Get the free Vic Tax Forum

Get, Create, Make and Sign vic tax forum

How to edit vic tax forum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vic tax forum

How to fill out vic tax forum

Who needs vic tax forum?

A Comprehensive Guide to the Tax Forum Form

Understanding the Tax Forum Form

The VIC Tax Forum Form is an essential document required for tax purposes in Victoria, Australia. It allows taxpayers to provide the necessary information to lodge their tax returns efficiently. This form captures individual or business-specific tax details needed for compliance with state and federal tax regulations.

Its importance cannot be overstated, as accurate submission helps taxpayers avoid penalties and ensures proper management of tax obligations. The form includes sections for reporting income, deductions, and credits, making it a comprehensive tool for both individuals and businesses.

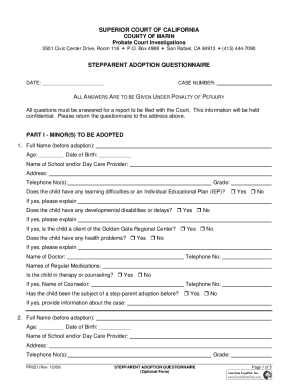

Who needs the Tax Forum Form?

Various parties need to utilize the VIC Tax Forum Form. Individuals, such as employees or entrepreneurs, often rely on this form to report their personal earnings and claim applicable deductions. Businesses and organizations, including sole traders and partnerships, must also fill out this form to meet their corporate tax obligations.

Moreover, tax professionals often assist clients in filling out this form accurately. Professionals like accountants and tax consultants are well-versed in tax laws and can provide valuable guidance on what to include. Thus, understanding who needs this form is pivotal for compliance.

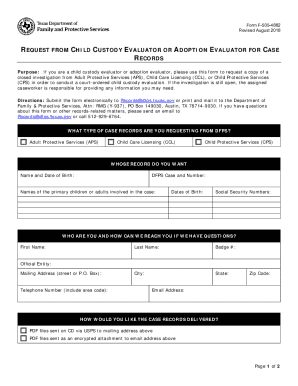

Preparing to fill out the Tax Forum Form

Preparation is key when filling out the VIC Tax Forum Form. Gathering the required documents ahead of time can significantly streamline the process. First, ensure you have your personal identification, such as your driver's license or passport. This will help verify your identity when submitting the form.

Next, collect any necessary financial statements that reflect your income and expenses. This may include pay stubs, bank statements, and receipts for deductible expenses. Understanding your tax obligations beforehand is also critical; this can include familiarizing yourself with the relevant tax rates and available credits. Addressing common taxpayer questions can help clarify any uncertainties you might face during the filing process.

Step-by-step guide to filling out the Tax Forum Form

Filling out the VIC Tax Forum Form can be a straightforward task if you follow a structured approach. Start with the personal information section, where you'll provide your name, address, and tax file number. Ensure that this information is accurate, as discrepancies could lead to delays.

Next, move onto the income details section. Report all sources of income, including wages, dividends, and business earnings. Understanding the distinction between ordinary income and capital gains will help you report correctly.

Editing the Tax Forum Form

Once you’ve finished filling out the VIC Tax Forum Form, editing is essential to ensure accuracy. pdfFiller provides powerful editing tools that allow you to revisit any section of the form. You can easily add notes, delete unneeded entries, or modify any inconsistencies.

Make sure your document adheres to the formatting requirements set forth by tax authorities. Compliance is crucial; therefore, ensure your form meets all legal stipulations before submission.

eSigning the Tax Forum Form

Incorporating electronic signatures (eSigning) adds a layer of convenience and security to submitting your VIC Tax Forum Form. The benefits include speed, enhanced security, and the ability to sign from any location. With pdfFiller, eSigning this document is as straightforward as clicking a button.

Tracking your document's status after sending for eSignature ensures you are aware of its progress. Knowing when your form has been signed and submitted can give you peace of mind.

Collaborating on the Tax Forum Form

Collaboration is vital, especially when multiple stakeholders are involved in filling out the VIC Tax Forum Form. pdfFiller allows users to share the form easily with others, enabling co-editing and real-time collaboration. This can be particularly relevant for businesses that need contributions from various departments or individuals.

Security features like password protection are essential when sharing sensitive documents, ensuring that only the intended recipients can access the information. Efficient collaboration results in a thorough and accurate submission.

Managing and storing the Tax Forum Form

Document management is crucial when dealing with multiple tax forms. pdfFiller helps users organize their VIC Tax Forum Forms efficiently. You can categorize your documents based on dates or relevance, allowing for easy retrieval when needed.

Implementing best practices for document management, such as filing forms immediately after submission can help you prevent any potential loss. Furthermore, accessing your forms from anywhere ensures you have the essential documents when you need them, irrespective of location.

Frequently asked questions about the Tax Forum Form

As users experience the VIC Tax Forum Form, several common queries arise. Frequently asked questions generally pertain to its purpose, necessary documentation for submission, and the timeline for processing. New users often seek clarification on how to start and what resources they can access during the process.

Technical support is also a main concern, as resolving issues during form completion is vital. Understanding these FAQs can help streamline the process, alleviating potential stress.

Upcoming changes in taxation relevant to the Tax Forum Form

As the tax landscape evolves, it's crucial to stay informed about changes that affect the VIC Tax Forum Form. Year-end tax updates from the government may introduce new deductions and credits, impacting how individuals and businesses complete their forms.

Additionally, upcoming legislative changes and revisions to current taxation laws may require adjustments in the information collected within the form. Keeping abreast of these changes is essential for accurate and compliant reporting.

External resources for further information

For those seeking additional support, various resources can provide more insight into the VIC Tax Forum Form. Government websites often offer detailed FAQs and guidelines for taxpayers, ensuring they have accurate and trustworthy information at their fingertips.

Taxation workshops and webinars hosted by experienced professionals are also quite beneficial, as they provide practical advice on navigating the complex world of taxation. Engaging with community forums can foster discussion around shared concerns and experiences with the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send vic tax forum to be eSigned by others?

Can I create an eSignature for the vic tax forum in Gmail?

Can I edit vic tax forum on an iOS device?

What is vic tax forum?

Who is required to file vic tax forum?

How to fill out vic tax forum?

What is the purpose of vic tax forum?

What information must be reported on vic tax forum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.