Get the free the Insurance Code of 1956 (excerpt)

Get, Create, Make and Sign form insurance code of

Editing form insurance code of online

Uncompromising security for your PDF editing and eSignature needs

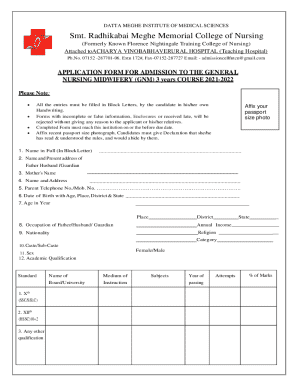

How to fill out form insurance code of

How to fill out form insurance code of

Who needs form insurance code of?

Form insurance code of form: A comprehensive guide

Understanding form insurance code

A form insurance code serves as a systematic identifier for various insurance forms used across personal and commercial lines. The purpose of this code is to streamline the processing, retrieval, and organization of insurance-related documents by establishing a universal reference system.

In the insurance industry, form insurance codes are crucial. They not only enhance efficiency in managing documentation but also ensure compliance with regulatory mandates. Insurers need to accurately classify and document claims, policies, and coverage types for smooth operations and audits.

The legal significance of the form insurance code cannot be overstated. It serves as a public record that aids in claims disputes and regulatory scrutiny. Without a standardized system, the insurance process becomes chaotic, complicating claims management and complicating audits.

Types of form insurance codes

Form insurance codes can be categorized into standard codes that are widely used across the industry, and customized codes, which are unique to specific companies or policies. Standard codes often originate from state regulations or associations and are utilized broadly.

Customized codes, however, allow firms to adapt their documentation to fit unique offerings or client requirements, driving personalized service in a competitive landscape. For instance, auto insurance policies may require unique coding for various coverage options.

Usage scenarios for these codes vary significantly. In personal insurance, such as auto or health coverage, they help categorize client types and their respective policies. Alternatively, in commercial insurance, codes are essential for ensuring compliance with extensive regulations while managing diverse liabilities across multiple lines of business.

International differences in form insurance codes

Form insurance codes are not uniform across borders, creating unique challenges for multinational insurers. For instance, the codes used in the European Union might differ substantially from those in the United States. Each country has specific compliance requirements, dictated by local insurance regulators.

Companies operating across different jurisdictions must adapt their forms and codes to meet various standards. This adaptation is crucial, not just for compliance, but also for maintaining customer satisfaction and operational efficiency globally.

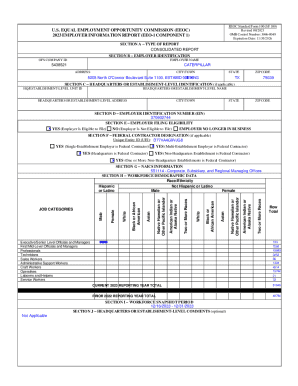

Steps to complete the form insurance code

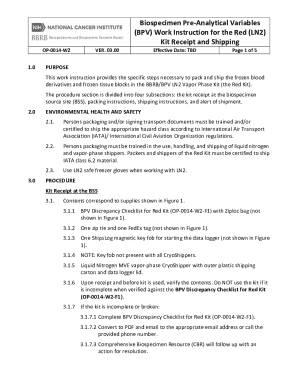

Completing a form insurance code involves a systematic approach to ensure that all necessary details are captured accurately. Below are the essential steps to guide you through the process.

Step 1: Gathering necessary information

Before starting any documentation, gather personal details such as names, addresses, and social security numbers, along with specific policy information, including coverage limits and endorsement types. Having all requisite data on hand will expedite the form-filling process.

Step 2: Understanding the code structure

Each form insurance code features a structured layout. Familiarize yourself with common sections, typically including personal information, policy details, and coverage descriptions. Understanding the logic behind the code can greatly simplify the filling process.

Step 3: Filling out the form

Pay close attention to detail when filling out the form. Utilize clear writing or digital entry, and cross-check your entries against the gathered information. Avoid common pitfalls such as incorrect spelling of names or inaccurate policy numbers, which can result in substantial delays.

Step 4: Reviewing and validating the code

After completing the form, it's vital to review and validate entries to catch any errors. Utilize validation tools, such as those available on pdfFiller, to ensure accuracy before submission. This practice not only saves time but also ensures compliance with regulatory standards.

Editing and managing the form insurance code

Editing a form insurance code can be straightforward with the right tools. pdfFiller provides enhanced functionality that allows users to modify documents seamlessly. The platform allows for real-time editing of forms, ensuring that changes are applied instantly and efficiently.

