Get the free Sba 912

Get, Create, Make and Sign sba 912

Editing sba 912 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sba 912

How to fill out sba 912

Who needs sba 912?

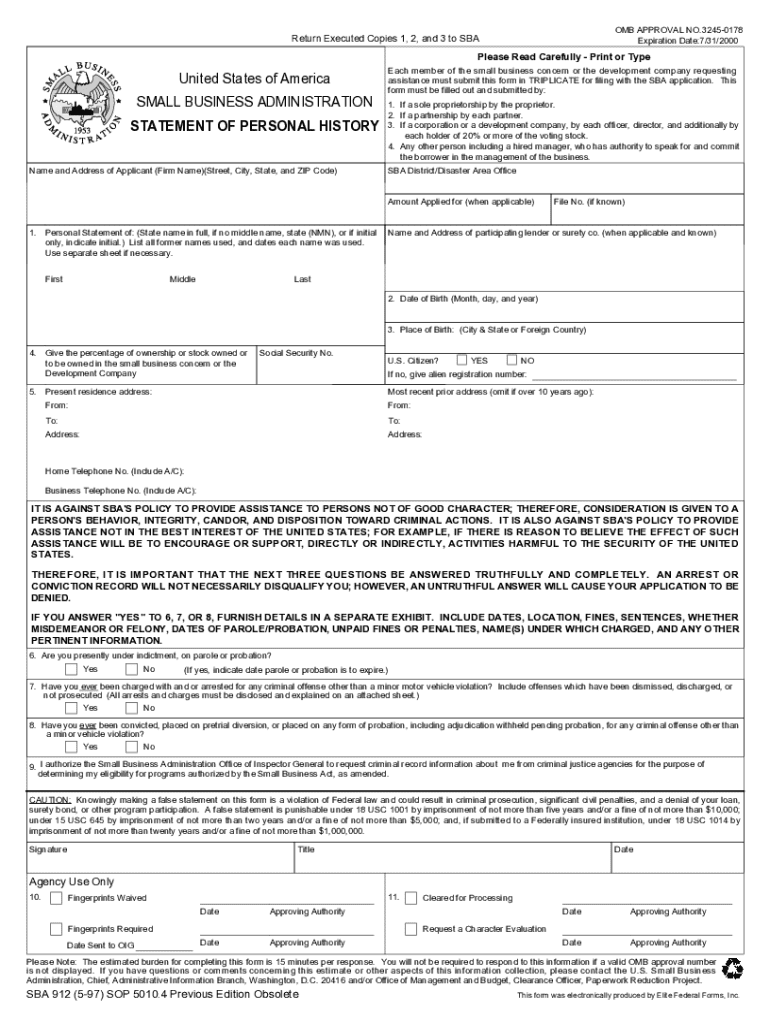

Understanding the SBA 912 Form: A Comprehensive Guide

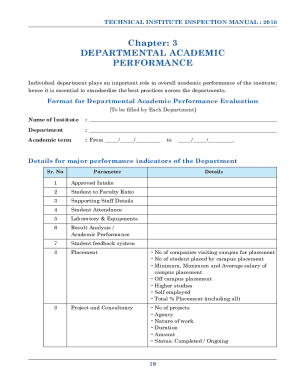

Overview of the SBA 912 Form

The SBA 912 form is a vital document within the framework of the Small Business Administration (SBA) that plays a crucial role in ensuring the ethical practices of businesses seeking financial assistance. This form is primarily utilized during the loan application process, where the SBA assesses the acceptable risk associated with lending to a business. Completing the SBA 912 form accurately is essential; it can greatly influence the potential for funding and the terms of any loans granted.

The SBA 912 form is particularly important for borrowers as it helps in collecting details about the individual's or business's integrity and financial history. Misrepresentation or errors on this form can lead to significant delays or even rejections of loan applications. Ensuring that this form is filled out thoroughly and accurately is thus critical for securing much-needed funding.

Who needs to fill out the SBA 912 Form?

Different categories of businesses and individuals are mandated to fill out the SBA 912 form. Most notably, any business connecting with the SBA for loan support, including startups and established enterprises, will need to submit this form. Furthermore, individuals, such as business owners or partners, who play a crucial role in the decision-making process of a business are also required to complete the form.

Situations requiring the SBA 912 form include applying for a 7(a) loan, 504 loan, or Microloan through the SBA. Each of these loan types serves various funding needs within the business community. Understanding when and why the SBA 912 form is needed is vital in navigating the financial landscape effectively.

Understanding the key sections of the SBA 912 Form

The SBA 912 form comprises several key sections that gather vital information necessary for the SBA to perform their review process. A comprehensive breakdown of these components can provide clarity and assist in the meticulous completion of the form.

