Get the free Boe-305-ah (p1)

Get, Create, Make and Sign boe-305-ah p1

Editing boe-305-ah p1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-305-ah p1

How to fill out boe-305-ah p1

Who needs boe-305-ah p1?

A Comprehensive Guide to the BOE-305-AH P1 Form for California Property Tax Assessments

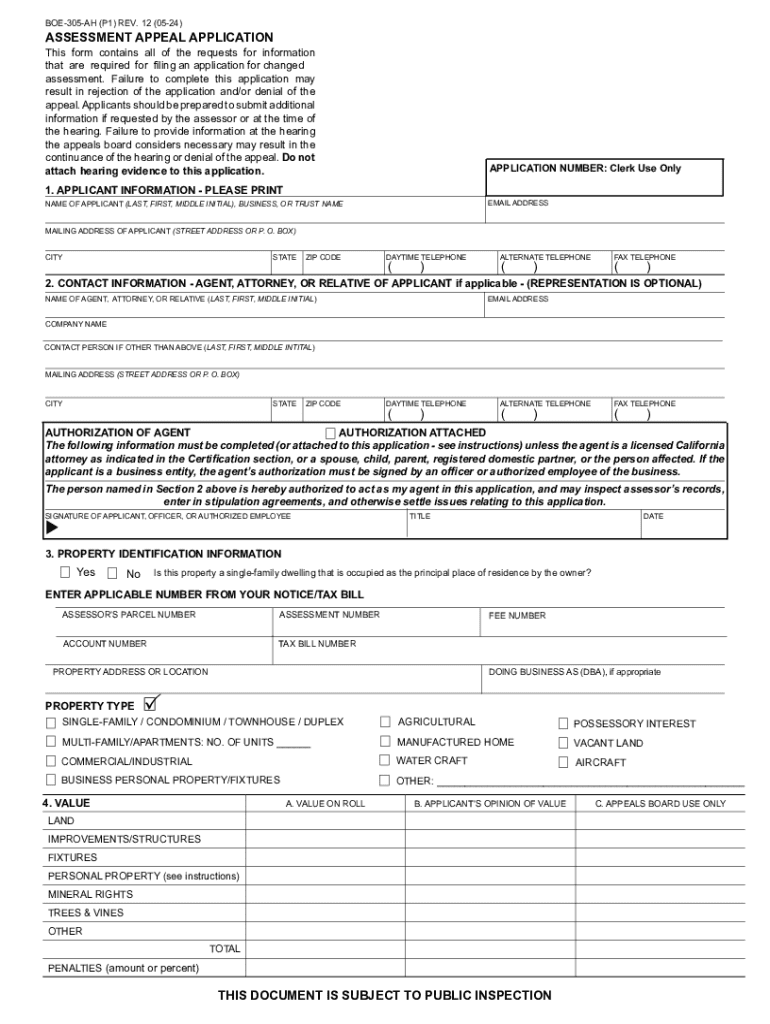

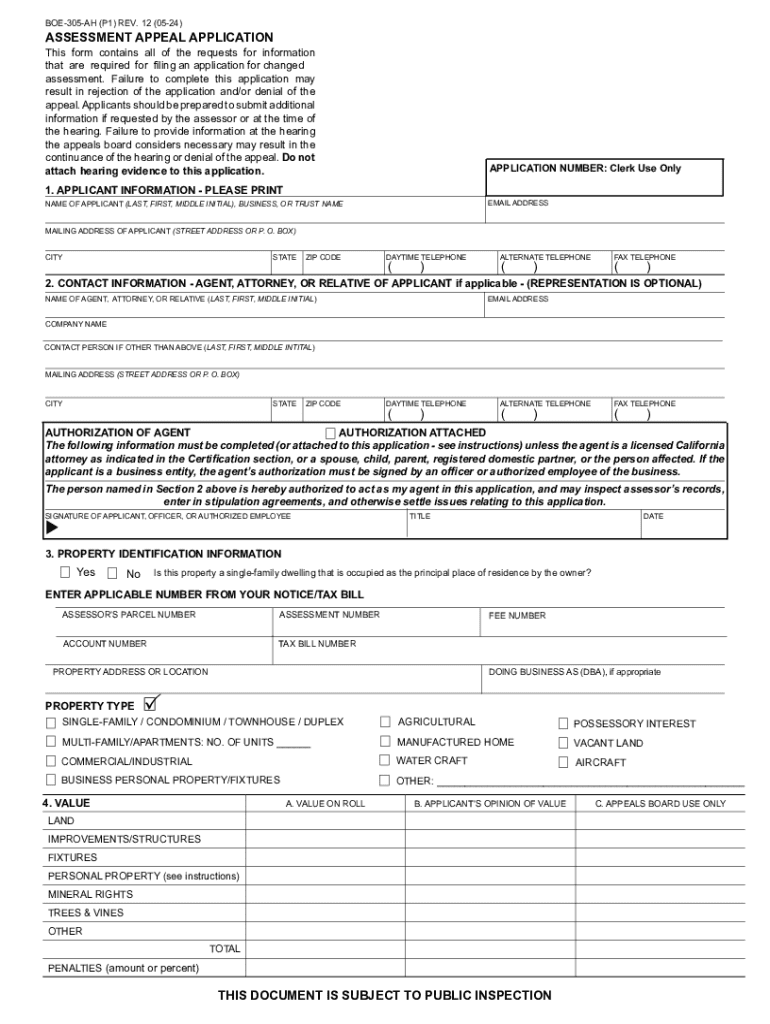

Understanding the BOE-305-AH P1 Form

The BOE-305-AH P1 Form is an essential document used in California to facilitate the process of property tax assessment appeals. This form allows property owners to appeal the assessed value of their property, which may have been inaccurately calculated or deemed higher than its actual market value. The form serves as a formal method for taxpayers to present their case to the Board of Equalization regarding property tax discrepancies.

Understanding the significance of the BOE-305-AH P1 Form is crucial for property owners, as an incorrect property assessment can lead to overpayment of taxes. This form ensures homeowners and property investors are afforded the opportunity to challenge those assessments through a structured process recognized by the state.

The BOE-305-AH P1 Form is specifically intended for property owners who believe their property has been overvalued. It is vital for individuals wanting to ensure they are assessed fairly according to current market conditions.

Who needs to use the BOE-305-AH P1 Form?

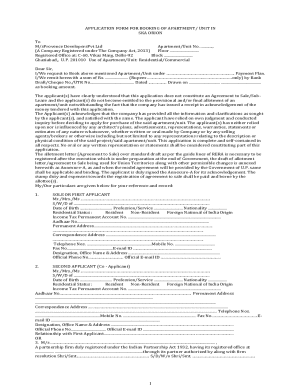

