Get the free Ultimate Beneficial Owner (ubo) and Directors Certified Attestation

Get, Create, Make and Sign ultimate beneficial owner ubo

How to edit ultimate beneficial owner ubo online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ultimate beneficial owner ubo

How to fill out ultimate beneficial owner ubo

Who needs ultimate beneficial owner ubo?

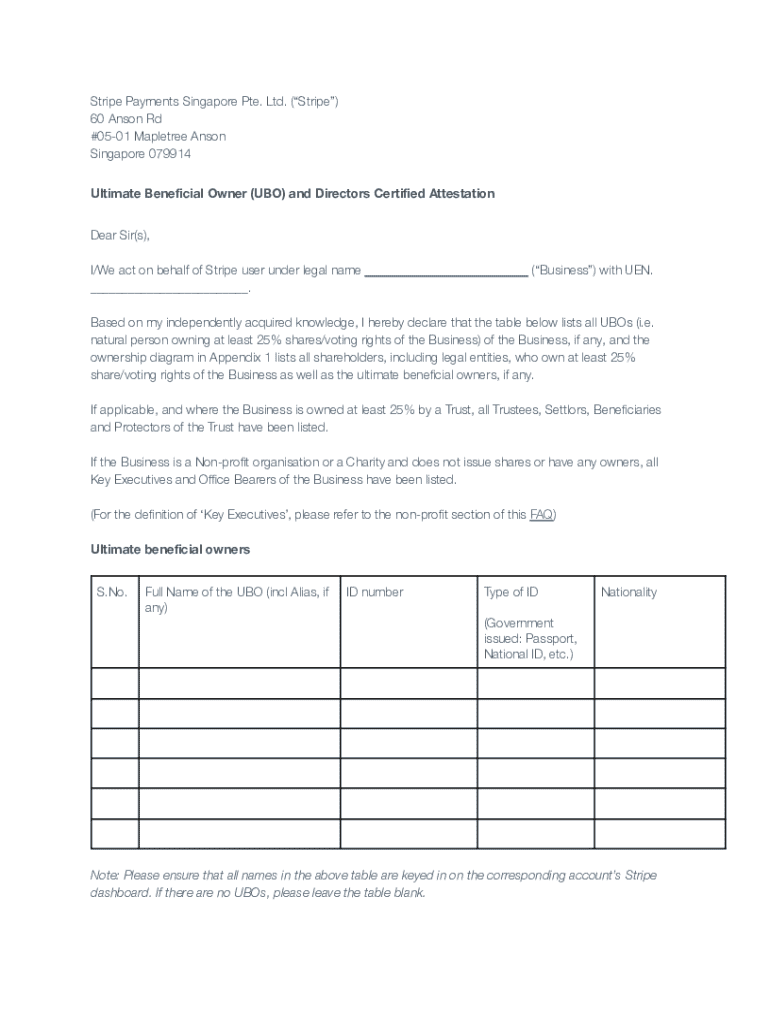

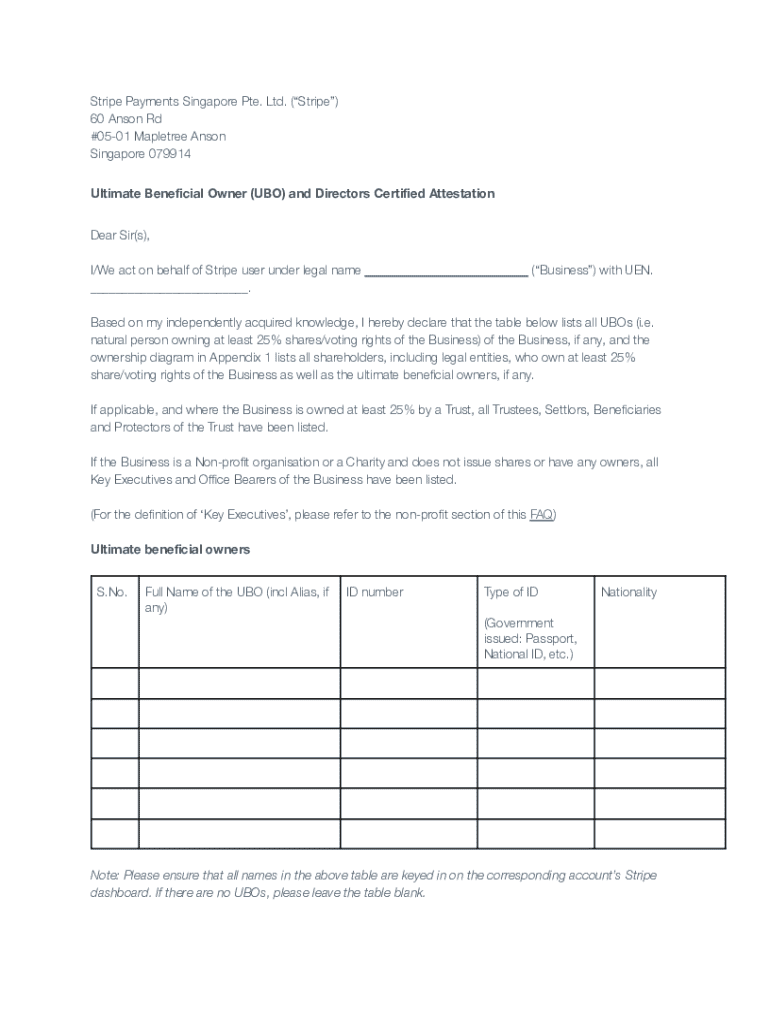

Understanding the Ultimate Beneficial Owner (UBO) Form

Understanding the ultimate beneficial owner (UBO) form

The ultimate beneficial owner (UBO) refers to the individual or entity that ultimately owns or controls a company, even if their name does not appear on the legal documents. Identifying UBOs is crucial for transparency in business operations and is a key aspect of compliance with anti-money laundering (AML) regulations and tax evasion prevention.

The UBO form is a standardized document used to declare the identities of the beneficial owners in business structures. This form is significant as it helps regulatory authorities and financial institutions to trace the origins of assets and fund flows, protecting the integrity of the financial system.

The role of UBO legislation

UBO legislation refers to laws and regulations aiming to ensure transparency about the ownership and control of companies. These laws vary significantly by jurisdiction, often influenced by regional economic conditions and compliance traditions.

Numerous global regulations, such as the Financial Action Task Force (FATF) guidelines and the EU's Anti-Money Laundering Directive, have shaped UBO legislation. Countries such as the UK and the US have their unique requirements, often focusing on different facets of ownership declaration.

Components of the UBO form

The UBO form consists of several critical components that help in the accurate declaration of beneficial ownership. The essential sections include personal details of the beneficial owner, the ownership structure of the entity, and a section for compliance verification.

Typically, to complete the UBO form, several documents are required. This can include proof of identity, proof of address, and possibly even documents showcasing the ownership structure of the business.

The process of identifying a beneficial owner

Identifying a beneficial owner requires a systematic approach that includes analyzing corporate structures and staking ownership interests. The process can be broken down into three main steps that ensure thorough and actionable results.

Firstly, analyze corporate structures to identify layers of ownership that could obscure the ultimate beneficial owner. Secondly, investigate ownership stakes from public records or other documented evidence. Finally, conducting due diligence on not only entities but also individuals promises a comprehensive understanding of the ownership hierarchies.

Why UBO checks are essential

Conducting UBO checks is vital for businesses to mitigate risks associated with non-compliance. The legal ramifications can be severe, including fines, sanctions, or even loss of the right to operate. Furthermore, failing to identify UBOs can lead to reputational damage, loss of customer trust, and impaired business relationships.

