Get the free Trade in Goods: Mexico: Total: Exports: BOP: CP: SA - abmec org

Get, Create, Make and Sign trade in goods mexico

Editing trade in goods mexico online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trade in goods mexico

How to fill out trade in goods mexico

Who needs trade in goods mexico?

Trade in Goods Mexico Form: Your Comprehensive Guide

Understanding trade regulations with Mexico

International trade laws dictate how goods can be exchanged between countries, and understanding these regulations is crucial when conducting trade with Mexico. Compliance with these laws not only fosters smoother transactions but also minimizes the risk of costly penalties or delays. For U.S. importers and exporters, ensuring adherence to these regulations is vital to maintain favorable relationships and avoid disruptions in the shipment process.

The U.S. and Mexico share a robust trading partnership, making it essential for importers to understand the key players in this relationship. Agencies such as the U.S. Customs and Border Protection (CBP), as well as various Mexican authorities, must be considered when navigating cross-border shipments. Recognizing the roles of these entities is invaluable to ensure compliance and efficiency in the trading process.

The significance of proper documentation

Proper documentation is the backbone of international trade. Failure to provide the correct documents can lead to severe consequences, including fines, delayed shipments, and potential loss of goods. Each document serves a specific purpose and contributes to the overall timeline of the shipment process. For instance, missing or inaccurate paperwork can halt the entire shipment until the issues are resolved, causing frustration for all parties involved.

Documentation directly influences trade timelines and costs. For businesses, understanding which forms are required and the information needed on each can prevent unnecessary delays and financial losses. Essential documents required for trade in goods may include commercial invoices, bills of lading, and certificates of origin, all of which play a crucial role in smooth customs clearance and compliance verification.

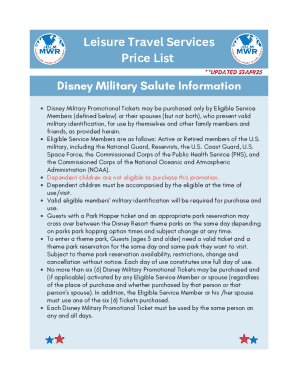

Simplified process for filing the Mexico trade-in-goods form

Filing the Mexico trade-in-goods form doesn't have to be overwhelming. By following a systematic approach, importers can ensure successful submissions. Begin by locating the trade-in-goods form online through the official government website. This form is typically available for direct download. Be sure to check for the latest version to adhere to the most current regulations.

Next, familiarize yourself with the required fields and supporting documentation needed to complete the form accurately. Consider creating a checklist to prevent omissions. After filling out the form, utilize digital tools to save and edit it efficiently, making necessary adjustments as needed. When ready, submit the form electronically, understanding that you may receive a confirmation when the form is processed.

To avoid errors in your submission, double-check all information for accuracy, ensure all fields are completed, and validate that supporting documents are attached. This diligence will streamline the process and prevent potential holdups.

Key documents for U.S. – Mexico shipments

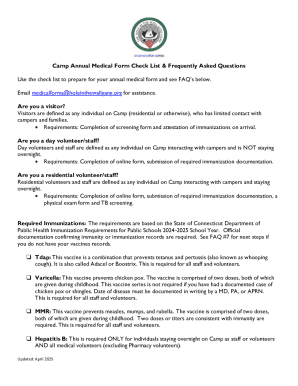

For successful trade between the United States and Mexico, specific documents are necessary to facilitate customs clearance and regulatory compliance. Essential documents include a commercial invoice, a bill of lading, and a certificate of origin. Each of these documents has a unique purpose that plays a crucial role in the trade process.

A commercial invoice details the transaction, including item descriptions, quantities, and prices, serving as the primary document for customs valuation. The bill of lading acts as a receipt for the shipment, providing evidence of the carrier's terms and ownership transfer of goods. The certificate of origin certifies the origin of goods, which can be important due to various tariffs and preferences under trade agreements. Ensuring that these documents are accurate and complete is essential for smooth operations.

