Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4: A Comprehensive Guide for Insiders and Investors

Understanding SEC Form 4: A Comprehensive Overview

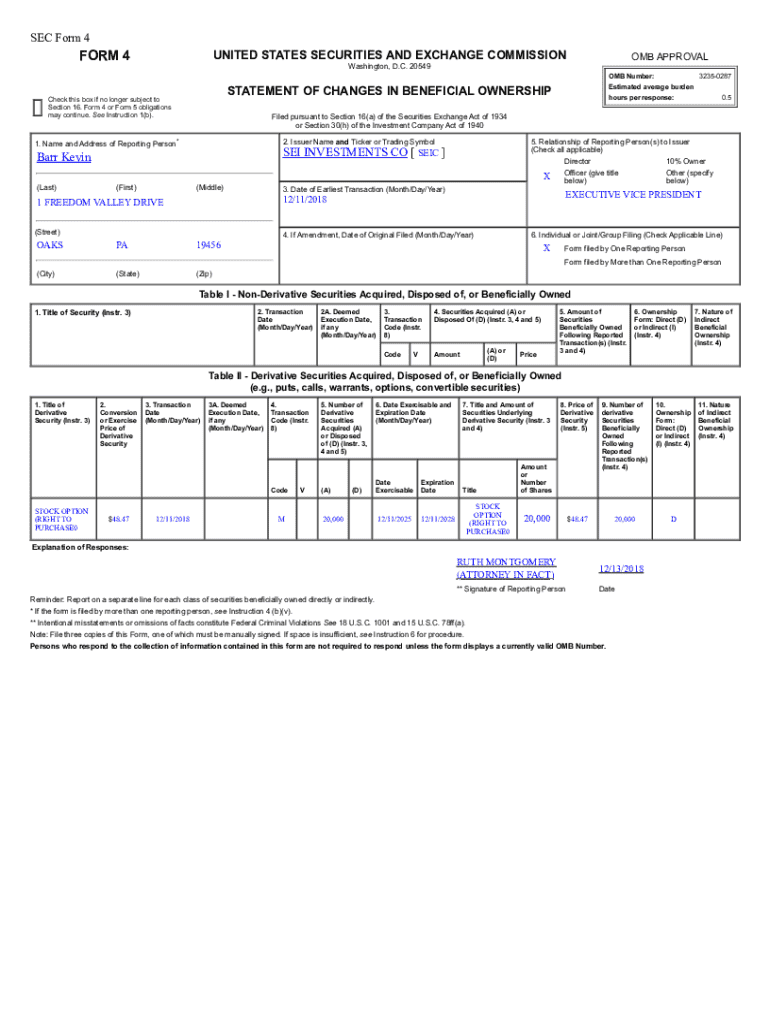

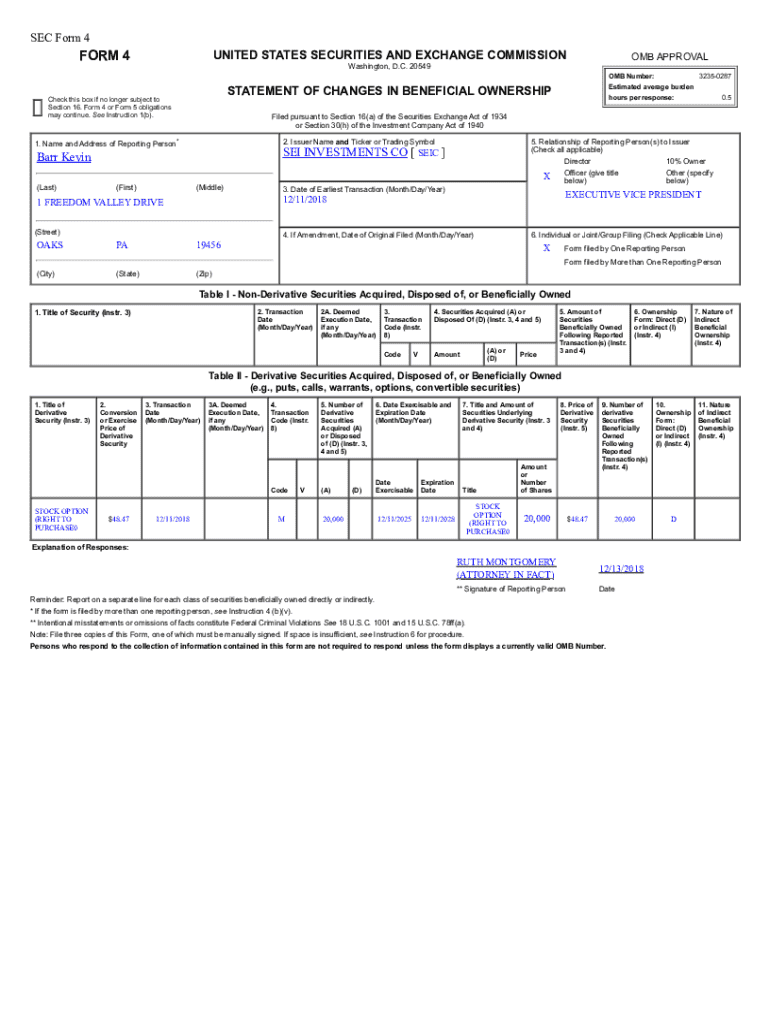

SEC Form 4 is a vital document required by the Securities and Exchange Commission (SEC) for reporting transactions made by corporate insiders. Corporate insiders, including executives, directors, and significant shareholders, must file this form within two business days of buying or selling their company’s stock. The form's primary purpose is to promote transparency in insider trading and provide essential information to shareholders and investors regarding the trading activities of those with access to confidential company information.

