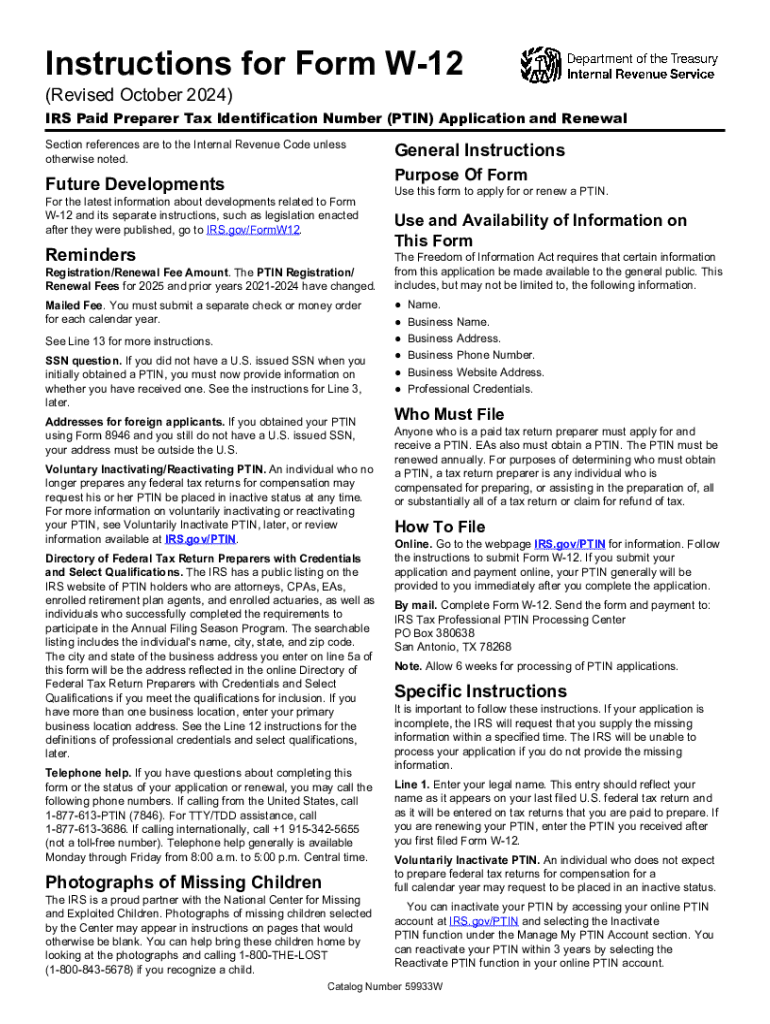

Get the free Form W-12

Get, Create, Make and Sign form w-12

Editing form w-12 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-12

How to fill out form w-12

Who needs form w-12?

How to Fill Out Form W-12 | pdfFiller

Understanding IRS Form W-12

Form W-12 is an essential document utilized by taxpayers to apply for an Individual Taxpayer Identification Number (ITIN) with the Internal Revenue Service (IRS). It serves as a critical tool for foreign nationals and other individuals who do not qualify for a Social Security Number (SSN) yet need to file a tax return or fulfill tax obligations in the United States.

The primary purpose of Form W-12 is to provide the IRS with necessary identification information that enables a taxpayer to comply with U.S. federal income tax laws. This is particularly important for individuals who earn income but do not hold an SSN.

Form W-12 is typically used by various demographics, including foreign students, non-resident aliens, and dependents of U.S. citizens or residents. Tax preparers often assist clients with completing this form to ensure compliance and accuracy.

Step-By-Step Guide to Completing Form W-12

Filling out Form W-12 requires attention to detail and an understanding of each section. This section will provide a comprehensive guide on how to accurately complete the form, ensuring you provide all necessary information.

Section 1: Personal Information

In the first section, you will need to provide personal information, which includes your name, current address, and date of birth. The IRS requires this information to verify your identity and determine your eligibility for the ITIN.

Specifically, you need to ensure the following details are correct:

Social Security Number (SSN)

Next, if you have an SSN, you must enter it in this section; if you do not, you will mark the box indicating you do not possess one. This is crucial as the IRS uses this number to track tax records and compliance.

Section 2: Reason for Application

In this section, you will select the reason for your application. Understanding the categories offered is essential to ensure you choose the correct one, as this can affect your application status and processing time.

Section 3: Signature and Date

The final section of the form requires your signature, which is a declaration that the information provided is accurate and complete. An unsigned form may delay the processing of your application.

Electronic signatures are accepted via pdfFiller, making it easy to sign and submit your Form W-12 securely without the hassle of printing or scanning paperwork.

Filing considerations for IRS Form W-12

Once Form W-12 is filled out correctly, it’s time to focus on how to submit it to the IRS. Understanding the submission methods available can help you avoid delays and complications.

Submission methods

There are two primary methods for submitting your Form W-12: online through the IRS portal or by mailing in a physical copy.

Deadlines to keep in mind

Filing deadlines for Form W-12 can vary depending on your individual circumstances, such as your eligibility for tax credits and refunds. Generally, it’s advisable to file as early as possible, ideally before the tax filing deadline in April.

Keeping track of key dates will help avoid any last-minute rush and ensure you have ample time to gather any necessary documentation.

Interactive tools for Form W-12

pdfFiller enhances your Form W-12 experience by offering various interactive tools designed to simplify the completion and management of the document.

Utilizing pdfFiller’s editor

With pdfFiller’s editor, users can easily fill out, edit, and manage their Form W-12 digitally. The platform's user-friendly interface allows for easy navigation, making it simple to add and modify information efficiently.

Additional features include the ability to:

Collaboration features

Sharing the Form W-12 with team members, tax preparers, or family members for review is made easy through pdfFiller’s collaboration features. This allows for efficient feedback and ensures accuracy before final submission.

Video walkthrough

For those who prefer visual learning, pdfFiller offers a comprehensive video guide on completing Form W-12. This walkthrough will guide users through each step, providing clarity on how to fill out the form accurately.

To access the video tutorial, simply visit the pdfFiller website and navigate to the resources section where you'll find other helpful guides and tips.

Frequently asked questions (FAQs)

It’s common to have questions or concerns while completing Form W-12. Here, we address some frequently asked questions to make the process smoother.

Related tax articles

For further reading and resources, explore additional articles related to tax forms and filing. Knowledge is power when it comes to tax obligations, and having a variety of guides can provide better insights.

These articles may include guides on different IRS forms, best practices for document management, and tax filing tips that enhance your understanding and ease the process.

Leveraging pdfFiller for enhanced document management

Using pdfFiller goes beyond simply completing Form W-12. The platform supports a range of features that enhance your overall document management experience.

Tips for a smooth filing experience

Preparation is key to ensuring your submission process goes smoothly. Here's a handy checklist to help you verify everything is in order before you submit Form W-12.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form w-12 for eSignature?

How do I fill out form w-12 using my mobile device?

How do I edit form w-12 on an Android device?

What is form w-12?

Who is required to file form w-12?

How to fill out form w-12?

What is the purpose of form w-12?

What information must be reported on form w-12?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.