Get the free Stock/share Transfer Form

Get, Create, Make and Sign stockshare transfer form

Editing stockshare transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stockshare transfer form

How to fill out stockshare transfer form

Who needs stockshare transfer form?

Stock Share Transfer Form: A Comprehensive How-to Guide

Understanding stock share transfers

A stock share transfer refers to the process of transferring ownership of shares from one party (the transferor) to another (the transferee). This is pivotal in both corporate environments and personal finance, as it involves changing the rights associated with the ownership of shares. Given that shares represent ownership in a company, it's crucial to ensure the transfer is executed correctly to maintain proper records and uphold legal obligations.

The importance of stock transfers extends beyond mere paperwork. They can affect corporate control, shareholder rights, and even share valuation. It's essential for individuals and businesses to understand the mechanics involved to successfully navigate the complexities of share ownership and avoid potential legal issues.

Types of stock transfers

Stock transfers can be categorized into several types. Voluntary transfers occur when an individual or entity willingly transfers ownership, often through sale or gift. Alternatively, involuntary transfers may happen due to legal actions such as bankruptcy or divorce.

Moreover, transfers can occur between individuals—commonly seen in personal arrangements—or between entities, which might involve more formal processes and regulatory compliance. Understanding these distinctions is vital to the proper execution of a stock share transfer.

The legal framework of stock transfers

Navigating the legal landscape of stock transfers requires an understanding of relevant laws and regulations that govern securities. Federal securities laws provide a framework that ensures transparency and fairness in the transfer process, primarily through the Securities and Exchange Commission (SEC). Additionally, state-specific regulations can impose further complexities, as different states may have their own rules regarding stock transfers.

Compliance requirements are critical when executing a stock share transfer. Necessary disclosures, such as financial statements and related party transactions, must be made to adhere to legal obligations. Failure to meet these compliance requirements can lead to unwanted penalties and delays in the transfer process, making it vital for shareholders to be well-informed.

Preparing for a stock transfer

Before embarking on a stock transfer, it’s essential to identify the need for the transfer, prompting considerations such as the motive behind the transfer. Individuals may want to transfer shares for multiple reasons, including financial planning, estate transfers, or business reorganizations. A clear understanding of these motivations will inform the approach taken during the transfer.

Additionally, gathering necessary documents is crucial. This includes stock certificates, transfer forms, and any agreements that outline the terms of the transfer. Ensuring that all paperwork is accurate will facilitate a smooth transfer process and help prevent complications. Be proactive in seeking legal guidance if the transfer involves significant assets or complex regulations.

