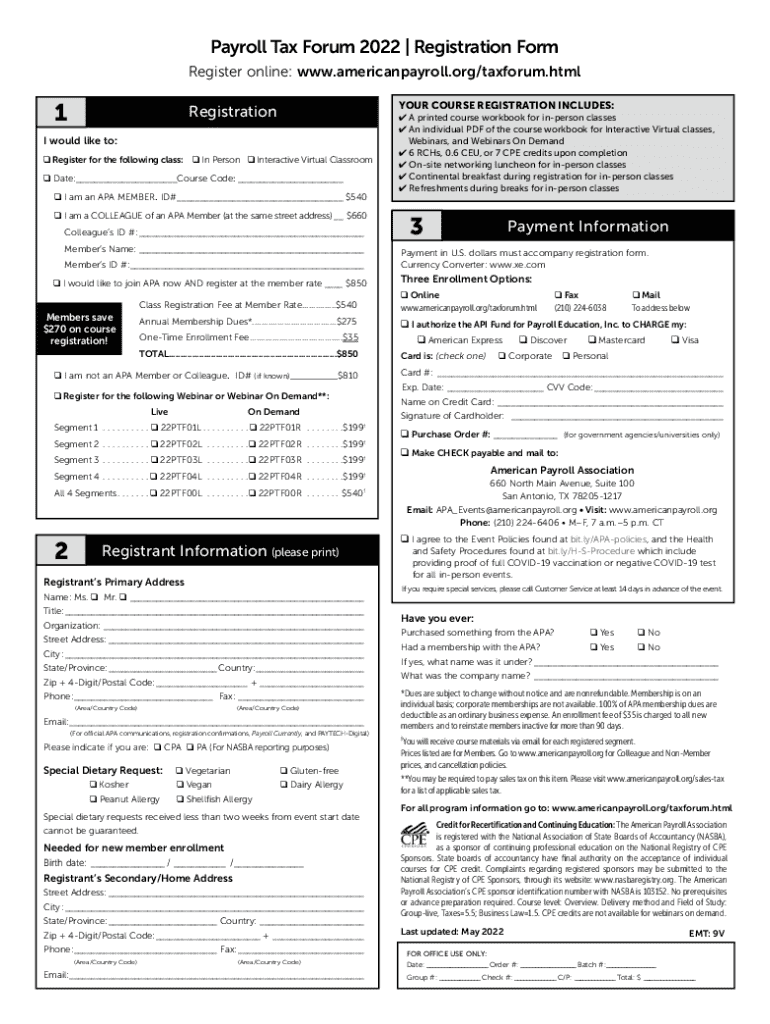

Get the free Payroll Tax Forum 2022 | Registration Form

Get, Create, Make and Sign payroll tax forum 2022

Editing payroll tax forum 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll tax forum 2022

How to fill out payroll tax forum 2022

Who needs payroll tax forum 2022?

