Get the free Family Savings Group - Program Entry Form

Get, Create, Make and Sign family savings group

How to edit family savings group online

Uncompromising security for your PDF editing and eSignature needs

How to fill out family savings group

How to fill out family savings group

Who needs family savings group?

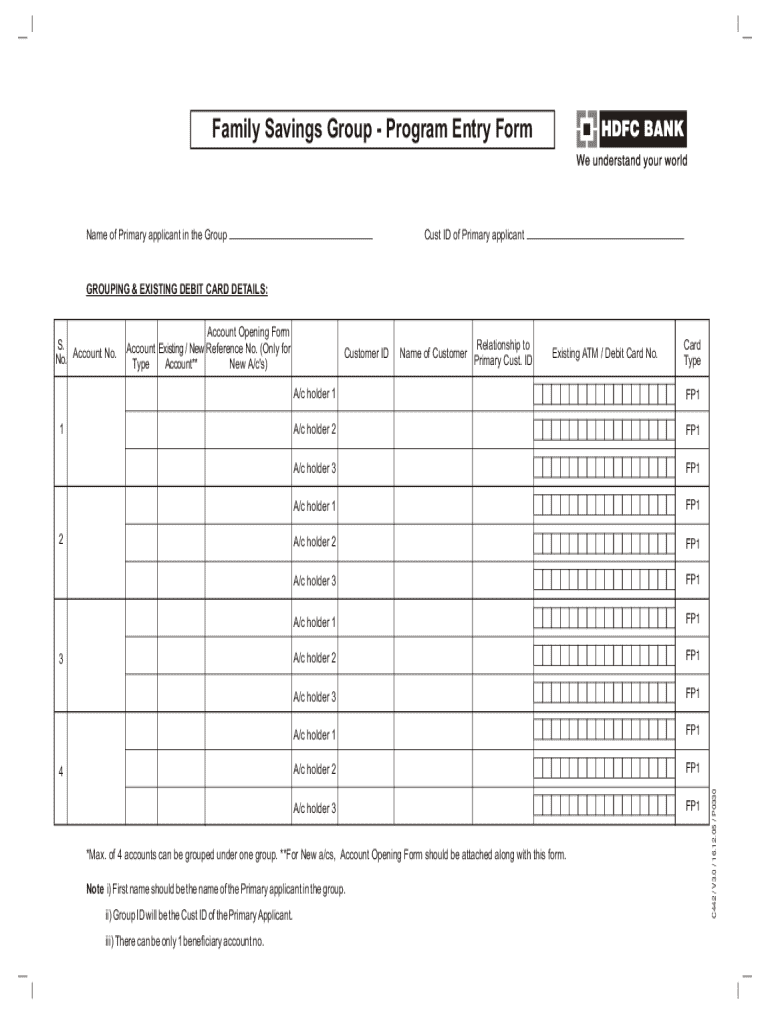

Understanding and Utilizing the Family Savings Group Form

Understanding the family savings group form

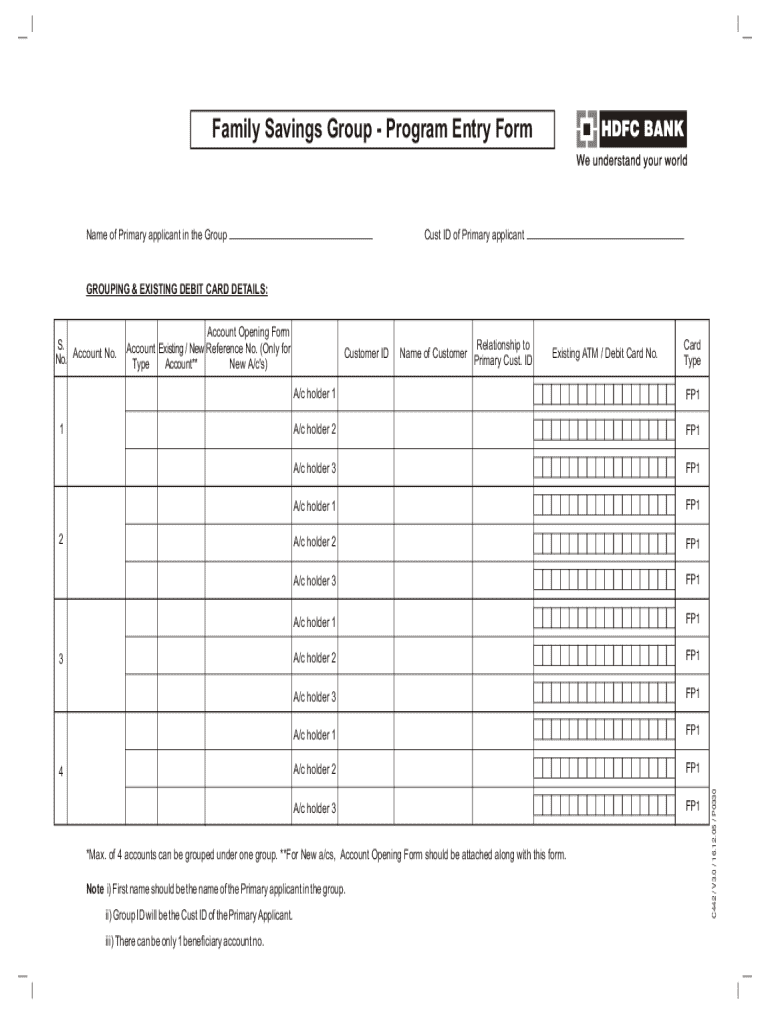

A family savings group form is a structured document designed to facilitate saving and financial collaboration among family members. The primary purpose of this form is to encourage family members to pool resources, set collective savings goals, and manage financial contributions effectively. Establishing such a group encourages accountability and fosters a sense of teamwork, allowing families to reach their financial dreams more efficiently.