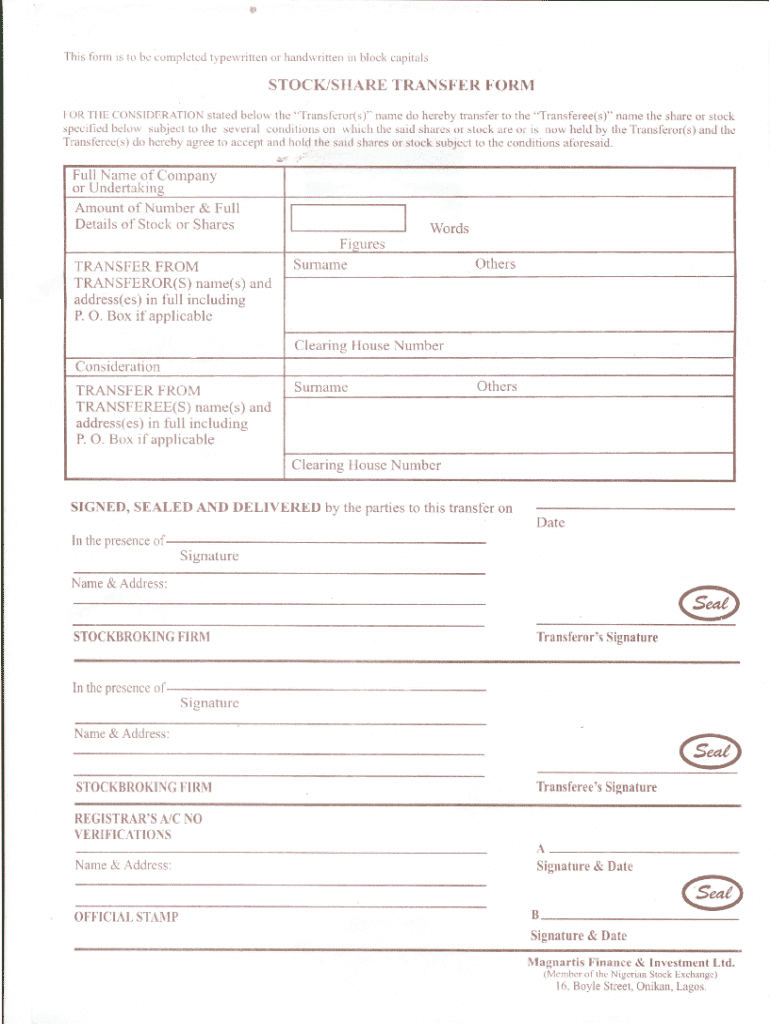

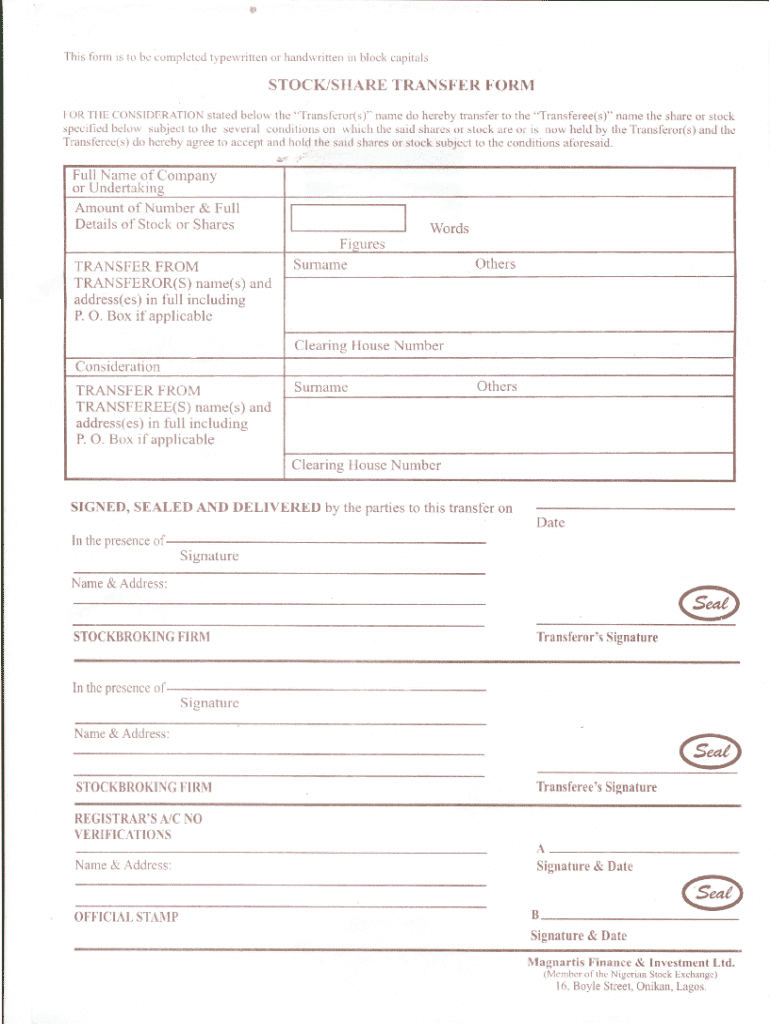

The stock share transfer form

The stock share transfer form is a pivotal document in the transfer process. It serves as the official record of the transfer and provides critical information regarding both the transferor and transferee. This form not only legitimizes the action taken but also aids in the legal documentation necessary for regulatory compliance.

Common fields within the form include the names and addresses of the transferor and transferee, the number of shares being transferred, and any relevant details about the company. Familiarizing oneself with the terminology used in the form will streamline the process and reduce the likelihood of errors.

Downloading the stock share transfer form

Accessing the stock share transfer form is straightforward through pdfFiller. To download the form, navigate to the pdfFiller template library and search for the stock share transfer form. Ensure that the template you obtain complies with your local laws to prevent any legal complications. The form is available as a PDF, which allows for seamless editing and completion.

