Get the free Commitment for Title Insurance (t-7)

Get, Create, Make and Sign commitment for title insurance

How to edit commitment for title insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commitment for title insurance

How to fill out commitment for title insurance

Who needs commitment for title insurance?

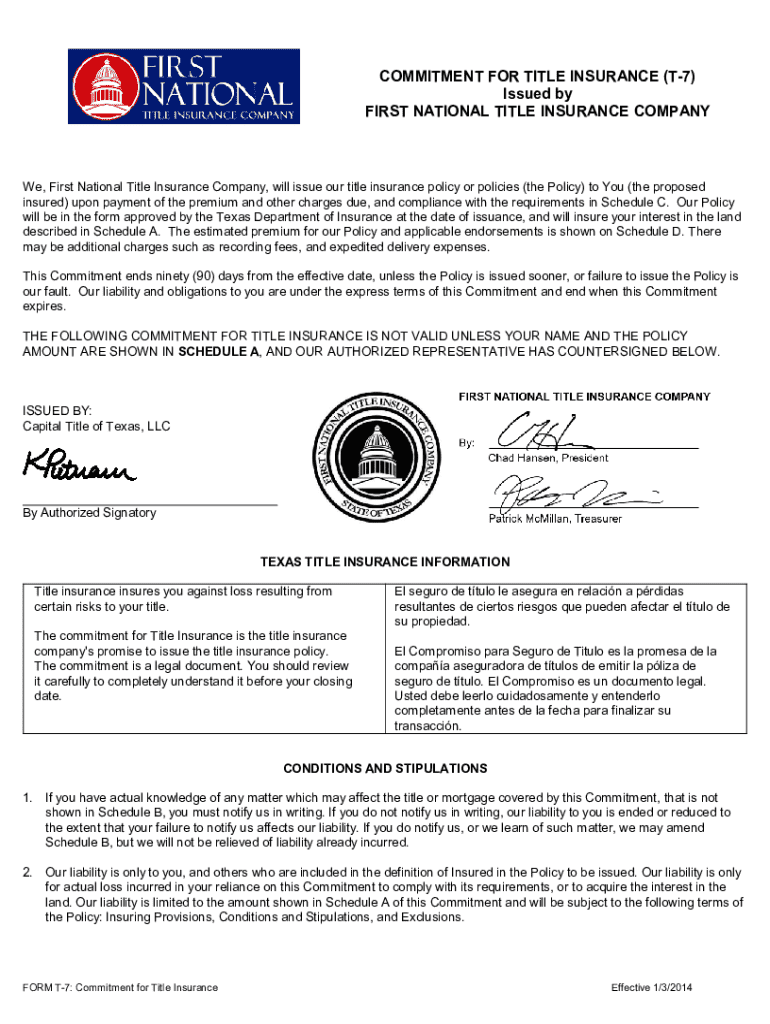

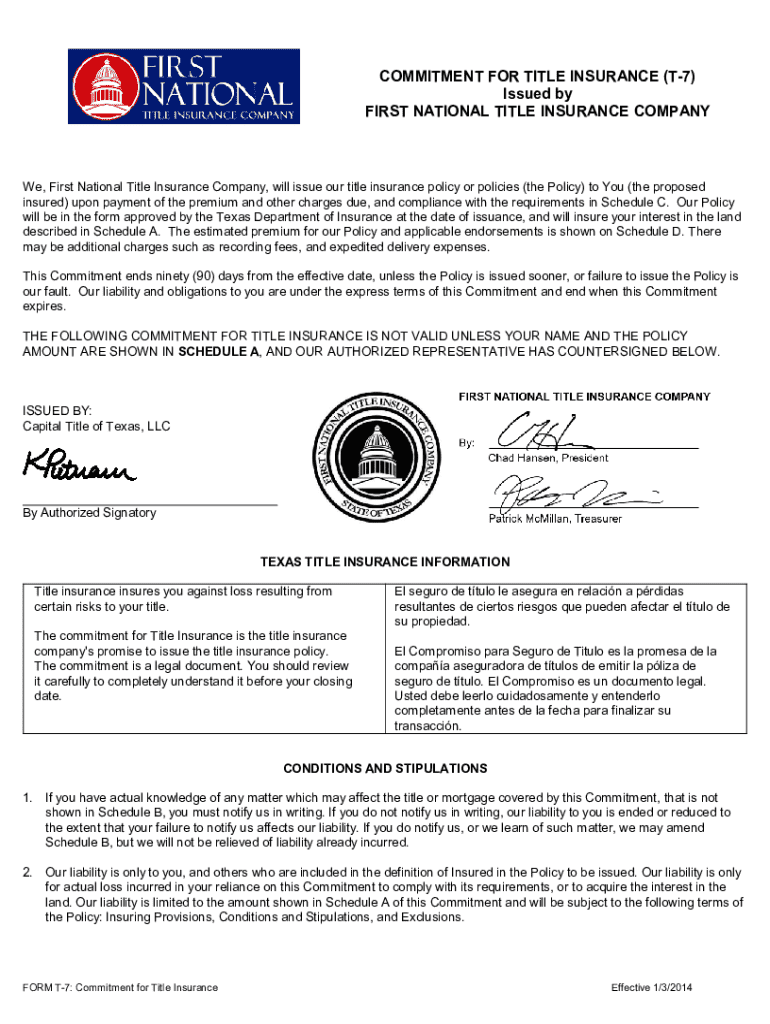

Understanding the Commitment for Title Insurance Form

Overview of title insurance and its importance

Title insurance provides protection to property buyers and lenders against any undiscovered defects in a title, ensuring that the purchaser has clear ownership of the property. Its significance in real estate transactions cannot be overstated; it helps mitigate risks related to ownership disputes and unforeseen liens that could jeopardize a buyer's investment.

The commitment for title insurance form plays a pivotal role in this process, as it outlines the terms and conditions under which a title policy will be issued. This commitment not only details coverage but also lists exceptions to coverage that buyers need to be aware of, forming the bedrock of informed decision-making in real estate.

What is a commitment for title insurance?

The commitment for title insurance acts as a preliminary report provided by title companies before issuing a title insurance policy. This document details what will be covered under the policy once it is finalized and outlines any exceptions that may apply. The primary purpose of having a commitment is to provide both buyers and lenders with clear insight into their title's status and any potential liabilities.

It's essential to grasp the difference between a commitment and a policy document. While a commitment serves as a roadmap pointing to possible issues that could hinder title clearances, the title policy itself is the actual insurance product that protects against these risks after closing.

Components of the commitment for title insurance form

Understanding the commitment for title insurance form requires a thorough examination of its components. The form typically includes several key sections, each serving its purpose within the title insurance process.

