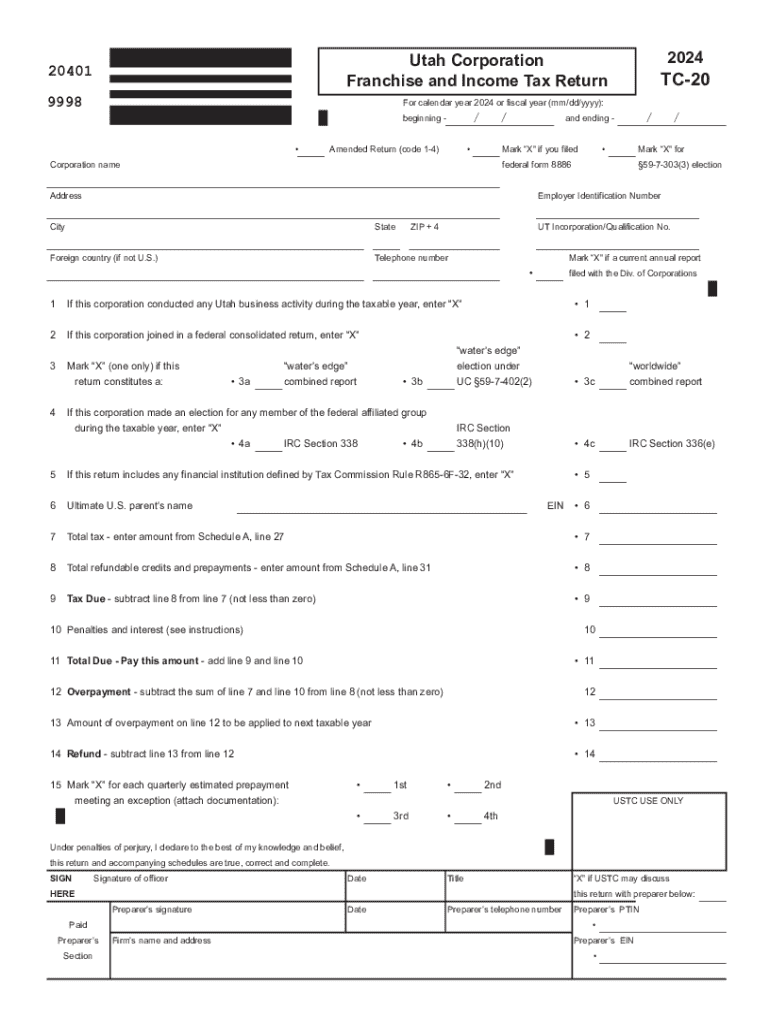

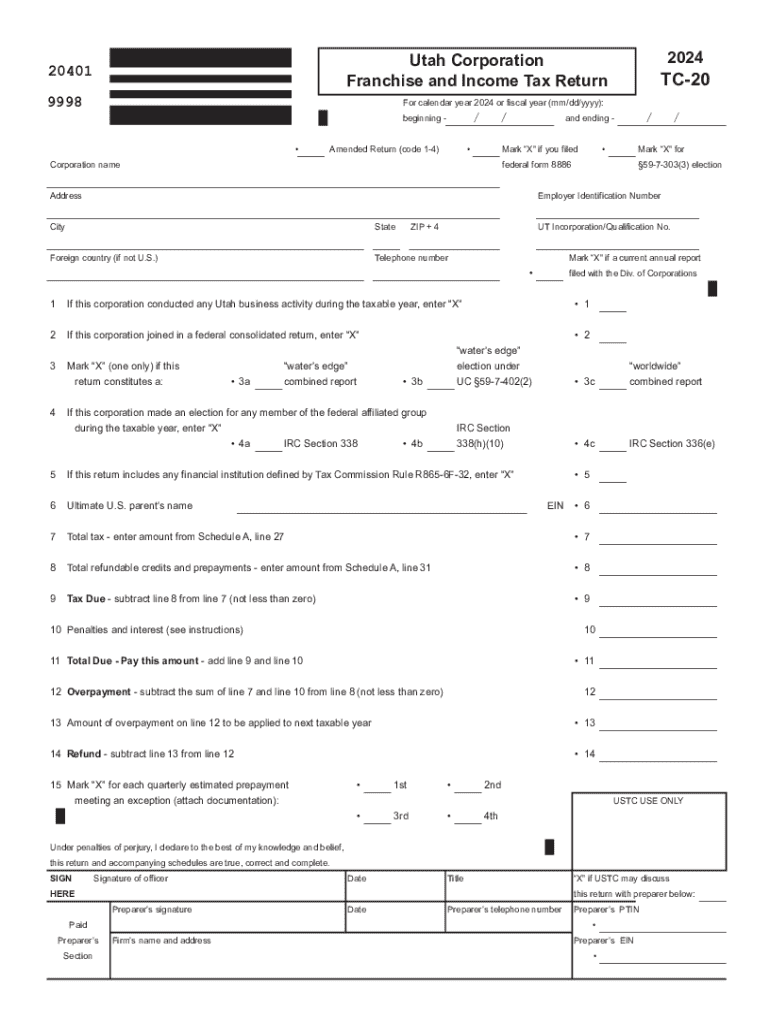

Get the free Utah Corporation Franchise and Income Tax Return

Get, Create, Make and Sign utah corporation franchise and

Editing utah corporation franchise and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah corporation franchise and

How to fill out utah corporation franchise and

Who needs utah corporation franchise and?