The form includes the following primary sections:

In addition to the primary sections, the SBA 912 form contains specialized terms. Understanding terms such as 'creditworthiness,' 'capitalization,' and 'business entity' can significantly enhance the user's comprehension and facilitate accurate submissions. Those unfamiliar with financial jargon may benefit from reviewing standard definitions to eliminate confusion.

Step-by-step instructions for completing the SBA 912 Form

Filling out the SBA 912 form can be a daunting process, but following a step-by-step approach ensures accuracy and completeness. Below are the recommended actions to take while filling out the form:

Step 1: Gather required documentation

Before starting the form, motivation arises through proper preparation. The following documents are typically required:

Step 2: Filling out the personal information section

Once you’ve gathered the necessary documents, proceed to fill out the personal information section accurately. Double-check each entry for consistency and completeness to avoid errors. Writing clearly and legibly can help prevent misunderstandings later in the review process.

Step 3: Completing the business information section

In this section, provide comprehensive details regarding your business structure and ownership. Confirm that your data aligns with the business registration documents to avoid discrepancies.

Step 4: Providing financial information

For the financial data, accuracy is paramount. Ensure that all figures are meticulously reviewed. Disclose all financial obligations and income sources honestly to maintain transparency. This will help in avoiding repercussions that could arise from financial misstatements.

Step 5: Final review and signature

Finally, conduct a thorough review of the completed SBA 912 form. Utilize a checklist to ensure all sections are filled, signatures are in place, and documents are attached as required. Accuracy and completeness in this stage can significantly impact your application's success.

Tips for a successful SBA 912 Form submission

Filling out forms can often become overwhelming, but awareness of common pitfalls can enhance your chances of success. Numerous applicants make frequent errors that can delay their submission. Below are some common mistakes to avoid:

For successful submission, consider implementing the following best practices: Conduct multiple reviews of the form before submission, keep your writing clear and concise, and adhere to formatting guidelines that improve readability. Clarity is vital in conveying your message accurately.

After submission: What to expect

After submitting the SBA 912 form, an applicant can anticipate a review period. Typical processing times can vary based on the volume of applications received by the SBA. Generally, expect a response within several weeks, though it may take longer during high-demand periods, especially during governmental budget constraints or shutdowns.

To track the status of your application, it is advisable to utilize the SBA’s online resources or directly contact your lender. Many businesses report increased efficiency in communication during follow-ups, highlighting the importance of maintaining awareness of your application's status.

Frequently asked questions (FAQs)

What happens if the form is filled out incorrectly?

If the SBA 912 form is filled out incorrectly, it may result in significant delays in processing or even outright rejection of the loan application. Correcting the errors could necessitate resubmitting the form, adding to the processing time.

Can edit my SBA 912 Form after submission?

Once submitted, making edits to the SBA 912 form generally isn’t permissible. It's advisable to review the form carefully before submission to ensure accuracy.

Are there any fees associated with the submission of the SBA 912 Form?

Typically, there are no fees specifically associated with submitting the SBA 912 form. However, other loan processing methods may incur fees, so it is best to confirm with your lender.

Is there assistance available for completing the form?

Yes, many local SBA offices offer assistance, and there are also online resources available through the SBA’s website or community organizations that can help guide applicants through the process.

Additional tools and resources from pdfFiller

To streamline the process of completing the SBA 912 form, pdfFiller offers a variety of interactive tools. Users can take advantage of features that allow for easy editing, collaborative signing, and document management within a single platform.

Utilizing pdfFiller enables teams to collaborate on filling out the SBA 912 form. This cloud-based solution ensures that all members can access the document, make necessary changes in real-time, and verify accuracy, thus significantly enhancing the workflow.

Related forms and templates

In addition to the SBA 912 form, applicants may encounter other related documents that facilitate the loan application process. Forms such as the SBA Form 2483 for PPP loans and the SBA Form 2202 for financial statements are also commonly utilized. Understanding these forms, alongside the SBA 912, can position applicants favorably when seeking funding.

For those seeking additional assistance, pdfFiller provides a library of resources and templates that can help address various document needs pertinent to the funding application process.

Contact information for further assistance

For formal inquiries regarding the SBA 912 form, individuals can reach out to the SBA directly via their official channels. Local SBA offices are also a great resource for personalized support. Additionally, pdfFiller customer support provides expert assistance for any document-related questions, ensuring users have the support they need while processing their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my sba 912 in Gmail?

How can I edit sba 912 on a smartphone?

How do I complete sba 912 on an iOS device?

What is sba 912?

Who is required to file sba 912?

How to fill out sba 912?

What is the purpose of sba 912?

What information must be reported on sba 912?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.