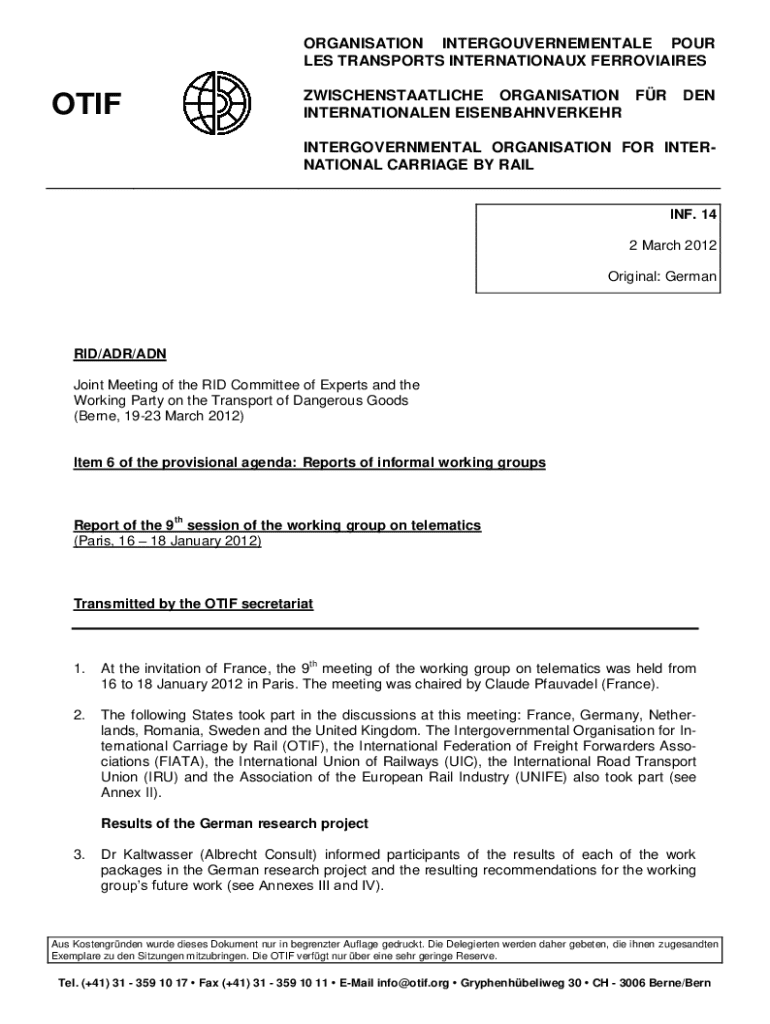

Get the free Inf. 14

Get, Create, Make and Sign inf 14

Editing inf 14 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out inf 14

How to fill out inf 14

Who needs inf 14?

A Comprehensive Guide to the INF 14 Form

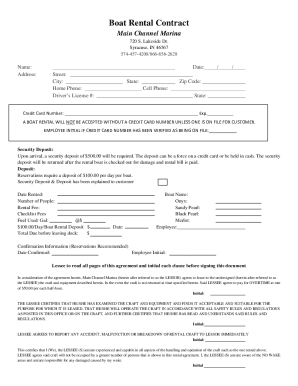

Understanding the INF 14 form

The INF 14 form is a crucial document designed to capture important information for various official purposes. It serves as a standardized template allowing individuals and organizations to report specific data required by authorities. Whether it's for tax declarations, financial assessments, or eligibility confirmations, the INF 14 form plays a significant role in ensuring compliance with regulations.

Various scenarios necessitate the use of the INF 14 form, including applications for government assistance, tax refunds, and other financial matters. By breaking down the process into clearly defined sections, the form helps users systematically present the required information, minimizing the chance of errors.

Key features of the INF 14 form

The INF 14 form consists of several key components, each structured to facilitate accurate reporting of information. The form typically includes sections for personal information, details of income, and any additional declarations relevant to the application. Understanding the importance of these components is vital for filling out the form correctly.

In particular, the personal information section requires accurate inputs regarding identification, ensuring that the form can be associated directly with the individual or organization involved. The income details section needs meticulous attention to ensure all reported figures are correct and comply with required guidelines. Moreover, the additional declarations can provide essential context around unique circumstances that may influence the final assessment.

