Get the free Utah S Corporation Return

Get, Create, Make and Sign utah s corporation return

Editing utah s corporation return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah s corporation return

How to fill out utah s corporation return

Who needs utah s corporation return?

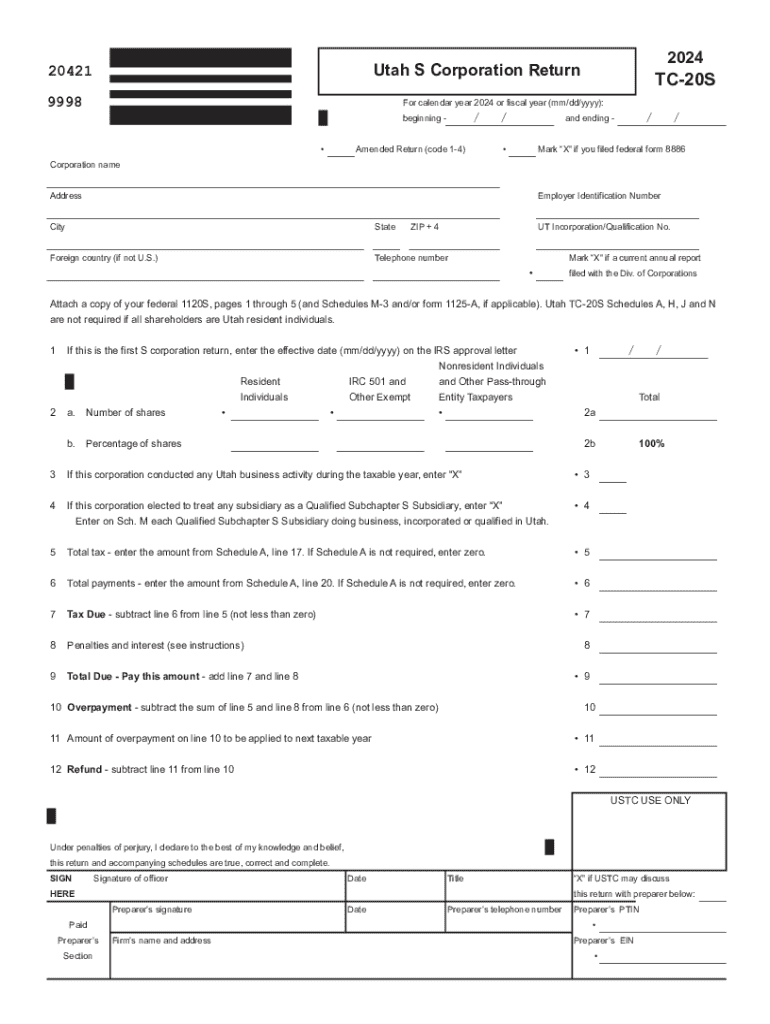

A comprehensive guide to the Utah S Corporation return form

Understanding the Utah S Corporation return form

The S Corporation classification allows specific businesses in Utah to enjoy a favorable tax status while maintaining the advantages of a corporation. An S Corporation, or S Corp, is a special type of corporation that allows profits to be passed through to shareholders to prevent double taxation on corporate income. This classification is essential for many Utah small businesses as it not only reduces the tax burden but also provides liability protection to owners.

