Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive Guide to Understanding and Managing Your Filings

Understanding Form 10-Q

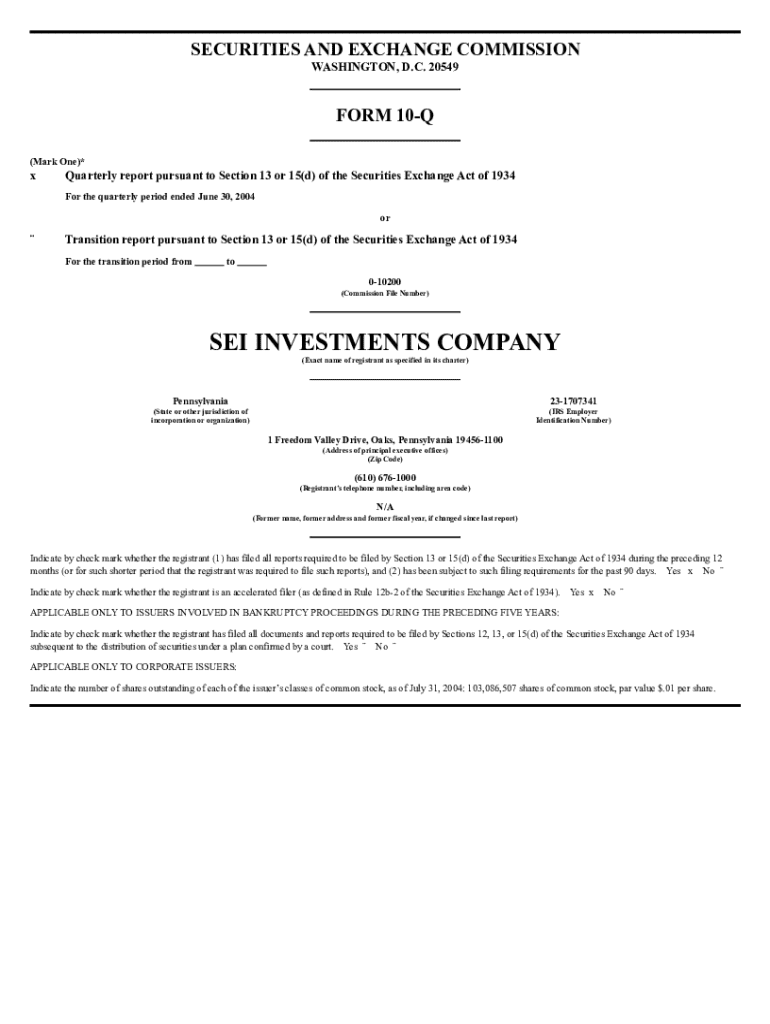

Form 10-Q is a crucial quarterly report that public companies are required to file with the U.S. Securities and Exchange Commission (SEC). This form provides a comprehensive overview of the company’s financial performance for the quarter, acting as a bridge between the yearly reporting through Form 10-K and the regular updates on business progress.

The purpose of this form is to give investors and stakeholders timely insights into a company's financial health, including any significant changes that may have occurred since the last report. The legal requirements mandate these filings to ensure transparency in the financial markets, thus fostering greater trust between companies and their stakeholders.

Who needs to file a Form 10-Q?

All public companies are mandated to file Form 10-Q quarterly. This requirement aims to ensure that shareholders and potential investors have ongoing visibility into a company’s operational status and financial performance. Private companies do not have this obligation, as their financial reporting obligations differ and tend to be less stringent.

The criteria for filing include being publicly traded on recognized exchanges or having more than a set number of shareholders. Therefore, starting from the first fiscal quarter of operations, any company meeting the SEC’s definitions of a public issuer must diligently prepare and file the Form 10-Q each quarter.

Contents of a Form 10-Q

Understanding what goes into a Form 10-Q is imperative for any stakeholder or potential investor. The document generally includes three key components: financial statements, Management's Discussion and Analysis (MD&A), and disclosures concerning market risks.

The first part of the filing often showcases the company's core financial statements—Balance Sheets, Statements of Income, and Cash Flow Statements—providing a succinct look at how the company is performing. The MD&A section offers management's perspective on the financial results, covering the reasons behind significant changes in financial health.

Breakdown of Key Sections

Form 10-Q can be divided into two distinctive parts for clarity.

Filing process for Form 10-Q

Preparing Form 10-Q necessitates a thorough understanding of the necessary documentation and relevant deadlines. The initial steps involve gathering the appropriate financial data from accounting systems and ensuring its accuracy. Companies need to have a review process in place to cross-check numbers against internal records for consistency, which is vital.

Once the data is finalized, drafting the Form 10-Q can begin. It requires a clear layout, ensuring all information aligns with SEC standards. Further, establishing a timeline for submission can help prevent last-minute issues.

How to submit Form 10-Q e-filing

Submitting the Form 10-Q is facilitated through the SEC’s EDGAR system. Companies must set up an account for electronic filing, ensuring compliance with SEC guidelines for online submissions. When preparing to file, documents should be structured according to the SEC's filing requirements to avoid errors during submission.

Common submission issues include improper formatting or missing signatures, underscoring the importance of carefully reviewing all elements before submission. Utilizing reliable online platforms can streamline this entire process, making it more efficient.

Important deadlines for Form 10-Q

Awareness of Form 10-Q filing deadlines is essential for regulatory compliance. Typically, public companies must file the Form 10-Q within 45 days of the end of each fiscal quarter. This timeline varies slightly for different reporting companies, depending on their size and public float.

Missing these deadlines can have serious implications. Companies may face regulatory penalties and can also damage their reputation, which can adversely affect shareholder trust and market perception.

Accessing and reviewing Form 10-Qs

Finding a company’s Form 10-Q filings is straightforward. The SEC’s EDGAR database is the primary source for these filings and allows public access to documents submitted by public companies. Additionally, most companies maintain a section on their Investor Relations websites where they archive past filings.

Analyzing a Form 10-Q involves looking for key metrics that affect investment decisions. By understanding the financial ratios and other indicators presented, investors can glean insights into a company's performance and market risks, enhancing their investment decisions.

Common challenges and FAQs related to Form 10-Q

Filing Form 10-Q comes with its own set of challenges. One common question is, 'What happens if you miss a filing?' This can lead to regulatory penalties and potential enforcement actions by the SEC, underscoring the importance of timely submissions.

Another frequent inquiry concerns amendments. While Form 10-Qs can be amended after filing, companies should be cautious and ensure that the amendments are properly justified to maintain stakeholder trust.

Tools and resources for managing Form 10-Q processes

In today’s fast-paced environment, digital solutions are becoming indispensable for managing Form 10-Q processes. Various platforms enable easy collaboration and efficient document management, allowing teams to streamline their workflows significantly.

For instance, using pdfFiller can help simplify the process of creating, editing, and e-signing your Form 10-Q. This cloud-based solution facilitates real-time collaboration, tracking changes, and maintaining a secure document management ecosystem.

Key highlights and best practices

Successful management of Form 10-Q filings requires adherence to a few essential best practices. Timely submissions are paramount; ensuring that documents are prepared well in advance of deadlines is critical to avoid last-minute complications.

Regular communication with stakeholders about the financial health of the company supports transparency and builds trust among investors. By utilizing document templates and keeping financial records organized, companies can further enhance their efficiency in preparing these quarterly reports.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 10-q without leaving Google Drive?

How can I send form 10-q for eSignature?

How do I complete form 10-q online?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.