Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Fill Out Form 8-K: A Comprehensive Guide

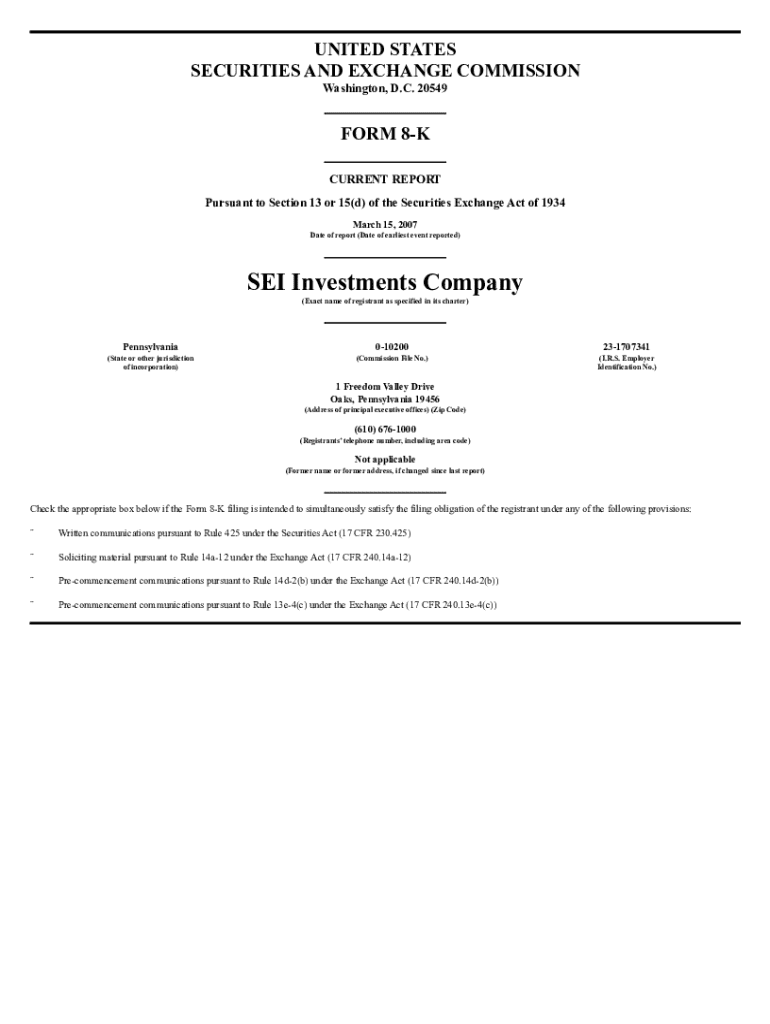

Understanding Form 8-K

Form 8-K is a critical filing that public companies must submit to the U.S. Securities and Exchange Commission (SEC) to report specific events that could significantly impact their financial condition or operations. This form is not a regular financial statement but serves as a timely disclosure mechanism for major corporate events, ensuring that stakeholders, including investors, are informed about key developments.

The primary purpose of Form 8-K is to maintain transparency and provide real-time information to the public about significant corporate events. For public companies, filing Form 8-K is not just a regulatory requirement; it is also a means to uphold their corporate governance responsibilities by keeping investors informed.

Disclosures required in Form 8-K vary widely and can include events such as mergers and acquisitions, financial issues, changes in leadership, or amendments to governing documents. This level of disclosure is crucial as it allows investors to make informed decisions based on the latest corporate actions.

When is Form 8-K Required?

There are specific scenarios that trigger the need for a Form 8-K filing, often related to significant events that affect the company. Some common events include:

The deadline for submitting Form 8-K is typically four business days after the triggering event. This quick turnaround is imperative to ensure that the information is communicated promptly, in compliance with SEC regulations that govern timely disclosures.

The structure of Form 8-K

Form 8-K consists of several itemized sections, each catering to different types of events. Some of the most commonly referenced sections include:

Beyond these core items, Form 8-K can have varying requirements depending on the specific event, such as mergers or financial restatements, each demanding distinct disclosures from the reporting company. Understanding these sections and their significance is paramount for accurate reporting.