The first section provides general information about the transaction, including the names of the parties involved and property details. Schedule A outlines the coverage and policy type, along with the premium amount. Schedule B delineates exceptions to coverage and may list special requirements that must be fulfilled for policy issuance. Lastly, conditions and endorsements stipulate any additional provisions necessary for completing the timeline of ownership.

How to fill out the commitment for title insurance form

Filling out the commitment for title insurance form can seem complex, but breaking it down into manageable steps can simplify the process significantly. First, gather all necessary information regarding the property and the parties involved. Accurate data is critical to avoid issues later.

Begin by completing Section A of the form diligently. It is vital to ensure that the names of the involved parties are correct and that the property details match the legal documents. After completing Section A, review Schedule B thoroughly to note any exceptions that may affect coverage. Check for any required disclosures and ensure that the form is accurately completed before sending it off for review.

Common mistakes to avoid when completing the commitment for title insurance form

Completing the commitment for title insurance form requires attention to detail, and certain common mistakes can arise throughout the process. One significant error involves overlooking critical information, which can result in delays or even denials.

Another frequent issue is misunderstanding exceptions listed in Schedule B. Failing to comprehend these exceptions could lead buyers into prospective risks that could have been easily avoided. Lastly, inaccuracies with party names or contact information can cause significant complications, particularly when initiating communications with title companies and in the final stages of the insurance process.

Interaction with title companies

Engaging with title companies is a crucial aspect of processing the commitment for title insurance form. Begin by establishing contact through their customer service or support channels for a prompt review of your commitment. Maintaining open lines of communication will help clarify any concerns and ensure efficiency during the transaction process.