The primary audience for the BOE-305-AH P1 Form includes homeowners, commercial property owners, and real estate investors in California facing disputes over property tax assessments. Individuals who receive a notice of assessment indicating their property value has increased significantly, or those who believe the assessed value does not reflect the property’s true worth, are encouraged to utilize this form.

Common scenarios warranting the use of the BOE-305-AH P1 Form include instances where a property’s market value has dropped, improved local economic conditions, or notable changes in neighborhood property values affecting overall assessments. Essentially, anyone who feels their property’s tax valuation is unfair can benefit from using this form.

Key features of the BOE-305-AH P1 Form

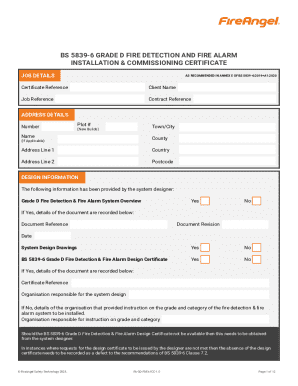

The structure of the BOE-305-AH P1 Form is specifically designed to facilitate the appeal process effectively. It contains several critical sections including the property owner’s contact information, property details, the current assessed value, and the requested value. The form also includes specific fields where appellants can justify their claims with evidence and supporting documentation, ensuring transparency in the assessment process.

It is important to be mindful of common mistakes when filling out the form. Errors such as incorrect property descriptions, incomplete information, or failure to attach necessary documentation can lead to delays or outright rejection of the appeal. Thoroughly reviewing the submitted form is vital to avoid these frequent pitfalls. Always ensure all fields are completed and accurately reflect the information required.