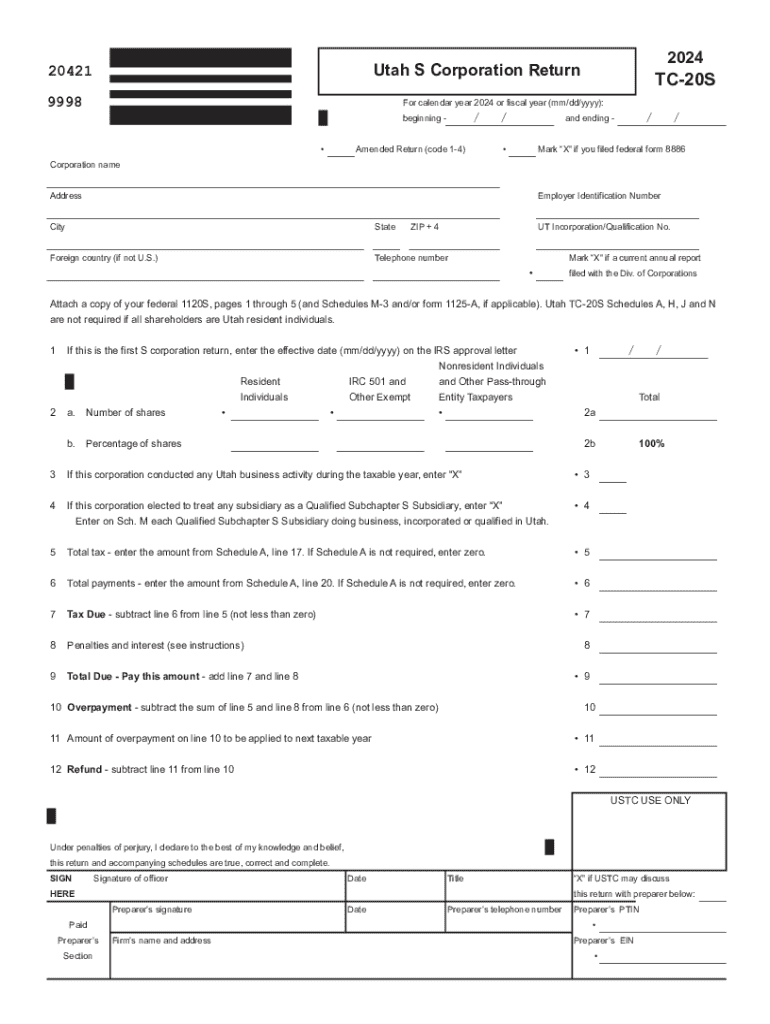

For businesses looking to file with the state of Utah as an S Corporation, they must use the TC-20S form. This particular return form ensures that S Corporations meet their tax obligations while allowing the business to maintain its unique tax advantages under Utah law.

Essential requirements for filing the Utah S Corporation return form

Filing the Utah S Corporation return form (TC-20S) requires a business to meet certain eligibility criteria. First, the business must operate as a corporation and have filed Form 2553 with the IRS to elect S Corporation status. Furthermore, eligibility for S Corporation status comes with strict ownership restrictions — specifically, it cannot have more than 100 shareholders, and all shareholders must be U.S. citizens or resident aliens.

When preparing to file, it's essential to have the necessary documentation in order. This includes the articles of incorporation, the S Corporation election form (Form 2553), and various financial documents that substantiate income, deductions, and credits. Proper organization of these documents is critical in ensuring a smooth filing process.

Step-by-step guide to completing the Utah S Corporation return form

Completing the Utah S Corporation return form involves several detailed steps. Start by gathering the necessary information. This will include identifying all business details and shareholders. Ensure you have comprehensive financial records available, including your income, deductions, and credits.

Next, move on to filling out the TC-20S form itself. Each section has specific requirements, some of which can be tricky. Be diligent in your entries to avoid common pitfalls, such as incorrect figures or incomplete information. For example, accurately reporting all income sources can save you from future audit issues.

Before submitting, undertake a thorough review of the form. Check for accuracy in your filings—simple mistakes can lead to significant penalties. Involving a knowledgeable third party, such as a tax professional, can further enhance your oversight and increase the chances that your submission will be accepted on the first attempt.

Finally, submit the form electronically or by paper, keeping the tax filing deadlines in mind. In Utah, the state filing deadline closely mirrors that of federal tax returns. Ensure you also plan for any payments required to accompany your return.

Common questions and FAQs on S Corporation return filing in Utah

Understanding the nuances of S Corporation filing can lead to various questions and concerns. One common issue is the penalties for late filing. Delayed submissions can incur penalties based on the amount of tax owed, underlining the importance of meeting deadlines. If you discover errors after submitting, you can amend your S Corporation return; however, specific procedures must be followed to do so.

Many new S Corp owners also show confusion regarding their liabilities and potential tax benefits. It’s pivotal to clarify that while S Corporations provide certain tax advantages, they do not entirely shield owners from personal liability if the business faces legal challenges.

Tools and resources for managing your Utah S Corporation return form

To simplify the completion and management of the Utah S Corporation return form, utilizing interactive online tools can significantly enhance the process. Platforms like pdfFiller provide features that allow users to edit PDFs directly, enable e-signatures, and collaborate in real-time with team members, reducing the potential for errors.

With pdfFiller, users can access templates and track past submissions efficiently. This kind of document management not only saves time but also helps ensure compliance with tax requirements by keeping all documentation organized and accessible.

Importance of regular compliance with Utah tax laws

For S Corporations in Utah, maintaining compliance with state tax laws is not just a one-off task; it’s an ongoing responsibility. Regular review and understanding of current tax regulations can have significant implications for your business operations. Keeping abreast of any tax law changes ensures that your corporation remains in good standing and avoids any compliance-related penalties.

Utilizing tools such as pdfFiller’s document management system can help businesses stay organized and compliant. Regularly updated records, streamlined filing processes, and adherence to deadlines create a stable environment for your S Corporation to flourish.

Additional considerations for S Corporations in Utah

When considering the future of your S Corporation in Utah, it’s essential to also explore available tax credits and unique benefits that may be applicable. Furthermore, understanding how S Corporations compare with other business entity types can aid in making informed decisions regarding tax implications, especially when contemplating business expansion or restructuring.

Proper planning and staying informed about state-specific advantages can allow for tactical growth and adaptation in your business strategy, all while maximizing benefits under the S Corporation classification.

Conclusion: Streamlining your filing process with pdfFiller

Navigating the intricacies of the Utah S Corporation return form may seem daunting, but leveraging pdfFiller's extensive suite of document services can significantly streamline the process. With capabilities for easy editing, e-signing, and collaboration, pdfFiller empowers users to enhance the efficiency and accuracy of tax filings.

Leveraging this comprehensive platform not only aids in completing the TC-20S form but also enhances overall business documentation management, allowing for a more systematic approach to compliance and operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my utah s corporation return directly from Gmail?

How do I execute utah s corporation return online?

How do I complete utah s corporation return on an Android device?

What is utah s corporation return?

Who is required to file utah s corporation return?

How to fill out utah s corporation return?

What is the purpose of utah s corporation return?

What information must be reported on utah s corporation return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.