Navigating the Utah Corporation Franchise and Form: A Comprehensive Guide

Understanding Utah corporation franchise requirements

A Utah corporation franchise refers to the privilege granted to businesses operating in Utah to conduct business while adhering to state guidelines and regulations. This status is crucial for legitimacy and protection in commercial endeavors.

Compliance with Utah state regulations is not merely advisable; it is mandatory. Failing to adhere to these can result in severe penalties, including the potential dissolution of your corporation. Thus, understanding the importance of franchise taxes and state fees is critical.

Types of corporations in Utah

In Utah, businesses can take several forms, with the primary distinction being between domestic and foreign corporations. Domestic corporations are incorporated in Utah, while foreign corporations are established outside Utah but wish to conduct business within the state.

The registration process for these two types varies significantly. Domestic corporations need to file Articles of Incorporation with the Utah Secretary of State, while foreign corporations must submit a Certificate of Authority. Each comes with its own set of tax implications that business owners should thoroughly understand.

Step-by-step guide to forming a corporation in Utah

Choosing a suitable business name is the first pivotal step in forming a corporation in Utah. The name must be unique and not already in use by another registered entity in the state. A search on the Utah Secretary of State's website can provide insight into availability.

Following this, designating a registered agent is necessary. This agent can be an individual or a business entity with a physical address in Utah and must be available during business hours to receive service of process and official government correspondence.

The next step entails filing Articles of Incorporation, a critical document that legally establishes the corporation. This requires detailed information regarding the business name, purpose, registered agent, and details of the initial corporate directors, along with associated filing fees.

Managing ongoing compliance and filings

Once established, corporations in Utah must stay compliant with ongoing requirements. This typically includes the submission of annual reports, which detail the corporation's current status, as well as payment of franchise taxes. Ensuring timely filing is essential to avoid penalties or loss of good standing.

Changes in corporate structure, such as modifications to the Articles of Incorporation, must also be properly documented and submitted through the correct forms. This could involve adding new directors, modifying share structure, or changing the business name.

Utilizing pdfFiller for efficient document management

With pdfFiller, editing and managing your corporate documents can become a seamless process. Not only can users edit Articles of Incorporation directly, but the platform also offers eSigning capabilities that speed up approval processes.

Additionally, pdfFiller’s collaboration features allow teams to work together on forms, track changes, and provide comments. This fosters a transparent and efficient workflow, essential for corporate management.

Frequently asked questions (FAQs) about Utah corporation franchise and form

Common misconceptions about Utah corporation requirements often revolve around the idea that compliance is optional or merely a one-time task. In reality, maintaining compliance is an ongoing responsibility. Individuals may also be uncertain of the implications some changes may have on their filings, necessitating expert guidance for any modifications.

For those experiencing challenges during the filing process, resources are readily available for resolving issues, including consulting with a business attorney or seeking assistance from the Utah Secretary of State's office. These steps are crucial for maintaining a compliant corporation in Utah.

Additional considerations for business owners in Utah

Choosing the right business entity is crucial to meet your business goals. Analysis of the various structures, such as S-Corporations or C-Corporations, can lead to significant variations in taxation and operational flexibility, emphasizing the need for a thoughtful choice.

Utah offers numerous resources for business owners, including local government services that provide advice for new businesses, predominantly through the Utah Governor's Office of Economic Development. There are also valuable networking opportunities that can offer connections and insights essential for a thriving corporate environment.

Tools and resources for successful corporate management

To successfully manage corporate compliance, utilizing software specifically designed for tracking franchise taxes and submissions can make the process easier. Various applications exist that will remind you of important deadlines and help streamline the filing process.

Links to state websites will guide you to the most recent regulations and compliance updates, ensuring that your business remains well-informed. Additionally, many educational resources are available for deeper learning regarding corporate management, from webinars to workshops.

Success stories: Colorado corporations that thrived

Examining success stories from corporations that have thrived in Utah can provide invaluable lessons for new business owners. Companies that navigated the complexities of Utah's corporate landscape often share a common thread: Informed compliance and strategic management decisions were key to their growth.

These case studies highlight the importance of staying informed about changes in regulations and best practices in corporate governance, thus enabling business owners to make decisions that foster long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my utah corporation franchise and directly from Gmail?

How can I send utah corporation franchise and for eSignature?

Can I sign the utah corporation franchise and electronically in Chrome?

What is utah corporation franchise and?

Who is required to file utah corporation franchise and?

How to fill out utah corporation franchise and?

What is the purpose of utah corporation franchise and?

What information must be reported on utah corporation franchise and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.