Step-by-step guide to filling out the BOE-305-AH P1 Form

To successfully complete the BOE-305-AH P1 Form, it’s essential to gather the necessary information beforehand. This includes your property tax bill, the most recent notice of assessment, and any comparative market analysis documents that support your appeal. Collecting these materials ahead of time can streamline the application process.

Next, begin filling out the form section by section. Start with your personal contact information and proceed to input detailed property information, including the property address, and the currently assessed value. When justifying your requested value, articulate clearly why you believe the assessed value should be lower and provide supportive evidence such as recent sales data or appraisals.

After completing each section, it's crucial to review your form thoroughly. Ensure every entry is accurate, check for typos, and verify that all required attachments are included. Increasing accuracy prior to submission can significantly affect the outcome of your appeal.

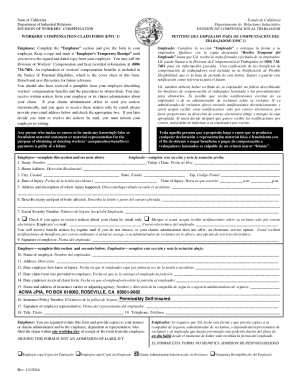

Submitting the BOE-305-AH P1 Form

The submission process for the BOE-305-AH P1 Form can be done in several ways — online, via mail, or in person at the local Board of Equalization office. Each method has its specific advantages. Electronic submissions are generally faster and offer confirmation receipts, while mailing in your application provides a tangible record.

Be mindful of submission deadlines, which vary based on individual circumstances. Typically, appeals must be filed within a specific time frame following the receipt of the assessment notice. Failing to adhere to these timelines can void your right to appeal, making prompt attention imperative.

Once submitted, you can expect a period of review from the assessing authority. This duration can vary, but officials usually inform you of their decision within a set timeframe. Being prepared for delays is part of the process, as each case is reviewed thoroughly.

Managing your completed BOE-305-AH P1 Form

Once you have submitted the BOE-305-AH P1 Form, it's wise to manage the documents related to your appeal meticulously. Storing both digital and physical copies can help maintain organized records. For individuals who prefer online management, utilizing cloud storage solutions like pdfFiller can streamline this process significantly.

pdfFiller not only offers document management but also enhances the submission process through its features. For instance, using pdfFiller, you can easily edit documents, eSign forms, and collaborate with teammates if needed. The benefits of utilizing digital platforms can't be overstated, as they can save you time and reduce the risk of losing essential documents.

Frequently asked questions (FAQs)

Many property owners have questions regarding the BOE-305-AH P1 Form. Some common topics include how long the review process takes, what happens if the appeal is denied, and whether they can change their appeal after submission. Most importantly, understanding the appeal procedures can provide clarity and alleviate concerns.

If you require additional assistance, contacting the Board of Equalization directly can offer valuable guidance. Their representatives are equipped to clarify details about filing appeals and addressing concerns specific to your situation.

Additional support and resources

For further information on the BOE-305-AH Form and related legislative guidelines, California's official resources offer comprehensive details. This encompasses not just the form but also broader tax assessment policies that govern property owners across the state. Furthermore, pdfFiller enhances the user experience by simplifying document creation and collaboration while providing easy access to templates such as the BOE-305-AH P1 Form.

Accessing these tools can empower users to navigate the complexities of property tax assessments more efficiently, ensuring that you are better positioned to advocate for fair property valuation and taxation.

User insights and testimonials

Real experiences from users indicate the BOE-305-AH P1 Form has been instrumental in successfully lowering property assessments. Testimonials reveal that many users found the form straightforward when utilizing resources like pdfFiller, which guided them through the submission process. With tools that clarify each step, users felt more empowered to advocate for the correct valuation of their properties.

Community forums often serve as valuable platforms for sharing tips and success stories related to the BOE-305-AH P1 Form. Engaging with others who have navigated similar experiences can offer insights into strategies for effectively advocating during an appeal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find boe-305-ah p1?

How do I fill out the boe-305-ah p1 form on my smartphone?

How do I edit boe-305-ah p1 on an Android device?

What is boe-305-ah p1?

Who is required to file boe-305-ah p1?

How to fill out boe-305-ah p1?

What is the purpose of boe-305-ah p1?

What information must be reported on boe-305-ah p1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.