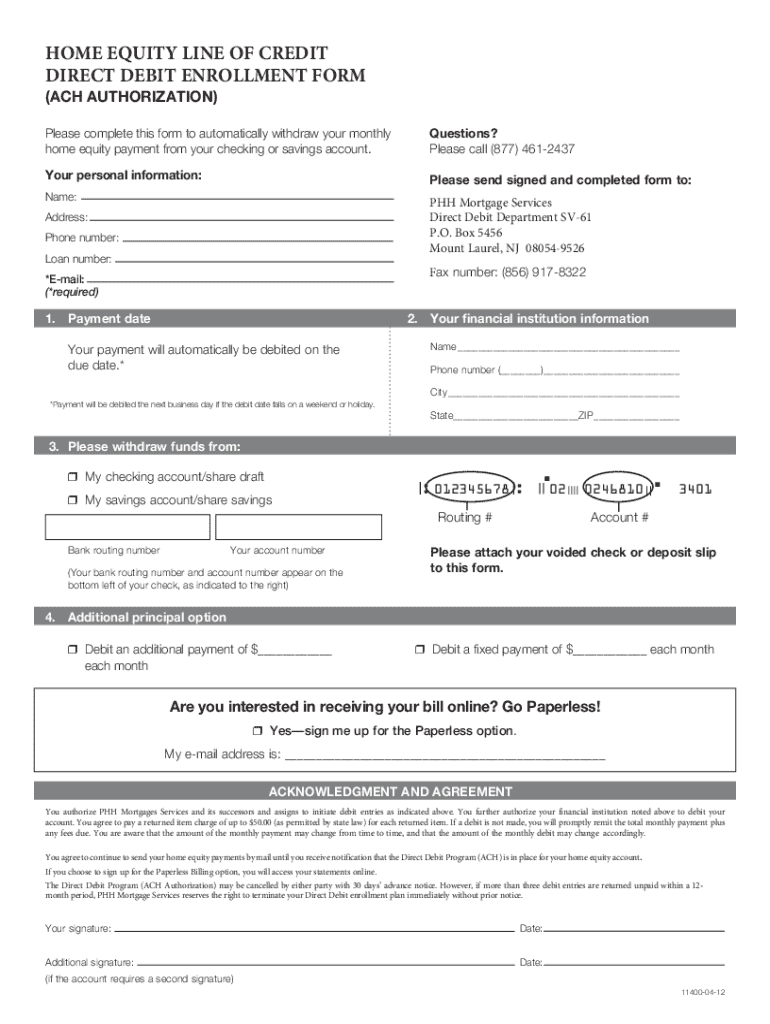

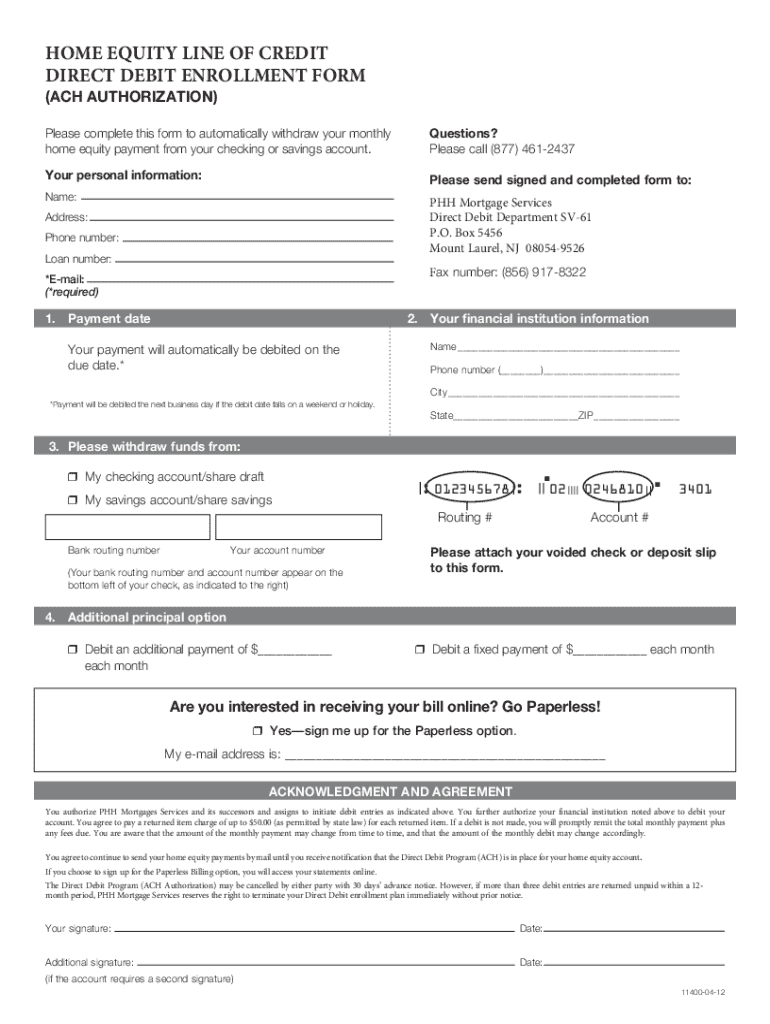

Get the free Home Equity Line of Credit Direct Debit Enrollment Form

Get, Create, Make and Sign home equity line of

Editing home equity line of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home equity line of

How to fill out home equity line of

Who needs home equity line of?

