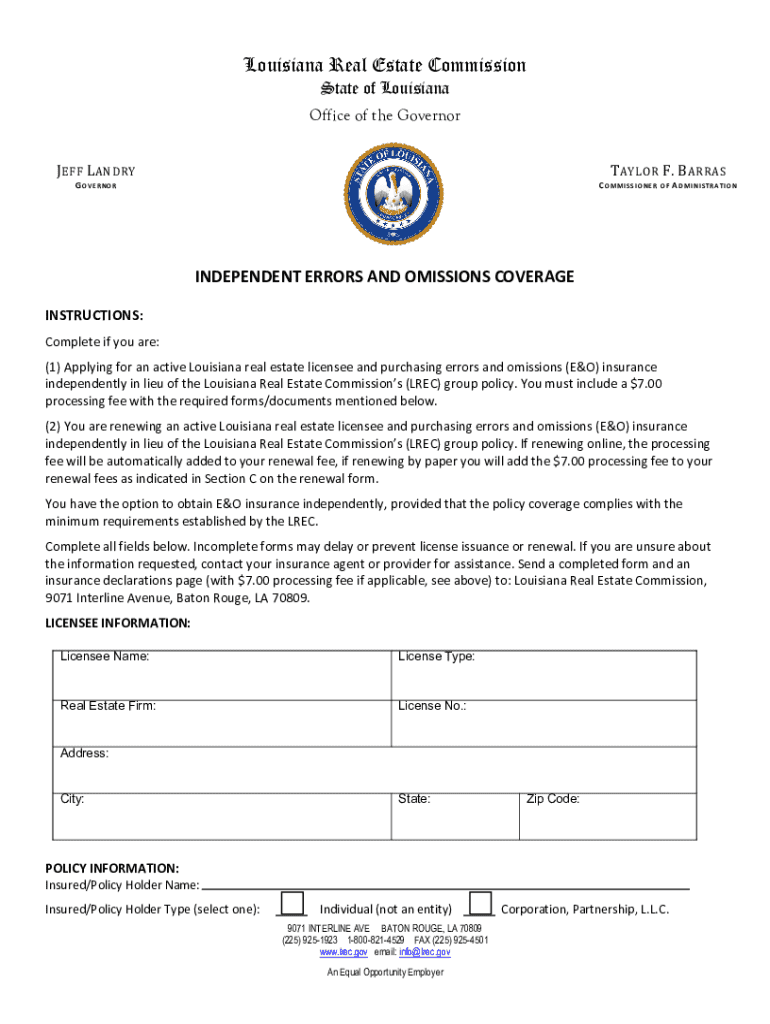

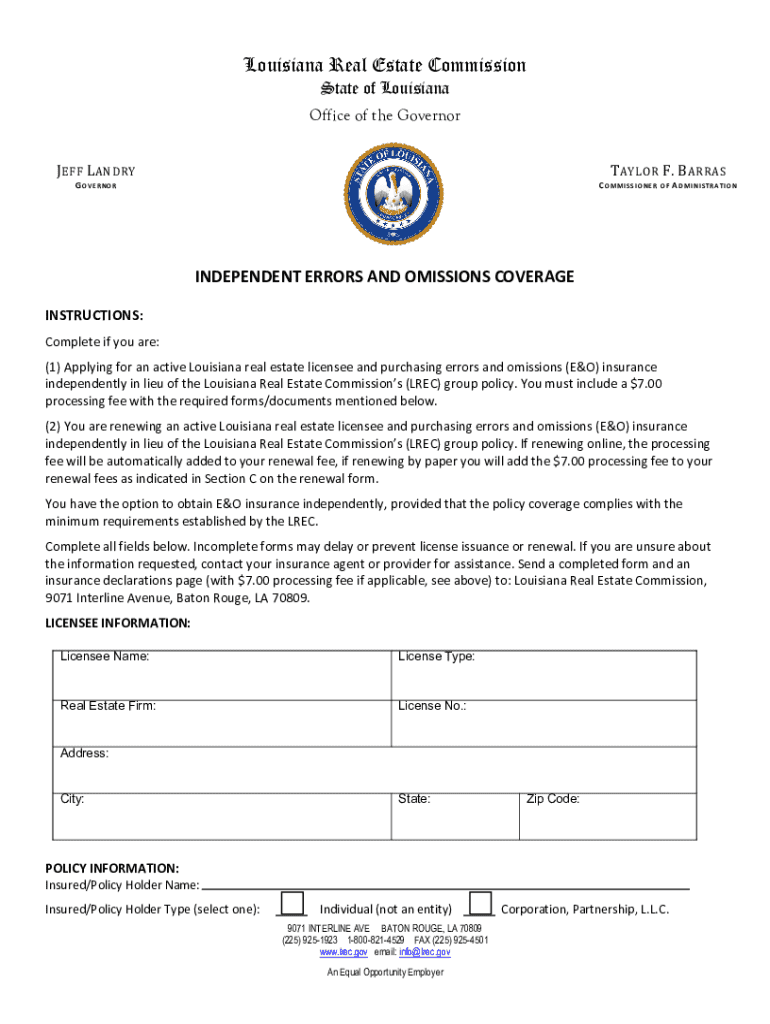

Get the free Independent Errors and Omissions Coverage

Get, Create, Make and Sign independent errors and omissions

How to edit independent errors and omissions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out independent errors and omissions

How to fill out independent errors and omissions

Who needs independent errors and omissions?