Best practices for trade compliance

To ensure ongoing compliance with trade regulations, businesses must actively monitor changes in laws affecting import/export activities. Keeping abreast of updates from Mexican and U.S. government organizations is essential for maintaining robust compliance. Engaging with sector registries or trade associations can also provide insightful information on pertinent changes in legislation.

Conducting regular audits and documentation checks can uncover inefficiencies or inaccuracies before they become problematic. Integrating technology into documentation processes enhances accuracy and efficiency. Tools like pdfFiller simplify the management and organization of trade documents, ensuring that you always have access to the most up-to-date versions while minimizing human error through streamlined workflows.

Handling common challenges in trade documentation

Despite careful planning, challenges in trade documentation can arise. Identifying potential roadblocks, such as incomplete forms or discrepancies in information, is crucial for preemptive action. Maintaining a checklist can be beneficial in minimizing these issues. Active communication with customs officials becomes critical during such situations; clarity and responsiveness are key to resolving document disputes swiftly.

When discrepancies occur, provide clear documentation supporting your case. This clarity helps facilitate faster resolutions and builds credibility with customs officials. Additionally, establishing good relationships with customs representatives can ease future communications and may assist in navigating complex situations more efficiently.

Utilizing pdfFiller for document management

pdfFiller significantly enhances the trade documentation process by offering a user-friendly platform for editing, eSigning, and managing documents. This technology ensures that users can easily input necessary information into forms like the trade-in-goods form, with seamless editing capabilities available for updates or corrections. Security features maintain confidentiality and integrity as documents are shared among team members.

The collaborative tools offered by pdfFiller allow teams to work together efficiently, ensuring everyone has access to essential documentation without the risk associated with traditional, physical paperwork. This digital approach accommodates remote workflows, making it easy for users to manage their documents from anywhere while maintaining compliance across borders.

Common questions and misconceptions about trade forms

Many individuals have questions about the trade-in-goods form and the associated processes. One commonly asked question regards the required time for form processing, which can vary based on the complexity of the shipment and the accuracy of the documentation submitted. Understanding the requirements and processes can mitigate delays and prevent confusion.

There are also misconceptions surrounding what constitutes 'proper documentation.' Some believe that minimal information suffices, whereas comprehensive details are essential for compliance. Misconceptions about the necessity of each document can lead to non-compliance; therefore, clear guidelines should be established to align expectations with regulations.

The future of trade documentation

The trend toward digitalization in trade documentation is reshaping the landscape of international trade. As businesses increasingly adopt digital tools, processes will become more streamlined, allowing for faster turnaround times and enhanced compliance. Furthermore, technology's role in simplifying document management cannot be overstated — automated solutions will reduce human error and improve overall efficiency in the filing and submission of trade forms.

In the future, we can expect to see further integration of systems designed to manage the entire trade process digitally. With ongoing advancements, businesses will have enhanced capabilities to track shipments, manage documentation in real-time, and ensure compliance with changing regulations seamlessly.

User testimonials: Experience with pdfFiller

Numerous users have shared their success stories about utilizing pdfFiller for their trade forms. Notably, users have reported significant time savings in document creation and submission processes. By leveraging pdfFiller's various features, they have streamlined their workflows, enabling them to focus on expanding their business rather than being bogged down by paperwork.

For example, a user in the textile sector experienced reduced turnaround time for their shipments, allowing them to enhance customer satisfaction and fulfill orders promptly. This efficiency not only translated into better operational capabilities but also increased profitability by reducing unnecessary costs associated with delayed shipments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find trade in goods mexico?

How can I edit trade in goods mexico on a smartphone?

How do I complete trade in goods mexico on an iOS device?

What is trade in goods mexico?

Who is required to file trade in goods mexico?

How to fill out trade in goods mexico?

What is the purpose of trade in goods mexico?

What information must be reported on trade in goods mexico?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.