Get the free Housing as an Economic Development Strategy for Virginia - dspace mit

Get, Create, Make and Sign housing as an economic

Editing housing as an economic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out housing as an economic

How to fill out housing as an economic

Who needs housing as an economic?

Housing as an Economic Form: A Comprehensive Guide

Understanding housing as an economic concept

Housing serves as a foundational component of economic systems across the globe. It fulfills a basic human need, influencing economic development, wealth accumulation, and social stability. The way housing is structured within an economy can significantly alter the landscape of wealth distribution and opportunity. For instance, access to affordable housing is vital for fostering economic mobility, allowing individuals and families to secure a stable environment from which they can pursue education and job opportunities.

Additionally, housing interacts with various economic sectors such as transportation, construction, and finance, representing a significant portion of national GDP. Changes in these industries can ripple through the housing market, reflecting broader economic trends. This interconnectedness makes housing a crucial barometer for gauging economic health.

Historical context of housing economics

The evolution of housing markets reflects historical economic trends and events. The Great Depression, for instance, led to substantial changes in housing policies and regulations, emphasizing the need for affordable housing. Post-World War II, a housing boom started in many nations, particularly in the United States, driven by an influx of returning veterans and economic prosperity. These shifts reveal how external economic factors can reshape the strategies and priorities surrounding housing investments.

In more recent times, the 2008 financial crisis drastically affected housing markets worldwide, spotlighting the consequences of speculative lending practices and the importance of sustainable financial policies in housing. The response to such events often shapes future housing regulations and community planning layouts.

Analyzing housing affordability

Housing affordability remains a pressing concern, influenced by various factors. Interest rates play a critical role; as they fluctuate, they can either ease or exacerbate the burden of homeownership. When rates are low, borrowing becomes cheaper, making it possible for more individuals and families to secure homes. However, in a rising economy, coupled with inflation, housing prices may outpace wage growth, making affordability elusive for many. Understanding local versus national economic conditions is essential in analyzing housing markets specifically suited to one's locality.

Assessing housing affordability requires a multi-faceted approach. Traditional measures like the price-to-income ratio offer insights into how accessible housing is for average earners. Evaluating local economic conditions, such as job availability and income levels, combined with a nuanced understanding of where housing is located, can inform better decisions. Areas with booming job markets but limited housing stock often face steeper prices, affecting accessibility for families and individuals.

The impact of government policies on housing

Government policies play a pivotal role in shaping the housing landscape. Zoning laws are among the most influential tools, dictating what can be built where, impacting everything from community density to property values. Communities facing restrictive zoning may struggle with housing supply, leading to increased prices and a lack of affordable options for families looking to settle down. By contrast, areas with more flexible zoning can enjoy more diverse and affordable housing stocks, thereby enhancing community stability.

Additionally, government interventions like rent control create unique dynamics within housing markets. While aimed at providing stability for renters, these regulations can result in reduced investment in building new housing. Furthermore, subsidies and incentives often help bridge affordability gaps, making homeownership attainable for lower-income families. However, the effectiveness of such programs can vary greatly depending on economic conditions and local government commitment.

Housing market trends and forecasting

Analyzing current trends within the housing market reveals vital insights into its future trajectory. Recent data show fluctuations in housing prices driven by supply chain issues and shifts in consumer demand. For example, the pandemic has reshaped where people prefer to live, often leading to increased demand in suburban and rural areas as remote work becomes normalized. Understanding how demographic changes affect this trend is essential; for instance, Millennials are now entering the housing market in larger numbers, influencing both demand and pricing.

Employing predictive analytics tools can provide deeper insights into potential shifts within the housing market. By analyzing large datasets, real estate agencies and investors can identify emerging patterns that signal future shortages or excesses, feeding into strategies that accommodate shifts before they culminate in crises. As technology continues to advance, new methods for forecasting housing trends will become more sophisticated, enabling smarter decision-making.

