Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4 Form: Comprehensive Guide

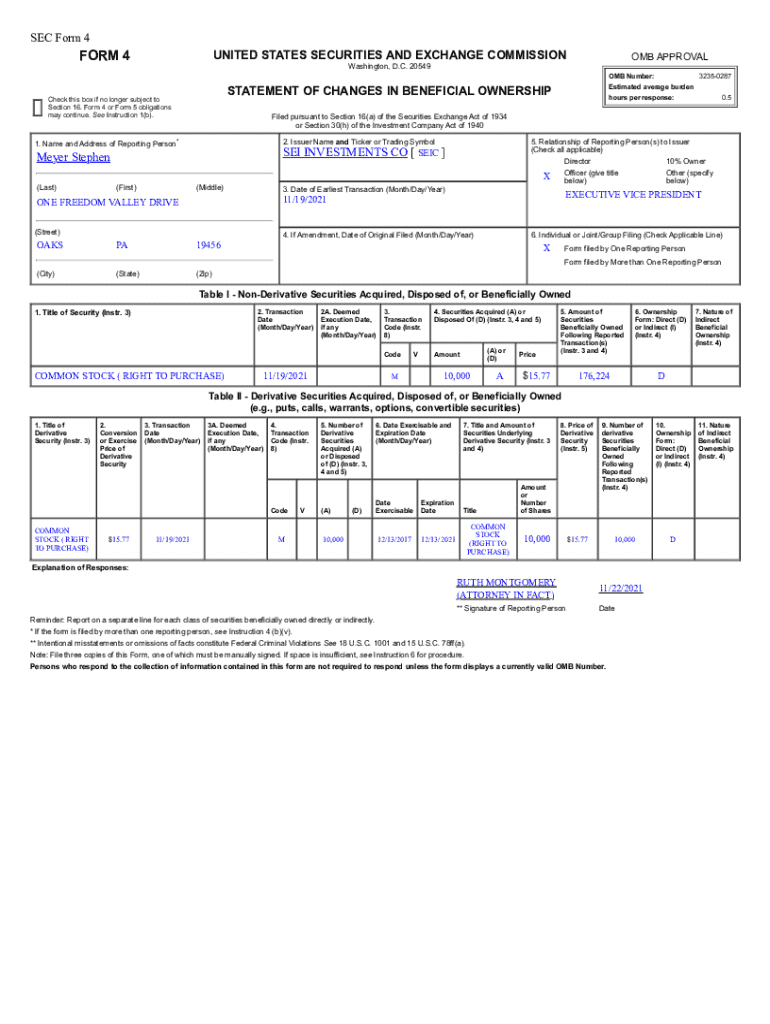

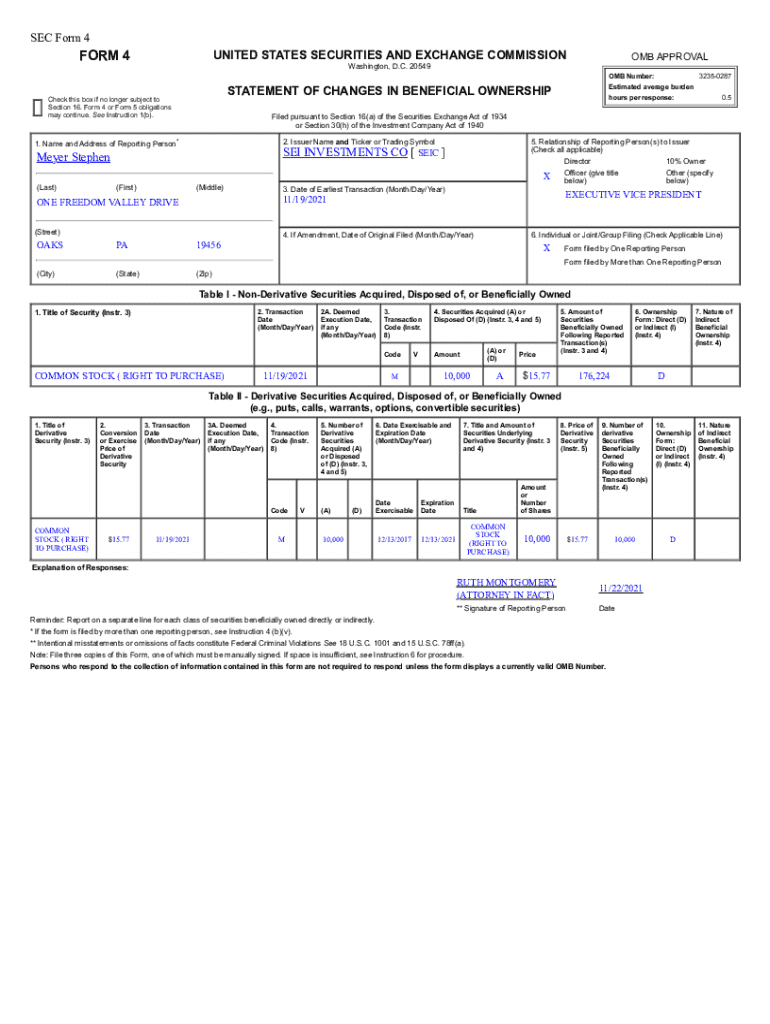

Understanding the SEC Form 4

SEC Form 4 is a crucial document mandated by the Securities and Exchange Commission (SEC) that provides insight into the trading activities of company insiders. This form must be filed by corporate executives, board members, and significant shareholders when they buy or sell company stock. The importance of SEC Form 4 cannot be understated; it enhances transparency in the market, allowing investors to observe insider activities which might influence their investment decisions.