Understanding the Independent Errors and Omissions Form

Understanding independent errors and omissions forms

Independent errors and omissions forms (E&O forms) are crucial documents for professionals across various industries. These forms serve as a written acknowledgment of the terms and conditions agreed upon between a service provider and their clients concerning errors or omissions in the services rendered. Errors and omissions insurance helps protect independent professionals from liability arising from claim disputes over their services and ensures their practice is covered against unintentional mistakes.

Having an E&O form is particularly vital for independent professionals. It not only provides legal protection but also enhances credibility in the eyes of potential clients. For professionals such as consultants, lawyers, and IT service providers, an independent E&O form can serve as a testament to their commitment to professionalism and accountability.

Components of an independent errors and omissions form

An independent errors and omissions form consists of several essential components that need careful consideration. The key terms and phrases included in the form typically outline the scope of coverage, any limitations, and definitions relevant to the services provided. Crucially, the form must capture key business details, including the name of the independent professional, business address, and contact information.

Moreover, it is essential to specify coverage limits clearly, which detail the monetary maximum an insurer will pay in the event of a claim. Also, describing the specific services your business provides is necessary for addressing scenarios that may lead to claims. Notably, for the E&O form to be valid, signed documentation from the involved parties is typically required, ensuring mutual agreement on the terms.

Step-by-step guide to filling out an independent errors and omissions form

Filling out an independent errors and omissions form can seem daunting, but following a structured process makes it manageable. Here’s a step-by-step guide.

Editing, signing, and managing your independent errors and omissions form with pdfFiller

Using pdfFiller is an effective way to manage your independent errors and omissions form. The platform offers a range of editing tools that enable users to modify documents easily. With pdfFiller, you can fill, edit, or correct any information on the E&O form without hassle.

In addition to editing, pdfFiller allows you to eSign your form securely, ensuring that your document remains legally binding. Collaborative features enable you to share the form with partners or legal advisors in real-time, making it easy to obtain consensus on terms. Furthermore, storing and managing your documents in the cloud gives you quick, anytime access to your vital information.

Common mistakes to avoid when completing an independent errors and omissions form

Completing an independent errors and omissions form requires diligence to avoid common mistakes that could jeopardize its effectiveness. One major pitfall is submitting incomplete information, which can lead to miscommunication or liability issues. It is crucial to ensure that every section of the form is filled out accurately.

Another common issue is misunderstanding personal liability clauses. Professionals must read these clauses thoroughly to grasp their responsibilities and potential fallouts. Additionally, many overlook renewal dates and the requirements for updating their E&O insurance—staying current is essential to maintaining protection.

Benefits of having an independent errors and omissions form

An independent errors and omissions form offers a plethora of benefits for professionals. First and foremost, it provides peace of mind by protecting individuals against unwarranted lawsuits stemming from mistakes or oversights in their work. This layer of security can reduce anxiety when fulfilling complex client projects and enhance focus.

Moreover, having an E&O form can significantly enhance professional credibility and build trust with clients. It signals your commitment to accountability and responsibility, while also fostering a stronger client relationship. Lastly, lacking an E&O form can have serious business implications, including financial loss, damage to reputation, and a decrease in client confidence.

Different professions that require an independent errors and omissions form

Various professions necessitate the use of an independent errors and omissions form due to the nature of their services. For instance, legal professionals often face complex litigation where mistakes can lead to severe consequences, thus making an E&O form essential for liability coverage.

Similarly, consultants and advisors provide guidance that could potentially lead to financial loss if errors occur, necessitating the protection that E&O insurance provides. Medical practitioners also require E&O coverage to defend against potential malpractice claims. Lastly, technology and IT service providers must safeguard against claims related to system failures or service interruptions that may impact clients' businesses.

How to update or modify your independent errors and omissions form

Staying up-to-date with your independent errors and omissions form is paramount. Updating your form is necessary when there are changes in services offered, coverage details, or if your business information changes. It’s advisable to review your E&O form periodically to ensure everything is accurate and current.

Making modifications is simple with pdfFiller, as the platform allows users to easily edit existing forms. Keeping your insurance information updated is vital not just for compliance but also for ensuring you have adequate protection against emerging risks.

Frequently asked questions (FAQs)

Addressing common queries provides clarity around independent errors and omissions forms. One frequently asked question is, 'What qualifications are needed to obtain an E&O form?' This generally depends on your profession and the specifics of the insurance provider you choose, but typically establishing your credentials and relevant experience is crucial.

Another common concern is, 'What happens if I fail to file my E&O form on time?' Delays could potentially expose you to liability risks. Timely submission is essential for coverage. Finally, understanding 'How does the claims process work regarding errors and omissions?' involves notifying your insurer promptly about any claims while providing necessary documentation and information.

Discovering insurance quotes and options for independent errors and omissions

When searching for independent errors and omissions insurance, exploring various providers is key to finding the best fit for your needs. Each provider may offer distinct plans, coverage limits, and pricing structures. Consequently, reviewing and comparing quotes effectively can help ensure that you are making informed decisions.

Utilizing online tools and resources to acquire secure quotes not only saves time but also broadens your options. Many platforms allow you to receive personalized quotes based on your unique business profile, ensuring the coverage you choose aligns perfectly with your requirements. Always take the time to thoroughly assess each option before committing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send independent errors and omissions to be eSigned by others?

Can I create an electronic signature for the independent errors and omissions in Chrome?

Can I create an electronic signature for signing my independent errors and omissions in Gmail?

What is independent errors and omissions?

Who is required to file independent errors and omissions?

How to fill out independent errors and omissions?

What is the purpose of independent errors and omissions?

What information must be reported on independent errors and omissions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.