Step-by-step guide to completing Form 8-K

Filling out Form 8-K entails several steps to ensure that the filing is accurate and compliant. The initial phase focuses on preparation.

Start by gathering all necessary information and documentation related to the event. Determine the event or change prompting the filing and confirm your filing obligations as per SEC guidelines. It's essential to have clear details for a successful submission.

Filling out the form

1. **Entering company information**: Begin by accurately entering the company's name, IRS employer identification number, and other relevant details. Formatting is crucial, especially ensuring consistency in data input.

2. **Disclosing the event**: Clearly articulate the event requiring disclosure. Follow specific instructions provided for different events, ensuring compliance with SEC regulations.

3. **Supplemental information**: When required, include any financial statements or exhibit documents that support the event being reported.

4. **Review and verification**: After completing the form, a thorough review is essential. Accuracy is crucial, so double-check all entries for any discrepancies.

Submitting the form

Form 8-K must be filed electronically through the SEC’s EDGAR system. Ensure that you adhere to the procedures for electronic submission to avoid any potential issues. Review recommendations for ensuring a successful submission like checking file formats and confirming acknowledgment of receipt.

Key benefits of using Form 8-K

Utilizing Form 8-K effectively yields several benefits for both companies and their stakeholders. One key advantage is enhanced transparency and timely disclosure, which fosters trust and provides investors with crucial insights into corporate activities.

The regulatory compliance aspect of Form 8-K is equally vital. Adhering to SEC regulations averts penalties or sanctions that could arise from non-compliance, thus protecting the company’s reputation.

Additionally, strategically leveraging Form 8-K can improve investor relations by enabling companies to communicate critical information promptly and directly. This proactive approach can lead to a more informed investor base.

Tips for managing your Form 8-K submissions

Effective management of Form 8-K submissions involves adhering to best practices to streamline the filing process. Recommended timelines should be established based on different scenarios. For example, companies should outline procedures for urgent situations and planned events.

Avoiding common mistakes is crucial. Errors in the form can lead to misinterpretations or compliance issues. Regular training and reviews are advisable to keep team members aware of any changes in regulations.

Adjusting to changes in regulations

The regulatory landscape can shift, necessitating ongoing education to remain compliant. Companies should subscribe to updates from the SEC and industry-specific news to adapt to any changes affecting Form 8-K filings.

Frequently asked questions about Form 8-K

Many queries arise regarding the implications of filing Form 8-K. For instance, one pressing question is: What happens if Form 8-K is not filed on time? Delays in filing can lead to substantial penalties, and in some cases, further scrutiny from regulators.

Another common concern is whether multiple events can be reported on a single Form 8-K. The SEC allows this under certain conditions, but companies must ensure clarity and specificity to prevent confusion among investors.

Lastly, companies often want to know how Form 8-K differs from other SEC filings, such as Form 10-K and Form 10-Q. While 10-K and 10-Q are periodic reports according to specific timelines, Form 8-K is event-driven, focusing on immediate disclosures.

Explore interactive tools on pdfFiller

pdfFiller provides a suite of document preparation tools that can significantly streamline the process of completing Form 8-K. Users can access features designed to enhance the accuracy of their filings, from structured templates to helpful prompts.

Collaboration features allow multiple team members to work seamlessly on submissions, aiding in efficiency and accuracy. The platform also supports electronic signatures, emphasizing the importance of eSigning in the filing process to ensure timely submission.

Subscribe for updates on Form 8-K

Keeping updated on the latest changes and insights regarding Form 8-K is essential for companies striving for compliance and efficiency. Subscribing for regular updates ensures that you remain on top of any modifications in regulations that may impact your filings.

Ongoing education in document management can enhance your company's approach to filings, turning potential mistakes into a streamlined filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8-k without leaving Google Drive?

How can I edit form 8-k on a smartphone?

How can I fill out form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.