Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4: Understanding and Navigating Insider Transactions

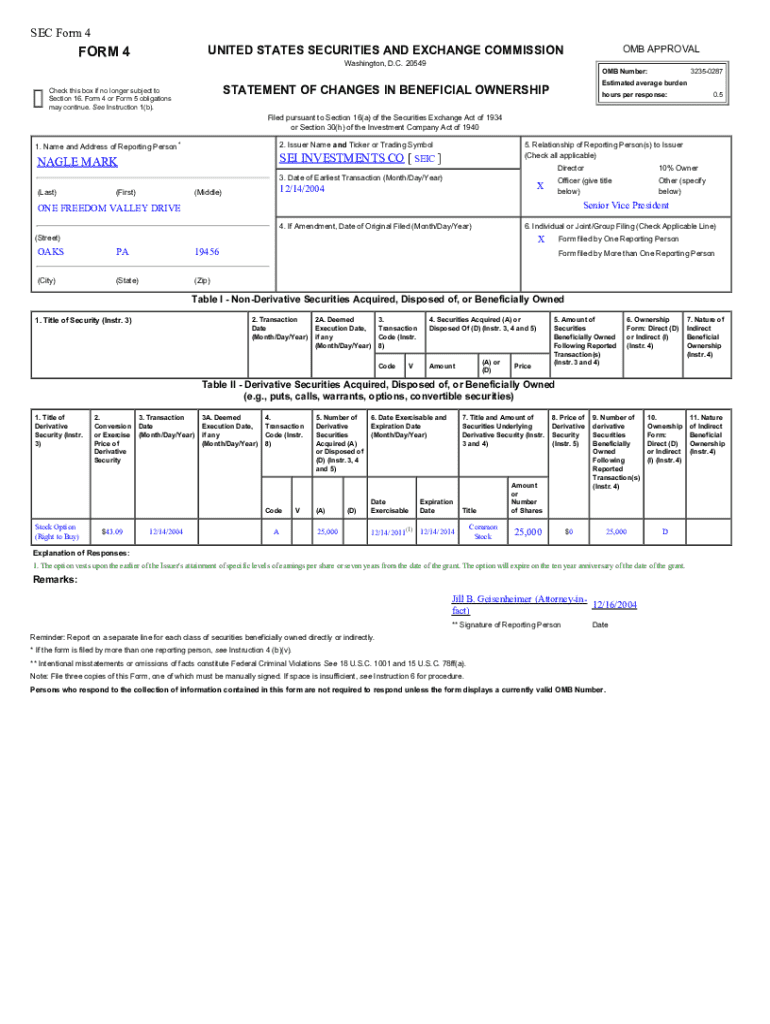

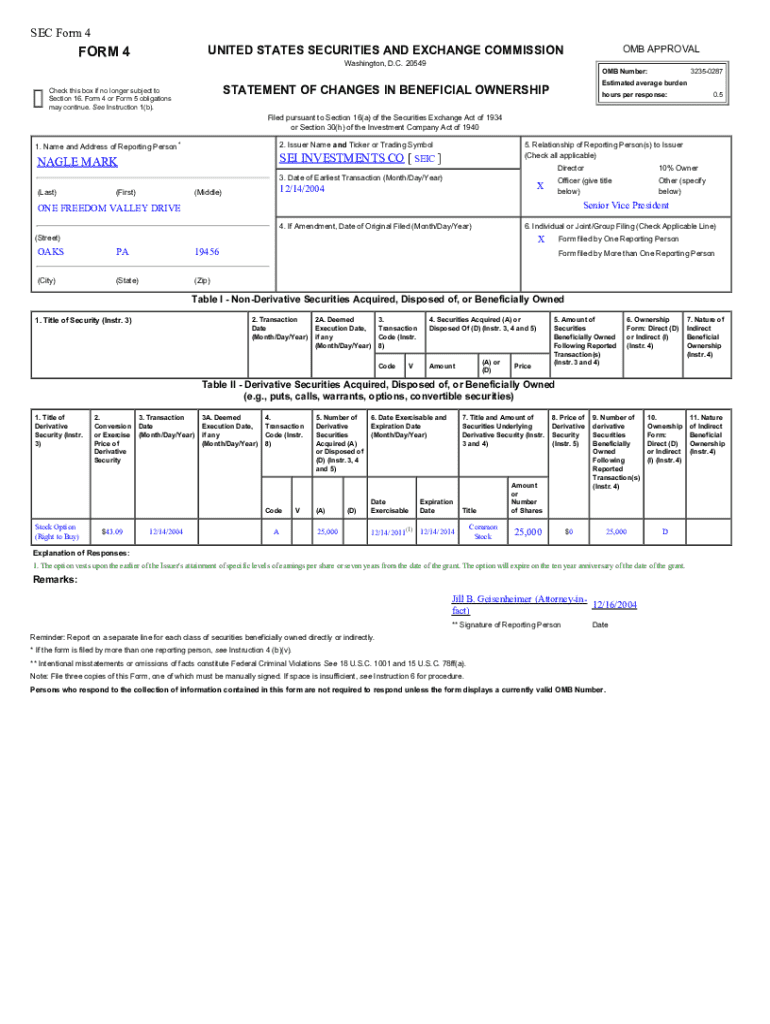

Understanding SEC Form 4

SEC Form 4 serves as a critical instrument for the disclosure of insider trading activities. It is required to be filed by corporate insiders—like executives, directors, and employees—whenever they engage in transactions involving their company’s stock. The form ensures that the market remains transparent and that the shareholders are informed about significant transactions that could influence the stock's market value.

This form holds paramount importance in financial reporting as it helps maintain the integrity of trading practices. Insider trading, both legitimate and illegal, is closely monitored through such disclosures, which can significantly impact investor confidence and market behavior. The stakeholders directly affected include current shareholders, potential investors, market analysts, and regulatory bodies alike.

Overview of SEC Form 4 components

The structure of SEC Form 4 is divided into several key components that must be diligently filled out to meet legal requirements. Understanding these components is essential for accurate reporting.

Steps to complete SEC Form 4

Completing SEC Form 4 is a straightforward process when approached methodically. Below is a step-by-step guide to ensure accuracy:

Common mistakes to avoid

When filling out SEC Form 4, several common pitfalls can lead to compliance issues. Awareness of these mistakes can save time and legal headaches.

To prevent these mistakes, maintain accurate records and calendars for reporting deadlines. Utilize pdfFiller’s reminders and collaborative features to keep track of your filings.

Filing and submitting SEC Form 4

Filing SEC Form 4 electronically is straightforward using the SEC's EDGAR system. Follow the steps outlined by your broker or firm's compliance department for submission.

Remember that filing deadlines are crucial—Form 4 must be filed within two business days of the transaction. Late filings can lead to fines, adverse publicity, and loss of investor trust, impacting your company’s reputation.