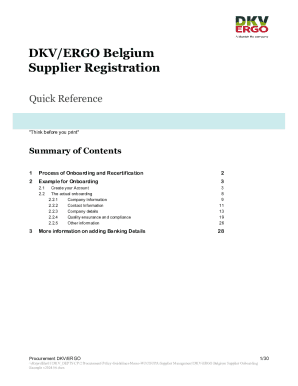

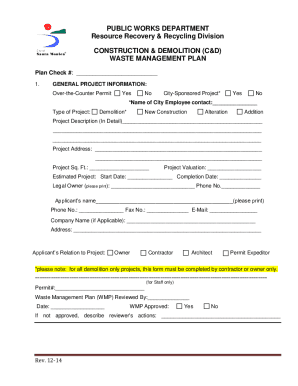

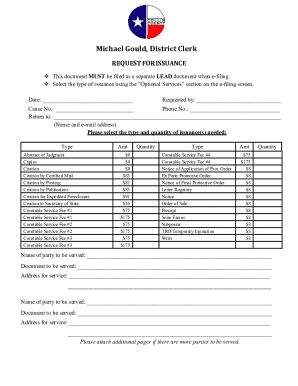

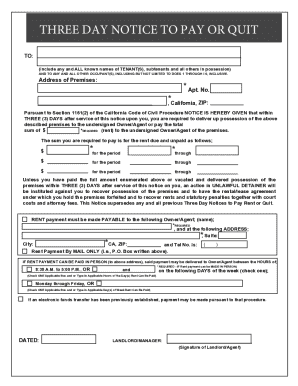

Platforms for document management in real estate transactions

Navigating the home buying process can be daunting, but the advent of cloud-based document solutions simplifies the experience significantly. Tools like pdfFiller allow for efficient management of the extensive documentation required in real estate transactions. Users can easily fill out, edit, and share forms electronically, reducing the need for face-to-face meetings or physical paperwork. This streamlining not only saves time but also mitigates errors during critical stages of the buying process.

Interactive document creation is another vital feature benefiting home buyers and sellers alike. Users can follow simple workflows to fill out necessary forms while leveraging helpful tips embedded within the documents. Additionally, eSigning capabilities speed up the process, ensuring that transactions can be completed swiftly without the burden of printing and mailing documents.

Collaborating on housing projects

Effective team collaboration is crucial in executing housing projects, particularly when multiple stakeholders are involved. pdfFiller empowers users with features that enhance communication and document sharing among project teams. Real-time collaboration allows team members to make edits and comments on shared documents, ensuring everyone stays informed throughout the development process. This fosters a culture of transparency and accelerates project timelines, as all stakeholders can access necessary documentation from anywhere.

Best practices for document sharing are critical for maintaining security and compliance. Utilizing features such as password protection and audit trails helps ensure that sensitive information is safeguarded. When teams prioritize these practices, they can minimize risks associated with data leaks or unauthorized access, further fortifying their collaborative efforts.

Real-world applications of housing as an economic form

Successful case studies highlight the transformative power of housing markets on urban landscapes and communities. For instance, cities that have implemented comprehensive urban renewal programs often see revitalization through improved infrastructure and increased property values. The restoration of neglected areas not only enhances the living conditions of current residents but also attracts new families and businesses, creating economic opportunity and increasing community investment.

Analyzing regional differences can reveal unique approaches to addressing housing challenges. In high-cost urban areas, innovative solutions such as tiny housing developments or cooperative housing models have emerged to manage demand without displacing residents. Conversely, rural regions may focus on enhancing accessibility through new community initiatives or public-private partnerships to promote homeownership.