Expect responsiveness from title companies, especially if you submit your commitment form through digital platforms like pdfFiller. Prepare a list of recommended questions to ask your title company, ensuring you cover aspects such as timelines, potential obstacles, and any additional costs that may arise.

Real estate scenarios requiring a commitment for title insurance

The commitment for title insurance is a fundamental document in various real estate scenarios. One common situation is when individuals are buying a new home, as it helps safeguard their investment against unknown title issues. Similarly, refinancing an existing mortgage often necessitates a commitment to ensure all title services are current and clear.

Inheriting property also requires a commitment, as heirs need assurance that the property title is free of encumbrances that could threaten their legal rights. Moreover, purchasing investment properties involves additional scrutiny, making the commitment for title insurance form critical in ensuring that all potential risks are addressed and that the investment is protected.

Regional considerations and variances in commitment forms

When examining the commitment for title insurance form, it's vital to recognize that variances exist based on geographic regions. Each state may have specific requirements such as essential information and documentation that must be provided within the commitment form. Local laws significantly influence these requirements and can affect the fee structures associated with title transactions.

Understanding these regional considerations will enable buyers and professionals to navigate the title insurance landscape more effectively. Furthermore, international forms and standards, while not as prevalent in domestic transactions, can also vary significantly, requiring extra vigilance when dealing with overseas transactions.

Understanding terminology in title insurance commitment forms

Navigating the commitment for title insurance form necessitates a solid grasp of specific terminology related to title insurance. Terms such as 'lien,' 'encumbrance,' and 'endorsement' are common and can significantly impact the understanding of coverage outlined in the commitment. For instance, a 'lien' is a legal right or interest a lender has in the borrower's property, which must be cleared to ensure full ownership by the buyer.

Using these definitions accurately is pivotal during the transaction process, as they can aid in reducing confusion for buyers and professionals alike. Hence, it is prudent to familiarize oneself with these key terms for an unhindered experience throughout the commitment and insurance policy process.

Tools and resources for managing title insurance documents on pdfFiller

pdfFiller offers robust tools for document creation and management that simplify the process of handling the commitment for title insurance form. Users can easily create, edit, and customize their commitment forms, streamlining workflow significantly. The platform provides essential features like eSignature capabilities, which allow users to sign documents electronically, adding convenience to the process.

Additionally, pdfFiller's interactive tools aid collaborative efforts among teams working on multiple transactions simultaneously. The editing functionalities are efficient, enabling users to make quick modifications to PDFs, ensuring up-to-date information, accuracy, and compliance. This flexibility makes pdfFiller a valuable resource for those managing complex real estate transactions.

Case studies and examples

Real-life examples often provide clarity on the importance of the commitment for title insurance form. For instance, there is a case in which a first-time homebuyer overlooked crucial exceptions listed in Schedule B. This omission nearly led to the buyer facing a significant financial burden due to unrecognized easements affecting future renovations.

In another example, a savvy investor utilized the commitment to identify potential liens on an inherited property. By addressing these issues before purchase, the investor saved considerable resources. Such instance underscores the significance of the commitment as a critical component in the title insurance process, and it serves as a learning tool for future transactions.

Frequently asked questions

Common queries surrounding the commitment for title insurance form include questions about its validity timeframe, whether a commitment guarantees an insurance policy, and what steps to take if discrepancies are found in the commitment document. Addressing these inquiries is important for enhancing buyer understanding, ensuring they are well-equipped throughout their transaction process.

To clarify, a commitment is not a guarantee of a policy but rather a document outlining the conditions under which a policy will be issued. It is essential for buyers to thoroughly review their commitment document with their title company to clarify any confusing sections or terms, ensuring a smooth transaction experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify commitment for title insurance without leaving Google Drive?

How can I send commitment for title insurance to be eSigned by others?

How do I edit commitment for title insurance online?

What is commitment for title insurance?

Who is required to file commitment for title insurance?

How to fill out commitment for title insurance?

What is the purpose of commitment for title insurance?

What information must be reported on commitment for title insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.