Monitoring SEC Form 4 filings

To keep track of SEC Form 4 submissions, consider utilizing pdfFiller’s document management features. By setting alerts and reminders for key filing dates, you can avoid delays and stay informed about insider trading activities.

In addition, monitoring SEC filings can provide valuable insights into market dynamics, such as shareholder behavior, institutional holdings, and insider moves, which influence investment strategies.

Frequently asked questions about SEC Form 4

Understanding SEC Form 4 can raise numerous questions.

Utilizing pdfFiller for document management

pdfFiller offers robust features for managing SEC Form 4 and similar documents, making it easier to handle compliance and document integrity. Users can store and organize documents securely in the cloud, eliminating the risk of lost or misplaced files.

Collaborative features allow teams to work together on filling out forms and ensuring accuracy before submission. The advanced editing tools facilitate necessary changes while maintaining compliance with SEC guidelines.

Real-world applications of SEC Form 4

Successful SEC Form 4 filings have been crucial for many organizations. Companies that maintain transparency in their insider transactions have often developed stronger relationships with investors, leading to sustained trust and shareholder stability.

For instance, businesses that adopt rigorous compliance measures often see improved market performance. Insights gleaned from public filings enable analysts to track ownership trends and insider transactions, informing investment strategies and enhancing market predictions.

Tips for effective document management

Maintaining compliance across various SEC documents, including SEC Form 4, demands strategic planning. Consider implementing a clear document management system that outlines responsibilities and filing timelines.

By leveraging tools like pdfFiller, your organization can enhance its ability to manage SEC forms efficiently, thereby ensuring adherence to all regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

Where do I find sec form 4?

Can I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.