Get the free Texas Form T-7 Commitment for Title Insurance

Get, Create, Make and Sign texas form t-7 commitment

How to edit texas form t-7 commitment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out texas form t-7 commitment

How to fill out texas form t-7 commitment

Who needs texas form t-7 commitment?

Texas Form T-7 Commitment Form: A Comprehensive Guide

Understanding the Texas Form T-7 Commitment Form

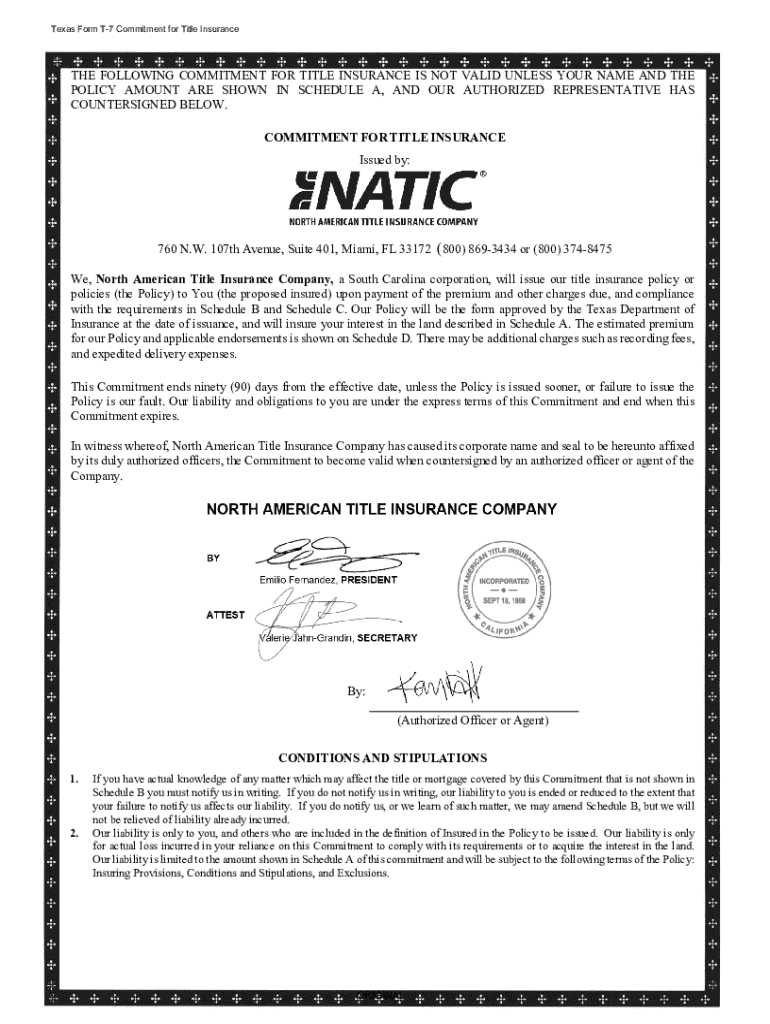

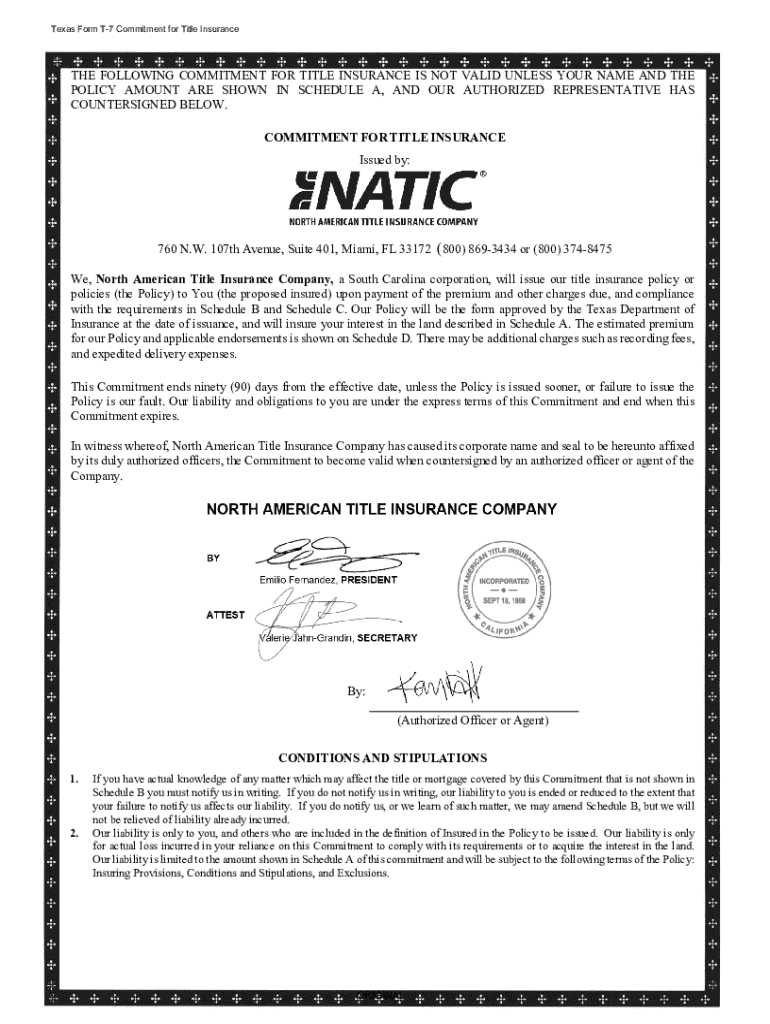

The Texas Form T-7 Commitment Form is a critical document used in real estate transactions across Texas. It serves as a commitment from a title insurance company to issue a title insurance policy, which protects buyers and lenders from potential title defects. The importance of the T-7 Commitment cannot be overstated; it is essential for safeguarding the interests of all parties involved in a property transaction, ensuring that the property is free from undisclosed claims or encumbrances.

Title insurance plays a key role in real estate transactions by providing financial protection against defects in title, thus making the Form T-7 vital. When buyers are purchasing property, the T-7 forms a part of the risk assessment process for lenders, affirming clear title before loans are issued.

Essential components of the Texas Form T-7 Commitment Form

The Texas Form T-7 comprises several key sections that outline vital information about the property and the parties involved. Each section must be filled with precise details to avoid complications in the future.

Who needs the T-7 Commitment Form?

Various stakeholders in real estate transactions require the Texas Form T-7 Commitment Form, ensuring comprehensive protection through title insurance. These include:

Filling out the Texas Form T-7 Commitment Form

Completing the Texas Form T-7 Commitment requires careful attention to detail. By following these step-by-step instructions, users can ensure accurate completion of the form:

Modifying and managing your T-7 Commitment Form

Managing the Texas Form T-7 Commitment effectively can be simplified using pdfFiller. This platform allows users to edit, collaborate on, and securely store their documents in the cloud.

Common FAQs about the Texas Form T-7 Commitment Form