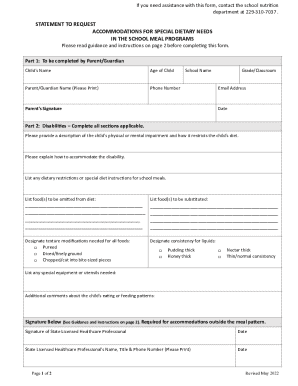

Accessibility is another important feature in the design of the INF 14 form. With user-friendly designs that consider diverse user needs, various adjustments are made to assist individuals with disabilities, ensuring that everyone can effectively navigate and complete the form with ease.

Step-by-step guide to completing the INF 14 form

Before diving into filling out the INF 14 form, prepare by collecting all necessary documents and data. This includes previous financial statements, identification documents, and any relevant correspondence that illustrate your current situation. Checking the eligibility criteria and understanding the specific requirements for the form is crucial to avoid unnecessary errors or delays.

Once you have everything you need, proceed to fill out the form section by section. Start with Section 1, where you’ll include your personal information. Ensure accuracy in all entries—double-check whether names and addresses are spelled correctly and match official documents.

It’s also essential to be aware of common mistakes. Overlooking certain requirements, such as not providing the necessary documentation or misreporting income can lead to delays or rejections. By cross-checking your entries and seeking a second opinion before submission, you can significantly improve your chances of a smooth process.

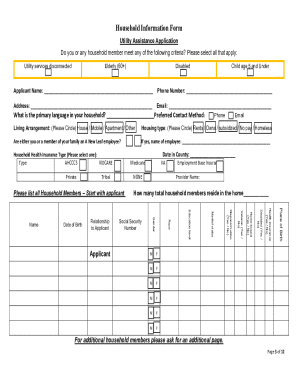

Editing and managing your INF 14 form

With pdfFiller, managing your INF 14 form becomes efficient and straightforward. Users can upload and edit the form directly through the platform, allowing for real-time changes and adjustments. This is especially beneficial for teams or organizations that may need to make collaborative edits or updates to the document.

The platform offers features such as form reusability, enabling you to save templates for future use or modify existing forms without starting from scratch. After completing edits, exporting options allow you to save the document in various formats, ensuring compatibility with different operating systems and preferences. Keeping digital records not only streamlines processes but enhances accessibility wherever you are.

eSigning your INF 14 form

eSigning the INF 14 form comes with significant advantages. Legally, electronic signatures hold the same weight as handwritten ones, making them a reliable choice for document submission. Utilizing electronic signatures not only speeds up the submission process but also enhances security, incorporating encryption and verification features not typically found in traditional signing methods.

When using pdfFiller, applying your signature on the INF 14 form is easy and user-friendly. With a step-by-step guide available on the platform, users can seamlessly add their eSignature, ensuring compliance with legal standards while maintaining a streamlined process. This feature offers peace of mind, knowing documents are securely processed without the need for physical copies.

Submitting your INF 14 form

Once completed and signed, knowing how to submit your INF 14 form is key to ensuring its acceptance. There are various submission methods, including online portals, mailing the document, or submitting in person at designated offices. Each method may have specific guidelines, so it's essential to review them before choosing your submission route.

Timely submission can often determine the success of your application; therefore, understanding deadlines and processing times is critical. Keeping a record of your submission method and tracking your form's status enables you to follow up with the respective authority, providing transparency and clarifications if necessary.

Addressing common queries and challenges

It's common for users to have questions about the INF 14 form, especially regarding its completion. Key concerns often include understanding specific terms, gathering the correct documentation, or resolving confusion around income reporting. Having a comprehensive FAQ available can significantly assist users in navigating common pitfalls associated with the form.

Resources such as online support forums and expert consultations can provide invaluable assistance. Whether it's clarifying stringent documentation requirements or offering insights into changes in regulation, leveraging community knowledge and expertise can ease the form-filling process. Staying informed and asking questions will enhance your ability to submit the INF 14 form successfully.

Updates and changes to the INF 14 form

The INF 14 form is not static; it has undergone several significant amendments in recent years. Staying updated on these changes is vital for users to ensure compliance and effective use of the form. For instance, the 2023 version introduces revisions that may affect reporting income or impacting specific declarations.

Keeping abreast of these updates not only guarantees accuracy in submissions but also prepares individuals and organizations for new requirements. Various channels exist for tracking updates, including official governmental releases or updates on platforms like pdfFiller that engage actively with changes affecting their users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute inf 14 online?

How do I edit inf 14 in Chrome?

How do I complete inf 14 on an Android device?

What is inf 14?

Who is required to file inf 14?

How to fill out inf 14?

What is the purpose of inf 14?

What information must be reported on inf 14?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.