Get the free Notary Public Bond Form

Get, Create, Make and Sign notary public bond form

Editing notary public bond form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notary public bond form

How to fill out notary public bond form

Who needs notary public bond form?

A Comprehensive Guide to the Notary Public Bond Form

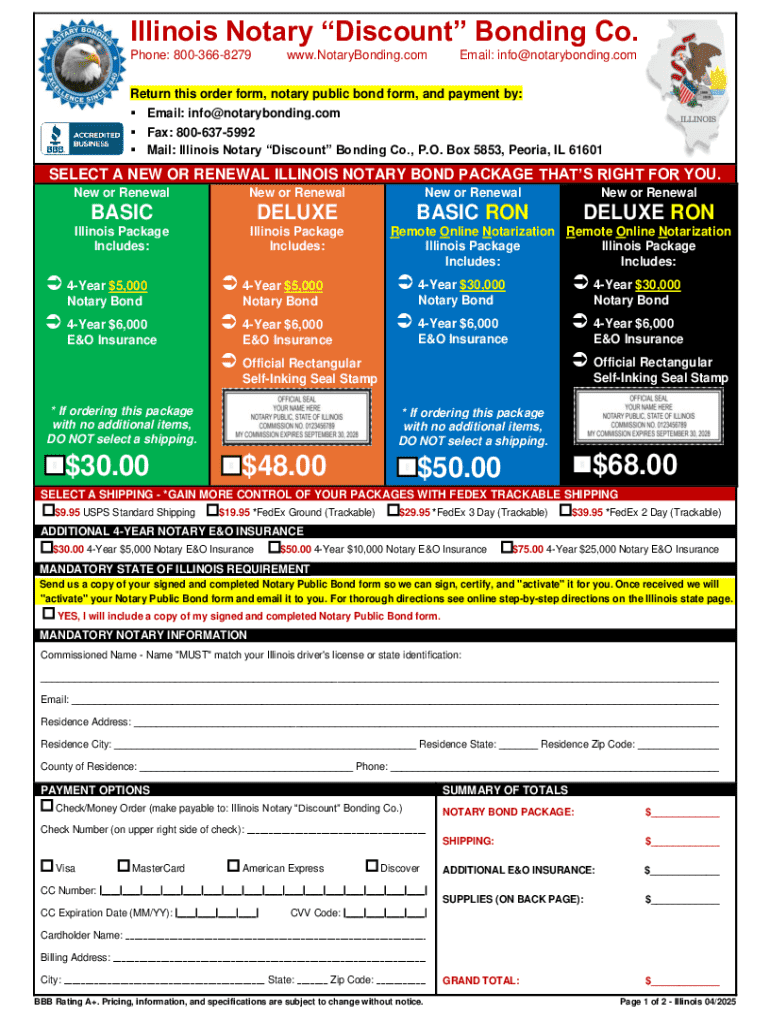

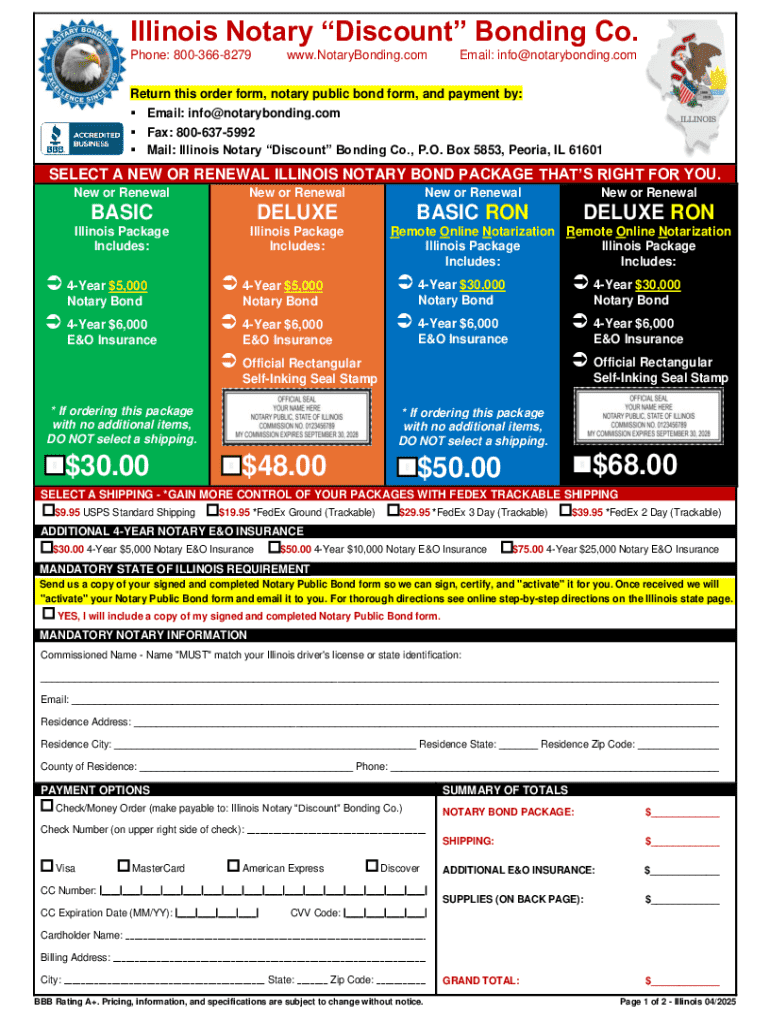

Overview of notary public bond requirements

A notary public bond is a vital instrument in establishing the credibility and legal responsibility of a notary public. This bond acts as a financial guarantee that protects the public from potential misconduct or errors by the notary. The bond ensures that if a notary malfeasance causes financial harm, affected individuals can seek compensation. Moreover, notary bonds function as a form of insurance for those relying on the notarial services, reinforcing trust in legal transactions.

