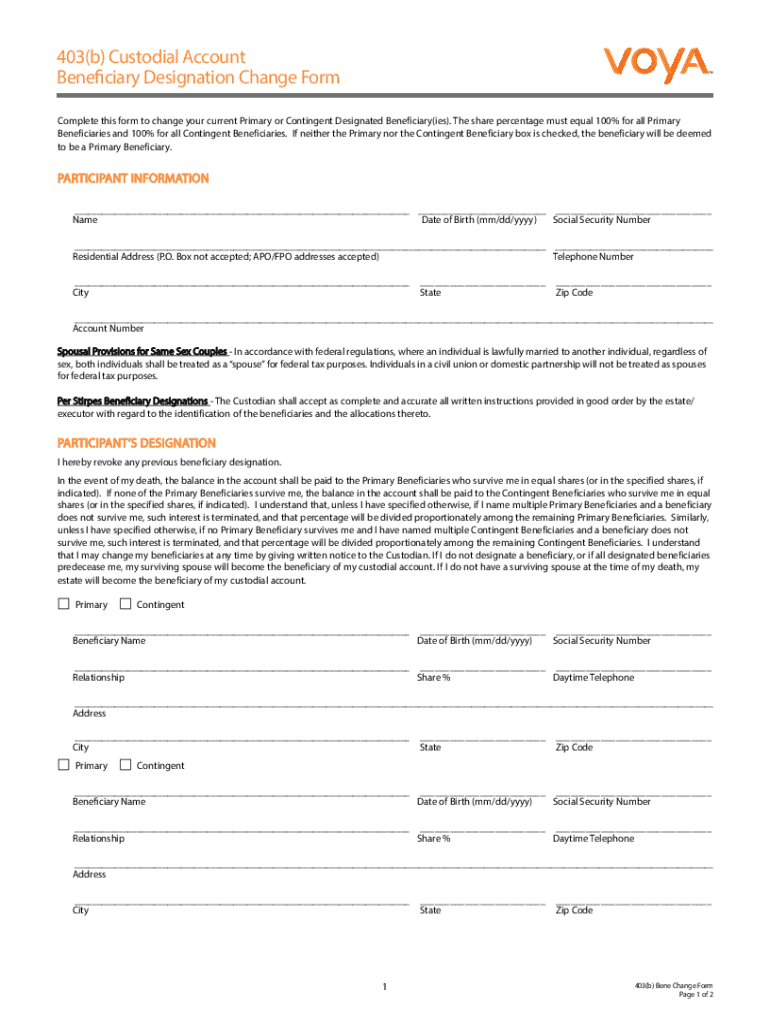

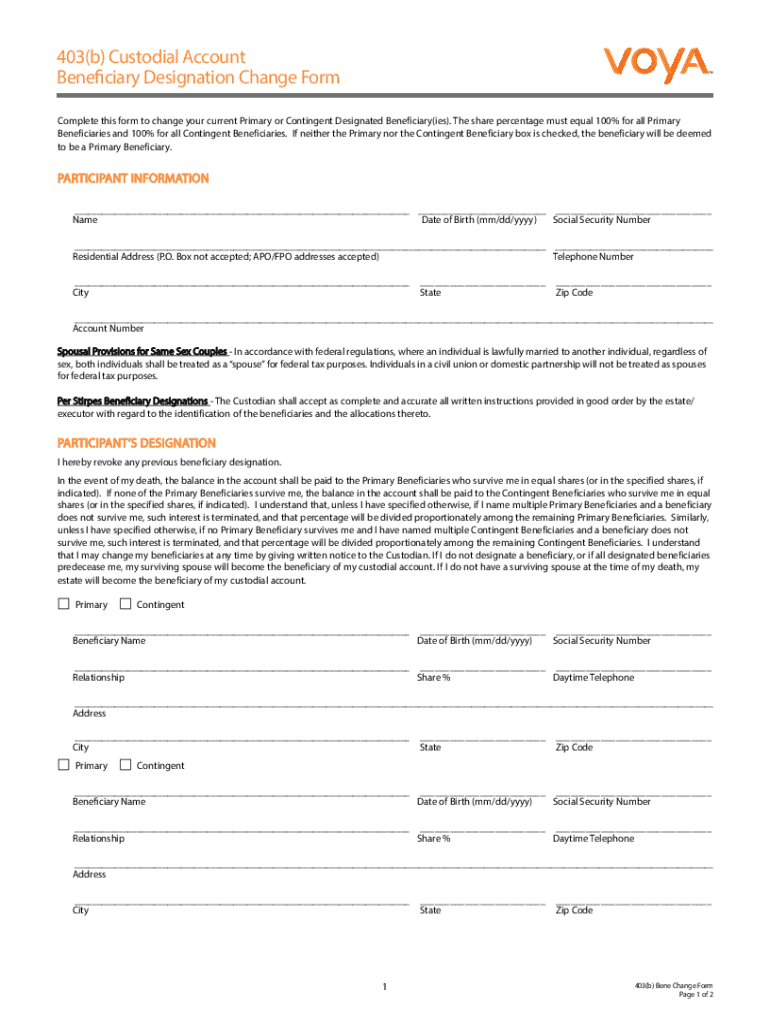

Get the free 403(b) Custodial Account Beneficiary Designation Change Form

Get, Create, Make and Sign 403b custodial account beneficiary

How to edit 403b custodial account beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 403b custodial account beneficiary

How to fill out 403b custodial account beneficiary

Who needs 403b custodial account beneficiary?