Navigating the Home Equity Line of Form: A Comprehensive Guide

Understanding home equity lines of credit (HELOC)

A Home Equity Line of Credit (HELOC) serves as a flexible loan option secured by the equity in your home. Unlike traditional loans which provide a single lump sum, a HELOC allows homeowners to borrow against the fluctuating value of their home, offering the possibility to withdraw funds as needed, much like a credit card.

Key features and benefits of a HELOC include:

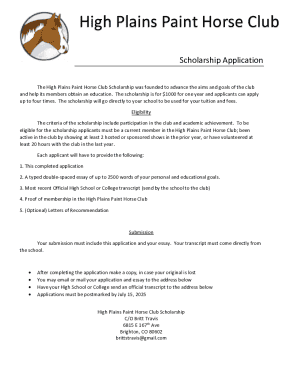

Prequalifying for a home equity line of credit

Before you dive into filling out the home equity line of form, understanding the eligibility criteria is crucial. Lenders will assess your equity in the home, credit score, and income verification.

Steps to calculate your home equity involve:

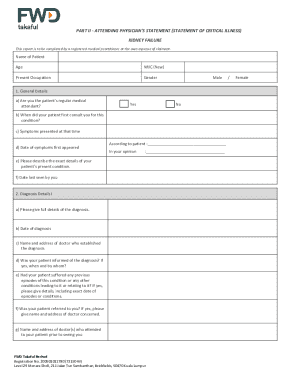

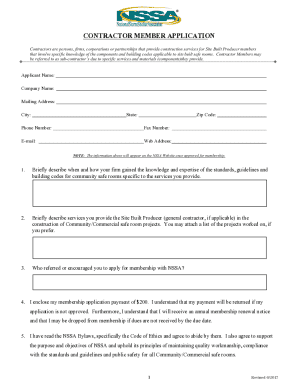

Preparing the home equity line of form

Accurate documentation is paramount when it comes to the home equity line of form. Submitting a form with errors can lead to delays or even denials in your application.

Key information to include in the form encompasses:

To efficiently gather these documents, utilize a checklist to keep track of requirements and ensure nothing is overlooked.

Detailed review of the home equity line of form structure

Understanding the structure of the home equity line of form is essential for a successful application. The form typically encompasses several key sections.

The primary sections of the form include:

Common pitfalls to avoid when filling out this form include missing signatures and providing incorrect or incomplete information, which can hinder the processing of your application.

Filling out the home equity line of form

Completing the home equity line of form requires attention to detail. Here’s a step-by-step guide to help you through the process.

Step-by-step instructions include:

Interactive tools can make this process even smoother, with options for digital form-filling and eSignature capabilities available on platforms like pdfFiller.

Editing and reviewing specifications of the home equity line of form

Revisions to your form prior to submission are vital to prevent issues. Effective editing can catch errors that might otherwise lead to processing delays.

Utilizing specialized tools for editing PDF forms includes:

Signing and submitting your home equity line of form

Once your form is completed and reviewed, signing it correctly is crucial. Understanding eSignatures is important as they are legally binding and recognized in most jurisdictions.

The submission process typically involves:

Managing your home equity line of credit after application

After you’ve submitted the home equity line of form and await approval, knowing what to expect can ease your mind. The timeline for approval varies, but keeping open communication with lenders is advisable.

Management strategies for your home equity line of credit include:

Unlocking home equity possibilities

A HELOC opens the door to numerous possibilities for utilizing your home equity, providing financial flexibility when needed most.

Common uses for home equity include:

A HELOC offers a line of credit that provides more flexibility compared to traditional loans, allowing you to withdraw funds as necessary.

Understanding current home equity market trends

The home equity market is dynamic, and staying informed on today’s competitive home equity rates can benefit your financial decisions.

Factors influencing rate changes include:

By maintaining an active home equity line of credit, you can benefit from potential future increases in your property’s value, translating to better borrowing power.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my home equity line of directly from Gmail?

How do I complete home equity line of on an iOS device?

How do I fill out home equity line of on an Android device?

What is home equity line of?

Who is required to file home equity line of?

How to fill out home equity line of?

What is the purpose of home equity line of?

What information must be reported on home equity line of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.