The importance of notary bonds cannot be overstated; they provide assurances that notaries adhere to ethical standards and perform their duties accurately. Various states have different requirements regarding notary bonds, reflecting the local legal frameworks. For instance, some states necessitate a bond amount of $5,000, while others require $10,000 or more. Understanding state-specific requirements is crucial for maintaining compliance with regulations.

Understanding the notary public bond form

The notary public bond form is a legal document declaring the bond agreement between the notary, the surety company, and the state or relevant authority. This form captures essential details that validate the notary's authority and the bond's enforceability. Key components of the form include information about the principal (the notary), the surety (the bonding company), the bond amount, and its effective date.

Completing the notary bond form accurately is crucial to avoid complications. Essential components of the form include principal information, which identifies the notary, and surety information, including specifics about the bonding company. Additionally, the bond amount reflects the financial coverage, while the effective date and duration mark the validity period of the bond.

Common mistakes when filling out the form can lead to unnecessary delays or issues with validity. Miswriting names, incorrect bond amounts, or misunderstanding state-specific clauses can create significant barriers in processing.

Step-by-step process to complete the notary public bond form

Completing the notary public bond form requires careful attention to detail. Here’s a systematic approach to ensure accuracy and compliance.

Step 1 involves gathering necessary information. This includes personal details such as full name, address, and any specific state requirements that pertain to the bond. Understanding your state’s laws is crucial, as different regulations may apply.

Step 2 is downloading the notary public bond form. The pdfFiller platform simplifies this process, allowing users to navigate through various document templates. When accessing the site, it’s essential to choose the correct form suited for your state to ensure you’re meeting specific legal criteria.

In Step 3, filling out the form requires following detailed instructions for each section. Ensure that you double-check principal information, bond amount, and effective dates, as this information is critical in validating the bond.

Step 4 involves reviewing and editing the form. Utilize pdfFiller’s editing features to correct any errors. Best practices for review include verifying all entries against official documents to guarantee accuracy.

Finally, in Step 5, use eSignature tools available on pdfFiller for signing and submitting the form. Follow guidelines for submitting the bond form to the appropriate state authority, ensuring it reaches the right department without delay.

Interactive tools for completing the notary public bond form

Interactive tools like those provided by pdfFiller enhance the user experience when completing notary public bond forms. These tools include fillable fields that streamline data entry and auto-populate features that save time by pre-filling repeated information.

Cloud storage and document management functionalities enable users to access completed forms securely at any time, facilitating ease of use. The ability to manage multiple documents from a single platform means that users can focus efficiently on their notarial duties.

Special considerations for different states

When dealing with notary public bonds, it's essential to recognize that requirements vary significantly from one state to another. These state-specific differences can include the bond amount, forms required, and any unique clauses that may need special attention.

For example, in some states, notaries are required to file their bond with a specific format, while others may necessitate additional documentation. Being aware of bond amounts, which can range from $5,000 to $25,000 depending on the jurisdiction, is essential for fulfilling legal obligations.

Resources, such as state government websites, offer guidance on requirements and offer detailed contacts for further assistance. Establishing relationships through these resources can provide invaluable support.

Frequently asked questions (FAQs)

Numerous queries may arise while completing a notary public bond form. One common question is, 'What happens if I make a mistake on the bond form?' It’s crucial to rectify any errors promptly, as inaccuracies can lead to the rejection of your application. Reaching out to the bonding company for guidance can often resolve issues effectively.

Another frequently asked question is, 'How long does it take to process the notary public bond?' Processing times can vary by state—generally ranging from a few days to several weeks depending on the workload of the governmental body involved. Users should plan accordingly.

Lastly, once the bond form is submitted, it's advisable to follow up with the appropriate authority to confirm receipt and processing status. This proactive approach helps ensure no unforeseen delays occur.

Additional tips for notary publics

As a notary public, maintaining compliance with state laws is fundamental for your professional practice. Regularly reviewing the requirements and ensuring that your bond is up-to-date is essential for protecting yourself and your clients. Also, consider renewing your bond well in advance of its expiration date to avoid any lapses in service.

Organizing your documents meticulously is also crucial. Keeping both physical and digital records of your bond, certificates, and completion of essential forms like the notary public bond form can save you significant time and prevent undue stress. Using systems offered by platforms like pdfFiller allows for streamlined management of these documents in one secure location.

Support and guidance

When navigating the notary public bond form, accessing support can be invaluable. Resources available through pdfFiller include live chat features and online support, making it easy to receive assistance in real-time as questions arise during the form completion process.

In addition, community forums and online resources for notaries can provide a wealth of shared knowledge and experiences. Participating in these communities enhances understanding and ensures better service to clients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find notary public bond form?

Can I sign the notary public bond form electronically in Chrome?

How do I fill out notary public bond form using my mobile device?

What is notary public bond form?

Who is required to file notary public bond form?

How to fill out notary public bond form?

What is the purpose of notary public bond form?

What information must be reported on notary public bond form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.