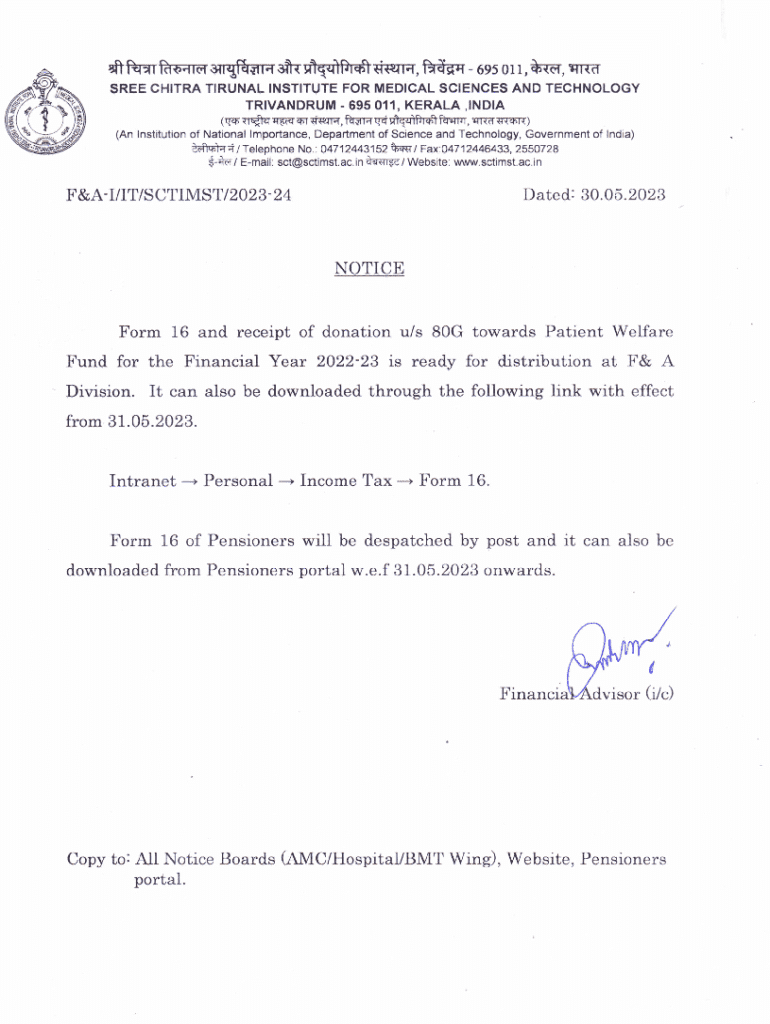

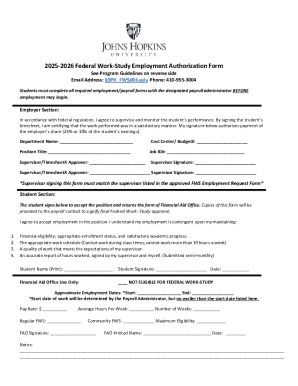

Get the free 30.05.2023 NOTICE Form 16 and receipt of donation u/s ...

Get, Create, Make and Sign 30052023 notice form 16

Editing 30052023 notice form 16 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 30052023 notice form 16

How to fill out 30052023 notice form 16

Who needs 30052023 notice form 16?

Understanding the 30052023 Notice Form 16 Form: A Comprehensive Guide

Understanding Form 16: A Comprehensive Overview

Form 16 serves as a critical document for taxpayers in India, acting as a certificate of tax deductions at source (TDS) on salary. This form is primarily issued by employers and provides a detailed summary of the employee's earnings and the corresponding tax deducted during the financial year. The importance of Form 16 cannot be overstated; it not only aids in annual tax filing but also serves as a vital proof of income and tax payments, which can be requested by financial institutions during loan or credit assessments.

Form 16 is typically issued once the financial year concludes, often by May 30th, making it pivotal for taxpayers to have it in hand for their income tax returns. The May 30, 2023, deadline is particularly significant, as it is the date by which employees should receive their Form 16 following the completion of the FY 2022-23. This timeline underscores the importance of keeping track of document issuance to avoid delays in tax filing.

Key components of the 2023 notice form 16

The 2023 version of Notice Form 16 contains several essential sections that provide a comprehensive breakdown of the employee's financial details. One of the primary components includes basic information about the employee, such as their name, PAN, and the name of the employer. This section establishes the identity of the taxpayer and the corresponding income source.

Tax-related details are paramount in Form 16 and include specifics on gross taxable income, deductions available under various sections like 80C, and the total tax payable. These components not only assist in preparing accurate income tax returns but also offer insights into potential areas for tax savings. It's crucial to keep supporting documentation, such as salary slips, investment proofs, and details of deductions claimed, ready to avoid common errors during this process.