Comprehensive Guide to the 403b Custodial Account Beneficiary Form

Understanding the 403b custodial account

A 403b custodial account is a retirement savings plan specifically designed for employees of public schools and certain tax-exempt organizations. This type of account allows participants to save and invest money for retirement on a tax-deferred basis. Contributions are made pre-tax, reducing taxable income in the year they are made, and the investment grows tax-free until withdrawals are made after retirement.

Individuals who work in qualifying sectors, including educators, healthcare professionals and non-profit employees should consider opening a 403b custodial account. It's particularly beneficial for those focused on long-term financial planning. Additionally, it's a crucial component of a comprehensive retirement strategy that ensures financial stability in the later years.

The importance of beneficiary designation

Designating a beneficiary for your 403b custodial account is crucial. A beneficiary is the individual who will receive the account’s assets upon your death. It's essential for minimizing complications in asset distribution. Without a designated beneficiary, the assets may be subject to lengthy probate processes, which can be time-consuming and costly.

Common misconceptions about beneficiary designations surround the belief that a will overrides any beneficiary designations. However, in a 403b custodial account, the designated beneficiary on file takes precedence, making it vital to ensure this information is current and accurate.

Overview of the 403b custodial account beneficiary form

The 403b custodial account beneficiary form is a specific document that allows you to designate individuals or entities as recipients of your account in the event of your death. This form outlines important information regarding who your beneficiaries are and what percentage of the account they will receive. It's an essential part of planning for the future and ensuring your assets are distributed according to your wishes.

Anyone who holds a 403b custodial account should complete this beneficiary form. This includes educators, healthcare employees, and other qualified individuals. It's important to keep this form up-to-date, especially after major life events such as marriages, divorces, or the birth of children.

Step-by-step guide to completing the beneficiary form

Completing the 403b custodial account beneficiary form is straightforward if you follow these steps carefully. First, you must gather necessary personal information about yourself and your designated beneficiaries. Personal details should include names, addresses, dates of birth, and Social Security numbers, ensuring accuracy to avoid future complications.

Next, when filling out the form, address each section meticulously. Start with your account holder details, providing all requested information accurately. Following this, clarify your beneficiary designations, specifying whether they are primary or contingent. Finally, all involved parties must provide their signatures to affirm the submissions.

Be vigilant about common mistakes when completing the beneficiary form; any inaccuracies could derail your plans. Errors in beneficiary names, percentages that do not total 100%, or missing signatures can lead to complications in the future.

Editing and managing your beneficiary designation

Life changes necessitate updates to your beneficiary designations. Common life events like marriage, divorce, or the addition of children trigger the need to revise this critical information. Keeping your designations current ensures that your assets will be allocated according to your intentions at the time of your passing.

To submit your updates, typically, you must complete a new beneficiary form and follow the protocol set forth by your 403b plan administrator. It's wise to maintain a record of such changes for your personal files. Utilizing pdfFiller, you can securely store these updates and manage all your documents from a single platform.

With pdfFiller, the document management capabilities allow users to track versions and history, ensuring you maintain an organized and comprehensive record of your beneficiary designations.

Signing and submitting the form

The completion of the 403b custodial account beneficiary form requires valid signatures to ensure its legitimacy. Generally, the account holder must sign the form, and, in some cases, witnesses may also be necessary depending on your plan's requirements.

Using pdfFiller simplifies the process; you can easily eSign the beneficiary form through the platform. Simply upload the form, add your signature securely, and make sure it's submitted to your plan's provider for processing.

FAQs about 403b custodial account beneficiary forms

Navigating beneficiary designations can be complex, and it's helpful to be informed. Here are some frequently asked questions that provide clarification on common concerns regarding the designation process for your 403b custodial account.

Using pdfFiller as your document solution

pdfFiller streamlines the process of managing the 403b custodial account beneficiary form and all complimentary documents. The advantage of a cloud-based platform ensures you can create, edit, sign, and store forms from anywhere, making document management convenient and efficient.

Besides ease of use, pdfFiller offers collaborative features that allow multiple account holders to interact with the document seamlessly. This is particularly useful in team environments where shared responsibilities may be required. Additionally, with secured storage capabilities, users can track version history and document alterations, providing a comprehensive overview of changes made over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 403b custodial account beneficiary directly from Gmail?

How do I fill out the 403b custodial account beneficiary form on my smartphone?

How do I complete 403b custodial account beneficiary on an iOS device?

What is 403b custodial account beneficiary?

Who is required to file 403b custodial account beneficiary?

How to fill out 403b custodial account beneficiary?

What is the purpose of 403b custodial account beneficiary?

What information must be reported on 403b custodial account beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.