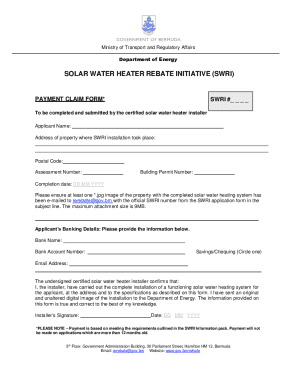

Get the free Quarterly Statement

Get, Create, Make and Sign quarterly statement

How to edit quarterly statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly statement

How to fill out quarterly statement

Who needs quarterly statement?

A comprehensive guide to quarterly statement forms

Understanding the quarterly statement form

A quarterly statement form is a document that summarizes financial information for a specific three-month period. Its primary purpose is to provide stakeholders, including businesses and individual taxpayers, with a clear view of financial performance. For businesses, quarterly statements are essential for gauging economic health, making informed decisions, and encouraging accountability among team members. Individuals also benefit from these statements, as they help track personal finances and prepare for tax submissions.

Quarterly statements serve various functions, including financial statements that help businesses evaluate their performance in terms of profit and loss. They can also include tax-related forms required by the government, ensuring compliance with local and federal regulations. Additionally, businesses often prepare performance reports to share with stakeholders, providing updates on both financial and operational metrics.

Types of quarterly statements

Preparing to complete your quarterly statement

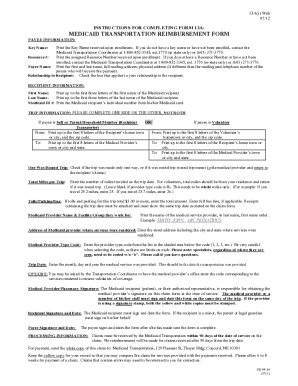

Before diving into filling out your quarterly statement form, preparation is crucial. Start by collecting all necessary documents that will serve as the foundation for your completed form. This includes last quarter’s financial records, receipts, and any relevant tax documentation. Having previous quarterly statements on hand can also provide context and insights that are beneficial as you aggregate your current data.

Understanding the format and structure of a typical quarterly statement is also vital. Most forms will include sections for income, expenses, assets, and liabilities. Familiarize yourself with these sections, noting any that may require extensive input based on the nature of your financial situation. Capturing all the necessary information beforehand will streamline your workflow and help you avoid last-minute scrambles for documentation and figures.

Collecting necessary information

Step-by-step guide to filling out the quarterly statement form

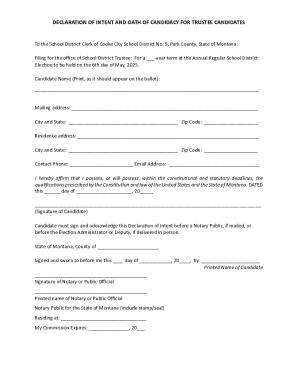

Filling out a quarterly statement form can be straightforward if you approach it systematically. Begin with the personal information section, which requires basic identification details such as your name, address, and contact information. Ensuring this information is accurate and complete is crucial, as errors can lead to delays or issues with processing your form.

The next section will cover your financial overview, where you'll report income and revenue. Be meticulous in this section, detailing every source of income, including wages, sales, and other financial inflows. Then, shift focus to your expenses, breaking down both fixed costs (like rent and salaries) and variable costs (like utilities and supplies). Finally, calculate your profit or loss by subtracting total expenses from total income.

Account balances and assets

Reporting current assets and liabilities is another key component of your quarterly statement. Systematically list out your assets, such as cash, accounts receivable, and inventory, followed by your liabilities, including accounts payable and any outstanding loans. This not only gives a snapshot of your financial position but also presents valuable insights into your equity and retained earnings.

Additional schedules and attachments

Certain quarterly statement forms may require you to attach additional schedules. Common examples include a cash flow schedule or detailed expense reports. Adding these can substantiate your income and expense claims, providing an added layer of transparency. Refer to your government and business requirements to determine which attachments are necessary.