Looking forward: The future of housing economics

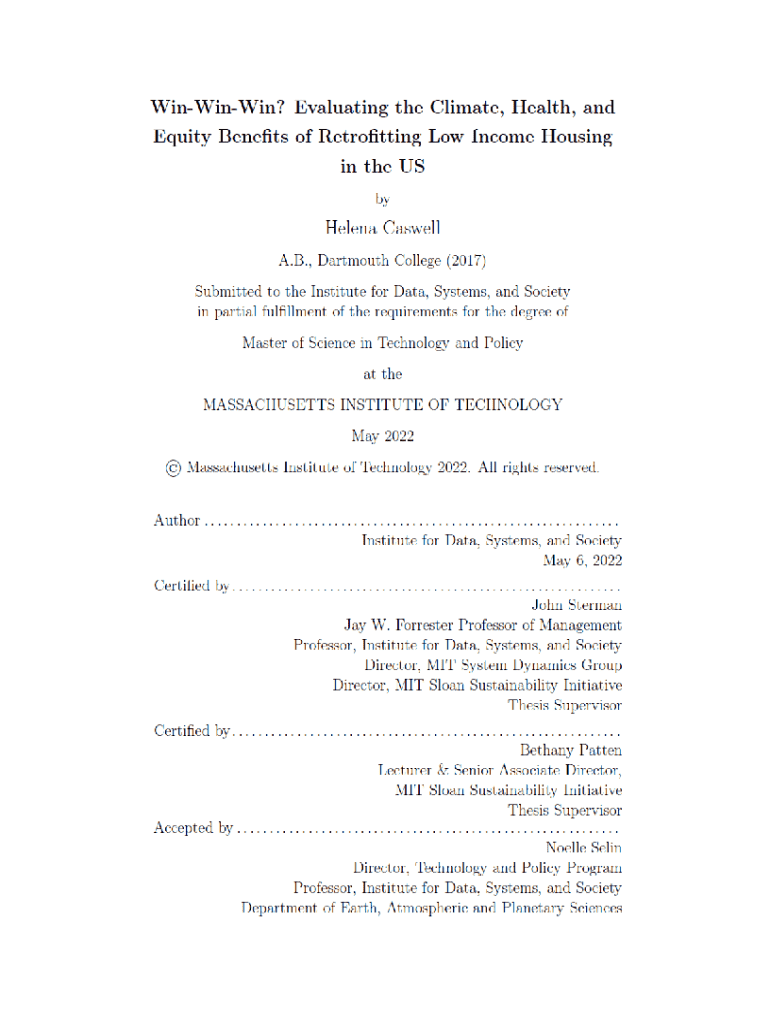

The future of housing economics is poised for change as emerging trends shape expectations and realities in the market. Sustainable housing practices continue to gain traction, presenting long-term economic advantages even amid rising material costs. As more people prioritize environmental impact, the demand for green building materials and energy-efficient homes is likely to increase, thereby influencing construction methods and market prices.

Moreover, advancements in technology will further redefine housing markets. With data-driven strategies and AI becoming increasingly prevalent, stakeholders can anticipate shifts in buyer preferences and housing demands. Preparing for challenges posed by evolving economic policies will also be essential, as maintaining flexibility in planning and investment can mitigate risks associated with sudden market changes.

Key takeaways for individuals and teams

Understanding housing as an economic form involves recognizing its critical relationship with overall economic stability, trends, and government policies. Individuals and teams engaged in real estate should prioritize affordability factors, leveraging tools such as pdfFiller to manage documentation effectively. Making informed decisions requires a mix of comprehensive market analysis and ready access to necessary documents, enhancing clarity and efficiency throughout the home buying or selling process.

Best practices in utilizing document management solutions streamline transactions, empowering buyers and sellers to focus on critical decision-making rather than bureaucratic hurdles. As housing economics continues to evolve, staying informed and adaptable will be crucial for navigating challenges and seizing opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in housing as an economic?

How do I edit housing as an economic straight from my smartphone?

How do I complete housing as an economic on an Android device?

What is housing as an economic?

Who is required to file housing as an economic?

How to fill out housing as an economic?

What is the purpose of housing as an economic?

What information must be reported on housing as an economic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.