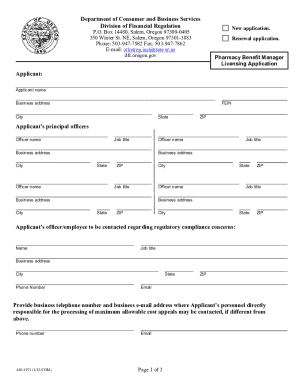

Step-by-step guide to filling out form 16

Proper preparation is key when tackling Form 16. Start by gathering all necessary information, including previous income details, TDS certificates, and proof of deductions. It's beneficial to have this data organized as some parts of the form require a recheck against the information provided in previous years, particularly if there have been significant earnings or deductions.

When filling out the form, begin by accurately inputting personal information, like your name and PAN. Then, detail your income from various sources, including salary, bonuses, and any other allowances. Pay special attention to the deductions section—ensure you include valid deductions under sections like 80C, 80D, etc., to minimize taxable income. Lastly, carefully calculate your taxable income and crosscheck each entry to ensure compliance.

Finally, undertake a thorough review and verification process. Create a checklist that includes all completed entries for quick reference. Ensuring accuracy is paramount, as mistakes could lead to complications or penalties. Use tools like pdfFiller to manage your documentation and finalize your Form 16 efficiently.

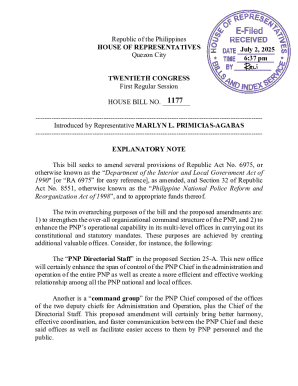

Using pdfFiller for form 16: Enhancing your experience

pdfFiller transforms the traditionally tedious task of filling Form 16 into a streamlined and efficient process. Leveraging a cloud-based interface, users can edit, sign, and manage this important document from anywhere, at any time. One of the standout features of pdfFiller is its interactive editing tools, which simplify document completion significantly, allowing for a more user-friendly experience.

In addition, pdfFiller provides collaboration tools, making it an ideal solution for teams. Multiple users can work on aspects of Form 16 concurrently, ensuring collective input and accuracy. Security is another key element; pdfFiller guarantees that sensitive data remains protected with state-of-the-art security measures. The eSigning feature further supports compliance with legal standards, making it a comprehensive tool for handling Form 16.

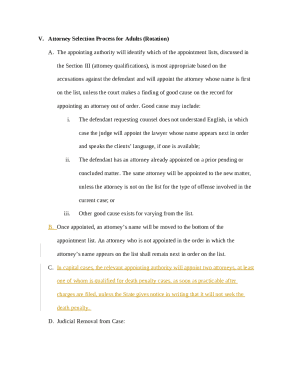

Tips and best practices for managing your form 16

Maintaining organization is essential when managing your Form 16 documentation. Implementing effective document management strategies will help both individuals and teams to keep track of past and current Form 16s effortlessly. For instance, pdfFiller allows you to track revisions, ensuring clarity over changes made through its cloud platform itself making access and sharing easy for all involved.

It's also crucial to address common queries as these often stem from misunderstandings surrounding taxation terms or sections of Form 16. Regularly referring to updates and tutorials relevant to Form 16 can bolster your understanding. Should you find any discrepancies post-submission, familiarize yourself with the steps needed for rectifying mistakes to avoid future complications. This proactive approach will ensure compliance and peace of mind.

Handling updates and notices related to form 16

Being informed about updates from regulatory authorities regarding Form 16 is vital, especially as tax laws evolve. Staying ahead of changes and the implications they bear on existing forms can help mitigate any potential issues during tax season. Regularly checking official tax authority communications ensures you are up-to-date, enabling you to adapt your submissions accordingly.

If you receive a notice regarding discrepancies in your Form 16 submission, it’s paramount to respond swiftly. Gather the necessary documentation to refute or clarify the errors noted in the notice. Keep communication lines open with both your employer and tax authorities, as this transparency can aid in resolving issues promptly.

Additional features of pdfFiller for form management

Integrating Form 16 with other financial tools can significantly enhance the efficiency of your tax filing and financial management processes. pdfFiller is designed with this compatibility in mind, allowing seamless integration with accounting software and tax filing systems. This ensures that data flows effortlessly across platforms, saving time and minimizing errors during tax preparation.

User testimonials reflect the positive experiences of those who have effectively managed their Form 16 submissions utilizing pdfFiller. From saving time to ensuring regulatory compliance, users have reported satisfaction with the platform's intuitive design. Additionally, pdfFiller offers training resources and webinars, which provide invaluable insights into effectively leveraging the features available for managing Form 16.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 30052023 notice form 16 directly from Gmail?

How can I modify 30052023 notice form 16 without leaving Google Drive?

How do I fill out the 30052023 notice form 16 form on my smartphone?

What is 30052023 notice form 16?

Who is required to file 30052023 notice form 16?

How to fill out 30052023 notice form 16?

What is the purpose of 30052023 notice form 16?

What information must be reported on 30052023 notice form 16?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.