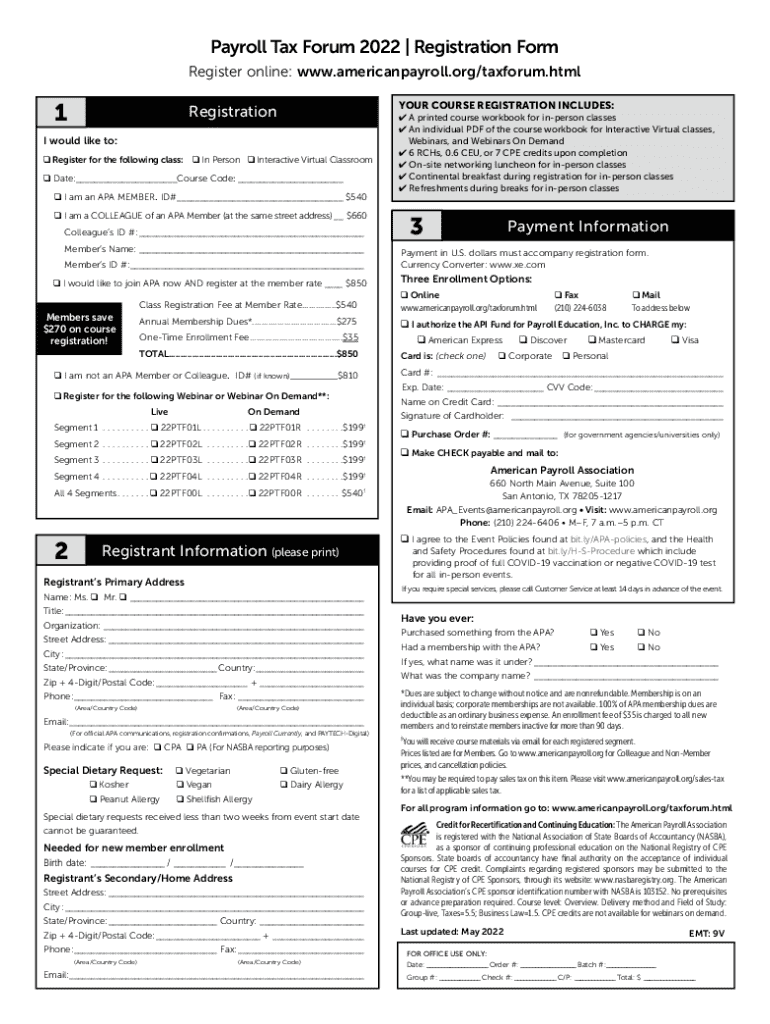

Comprehensive Guide to the Payroll Tax Forum 2022 Form

Understanding payroll taxes

Payroll taxes are essential contributions that employers must withhold from employees' wages, funding various government programs like Social Security and Medicare. They play a critical role in the economy, ensuring that public services, such as unemployment benefits and social safety nets, remain funded and operational.

The main components of payroll taxes include federal, state, and local variations. Employers and employees equally share federal payroll taxes, typically earmarked for federal insurance programs. State payroll taxes can vary significantly, contributing to state-specific unemployment and disability insurance. Local payroll taxes may also apply based on geographic location, further complicating compliance for businesses.

Overview of the 2022 payroll tax forum form

The Payroll Tax Forum 2022 Form serves as a vital resource for businesses to ensure compliance with the changing landscape of payroll taxation. This form integrates critical guidelines and updates necessary for the accurate calculation and reporting of payroll taxes.

Updates for 2022 focus on adjustments to tax rates and regulations that have occurred due to federal mandates and state-specific changes. Staying informed about these updates is not just beneficial for compliance; it also helps businesses avoid penalties and optimize tax payment strategies.

Step-by-step guide to accessing the payroll tax forum 2022 form

Accessing the Payroll Tax Forum 2022 Form is easy. Individuals or business representatives can navigate to the dedicated page on pdfFiller to find the latest version available for download and online completion.

The pdfFiller platform allows users to easily edit fields, add necessary information, and ensure compliance in real-time. It also features a user-friendly interface to simplify navigation.

Detailed instructions for completing the payroll tax forum 2022 form

Completing the Payroll Tax Forum 2022 Form involves a few structured steps, ensuring accurate representation of payroll details. The form consists of several sections, each targeting specific information necessary for effective tax processing.

Avoid common mistakes, such as incorrectly entering personal information or miscalculating tax liabilities, to prevent delays and potential issues with tax authorities. It's wise to double-check figures and cross-reference with company payroll records.

Interactive tools for managing payroll forms

pdfFiller offers cutting-edge features that empower users to manage their payroll forms efficiently. For example, the platform allows direct editing of PDF files while retaining their original format. This feature is particularly useful as it enables revisions or updates to be made quickly in compliance with changing regulations.

Moreover, pdfFiller provides eSigning capabilities, allowing users to electronically sign documents securely. This quickens processing and provides the necessary legal binding without the hassle of printing and scanning.

Collaboration on payroll tax filing

For businesses employing multiple individuals in the payroll process, collaboration is key. Users can utilize pdfFiller's collaboration tools to streamline form submission workflows and team communication.

This level of collaboration not only bolsters accuracy but also makes the payroll tax filing process considerably more efficient. Engaging various team members ensures that all relevant insights are considered before submissions.

Managing forms post-completion

After completion, saving and storing the Payroll Tax Forum 2022 Form correctly is vital for ongoing compliance and easy retrieval. Businesses should adopt a systematic approach to document management.

An organized approach not only provides peace of mind but also prepares businesses for any audit scenarios, allowing for quick access to critical documents.

Case studies and real-world application

Numerous individuals and businesses have benefited from using pdfFiller in managing their payroll forms. For instance, a small business in Texas streamlined its payroll tax process by adopting pdfFiller, which resulted in reduced errors and quicker submissions.

These success stories highlight the significance of utilizing technology to improve compliance and efficiency. Organizations have reported that using pdfFiller has not only simplified their processes but also saved them valuable time and resources.

Frequently asked questions (FAQs) about payroll tax filing

Many individuals have questions regarding payroll taxes and the nuances of completing the Payroll Tax Forum 2022 Form. Common queries include details on eligibility for tax deductions, clarifications on specific tax rates, and instructions on how to rectify filing errors.

Understanding these FAQs can significantly assist businesses in completing their forms accurately while ensuring compliance with both state and federal regulations. Knowledge is power when it comes to payroll tax responsibilities.

Additional support and resources via pdfFiller

pdfFiller offers extensive customer support for users navigating payroll tax queries. From dedicated tutorials on their website to live webinars, resources are available to help users master payroll tax management.

Additionally, community forums allow users to connect and share insights on best practices. Leveraging these resources can empower businesses to enhance their understanding of payroll obligations and optimize their workflows effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get payroll tax forum 2022?

Can I create an electronic signature for signing my payroll tax forum 2022 in Gmail?

How can I edit payroll tax forum 2022 on a smartphone?

What is payroll tax forum?

Who is required to file payroll tax forum?

How to fill out payroll tax forum?

What is the purpose of payroll tax forum?

What information must be reported on payroll tax forum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.