Get the free Policy of Money Laundering and Terrorism Financing Risk System (siplaft)

Get, Create, Make and Sign policy of money laundering

Editing policy of money laundering online

Uncompromising security for your PDF editing and eSignature needs

How to fill out policy of money laundering

How to fill out policy of money laundering

Who needs policy of money laundering?

Understanding and Implementing a Policy of Money Laundering Form

Understanding money laundering: Overview

Money laundering refers to the process of disguising the origins of illegally obtained money, typically by passing it through a complex sequence of banking transfers or commercial transactions. This illegal activity aims to make the proceeds of crime appear legitimate. The methods vary, but the core goal remains the same: to obscure the illicit source of the funds. Importantly, money laundering poses severe risks to the integrity of financial systems and undermines public trust.

Compliance with money laundering policies is essential for organizations to mitigate legal risks and protect their reputation. Failure to adhere to these regulations can result in severe penalties, including hefty fines and even the loss of operating licenses. Organizations must implement robust systems that detect and prevent such illicit transactions.

The legal framework surrounding money laundering includes numerous international and local laws. For instance, organizations are often required to comply with standard measures, such as the Financial Action Task Force (FATF) recommendations and regional regulatory requirements, ensuring that they have adequate controls in place.

The role of a money laundering policy form

A money laundering policy form serves several critical purposes. It provides a documented framework outlining how an organization will prevent, detect, and report suspected money laundering activities. This form is a vital piece of operational compliance, guiding employees in their responsibilities and clarifying the organization's approach to handling potential risks associated with money laundering.

Key components of an effective policy form include clear definitions of roles and responsibilities, procedures for monitoring transactions, and guidelines for training employees on compliance issues. By consolidating all relevant information into one document, organizations enhance their ability to manage compliance proactively.

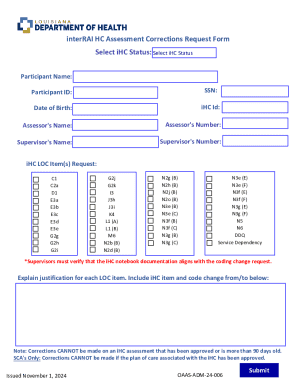

Essential elements to include in a money laundering policy form

Several essential elements must be incorporated into a money laundering policy form to ensure effectiveness. These elements establish clear protocols for identifying and verifying customers, laying the groundwork for compliance.

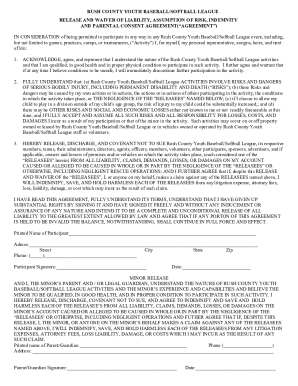

Steps to create a money laundering policy form with pdfFiller

Creating a money laundering policy form using pdfFiller can facilitate a streamlined process that enhances compliance and efficiency. Follow these steps:

Best practices for implementing the money laundering policy

Effective implementation of a money laundering policy requires adherence to several best practices. Regular training and awareness programs for employees are essential to ensure everyone understands their role in compliance. Furthermore, organizations must continuously review and update the policy as regulations evolve to reflect any changing requirements.

Establishing effective communication channels for reporting issues or suspicious activities is critical. An environment that encourages employees to speak up can dramatically enhance the monitoring and detection of illicit activities.

Common pitfalls to avoid when completing a money laundering policy form

When completing a money laundering policy form, several common pitfalls can undermine its effectiveness. One significant issue is inadequate customer due diligence, which can leave organizations exposed to risks. Organizations must prioritize rigorous verification processes.

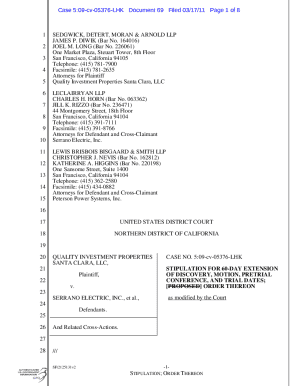

Utilizing interactive tools on pdfFiller

pdfFiller offers a robust suite of interactive tools for document management that can aid in completing and managing the money laundering policy form effectively. Features like document embedding, field creation, and tracking changes enhance collaboration and organization.

Additionally, instant help features ensure that users can efficiently complete forms without unnecessary delays, providing guidelines and tips directly within the platform.

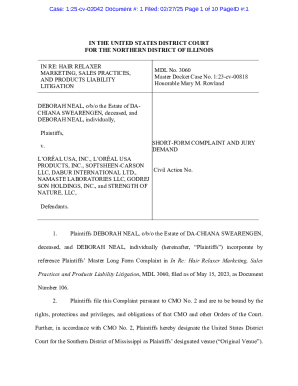

Practical examples of money laundering policy forms

Practical examples and case studies of money laundering policy forms can provide invaluable insight into different approaches. Organizations may choose to adopt varying levels of rigor in their policies, depending on their industry and exposure to risk.

Conclusion of the form-fill process

Integrating the money laundering policy into everyday business operations is crucial for creating an effective compliance environment. Ongoing assessment of compliance status, coupled with allocated training resources, is vital for mitigating risks related to money laundering. A well-executed policy enhances an organization's ability to navigate the complexities of regulatory environments and strengthens the integrity of its operations.

By leveraging tools like pdfFiller, organizations can ensure comprehensive compliance, streamline document management, and foster a proactive approach to combating money laundering.

FAQ section: Common questions about money laundering policies

When it comes to money laundering policies, organizations frequently have questions regarding compliance requirements, best practices, and implementation strategies. Understanding these elements is crucial for maintaining legal standards and protecting against risks.

Additionally, firms must stay informed about updates to government regulations and how they impact policy formulation.

User testimonials: Success stories from pdfFiller users in regulating compliance

Various users have reported success stories illustrating how pdfFiller has empowered them to efficiently manage their compliance documentation, including money laundering policies. Testimonials highlight the platform's ease of use and effectiveness in fostering collaboration among team members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my policy of money laundering in Gmail?

How can I modify policy of money laundering without leaving Google Drive?

How do I complete policy of money laundering on an iOS device?

What is policy of money laundering?

Who is required to file policy of money laundering?

How to fill out policy of money laundering?

What is the purpose of policy of money laundering?

What information must be reported on policy of money laundering?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.