Step-by-step guide to filling out the stock share transfer form

Filling out the stock share transfer form should be approached methodically to ensure accuracy. Start by completing the header information, where you’ll include details such as the names and addresses of both the transferor and transferee. This section lays the groundwork for the official record.

Next, detail the shares being transferred. You will need to specify the type of shares, the number being transferred, and any identifying descriptions, such as serial numbers. This clarity helps prevent misunderstandings and ensures that all parties are aware of the specifics of the transfer.

Signatures from both parties are then required to validate the transfer. The significance of this step cannot be overstated; both the transferor’s and transferee’s acknowledgment of the transaction is crucial. In some cases, notarization may also be necessary, especially for larger or more formal transactions. Finally, take time to review the form thoroughly, verifying all details to avoid errors that could hinder the transfer.

Submitting the stock share transfer form

Upon completion, knowing where and how to submit the stock share transfer form is vital for ensuring a successful transfer. Depending on the situation, you might submit the form to the company’s registered transfer agent or directly to the company itself. It's essential to ascertain the preferred method of submission, as some organizations accept electronic submissions, while others require physical paperwork.

Common pitfalls during submission can include incorrect completion or failure to meet submission deadlines. Make sure all supporting documentation is included and that the transfer is submitted promptly to avoid delays. A proactive approach will help minimize hurdles during this crucial phase of the transfer process.

Tracking the stock transfer

After submitting the stock share transfer form, tracking its status involves staying vigilant and proactive. Communicate with the relevant parties—such as the transfer agent or company representatives—to confirm the transfer is being processed. Having a reference for your submission can help streamline inquiries.

Once the transfer has been completed, expect confirmation from the company regarding the successful transfer of ownership. This confirmation serves as a vital piece of documentation for both parties, reinforcing the change in share ownership. Retaining a copy of all received communications is highly recommended for future reference.

Tax implications of stock transfers

Understanding the tax implications of stock transfers is critical for both parties involved. Generally, stock transfers can trigger tax obligations such as capital gains taxes for the transferor if shares are sold at a profit. It's crucial for individuals to be aware of their tax responsibilities to avoid unforeseen liabilities.

Interestingly, certain exemptions exist for small business stocks under Section 1202 of the Internal Revenue Code. Taxpayers should evaluate whether their situation qualifies for these exemptions, potentially providing significant tax benefits during the transfer of shares.

Filing related tax returns should be undertaken with diligence. Ensure that necessary forms are completed correctly and submitted by the required deadlines to minimize penalties. Engaging with a tax professional can provide further clarity on the implications of stock transfers and the necessary reporting.

Share transfer agreement: a sample template

A share transfer agreement is integral to formalizing the terms of a stock transfer. By documenting the agreement, parties articulate the specifics of the transfer, improving transparency and preventing disputes. This legally binding document outlines the rights and obligations of each party involved.

Key components of a share transfer agreement typically include the identity of the parties, a detailed description of shares being transferred, the purchase price if applicable, and representations and warranties regarding the ownership of shares. Customizing the agreement to suit the specific transaction is essential to ensure it meets your needs accurately while protecting the interests of both parties.

When drafting the agreement, consider utilizing templates available through services like pdfFiller. These templates can streamline the process, allowing for easy edits and adaptations to suit your unique circumstances.

Using pdfFiller for document management

pdfFiller serves as an invaluable tool for managing stock share transfer forms and agreements. The platform simplifies the editing, signing, and sharing of various documents, eliminating traditional barriers associated with paperwork. Users can easily navigate through a secured, cloud-based environment, ensuring that their files are accessible anytime, anywhere.

Collaborating with teams can also be streamlined through pdfFiller’s platform features. Multiple users can edit and provide input on documents in real-time, promoting efficiency and reducing the likelihood of errors. Such collaboration is critical, particularly for businesses, where accuracy and transparency are paramount throughout the share transfer process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute stockshare transfer form online?

How do I fill out the stockshare transfer form form on my smartphone?

How can I fill out stockshare transfer form on an iOS device?

What is stockshare transfer form?

Who is required to file stockshare transfer form?

How to fill out stockshare transfer form?

What is the purpose of stockshare transfer form?

What information must be reported on stockshare transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.