Get the free Form Fwp

Get, Create, Make and Sign form fwp

Editing form fwp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form fwp

How to fill out form fwp

Who needs form fwp?

Form FWP Form: A Comprehensive Guide to Free Writing Prospectus Completion

Understanding the FWP Form

A Free Writing Prospectus (FWP) serves as a vital communication tool in the securities industry, primarily utilized for the purpose of providing investors with key financial information while minimizing liability risks for issuers. Unlike traditional prospectuses, FWPs allow companies to present their securities offerings in a more flexible and accessible format. They are particularly useful for conveying marketing materials that can attract potential investors without being tied to strict regulatory language.

The importance of the FWP in the context of securities regulation cannot be understated. It plays a crucial role in ensuring transparency and informed decision-making among investors, while simultaneously adhering to guidelines set forth by regulatory authorities like the Securities and Exchange Commission (SEC).

When is an FWP required?

An FWP is typically required when a company is conducting a securities offering and aims to provide investors with updated information not contained within the formal prospectus. Conditions under which an FWP can be utilized include situations where an issuer wishes to communicate information about a new offering or when they want to present marketing materials associated with a securities registration.

Key components of the FWP form

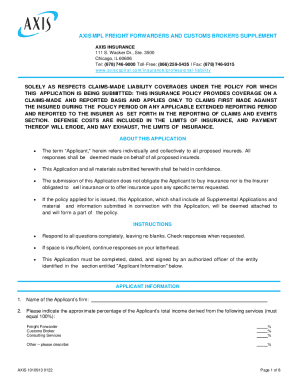

When preparing an FWP, it’s crucial to include essential information that accurately describes the offering. Required data points typically encompass detailed company information, a comprehensive description of the securities being offered, and an overview of the associated financial risks. This level of detail not only meets regulatory mandates but also reassures potential investors about the viability of the investment.

When it comes to formatting the FWP, clarity is key. The layout should be structured logically to facilitate easy navigation, making it simple for potential investors to locate relevant details. Moreover, legal language considerations must be upheld to ensure compliance, which requires incorporating standardized disclaimers and risk language deemed necessary by regulatory agencies.

Step-by-step guide to completing the FWP form

Step 1: Gather necessary documentation and information

Before filling out the FWP form, it is essential to gather all necessary documentation and information that will support the content of the form. This includes financial statements, previous offering documents, and any marketing materials that may help articulate the investment strategy. Ensuring accuracy in these details not only fosters trust with potential investors but also mitigates the risk of legal complications.

Step 2: Fill out the FWP form

Now that all documentation is gathered, the next step is to fill out the FWP form meticulously. Each section, from company details to risk factors, must be completed with care. Be sure to pay keen attention to common pitfalls such as underreporting risk factors or failing to update older financial data.

Step 3: Review and edit your FWP

The importance of a thorough review cannot be overstated. Once the form is completed, revisiting it for clarity, accuracy, and compliance is crucial. Utilizing tools offered by pdfFiller can significantly streamline the editing process, allowing you to modify text, swap out data, and ensure that all necessary elements are present before finalizing your submission.

Step 4: Finalize and file your FWP

After editing your FWP, the final step is to file it. Options for submission typically include electronic filings via the SEC's EDGAR system or mailing physical copies to the appropriate regulatory body. Be mindful of deadlines and critical dates to ensure compliance and avoid unnecessary delays in your offering process.

Tools and resources for managing FWPs

Using pdfFiller for FWP management

pdfFiller offers a comprehensive suite of document management features that can streamline the FWP process. Whether you’re drafting, editing, or signing your FWP, pdfFiller provides a user-friendly interface that allows you to manage documents from a single, cloud-based platform. Users can easily incorporate e-signatures and collaborate with team members in real-time, ensuring an efficient process that keeps everyone informed.

Interactive tools to simplify FWP creation

Additionally, pdfFiller offers various templates that can assist in the creation of your FWP. These templates can be customized to meet your specific needs, allowing you to modify sections as necessary while preserving essential formatting. Leveraging these interactive tools simplifies the process, making it accessible for individuals and teams alike.

FAQs related to the FWP form

Common questions about the FWP process

Understanding the FWP process can generate numerous questions among potential filers. Some common inquiries include the distinction between an FWP and a traditional prospectus, the timeframe for FWP preparation, and specific criteria for risk disclosure. Addressing these questions upfront not only clarifies the process but also enhances user confidence in filing.

Troubleshooting common issues

Filing an FWP may bring up unforeseen issues, such as missing information or questions about regulatory compliance. Having troubleshooting resources handy, including guides provided by industry experts or FAQs offered by regulatory agencies, ensures that you can navigate these issues effectively. Consideration of financial advisors or consultants may also equip you with the necessary expertise to resolve complex questions.

Additional considerations when filing an FWP

Implications of filing an FWP

Filing an FWP carries significant implications from a regulatory standpoint. Companies must understand their responsibilities to provide complete, accurate, and timely information to potential investors. The ramifications of misinformation can be financial, legal, and reputational, making it crucial to adhere to the stringent regulations set forth by the SEC.

Future trends in FWP regulations

As financial markets evolve, so too do the regulations surrounding FWPs. Keeping abreast of changes in regulatory frameworks and understanding how these modifications may impact your compliance strategy will benefit both issuers and investors. Engaging with industry associations or subscribing to professional updates can provide valuable insights into prospective trends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form fwp on a smartphone?

How do I complete form fwp on an iOS device?

How do I fill out form fwp on an Android device?

What is form fwp?

Who is required to file form fwp?

How to fill out form fwp?

What is the purpose of form fwp?

What information must be reported on form fwp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.