Get the free Invoice

Get, Create, Make and Sign invoice

Editing invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invoice

How to fill out invoice

Who needs invoice?

Invoice Form: A Comprehensive How-to Guide

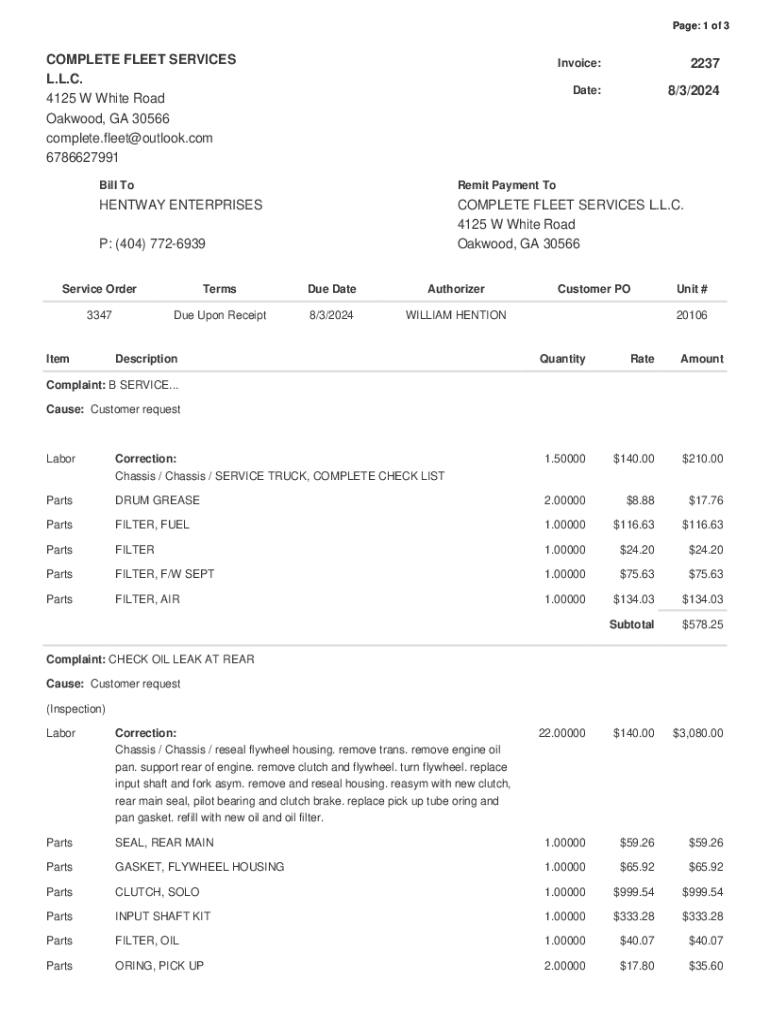

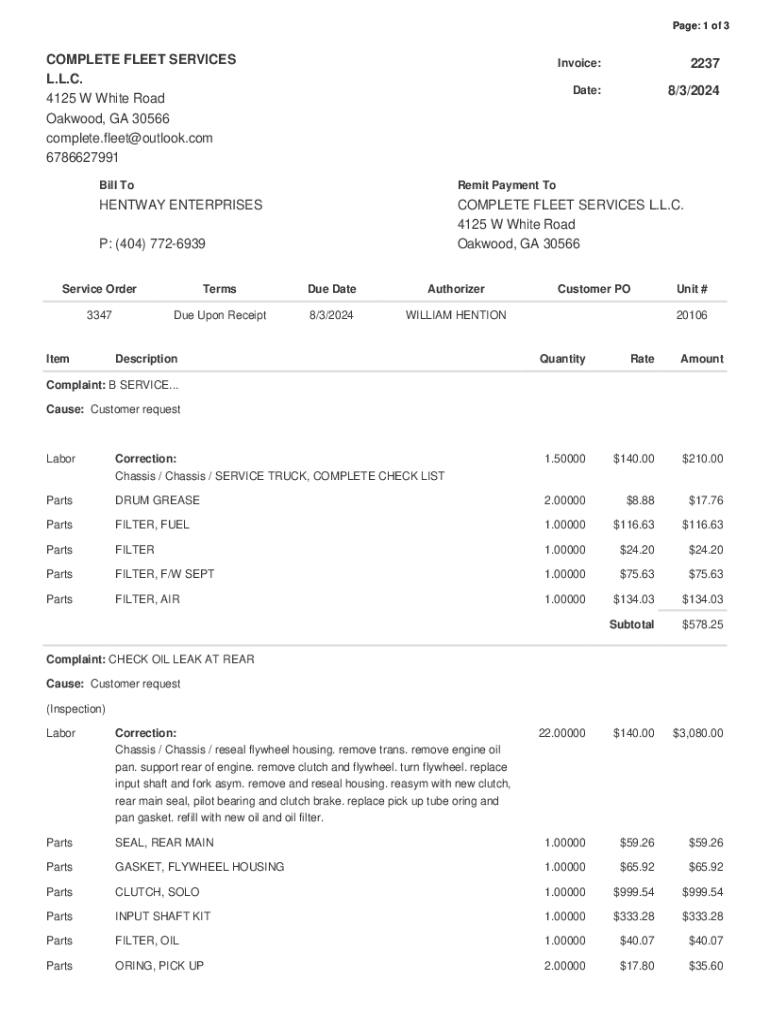

Understanding invoice forms

An invoice form is a crucial document in business transactions that serves as a formal request for payment from buyers to sellers. Its primary purpose is to provide detailed information about goods or services delivered, as well as the payment terms agreed upon by both parties. Invoice forms not only serve as a record of transaction but also establish legal documentation for both the buyer and seller.

Invoices are essential for businesses to maintain financial records, ensuring smooth cash flow and bookkeeping processes. Their importance lies in their ability to clarify the terms of sales, helping to prevent misunderstandings between businesses and their customers. Without an appropriate invoice, companies may struggle to collect due payments, leading to cash flow issues.

Types of invoice forms

There are various types of invoice forms that businesses might use depending on their specific needs. Understanding these types can help streamline the billing process and ease the tension of payment collection.

Components of a comprehensive invoice form

A well-structured invoice should include several essential elements to ensure clarity and ease of financial management. The key components consist of numerous elements which provide both the seller and buyer with all the necessary information regarding the transaction.

Using pdfFiller to create an invoice form

Creating a professional invoice form has never been easier with pdfFiller. This platform offers a range of templates and customization tools to help you craft the perfect invoice tailored to your needs. The user-friendly interface allows for seamless navigation, ensuring that individuals and teams can create invoices effortlessly.

To start crafting your invoice form, follow these step-by-step instructions:

In addition to these steps, pdfFiller allows users to interact with various customizable tools. You can add text fields, checkboxes, and even digital signatures to enhance your invoice. Adjusting formatting and layout is crucial for clarity, ensuring that recipients can quickly understand the billing details.

Editing and modifying existing invoice forms