The primary purpose of SEC Form 4 is to disclose changes in beneficial ownership of certain securities, ensuring that the market operates fairly and that insider trading regulations are upheld. Those who should file include corporate insiders, typically defined as directors, officers, and anyone owning more than 10% of a company's shares. By monitoring these filings, shareholders gain insights into ownership trends and insider moves, which can impact their perspectives on a company's future performance.

Key components of SEC Form 4

Each SEC Form 4 consists of several key components that must be accurately reported. This form requires the reporting person's details, such as name, address, and relationship to the issuer—this could be an officer, director, or more than 10% shareholder. Additionally, it asks for transaction dates and types, specifying whether the insider is acquiring or disposing of shares, and it includes a detailed listing of the securities involved in these transactions.

Understanding common terms is key to completing SEC Form 4 correctly. 'Beneficial ownership' refers to the right of an individual or entity to enjoy the benefits of ownership of a security, even if the title is in another name. Distinguishing between a 'disposition' and an 'acquisition' is crucial, as they indicate whether the insider is selling or buying shares, which provides insights into their confidence in the company’s future.

Steps to complete the SEC Form 4

Completing SEC Form 4 begins with gathering all necessary information. This includes personal details for the reporting person, such as their name and address, as well as the specifics of the transaction. Having accurate records ready can simplify the process considerably. Each section of the form has its specific requirements, and understanding these can lead to a smoother filing experience.

When reporting transactions, it's essential to accurately detail the type of transaction—whether it’s an acquisition or a disposition—by using the correct codes provided in the form. Each entry should also include the exact date of the transaction, along with the number of shares traded and their price. It's worth noting that common mistakes include omitting transaction dates or inaccurately classifying the type of transaction. Double-checking your information minimizes the risk of such errors.

Filing SEC Form 4

Filing SEC Form 4 can be done through several methods, with electronic filing through the SEC's EDGAR system being the most common. This platform allows for quick submissions, and companies are encouraged to file electronically to ensure the information is publicly accessible. While there are options to file via paper, electronic submissions are typically more efficient, reducing the chances of delays or errors.

Understanding the implications of late filings is essential. Failure to file Form 4 on time can have significant consequences including potential fines and increased scrutiny from regulators. It is critical for insiders to keep track of their transactions and file accordingly to maintain compliance with SEC regulations.

Managing SEC Form 4 records

Once SEC Form 4 is filed, proper management of these records is paramount. Best practices recommend maintaining both digital and physical copies of filings. Using a cloud-based solution can enhance accessibility, allowing authorized personnel to view important documents from various locations without compromising security.

pdfFiller offers a unique advantage in managing SEC Form 4 records. Its platform enables users to easily edit forms, track changes, and share documents with collaborators, ensuring accuracy in record-keeping and compliance with SEC regulations. This reduces the burden on teams and increases efficiency in document management.

Tips and tricks for efficient filing

To maximize efficiency while preparing SEC Form 4, utilizing interactive tools can be incredibly beneficial. For instance, pdfFiller provides templates specifically tailored for SEC Form 4, making the initial steps much more straightforward. These templates come equipped with pre-defined fields, reducing the likelihood of omissions and errors.

Regularly updating information and keeping abreast of ownership trends will help maintain the accuracy of filings. Companies should consider setting reminders for when to file SEC Form 4 to ensure compliance, avoiding last-minute scrambles as deadlines approach.

Common questions about SEC Form 4

Filing SEC Form 4 raises several questions, particularly regarding procedures and legal implications. Individuals often seek clarity on the timeline for submission and the consequences of inaccurately reported data. FAQs around this form provide insights into the correct filling and ensure compliance with SEC's stringent regulations.

Utilizing resources that detail these FAQs can significantly enhance your understanding and ease any concerns regarding the filing process, ensuring that you meet all regulatory obligations.

Final thoughts on SEC Form 4

Accuracy in reporting is critical when it comes to SEC Form 4. A single error can result in regulatory scrutiny and impact market perceptions of a company. Users should take advantage of tools like pdfFiller which not only offers editing and management capabilities but also supports collaboration and enhances overall compliance in the filing process.

By utilizing a dedicated platform for SEC reporting, companies can streamline their processes and reduce the stress associated with these mandatory disclosures, ensuring they remain aligned with SEC standards and uphold their commitments to transparency and accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my sec form 4 in Gmail?

How do I fill out sec form 4 using my mobile device?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.