Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide

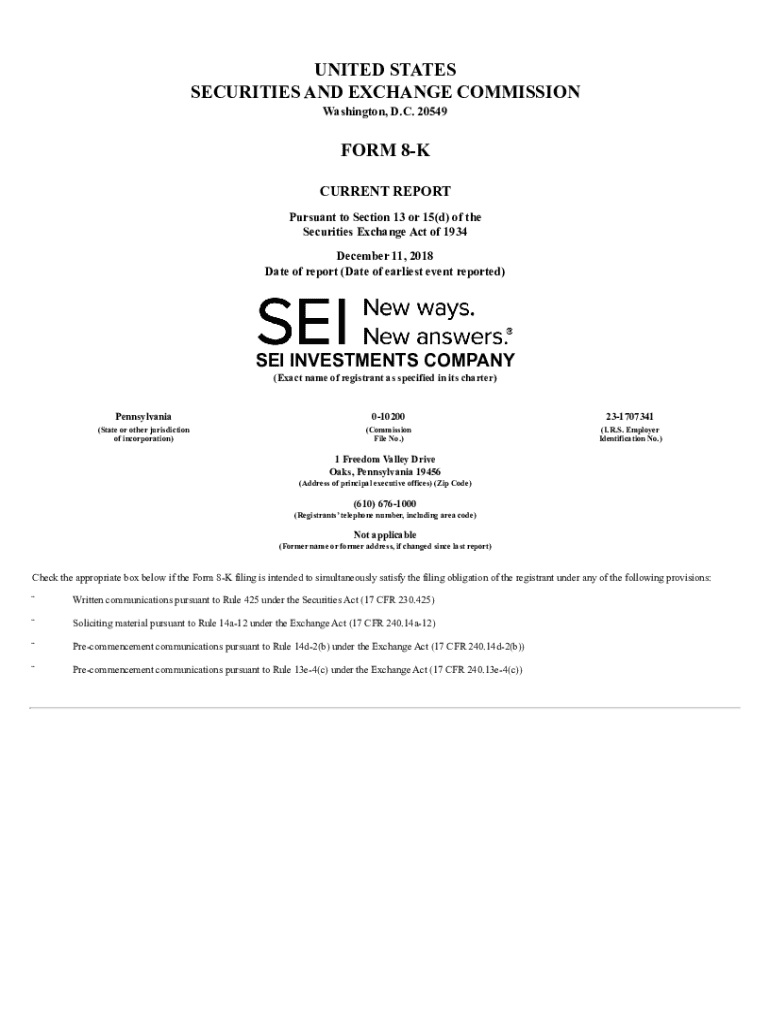

Understanding Form 8-K

Form 8-K is a crucial filing that publicly traded companies in the United States must submit to the Securities and Exchange Commission (SEC) whenever certain significant events occur. This form serves as a means for companies to provide immediate updates related to their business operations, financial condition, or other pertinent information that could affect their stock prices.

Primarily, Form 8-K is used to disclose unscheduled material events or corporate changes that are of importance to shareholders and potential investors. Key components of this form include specific disclosures that categorize these events, ensuring accountability and transparency within corporate reporting.

Significance of Form 8-K in financial reporting

The significance of Form 8-K cannot be overstated when it comes to financial reporting. It plays a vital role in maintaining transparency by ensuring that shareholders have access to timely and relevant information. This immediate communication fosters trust among investors, allowing them to make informed decisions based on the latest corporate developments.

Unlike other SEC filing forms such as Form 10-K, which is an annual report, or Form 10-Q, a quarterly report, Form 8-K serves a different purpose. It is not cyclical but rather event-driven. This distinction is important as it allows companies to disclose important events quickly without waiting for the regular reporting periods.

Key elements of Form 8-K

Form 8-K encompasses several key elements, particularly information that must be disclosed upon the occurrence of specific events. Triggering events include, but are not limited to, significant changes in corporate leadership, mergers, acquisitions, bankruptcies, and amendments to company constitutive documents or governance practices.

Companies are required to file Form 8-K within four business days of triggering events. Timeliness is crucial here; delays in disclosure of material events can lead to penalties and may signal mismanagement or lack of transparency to investors.

When is Form 8-K required?

Identifying when Form 8-K is required hinges on recognizing triggering events. These can vary widely but generally include key corporate transitions and financial developments. Commonly encountered situations necessitating an 8-K filing include mergers and acquisitions, changes in the executive team, or other significant corporate agreements that might influence investor perception.