The importance of financial cooperation in family settings cannot be overstated. As families face increasing expenses and economic uncertainties, it’s crucial to develop habits that encourage saving. By creating a savings group, families can harness the power of collective effort, helping each member achieve financial goals through collaboration and mutual support.

Key components of the family savings group form

A well-structured family savings group form comprises several essential components to ensure clarity and functionality. The first part typically includes the personal information section, where family members provide their names, relationships, and contact information. It's important to collect accurate information to maintain a clear record of all participants.

Collecting accurate information can be facilitated by setting up a family meeting where details are discussed openly. This not only helps in gathering data but also reinforces the commitment each family member has towards the savings goal.

Another critical component is specifying the financial contributions. Here, families must decide on the contribution amounts and the frequency of contributions, which can be weekly, bi-weekly, or monthly. Establishing a clear plan for contributions helps in setting realistic savings goals.

Filling out the family savings group form

Filling out the family savings group form may seem daunting at first, but following a simple step-by-step approach can ensure a smooth process. Start by gathering the necessary documentation and information, which includes personal details and agreed-upon financial contributions.

Next, open the family savings group form in pdfFiller, an accessible platform that allows you to edit and manage documents easily. Input personal information accurately to avoid any discrepancies later on. After that, specify the agreed-upon contribution amounts and outline your withdrawal rules to provide clear guidelines for accessing funds.

Finally, review and confirm all entered details before finalizing the document. This step is crucial to ensure that all family members are on the same page regarding contributions and withdrawal procedures.

However, while filling out the form, it's important to be aware of common mistakes to avoid. Inaccurate financial data can lead to misunderstandings, and missing signatures or dates can invalidate the agreement.

Editing and customizing the family savings group form

One of the key advantages of using pdfFiller is its editing features, which allow you to customize the family savings group form to suit your unique needs. You can modify pre-filled sections to correct inaccuracies or update information as required. This ensures that your document remains relevant and accurate as time progresses.

Additionally, adding notes or comments directly onto the form can enhance clarity for all family members. If there are specific terms or details that need further explanation, leveraging pdfFiller’s commenting features ensures that everyone is informed. For personalized needs, consider exploring templates that are available through pdfFiller, as they can offer alternative structures suited to your family's specific context.

Collaborating with family members

Collaboration is key when it comes to managing a family savings group form. It’s essential to invite participation from all family members to ensure everyone feels included in the decision-making process. Utilize pdfFiller’s sharing features to circulate the form among participants, allowing them to provide their input and feedback on the proposed financial structure.

Setting deadlines for feedback is equally important, as it helps maintain momentum and ensures that everyone remains engaged. After gathering input, employ tools available through pdfFiller to track contributions and changes. This encourages accountability, and at the same time, establishes a sense of responsibility among family members.

Signing and securing the family savings group form

Ensuring that the family savings group form is signed and secured is crucial for maintaining its legitimacy. With pdfFiller, the process of eSigning is streamlined and straightforward. Family members can utilize electronic signatures to authenticate their commitment to the agreement. This not only simplifies the signing process but also adheres to all legal considerations surrounding digital signatures.

In addition to signatures, securing financial data is of utmost importance. As sensitive information may be stored in the form, ensure that adequate privacy measures are taken to protect against unauthorized access. This includes choosing secure storage options offered by pdfFiller and being diligent about data visibility among family members.

Managing the family savings group

Ongoing management of the family savings group involves consistent record keeping. It’s vital to track contributions and withdrawals over time, which can be facilitated by utilizing reports generated by pdfFiller. These tools allow families to have a clear overview of their financial engagements, making it easier to adjust as needed.

Additionally, being prepared to troubleshoot common issues, such as discrepancies in financial contributions, is crucial. Open communication among family members can help address concerns promptly and amicably. It’s also beneficial to have a plan in place for managing conflicts or misunderstandings, ensuring that the group remains functional and goal-oriented.

Real-life applications of the family savings group form

Real-life applications of the family savings group form showcase its effectiveness in helping families manage financial goals. For instance, many families share success stories where pooling resources led to establishing emergency funds or saving for special events such as weddings or family vacations. These stories serve as inspiration for others considering adopting a similar approach.

To ensure long-term success in managing a family savings group, encourage regular meetings where family members can discuss financial goals and adjust plans as necessary. It's equally important to adapt the group structure to accommodate changing family needs, ensuring sustainability and participation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find family savings group?

Can I sign the family savings group electronically in Chrome?

How do I fill out the family savings group form on my smartphone?

What is family savings group?

Who is required to file family savings group?

How to fill out family savings group?

What is the purpose of family savings group?

What information must be reported on family savings group?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.