Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

Understanding SEC Form 4

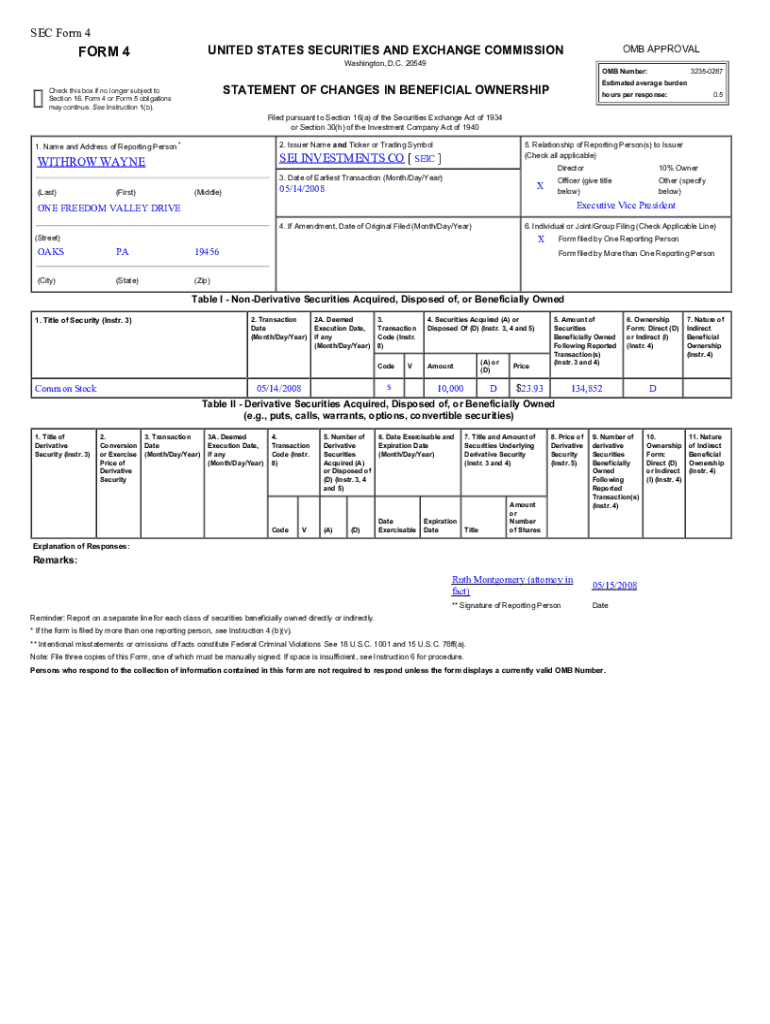

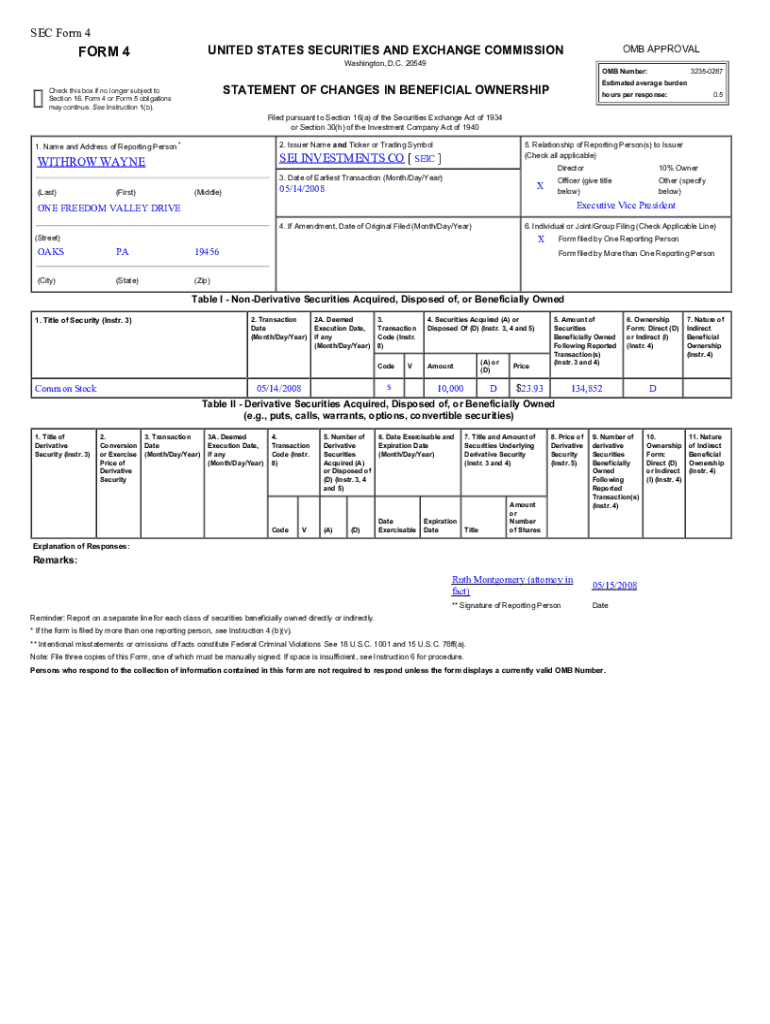

SEC Form 4 is a critical document required by the Securities and Exchange Commission for corporate insiders to report their securities transactions. This form ensures transparency in the stock market, allowing investors to understand if executives or board members are buying or selling their company's stock. Its primary aim is to provide stakeholders with key insights into executive behavior, potentially influencing market perceptions and company stock performance.