The SEC stipulates various rules to clarify what constitutes a material event that must be disclosed in an 8-K. Each of these events falls under specific 'Item' categories in the form, such as Item 1.01 for entry into material agreements and Item 2.02 for the results of operations and financial condition.

Benefits of using Form 8-K

Utilizing Form 8-K offers numerous benefits, primarily in enhancing investor trust. By maintaining an open line of communication regarding material events, companies can foster greater confidence among stakeholders. This transparency is crucial for building lasting relationships with investors.

Moreover, timely filing of Form 8-K aids in ensuring legal compliance. Companies that neglect to file on time can face penalties from the SEC, thus protecting companies from financial and reputational risks. Form 8-K can also serve as a strategic tool for communication; corporations can use it to shape public perception and react to marketplace shifts proactively.

How to read an 8-K form

Reading an 8-K form requires familiarity with its structure and the type of information disclosed. Each filing typically includes an introduction that specifies the date of the material event, followed by detailed sections that outline the context, implications, and financial impact of the event. Understanding these sections is crucial for investors and stakeholders.

Financial information disclosed in an 8-K can often seem complex, but breaking it down into smaller parts allows for better comprehension. Look for numerical data, which might indicate shifts in financial health, and be sure to note any qualitative disclosures that can provide context around raw numbers. real-world examples can provide insight into interpreting these critical disclosures.

Filling out Form 8-K

Completing Form 8-K involves a step-by-step process to ensure accuracy and compliance with SEC standards. Users must start by selecting the appropriate Item category that corresponds with the triggering event. For example, if a company is disclosing a leadership change, they would select Item 5.02, which outlines changes in executive officers.

Common pitfalls include failing to provide sufficient detail or delaying the filing beyond the required timeframe. Therefore, it's essential to double-check each entry and consult existing guidelines. Amendments can also be filed if inaccuracies are discovered post-filing, but this should be avoided whenever possible.

Tools for managing Form 8-K

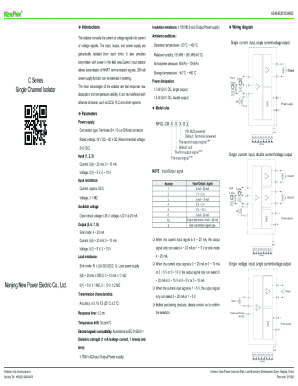

Managing the Form 8-K process can often be streamlined with the use of digital solutions. Tools such as pdfFiller provide features that facilitate the preparation of Form 8-K, allowing users to create, edit, and manage their documents all in one cloud-based platform. This integrated solution simplifies the paperwork process, enhancing efficiency.

Key functionalities include editing tools for real-time modifications, eSignature capabilities for timely approvals, and collaborative features that enable team input. These tools not only aid in document creation but also help users stay compliant with SEC filings by providing reminders and tracking changes in submission statuses.

Frequently asked questions about Form 8-K

Amidst the intricacies of Form 8-K, several common queries often arise. A prevalent concern is what happens if a company misses a filing deadline. The consequences of such negligence can include fines from the SEC and a potential loss of credibility in the market, thus making it crucial for companies to prioritize timely submissions.

Another frequent question pertains to how often a company should anticipate filing Form 8-Ks. The frequency depends on the nature of business activities; companies may find themselves filing multiple 8-Ks within a month or only sporadically based on operations. It's also important to consider that different industries may have unique expectations and filing requirements.

Case studies: real-world applications of Form 8-K

Real-world applications of Form 8-K provide valuable insights for both investors and corporations alike. Notable filings by major companies have shed light on various significant corporate actions and set precedents for best practices. For instance, when a leading tech firm announced its acquisition of a start-up via Form 8-K, it not only informed stakeholders but also positively influenced market perception.

On the other hand, there have been instances where poorly managed 8-K disclosures led to declines in stock prices, highlighting the critical nature of accurate and transparent communication. By analyzing these high-profile examples, corporations can glean lessons on how to navigate their disclosures strategically.

Future of Form 8-K and corporate transparency

Looking ahead, the future of Form 8-K and corporate transparency is poised for transformation as regulatory bodies adapt to changing market conditions. Anticipated changes in regulations may focus on the timeliness and the format of disclosures. Companies may find themselves needing to provide even more granular details or updates in real-time as technology continues to evolve.

Moreover, the importance of innovation in filing processes cannot be overstated. Evolving digital tools accessible through platforms like pdfFiller can greatly enhance how companies manage their Form 8-K filings. Staying ahead in this regard will not only ensure compliance but also provide companies a competitive advantage in transparency and communication within the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 8-k in Gmail?

How do I edit form 8-k straight from my smartphone?

Can I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.