Several common questions arise regarding the Texas Form T-7 Commitment, particularly around its processes and implications. Understanding these can help demystify title insurance for all parties involved.

Exploring related forms and resources

In addition to the T-7, other title insurance forms may be relevant depending on the specifics of your transaction. Understanding these can enhance your overall knowledge of title insurance in Texas.

The role of pdfFiller in streamlining document processes

pdfFiller is revolutionizing how users manage the Texas Form T-7 Commitment and other documents by providing a cloud-based platform that is accessible from anywhere, fostering flexibility in document management.

Troubleshooting common issues with the T-7 Commitment Form

While filling out and managing the Texas Form T-7 Commitment, users might encounter various issues. Addressing these promptly is crucial to avoid delays in real estate transactions.

Beyond the T-7: The bigger picture of title insurance in Texas

Understanding the Texas Form T-7 Commitment in the context of the broader title insurance landscape is essential for any real estate professional or stakeholder. Title insurance protects property owners and lenders against losses resulting from title defects, fraud, or liens.

The title insurance market in Texas has seen significant evolution, with increasing reliance on digital documentation and remote closing procedures. As technology continues to advance, it is likely that more efficient practices and enhanced security measures will emerge in this space, reinforcing the need for comprehensive understanding of forms such as the T-7.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the texas form t-7 commitment in Gmail?

How do I complete texas form t-7 commitment on an iOS device?

How do I fill out texas form t-7 commitment on an Android device?

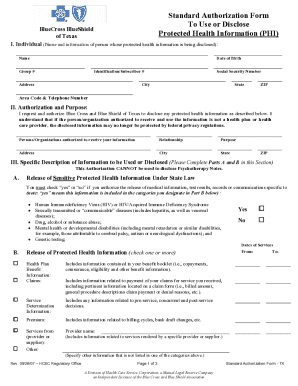

What is texas form t-7 commitment?

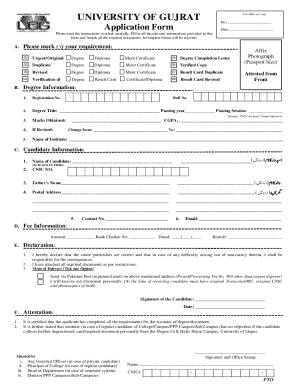

Who is required to file texas form t-7 commitment?

How to fill out texas form t-7 commitment?

What is the purpose of texas form t-7 commitment?

What information must be reported on texas form t-7 commitment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.