exemption.

To avoid common pitfalls, taxpayers should familiarize themselves with each section of the form. One of the frequent mistakes people make is misunderstanding which income types must be reported. Failing to disclose additional sources of income can lead to penalties or disqualification from receiving exemptions.

Step-by-step instructions for claiming exemption

Navigating the exemption claim process requires careful attention to detail and accurate documentation. Here’s a step-by-step guide that outlines how to approach this task efficiently.

Step 1: Gather necessary documentation

Begin by collecting all necessary documentation that supports your claim for exemption. This could include recent tax returns, proof of income, and any supporting materials related to dependents.

Step 2: Fill out the exemption form

Once you have gathered your documents, proceed to fill out the exemption form. Pay close attention to each section; misunderstanding instructions could result in errors.

Step 3: Review and verify information

After completing the form, reviewing and verifying your information against your gathered documents is crucial. This ensures that everything is accurate and correctly compiled.

Step 4: Submit the exemption form

The final step is submitting your completed exemption form. Depending on your preferences, this can often be done either online or by mailing a hard copy to the relevant tax authority.

Understanding the implications of exemption

Claiming a tax exemption has both immediate and long-term implications. One of the primary benefits is the immediate increase in your disposable income due to reduced withholding amounts. This means you have more money in your pocket today, which can enhance your financial flexibility.

However, it's important to understand that claiming exemptions can also affect your future tax filing. If you claim too many exemptions, you may face a higher tax bill later when you file your returns, leading to potential penalties or interest charges due to underpayment.

Risks involved in claiming exemption

Claims for exemptions, if done incorrectly, could prompt an audit or penalties from tax authorities. Potential risks include being cited for underreporting income or being flagged for discrepancies in your claims versus income documentation. It is essential to maintain accurate records for the entire year.

Tools and resources for managing exemption claims

For efficient management of your exemption claims, utilizing interactive tools and resources can be invaluable. pdfFiller provides several features that help streamline the process of claiming exemptions, allowing for easy editing, signing, and sharing of documents.

Interactive tools available on pdfFiller

Users can easily edit and manage their exemption forms using pdfFiller's cloud-based platform. From collaborating with tax professionals to submitting forms to local tax authorities, its functionalities are tailored to simplify the entire process.

FAQs about exemptions

Common questions regarding exemption claims often involve eligibility requirements, how many exemptions can be claimed, and what to do if an exemption is denied. Addressing these queries effectively can relieve much of the confusion surrounding tax exemptions.

Expert tips for successful exemption management

Maintaining organized and precise records is vital for anyone handling exemption claims. Proper documentation ensures you can substantiate your claims, especially if questions arise from tax authorities.

Staying informed about changes in tax laws is equally important, as compliance is crucial for successful claims. Resources like pdfFiller not only help document management but also offer insights into recent tax law changes that could impact your exemptions.

What to do if you have questions or concerns

Navigating the world of tax exemptions can be complex, and it's natural to have questions. When facing uncertainties, utilizing customer support can clarify issues effectively.

Contacting customer support

pdfFiller offers robust customer support options to assist users with any concerns regarding exemption claims or the use of their platform. This service is essential for users new to the process or those needing additional clarification.

Community discussions and forums

Engaging with other users in forums or community discussions can also provide valuable insights. Shared experiences often answer questions that can arise regarding exemption claims.

Keeping your information secure

When dealing with sensitive information like tax-related documents, security is paramount. pdfFiller prioritizes user data protection through various industry-standard security measures, ensuring confidentiality remains intact.

By utilizing encrypted channels for document transmission and robust data storage practices, users can trust that their information is secure while managing exemption claims or any other documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my claim for exemption of in Gmail?

How can I edit claim for exemption of from Google Drive?

How do I edit claim for exemption of online?

What is claim for exemption of?

Who is required to file claim for exemption of?

How to fill out claim for exemption of?

What is the purpose of claim for exemption of?

What information must be reported on claim for exemption of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.