On the flip side, thorough UBO checks enhance corporate transparency, which fosters confidence among investors and stakeholders. Knowing your customer (KYC) principles hinge upon the clarity of beneficial ownership to prevent illicit activities and promote ethical business practices.

Benefits of accessing beneficial ownership information

Leverage gained from UBO disclosures extends beyond compliance; these insights can unveil trends and patterns that businesses can use for strategic decisions. Through transparency, businesses gain trust in the financial ecosystem, which is essential for attracting investments and collaborations.

Moreover, accessing beneficial ownership information supports regulatory compliance, ensuring that businesses operate within legal frameworks. The ability to analyze ownership data arms companies with critical business intelligence that aids operational efficiency.

How pdfFiller simplifies UBO form management

pdfFiller provides an array of features that streamline UBO form management. Users can edit and customize UBO forms easily, allowing for quick updates as ownership structures evolve.

With eSigning capabilities, the platform enhances the speed of processing forms while ensuring that all submissions are secure and legally binding. Collaborative tools foster teamwork, enabling different departments to contribute to form completion efficiently.

Common challenges in the UBO form process

The UBO form process isn’t without its hurdles. Navigating complicated ownership structures can be daunting, particularly when multiple layers exist or when private entities are involved. Addressing privacy concerns and ensuring compliance with regulations that shift frequently presents another layer of complexity.

In response to these challenges, best practices such as using clear diagrams for ownership structures can enhance understanding, and staying current with regulatory updates can mitigate risks effectively.

Future trends in UBO reporting

The landscape of UBO regulations is evolving rapidly, with increased focus on transparency globally. Technological advancements are paving the way for more efficient tracking and reporting of beneficial ownership.

As businesses harness data analytics and digital tools, predictions for UBO compliance suggest a shift towards automation for greater efficiency and enhanced accuracy in reporting processes.

Interactive resources and tools

To aid in the completion of the UBO form, a variety of tools and resources are available. Options include online wizards for form completion, FAQs specifically addressing common queries, and expert tips for ensuring successful submissions. These resources provide valuable support, making the process user-friendly and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ultimate beneficial owner ubo in Chrome?

Can I create an eSignature for the ultimate beneficial owner ubo in Gmail?

How do I fill out ultimate beneficial owner ubo using my mobile device?

What is ultimate beneficial owner ubo?

Who is required to file ultimate beneficial owner ubo?

How to fill out ultimate beneficial owner ubo?

What is the purpose of ultimate beneficial owner ubo?

What information must be reported on ultimate beneficial owner ubo?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.