Sometimes, you may need to modify an existing invoice. Utilizing pdfFiller makes this process straightforward. You can easily import current invoices by following a few simple steps.

Signing and sending invoice forms

After creating or modifying your invoice form, the next step is to send it to the buyer. pdfFiller offers robust eSignature functionality, which streamlines the signing process. eSigning is not only a secure method but also instills confidence in both parties regarding the transaction.

Managing your invoices with pdfFiller

Effective management of invoices is vital for maintaining healthy cash flow within a business. With pdfFiller, you can keep track of payments and due dates while organizing your invoices for easy reference.

Best practices for invoice creation and management

To maximize the effectiveness of your invoicing process, implementing best practices is essential. Beginning with clear language and straightforward terms ensures that clients understand the expectations regarding payments.

Additionally, encouraging automatic payments can significantly alleviate the stress of bill collection by streamlining the process. Awareness of common mistakes to avoid is equally important.

Real-world use cases for invoice forms

Different industries rely on invoice forms to ensure financial clarity and professionalism. Freelancers, for instance, often manage multiple clients and require clear invoicing for each transaction to maintain effective cash flow. Retail businesses, on the other hand, streamline their sales records through itemized invoices, which simplify the process for accounting and inventory management.

For example, consider a freelance graphic designer who consistently sends invoices through pdfFiller. By leveraging the platform's features, they not only manage client billings effectively but also experience an improvement in cash flow through timely payments facilitated by their professional invoice forms.

FAQs about invoice forms

When implementing invoice forms, several questions may arise from both new businesses and established companies alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute invoice online?

How do I make changes in invoice?

Can I create an eSignature for the invoice in Gmail?

What is invoice?

Who is required to file invoice?

How to fill out invoice?

What is the purpose of invoice?

What information must be reported on invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.