Editing and reviewing your completed form

Once you’ve filled out the quarterly statement form, reviewing it is essential. Utilize tools like pdfFiller’s editing capabilities to make it easy to check for errors, correct mistakes, and ensure that all details are compliant with government standards. Engaging team members for cross-verification can also enhance accuracy, as an additional pair of eyes can catch errors you may have overlooked.

Common mistakes to avoid include overlooking significant details like missing revenue streams or expenses. Miscalculating figures can also lead to significant discrepancies. Paying attention to detail during the review phase will bolster the integrity of your quarterly statement and prevent issues with submission.

Using pdfFiller’s editing tools

Signing and submitting your quarterly statement

After reviewing your final document, it’s time to sign and submit your quarterly statement. If you’re using pdfFiller, you can opt for an electronic signature, which is often faster and provides a digital trail for tracking submissions. If you prefer a traditional method, ensure that your signature is clear and legible, as this is required for validation.

Knowing the submission guidelines is critical to ensure your forms are filed on time. Each state, including Georgia, has specific deadlines for filing quarterly statements. Adhering to these deadlines is crucial for compliance, especially for tax-related forms. Failure to submit on time can result in penalties or complications with your government filings.

Where to send the quarterly statement form

Managing your quarterly statements effectively

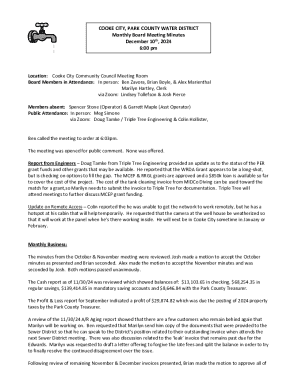

Effective management of your quarterly statements can simplify your financial reporting process. Start by archiving and storing your completed forms in an organized manner. Digital storage solutions, like those offered by pdfFiller, facilitate easy retrieval without the hassle of sifting through physical paperwork. Take advantage of robust organization features to categorize your quarterly statements by year or type.

Tracking performance over time is another benefit of managing your quarterly statements effectively. By analyzing previous statements, you can identify trends in revenue and expenditures, which can inform strategic planning for future quarters. Setting reminders for future submissions ensures that you remain compliant with deadlines and organized in your financial management process.

Best practices for digital storage

Troubleshooting common issues

Encountering obstacles in the submission or approval process is common when dealing with quarterly statements. If you receive a rejection for any reason, take proactive steps to rectify any errors highlighted by the reviewing authority. Typically, you will need to amend your submission promptly and possibly consult with customer support for clarity.

Frequent questions surrounding quarterly statements often revolve around how to correctly report certain income types or how to handle discrepancies in figures. Much of this information can be gathered from your state government websites, including email systems that provide additional instructions and help during shutdowns.

What to do if you receive a rejection

Leveraging pdfFiller for document management

Cloud-based document solutions like pdfFiller offer extensive benefits, ensuring that access to your quarterly statements is available anytime and anywhere. This convenience is especially advantageous for teams that require collaborative input on financial data. The platform’s collaborative features enable team members to comment, edit, and sign documents, streamlining workflows.

Using additional tools and features available on pdfFiller can further enhance your document management strategy. For example, integration with existing workflows can allow for seamless tracking of the financial health of your organization. This means quarterly statements are not just static documents but an integral part of your financial planning and decision-making processes.

Advantages of cloud-based document solutions

Feedback and assistance

When managing quarterly statements, having access to customer support can make a significant difference. If you encounter challenges while using pdfFiller, reaching their customer service representatives for assistance is a straightforward process. Options include live chat support, which often provides quick responses to your queries.

Engaging with the pdfFiller community can also enrich your experience. By sharing tips and experiences with other users, you can gather insights that improve your handling of quarterly statements and learn from others' best practices in document management.

Contacting support for help

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the quarterly statement in Chrome?

How can I edit quarterly statement on a smartphone?

How do I complete quarterly statement on an iOS device?

What is quarterly statement?

Who is required to file quarterly statement?

How to fill out quarterly statement?

What is the purpose of quarterly statement?

What information must be reported on quarterly statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.