The importance of SEC Form 4 cannot be understated in terms of corporate governance. By mandating disclosures of insider trades, it helps promote ethical trading practices, discouraging improper behaviors that could lead to insider trading allegations. Furthermore, stakeholders rely on these disclosures to analyze insider buying or selling patterns, which can serve as indicators of a company's future performance.

Who is required to file SEC Form 4?

Reporting persons, defined by the SEC, are individuals required to file Form 4. Typically, this includes executives, directors, and major shareholders with more than 10% ownership of a company's outstanding shares. These persons are referred to as insiders, and their compliance with reporting requirements is vital for ensuring market fairness.

Insiders are classified into two categories: primary insiders, such as the CEO or CFO, who hold executive roles, and secondary insiders, which may include board members or significant shareholders. Any securities transactions involving company stocks, whether buying, selling, or options transactions, trigger the need to file SEC Form 4. This process emphasizes the importance of transparency surrounding insider actions.

Detailed breakdown of SEC Form 4 sections

SEC Form 4 consists of several key sections that each play a vital role in reporting insider transactions accurately. Understanding these sections is crucial for both filing and interpreting the documents.

The first section relates to the reporting person's information. Here, the insider must provide their personal details, such as name, address, and relationship to the company. This establishes the identity of the reporting individual and their connections to the corporation.

Transaction details reveal the type of security involved, transaction date, volume of shares, and price per share. Understanding these particulars aids analysts and investors in evaluating the motives behind the transactions. Lastly, the ownership information details the number of shares held before and after the insider's transactions and the total holdings, giving an overview of their financial engagement with the company.

Step-by-step guide to filling out SEC Form 4

Filling out SEC Form 4 can seem overwhelming, but with a structured approach, it becomes manageable. Start by gathering all necessary information, including personal details, transaction specifics, and ownership data.

Once you have all relevant data, navigate to the form interface on the SEC’s website or use tools like pdfFiller for a more seamless experience. Inputting each section methodically ensures accuracy and completeness.

When filling out the form, aim for precise data entry to avoid discrepancies that could lead to complications. Common pitfalls include incorrect dates or misreported transaction amounts, which ultimately affect the transparency of insider trades. Review and proofread before submission.

Editing and submitting SEC Form 4 via pdfFiller

Using interactive tools for form completion enhances the filing process. PdfFiller offers versatile features for filling out and submitting SEC Form 4. Users can easily navigate the platform to edit existing documents or create new submissions.

Editing PDF documents is straightforward within pdfFiller. You can insert and remove information, making it easier to adjust filings for accuracy. Moreover, the platform allows for secure electronic signatures, ensuring your filings are valid and compliant with legal standards.

The validity and security of eSignatures are paramount, ensuring your filings are trustworthy, thus maintaining integrity in your reporting obligations as an insider. This technology also allows for quick turnaround times, making it simple to stay compliant.

Managing your SEC Form 4 filings

Keeping track of your Form 4 filings is essential for effective compliance management. Establishing a system to document submissions ensures you can easily refer back to previous filings for any necessary amendments or inquiries.

In the instance where you need to modify filed forms after the initial submission, understanding the amendment process is fundamental. It is recommended to review the SEC’s guidelines to ensure accuracy and compliance regarding modifications.

Best practices for document management not only foster compliance but also prepare you for any inquiries regarding your insider trades. Staying organized and thorough mitigates risks associated with potential penalties or compliance issues.

Frequently asked questions (FAQs)

When it comes to filing SEC Form 4, several common queries arise among insiders. Being aware of these FAQs can aid in navigating the complexities of the filing process.

One major concern is missing the filing deadline. If you fail to file on time, there may be significant penalties and other repercussions, including potential fines. Additionally, many wonder if they can amend a filed SEC Form 4; yes, you can, but it must be done promptly to reflect any changes in transactions.

Analyzing SEC Form 4 data

Monitoring SEC Form 4 filings is essential for tracking insider trading activities, providing valuable insights into corporate governance and market integrity. Data from these filings allows analysts and investors to observe the behaviors of executives, thus forming hypotheses about company prospects.

Utilizing tools that track SEC Form 4 filings aids investors in gaining real-time insights into insider transactions, offering a competitive edge in understanding market sentiment. Many platforms now provide alerts for insider moves, highlighting significant transactions and ownership trends that may affect stock performance.

The tipping point of insider trading on stock performance is often highlighted in reports and analyses. Keeping an eye on these movements is vital for stakeholders assessing risk-reward scenarios of their investments.

Getting help with SEC Form 4

Individuals requiring assistance with the SEC Form 4 can benefit from various resources available on pdfFiller. The platform provides comprehensive guides and tools that walk users through the filing process, ensuring compliance.

For specific inquiries, customers can easily access pdfFiller’s customer support, which is equipped to help with any challenges faced during the filing. Additionally, community forums serve as a valuable space for individuals to share insights and tips, further enriching the user experience.

Why choose pdfFiller for your form management?

PdfFiller stands out as an ideal choice for managing SEC Form 4 and similar filings. The platform integrates various features that streamline document creation and filing processes. Users can easily create, edit, and manage forms from anywhere, providing unmatched convenience.

As a cloud-based document solution, pdfFiller ensures secure access and convenient collaboration. This solution is tailored to cater to individuals and teams seeking comprehensive document management tools, allowing for real-time updates and seamless communication.

Choosing pdfFiller not only empowers users to navigate the SEC Form 4 filing with ease but also enhances overall compliance and reporting practices, fortifying corporate integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

How can I get sec form 4?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.