The significance of filing Form 4 cannot be overstated. It allows investors to monitor the trading activities of insiders, often offering clues to the company’s future performance. Additionally, knowing insider holdings is beneficial for assessing trust and confidence in the firm's prospects. For corporate insiders, timely and accurate reporting ensures compliance with legal requirements, helping avoid potential penalties and fines.

The legal framework surrounding Form 4

SEC regulations surrounding Form 4 are governed by the Securities Exchange Act of 1934, specifically designed to enforce transparency in the securities markets. The Act mandates that Form 4 be filed any time there is a change in ownership of a reporting person’s interest in a company’s securities. This differs from Form 3, which is filed upon an insider's initial ownership and Form 5, which is used for reporting transactions that were not previously reported, often due to oversight.

Non-compliance with these regulations can lead to substantial consequences, including fines and legal action. Reports that contain false information or misrepresentation can not only damage the reputation of the individual but also lead to investigations by regulatory authorities, potentially resulting in severe penalties and long-lasting effects on the company.

Steps to fill out SEC Form 4

Gather necessary information

To fill out SEC Form 4 accurately, insiders must first gather necessary personal information, including their name, address, and relationship to the issuer. Additionally, complete transaction details must be collected, indicating the type of transaction undertaken, timing, and the number of shares involved. For example, is it a purchase or a sale? What is the exact date of the transaction? Such details are crucial for compliance.

Detailed breakdown of section fields

Each section of Form 4 serves a specific purpose:

Common mistakes to avoid

When filling out Form 4, common mistakes can lead to erroneous filings. It is essential to ensure that personal or transaction details are correct. A frequent mistake includes underreporting or misreporting changes in ownership. Insiders must capture all relevant transactions accurately to avoid potential legal repercussions.

Interactive tools for SEC Form 4 management

pdfFiller offers a suite of interactive tools that streamline the document management process for SEC Form 4. The platform boasts pre-designed templates that facilitate quick and accurate filling out of the form, ensuring compliance with SEC standards.

Users can easily create or edit SEC Form 4 using pdfFiller's intuitive drag-and-drop features. This functionality allows individuals to add necessary document elements, such as signatures or additional text boxes, with ease. Furthermore, pdfFiller enables tracking and managing submissions through its comprehensive dashboard, facilitating timely compliance.

eSigning and collaborating on SEC Form 4

The eSigning capability provided by pdfFiller plays a significant role in the SEC filing processes. Insiders can easily sign their Form 4 electronically, which speeds up submission and ensures adherence to SEC regulations. Moreover, pdfFiller supports team collaboration through features that allow multiple users to edit and provide feedback in real time.

Sharing documents through pdfFiller comes with numerous security measures. Users can send documents securely, ensuring that only authorized personnel have access to sensitive information. Enhanced security features like document locking after eSigning also safeguard the integrity of filings.

Frequently asked questions about SEC Form 4

Understanding insider transactions and their impact

The activities of insiders, whether buying or selling shares, provide critical insights into the company's inner workings. Such transactions can reveal management's confidence in the company’s future. Frequently, insiders will purchase shares in significant volumes as a show of faith in their company's prospects, while selling might raise concerns about impending challenges.

Investors often analyze trends from submitted Form 4s to gauge the sentiment of board members and executives. Observing patterns in insider trading can guide shareholders’ decisions, contributing to more informed market strategies. For example, if a large number of executives start selling shares, this could signal a potential downturn.

Real-time insights into SEC Form 4 filings

Several platforms provide real-time updates on insider transactions, allowing investors to stay informed about significant movements in the market. Leveraging such data not only helps identify potential investment opportunities but also enhances one’s risk management strategies. Monitoring SEC Form 4 filings regularly can prove advantageous for any serious investor.

Additionally, utilizing tools that aggregate and analyze Form 4 data can simplify research processes, offering insights into ownership trends and hedge fund activity. By tracking insider moves, investors can discern the motivations behind stock transactions and adjust their portfolios accordingly.

Case studies: Successful management of SEC Form 4

Numerous companies have excelled in managing their Form 4 filings, showcasing the importance of compliance and transparency. For instance, a well-known technology firm consistently provides detailed filings, enhancing investor trust and market stability. On the other hand, some companies have faced backlash due to poor Form 4 management, leading to distrust among shareholders.

Learning from these case studies can help insiders avoid pitfalls. Best practices include timely filings, clear documentation of transactions, and leveraging interactive tools like pdfFiller to ensure adherence to regulations while enhancing transparency with stakeholders.

Conclusion: Navigating the complexity of SEC reporting

In conclusion, navigating the intricacies of SEC Form 4 filing requires diligence and precision. Insiders must ensure compliance with SEC regulations and avoid common missteps to maintain integrity and transparency in the marketplace. Utilizing solutions like pdfFiller can simplify these processes, allowing for efficient document management and timely submissions.

As the landscape of insider trading continues to evolve, staying informed and utilizing modern document management tools will empower corporate insiders and investors alike to navigate these complexities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 directly from Gmail?

How do I edit sec form 4 on an iOS device?

How do I complete sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.