How to edit the code

To edit the form insurance code using pdfFiller, follow these steps: open the document, highlight the section you wish to edit, and enter the new information. The interface is user-friendly, enabling users to make changes without technical expertise.

pdfFiller also offers collaboration features, allowing team members to comment and suggest changes directly on the document. This functionality ensures that all parties can actively contribute to the completion of forms, promoting accuracy and reducing the likelihood of errors.

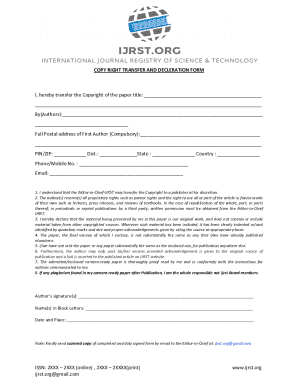

Signing and submitting the form insurance code

Electronic signatures have transformed the way users sign and submit documents. In many jurisdictions, eSignatures are legally accepted, providing the convenience of signing documents from any location. pdfFiller simplifies this process with an easy-to-use electronic signature feature.

How to eSign with pdfFiller

To eSign the form, navigate to the designated signature field and select the option to add your signature. Users can draw, type, or upload their signatures, making the process flexible and user-friendly. After signing, review the document to ensure all required fields are complete.

Submission guidelines

Once the form is signed, it’s essential to know where and how to submit it. Verification of submission requirements with the insurance provider is a must to ensure correct handling of your document. Many insurers allow submissions via email, online portals, or physical mail. Lastly, tracking submission status is crucial, which can often be handled through the submitting platform.

Common questions and troubleshooting

Navigating the complexities of form insurance codes often raises common questions. Users frequently ask about the differences between standard and customized codes, how to handle discrepancies, or what to do in case of rejections. Understanding these aspects can significantly ease the experience.

If issues arise, several troubleshooting steps can be taken. First, review the documentation thoroughly to ensure that all information is correct. Secondly, utilize resources such as online support from pdfFiller, where you can get answers to frequently asked questions about form insurance codes.

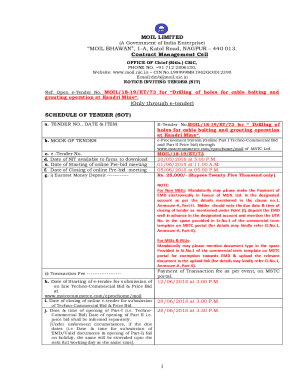

Regulatory compliance and updates

Insurance regulations can change frequently, necessitating a keen awareness of compliance requirements surrounding form insurance codes. Staying informed about changes can ensure that your documentation remains valid and accepted by insurers.

Regularly monitoring relevant regulatory updates through industry publications or the website of your local insurance regulator is advisable. Utilizing resources like the content offered on pdfFiller can also alert users to updates that may impact their documentation processes.

Best practices for managing form insurance codes

Effective management of form insurance codes relies on establishing best practices that enhance organization and retrieval. One efficient strategy is to maintain thorough record-keeping practices. Organizing documents in a structured manner saves time and ensures compliance during audits.

Implementing a standardized naming convention for files can aid in quick retrieval, making it straightforward to access necessary forms when needed. Additionally, leveraging tools on pdfFiller, such as pre-designed templates for commonly used forms, simplifies the process of creating future documents.

User experiences and case studies

Real-world applications provide insight into how form insurance codes can be effectively managed. For example, a regional insurance company successfully streamlined its claims process by implementing a centralized system for form insurance codes. This transition improved efficiency and reduced claim processing times significantly.

Additionally, testimonials from pdfFiller users articulate the value of using the platform for managing form insurance codes. Users report reduced errors, improved collaboration for document handling, and enhanced overall productivity.

Interactive tools for form insurance code management

pdfFiller provides a robust set of interactive features that enable users to efficiently manage form insurance codes. Guidelines and templates included in the platform allow for easy customization, catering to a variety of insurance needs and scenarios.

To maximize the benefits of these tools, users are encouraged to explore the functionality of templates thoroughly. Customization options allow for adapting to specific requirements, ensuring that the form insurance code matches the policy type or business industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form insurance code of online?

Can I create an electronic signature for signing my form insurance code of in Gmail?

How can I fill out form insurance code of on an iOS device?

What is form insurance code of?

Who is required to file form insurance code of?

How to fill out form insurance code of?

What is the purpose of form insurance code of?

What information must be reported on form insurance code of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.